Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help! will leave thumbs up Weiss Inc. arranged a $10,000,000 revolving credit agreement with a group of banks. The firm paid an annual commitment fee

help! will leave thumbs up

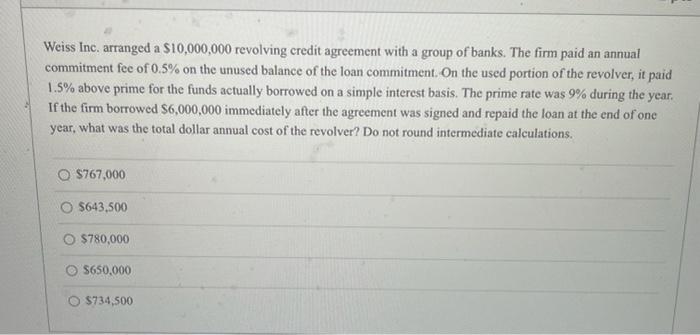

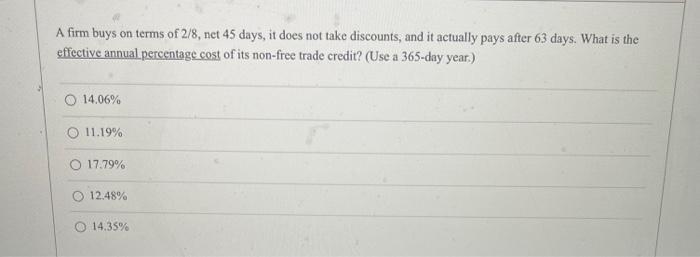

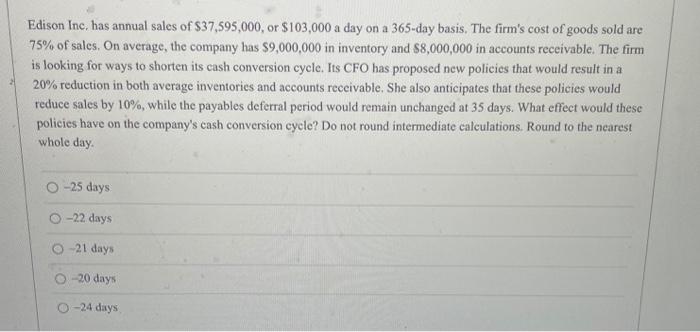

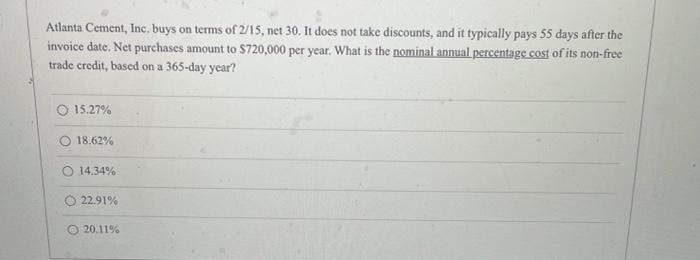

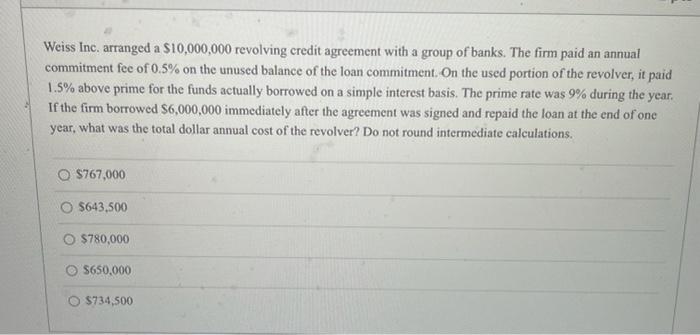

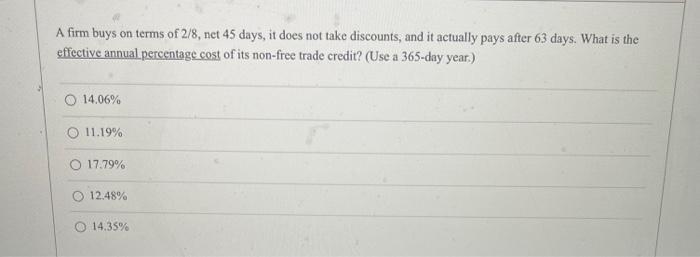

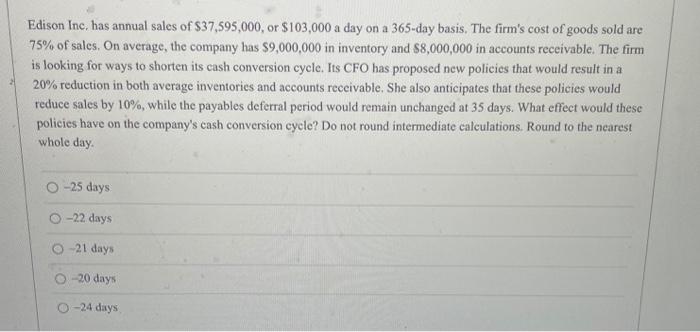

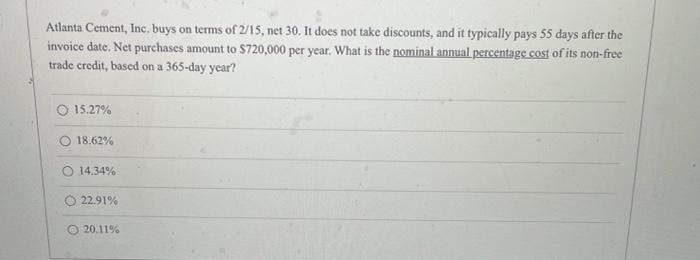

Weiss Inc. arranged a $10,000,000 revolving credit agreement with a group of banks. The firm paid an annual commitment fee of 0.5% on the unused balance of the loan commitment. On the used portion of the revolver, it paid 1.5% above prime for the funds actually borrowed on a simple interest basis. The prime rate was 9% during the year. If the firm borrowed 56,000,000 immediately after the agreement was signed and repaid the loan at the end of one year, what was the total dollar annual cost of the revolver? Do not round intermediate calculations. O $767,000 O $643,500 $780,000 $650,000 O $734,500 A firm buys on terms of 2/8, net 45 days, it does not take discounts, and it actually pays after 63 days. What is the effective annual percentage cost of its non-free trade credit? (Use a 365-day year.) O 14.06% O 11.19% O 17.79% 12.48% 14.35% Edison Inc. has annual sales of $37,595,000, or $103,000 a day on a 365-day basis. The firm's cost of goods sold are 75% of sales. On average, the company has $9,000,000 in inventory and $8,000,000 in accounts receivable. The firm is looking for ways to shorten its cash conversion cycle. Its CFO has proposed new policies that would result in a 20% reduction in both average inventories and accounts receivable. She also anticipates that these policies would reduce sales by 10%, while the payables deferral period would remain unchanged at 35 days. What effect would these policies have on the company's cash conversion cycle? Do not round intermediate calculations. Round to the nearest whole day. - 25 days O-22 days O21 days -20 days --- 24 days Atlanta Cement, Inc, buys on terms of 2/15, net 30. It does not take discounts, and it typically pays 55 days after the invoice date. Net purchases amount to S720,000 per year. What is the nominal annual percentage cost of its non-free trade credit, based on a 365-day year? O 15.27% O 18.62% 14.34% 22.91% 20.11%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started