Answered step by step

Verified Expert Solution

Question

1 Approved Answer

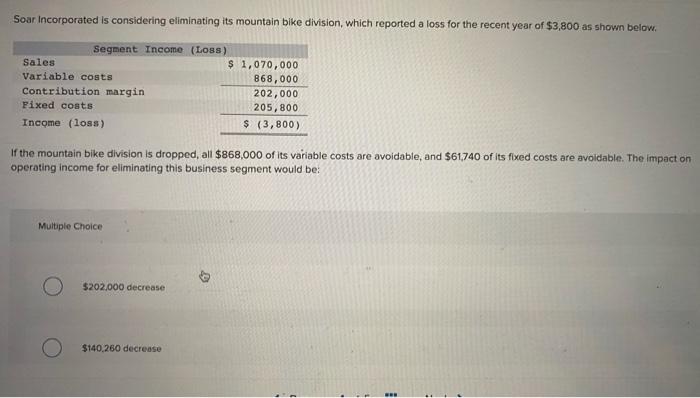

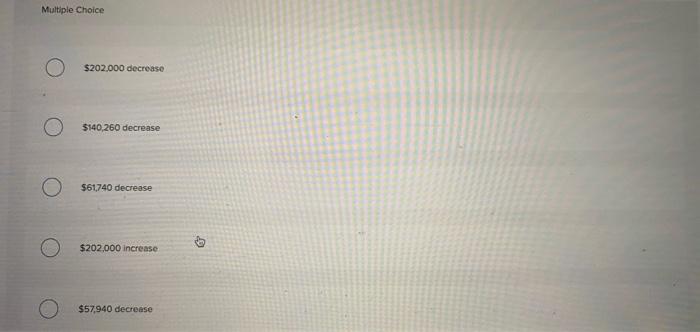

HELP. will rate Soar incorporated is considering eliminating its mountain bike division, which reported a loss for the recent year of $3,800 as shown below.

