Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help What does it mean that inventory was written down? Companies must record their inventory at lower of cost of market value. That means that

help

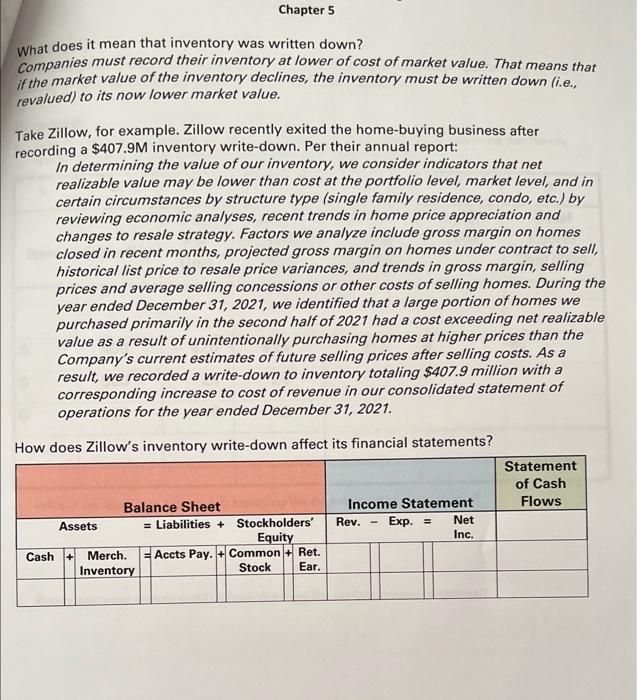

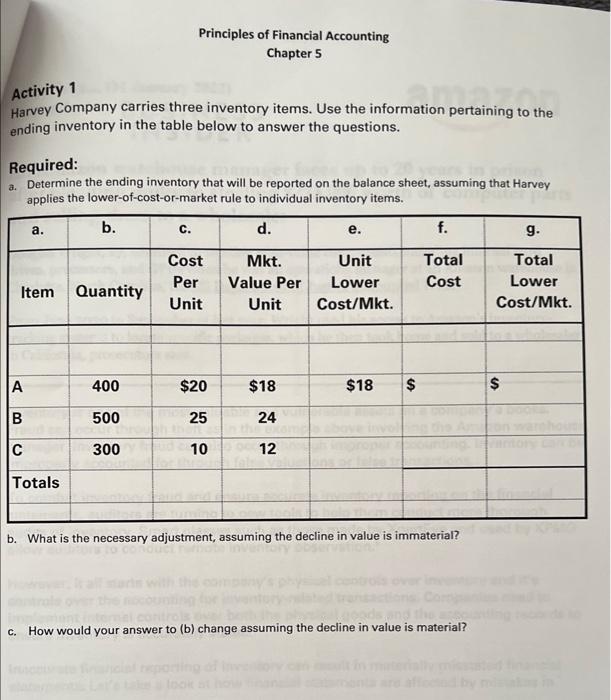

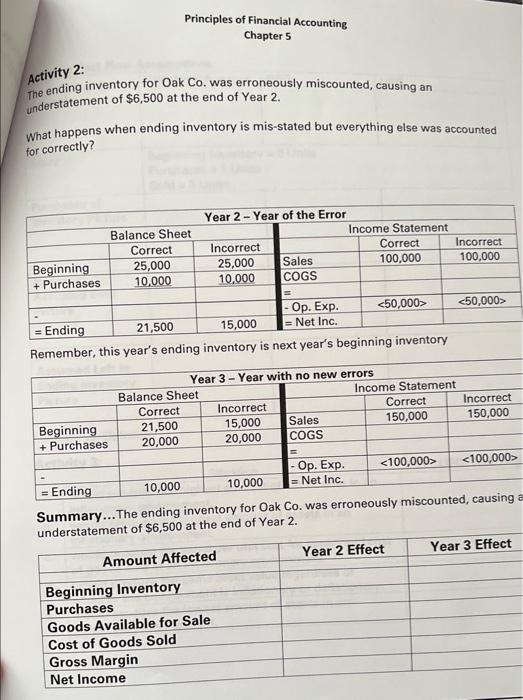

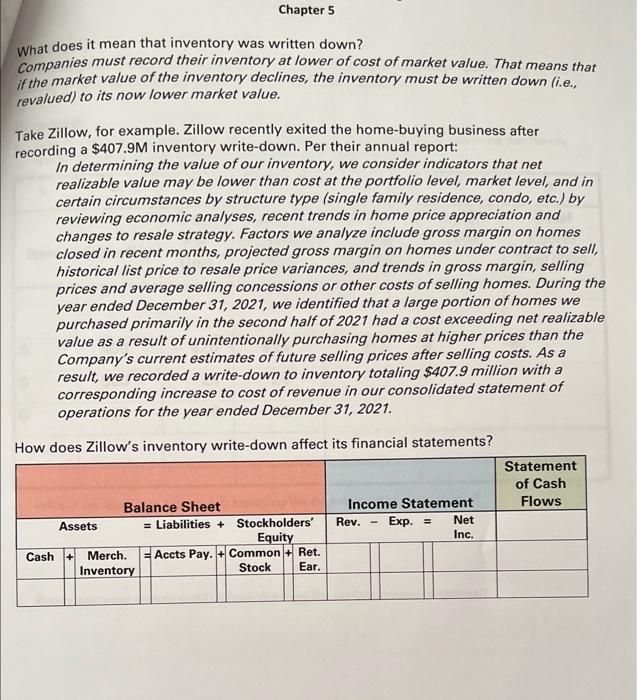

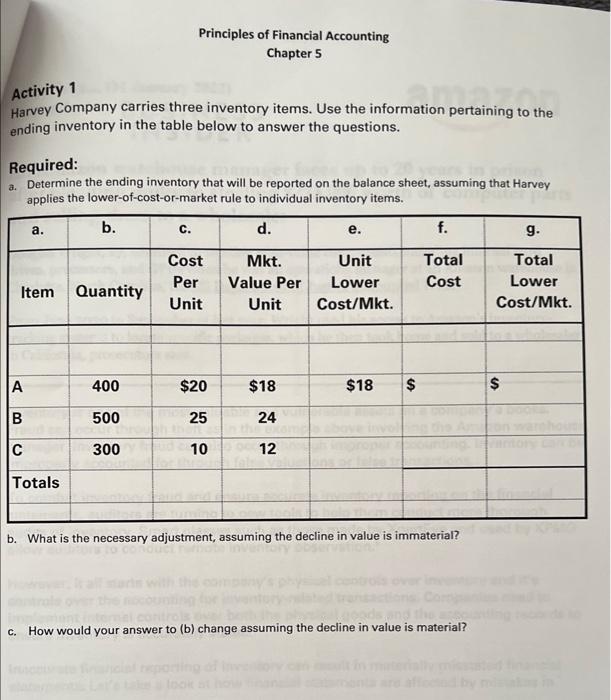

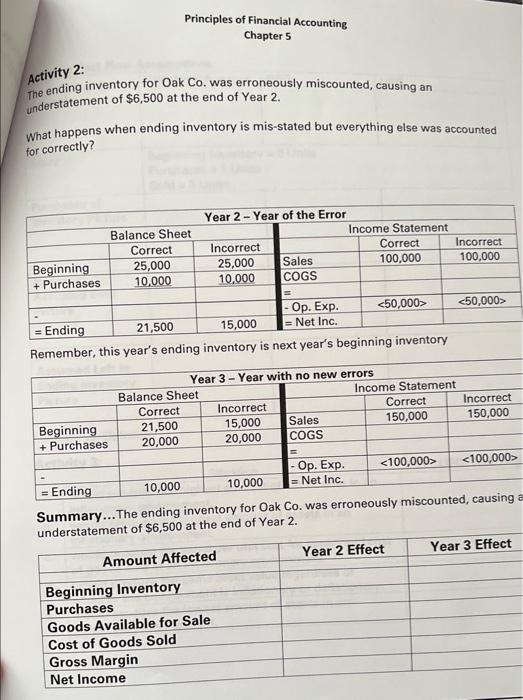

What does it mean that inventory was written down? Companies must record their inventory at lower of cost of market value. That means that if the market value of the inventory declines, the inventory must be written down (i.e., revalued) to its now lower market value. Take Zillow, for example. Zillow recently exited the home-buying business after recording a $407.9M inventory write-down. Per their annual report: In determining the value of our inventory, we consider indicators that net realizable value may be lower than cost at the portfolio level, market level, and in certain circumstances by structure type (single family residence, condo, etc.) by reviewing economic analyses, recent trends in home price appreciation and changes to resale strategy. Factors we analyze include gross margin on homes closed in recent months, projected gross margin on homes under contract to sell, historical list price to resale price variances, and trends in gross margin, selling prices and average selling concessions or other costs of selling homes. During the year ended December 31, 2021, we identified that a large portion of homes we purchased primarily in the second half of 2021 had a cost exceeding net realizable value as a result of unintentionally purchasing homes at higher prices than the Company's current estimates of future selling prices after selling costs. As a result, we recorded a write-down to inventory totaling $407.9 million with a corresponding increase to cost of revenue in our consolidated statement of operations for the year ended December 31, 2021. Principles of Financial Accounting Chapter 5 Activity 1 Harvey Company carries three inventory items. Use the information pertaining to the ending inventory in the table below to answer the questions. Required: a. Determine the ending inventory that will be reported on the balance sheet, assuming that Harvey applies the lower-of-cost-or-market rule to individual inventory items. b. What is the necessary adjustment, assuming the decline in value is immaterial? c. How would your answer to (b) change assuming the decline in value is material? Activity 2: The ending inventory for Oak Co. was erroneously miscounted, causing an understatement of $6,500 at the end of Year 2. What happens when ending inventory is mis-stated but everything else was accounted for correctly? Remember, this year's ending inventory is next year's beginning inventory Summary... The ending inventory for Oak Co. was erroneously miscountea, causmy ...ndaretatement of $6,500 at the end of Year 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started