Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help with #3 1) You have been asked to prepare a proforma capitalization table for your company. You and your co-founder had each put a

help with #3

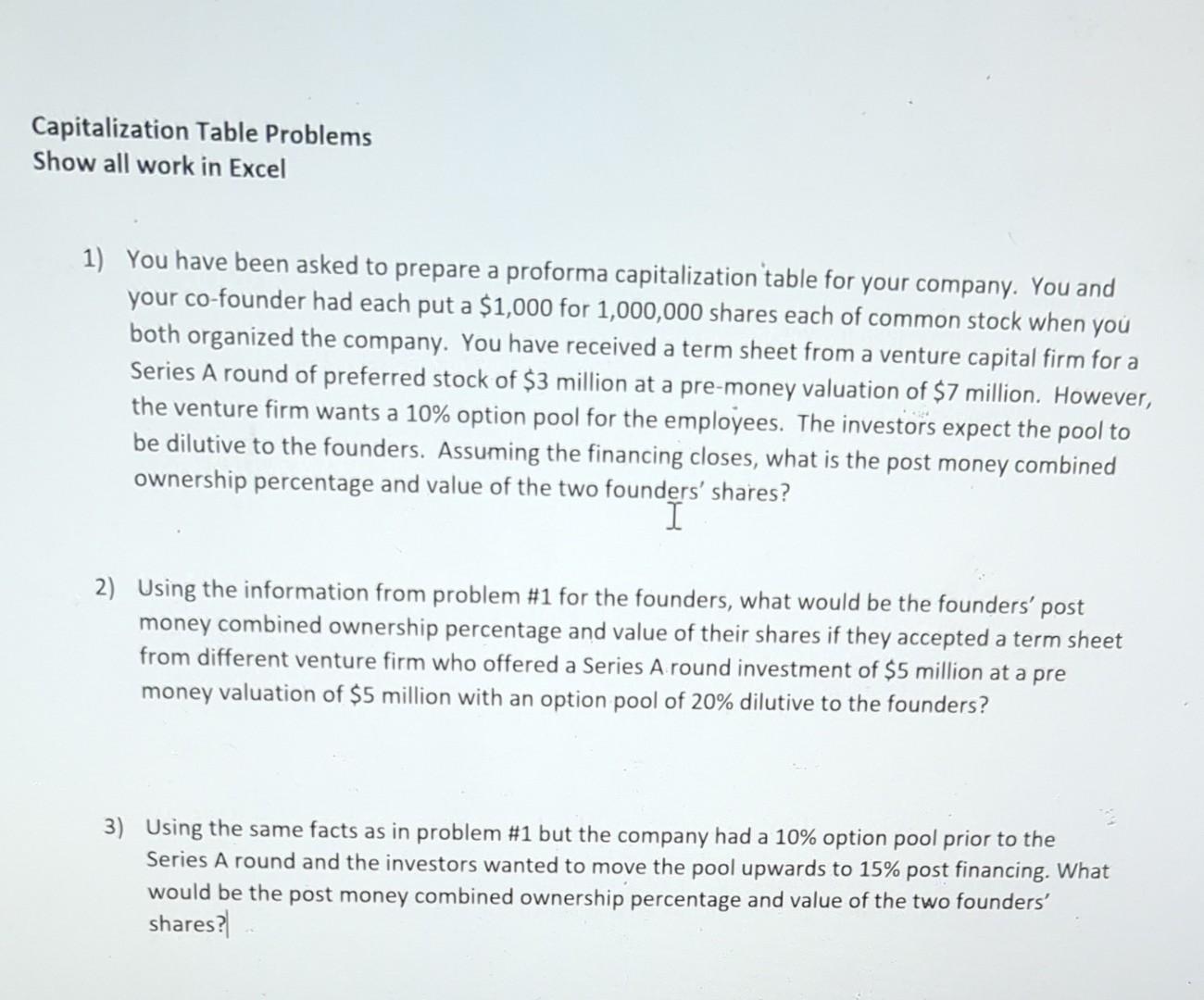

1) You have been asked to prepare a proforma capitalization table for your company. You and your co-founder had each put a $1,000 for 1,000,000 shares each of common stock when you both organized the company. You have received a term sheet from a venture capital firm for a Series A round of preferred stock of $3 million at a pre-money valuation of $7 million. However, the venture firm wants a 10% option pool for the employees. The investors expect the pool to be dilutive to the founders. Assuming the financing closes, what is the post money combined ownership percentage and value of the two founders' shares? 2) Using the information from problem \#1 for the founders, what would be the founders' post money combined ownership percentage and value of their shares if they accepted a term sheet from different venture firm who offered a Series A round investment of $5 million at a pre money valuation of $5 million with an option pool of 20% dilutive to the founders? 3) Using the same facts as in problem \#1 but the company had a 10\% option pool prior to the Series A round and the investors wanted to move the pool upwards to 15% post financing. What would be the post money combined ownership percentage and value of the two founders' sharesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started