Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help with 17-22 please 17) Cost of Goods Sold is: A) An asset account. B) A revenue account. C) An expense account D) A gross

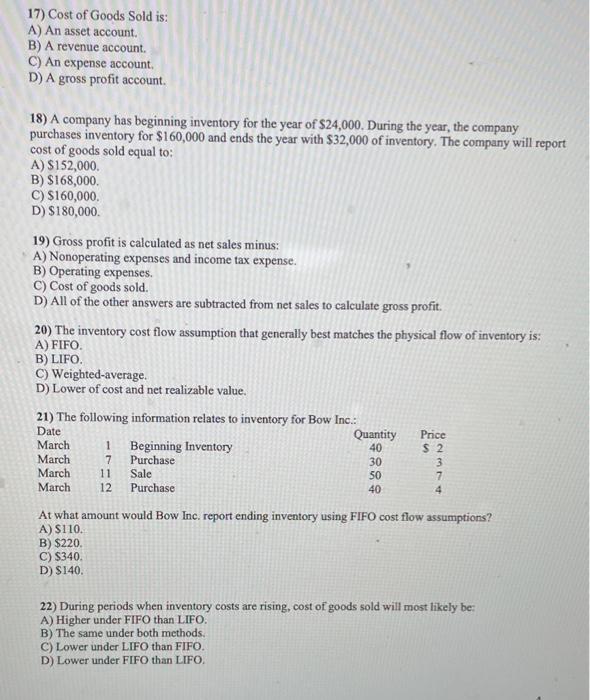

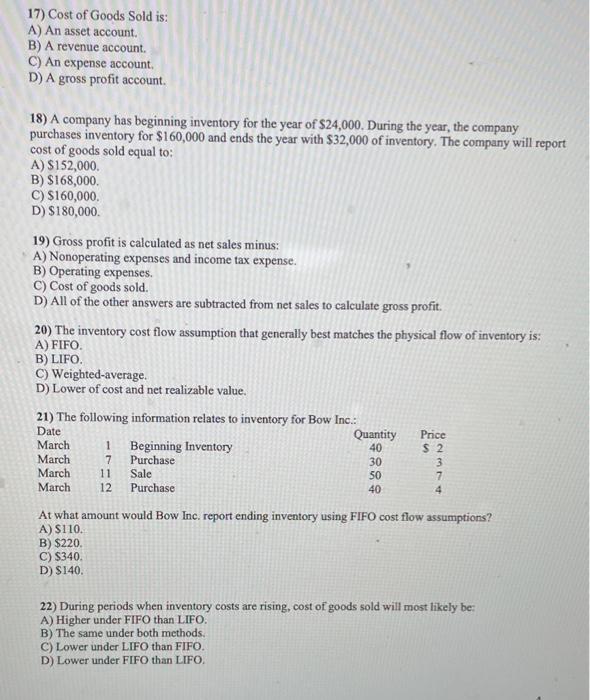

help with 17-22 please  17) Cost of Goods Sold is: A) An asset account. B) A revenue account. C) An expense account D) A gross profit account. 18) A company has beginning inventory for the year of $24,000. During the year, the company purchases inventory for $160,000 and ends the year with $32,000 of inventory. The company will report cost of goods sold equal to: A) $152,000 B) $168,000 C) $160,000 D) $180,000 19) Gross profit is calculated as net sales minus: A) Nonoperating expenses and income tax expense. B) Operating expenses. C) Cost of goods sold. D) All of the other answers are subtracted from net sales to calculate gross profit. 20) The inventory cost flow assumption that generally best matches the physical flow of inventory is: A) FIFO. B) LIFO. C) Weighted average. D) Lower of cost and net realizable value. 21) The following information relates to inventory for Bow Inc.: Quantity Price Beginning Inventory 40 $ 2 March Purchase March Purchase Date March 1 7 11 12 4m Sale 30 50 40 3 7 March At what amount would Bow Inc. report ending inventory using FIFO cost flow assumptions? A) $110. B) $220. C) $340 D) $140. 22) During periods when inventory costs are rising, cost of goods sold will most likely be A) Higher under FIFO than LIFO. B) The same under both methods. C) Lower under LIFO than FIFO. D) Lower under FIFO than LIFO

17) Cost of Goods Sold is: A) An asset account. B) A revenue account. C) An expense account D) A gross profit account. 18) A company has beginning inventory for the year of $24,000. During the year, the company purchases inventory for $160,000 and ends the year with $32,000 of inventory. The company will report cost of goods sold equal to: A) $152,000 B) $168,000 C) $160,000 D) $180,000 19) Gross profit is calculated as net sales minus: A) Nonoperating expenses and income tax expense. B) Operating expenses. C) Cost of goods sold. D) All of the other answers are subtracted from net sales to calculate gross profit. 20) The inventory cost flow assumption that generally best matches the physical flow of inventory is: A) FIFO. B) LIFO. C) Weighted average. D) Lower of cost and net realizable value. 21) The following information relates to inventory for Bow Inc.: Quantity Price Beginning Inventory 40 $ 2 March Purchase March Purchase Date March 1 7 11 12 4m Sale 30 50 40 3 7 March At what amount would Bow Inc. report ending inventory using FIFO cost flow assumptions? A) $110. B) $220. C) $340 D) $140. 22) During periods when inventory costs are rising, cost of goods sold will most likely be A) Higher under FIFO than LIFO. B) The same under both methods. C) Lower under LIFO than FIFO. D) Lower under FIFO than LIFO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started