HELP. will rate

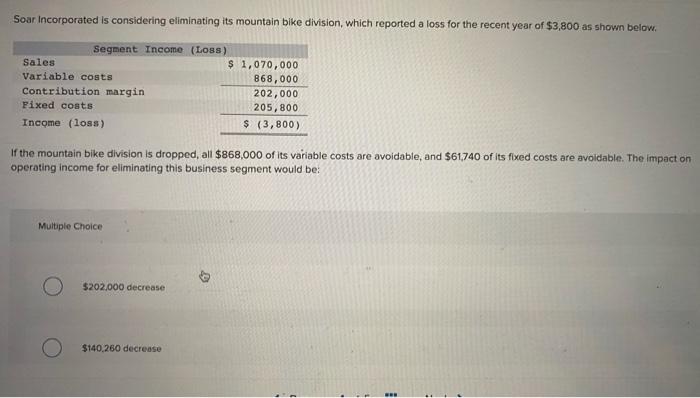

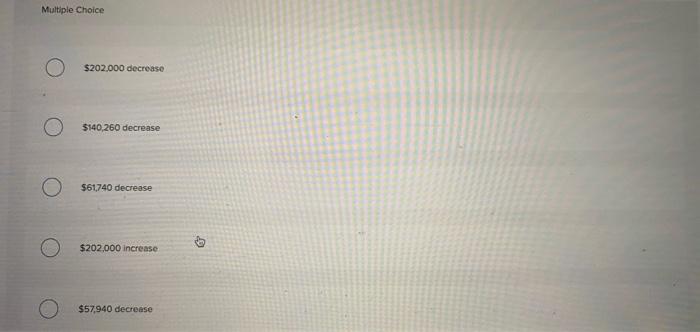

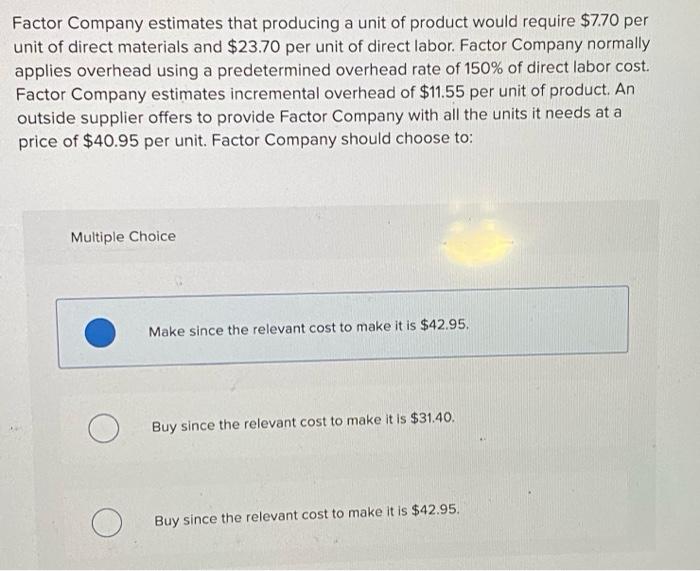

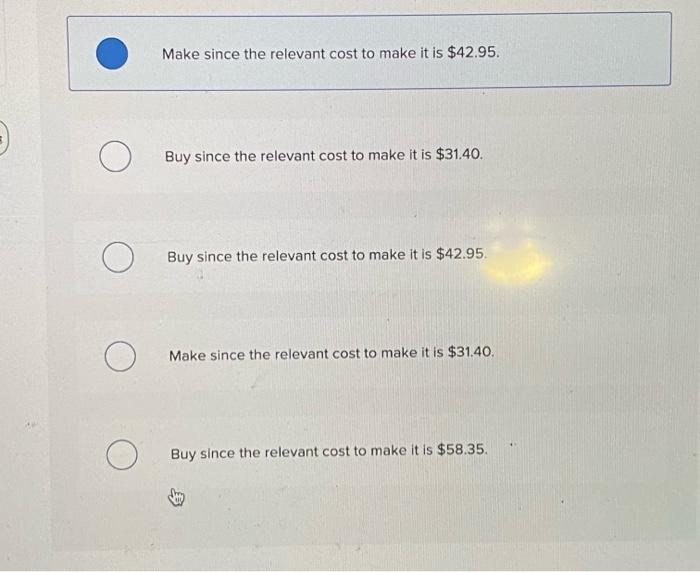

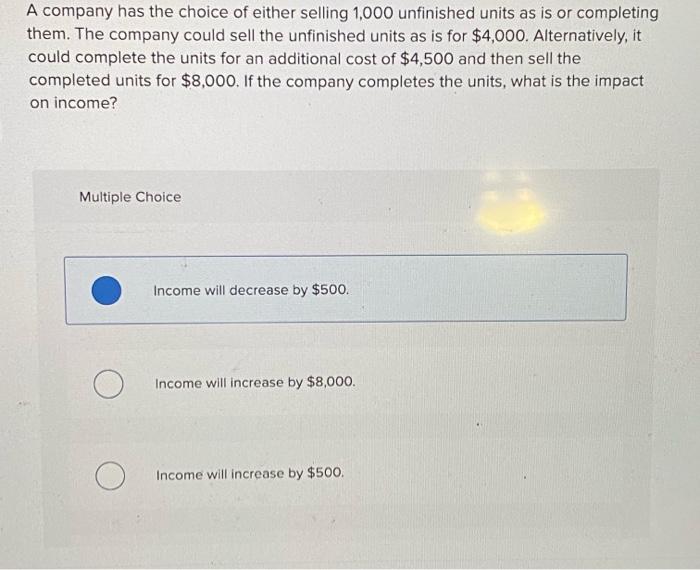

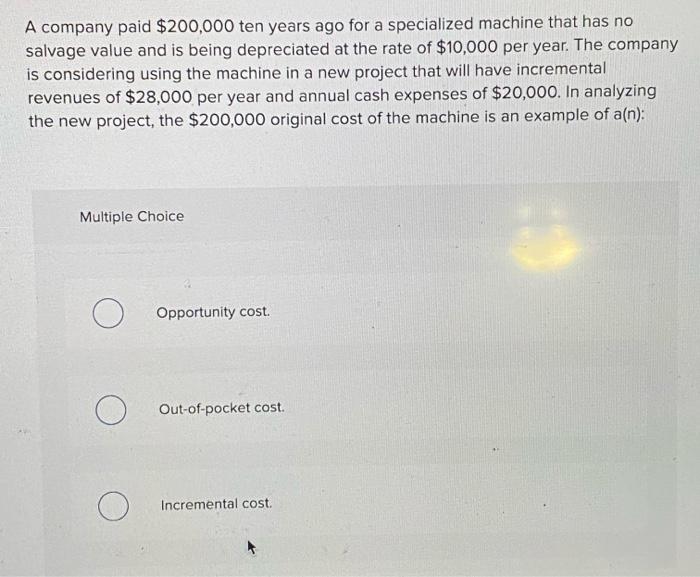

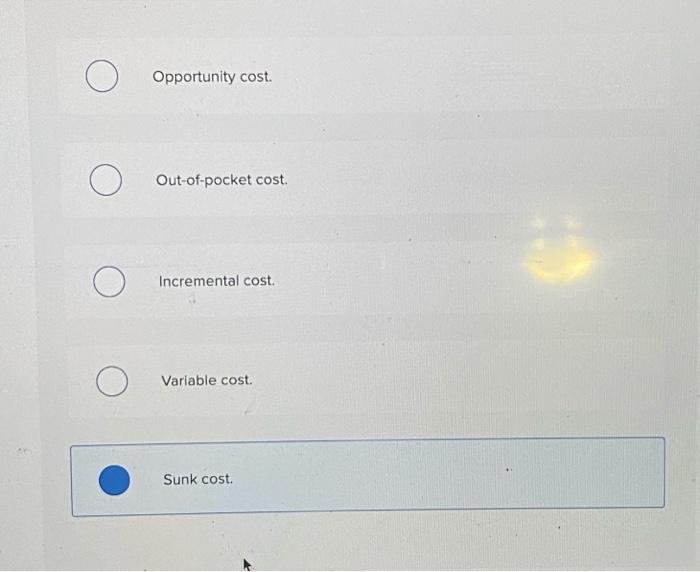

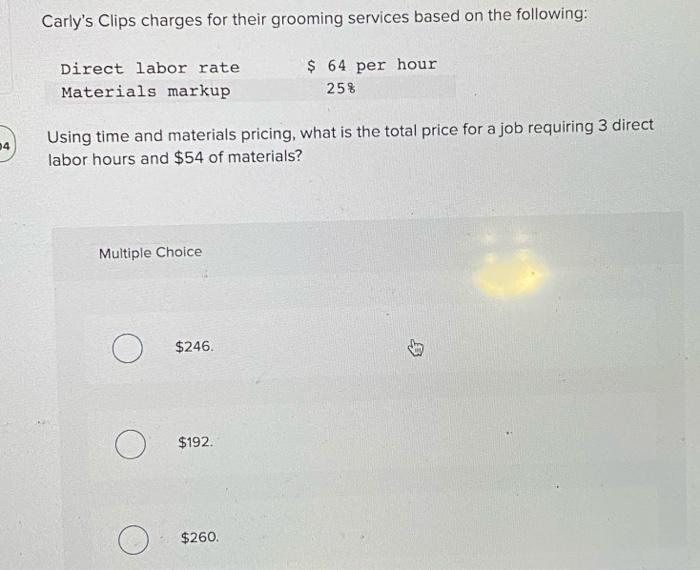

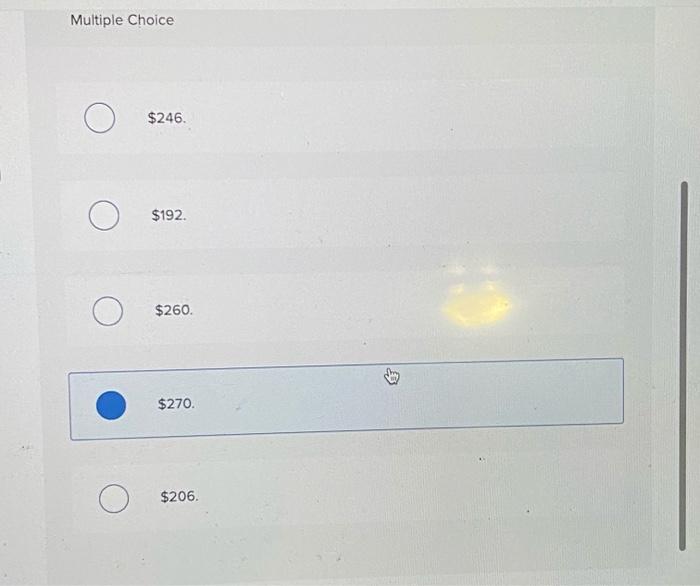

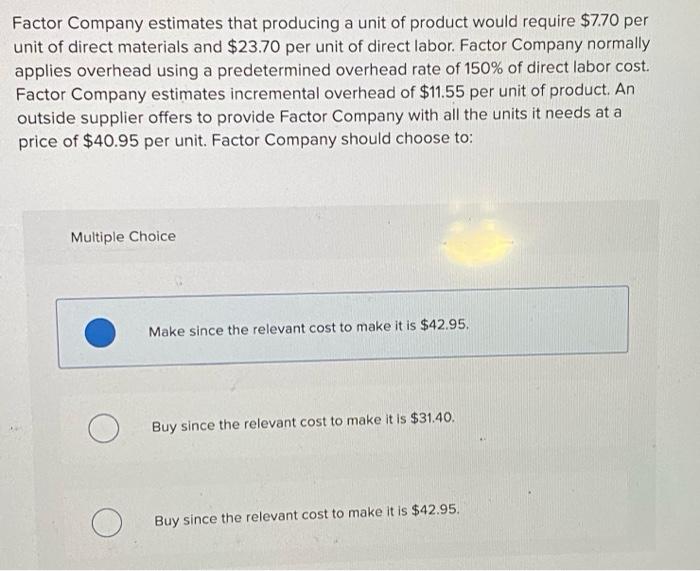

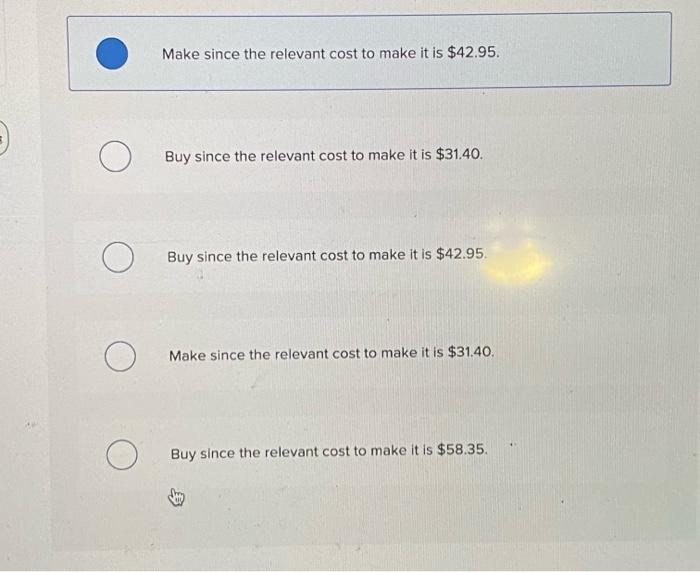

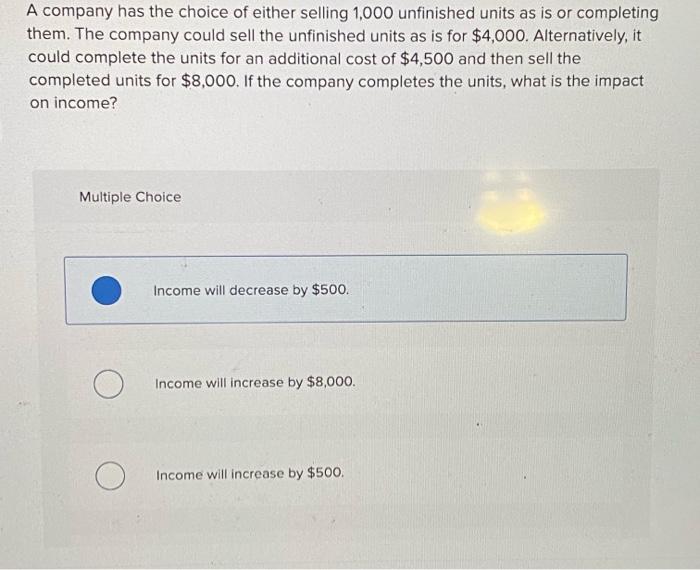

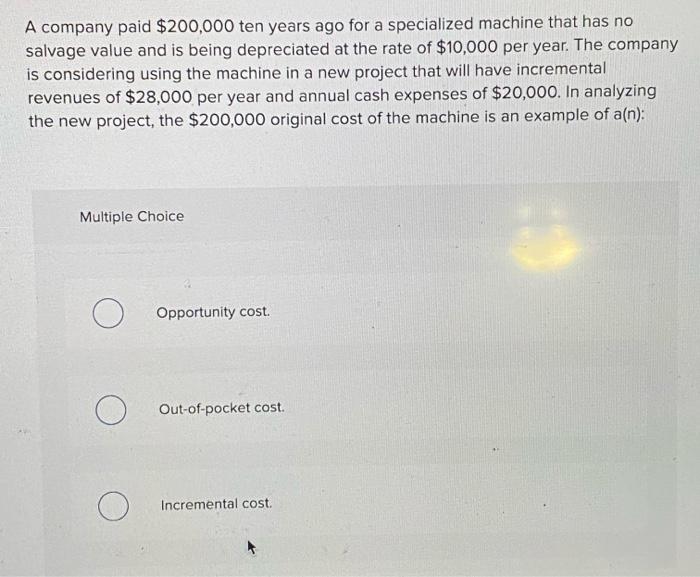

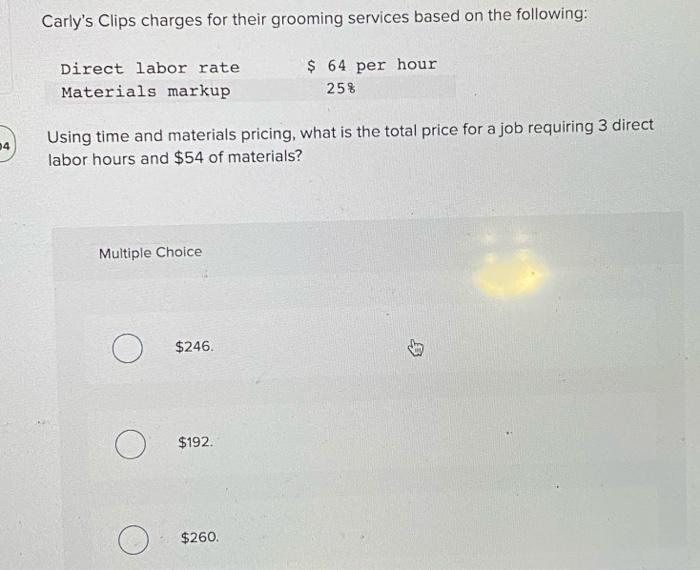

Soar incorporated is considering eliminating its mountain bike division, which reported a loss for the recent year of $3,800 as shown below. Segment Income (Loss) Sales Variable costs Contribution margin Fixed costs Income (loss) 1,070,000 868,000 202,000 205,800 $ (3,800) If the mountain bike division is dropped, all $868,000 of its variable costs are avoidable, and $61740 of its fixed costs are avoidable. The impact on operating income for eliminating this business segment would be: Multiple Choice $202.000 decrease $140.260 decrease Multiple Choice $202.000 decrease $140,260 decrease O $61,740 decrease $202.000 increase $57,940 decrease Factor Company estimates that producing a unit of product would require $770 per unit of direct materials and $23.70 per unit of direct labor. Factor Company normally applies overhead using a predetermined overhead rate of 150% of direct labor cost. Factor Company estimates incremental overhead of $11.55 per unit of product. An outside supplier offers to provide Factor Company with all the units it needs at a price of $40.95 per unit. Factor Company should choose to: Multiple Choice Make since the relevant cost to make it is $42.95. O Buy since the relevant cost to make it is $31.40. Buy since the relevant cost to make it is $42.95. Make since the relevant cost to make it is $42.95. Buy since the relevant cost to make it is $31.40. Buy since the relevant cost to make it is $42.95 O Make since the relevant cost to make it $31.40. Buy since the relevant cost to make it is $58.35. A company has the choice of either selling 1,000 unfinished units as is or completing them. The company could sell the unfinished units as is for $4,000. Alternatively, it could complete the units for an additional cost of $4,500 and then sell the completed units for $8,000. If the company completes the units, what is the impact on income? Multiple Choice Income will decrease by $500. Income will increase by $8,000. Income will increase by $500. Income will decrease by $500. Income will increase by $8,000. Income will increase by $500. Income will increase by $4,000. Income will decrease by $4,500. A company paid $200,000 ten years ago for a specialized machine that has no salvage value and is being depreciated at the rate of $10,000 per year. The company is considering using the machine in a new project that will have incremental revenues of $28,000 per year and annual cash expenses of $20,000. In analyzing the new project, the $200,000 original cost of the machine is an example of a(n): Multiple Choice Opportunity cost. Out-of-pocket cost. O Incremental cost Opportunity cost. Out-of-pocket cost. Incremental cost. Variable cost. Sunk cost. Carly's Clips charges for their grooming services based on the following: Direct labor rate Materials markup $ 64 per hour 258 14 Using time and materials pricing, what is the total price for a job requiring 3 direct labor hours and $54 of materials? Multiple Choice $246. $192 $260. Multiple Choice $246. . $192. $260. $270. O $206

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started