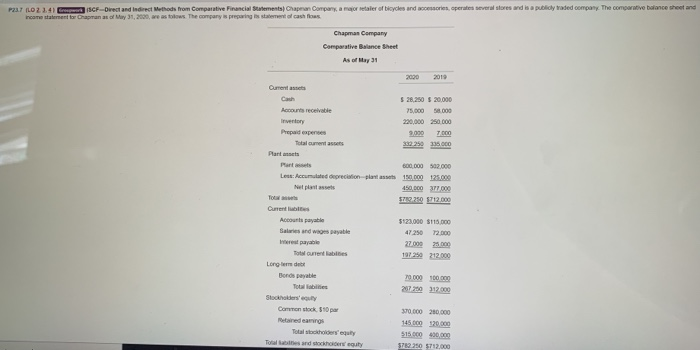

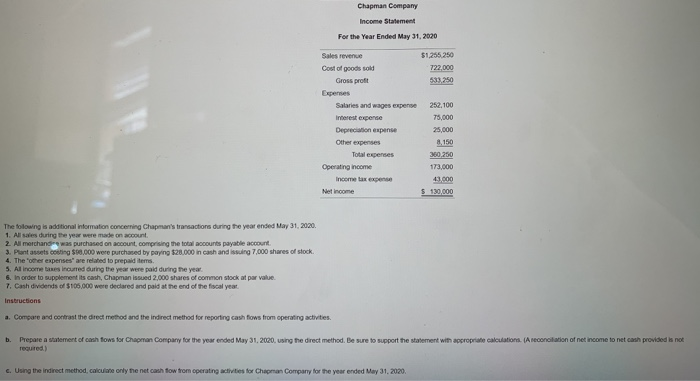

so operates several stores and is a publicly traded company. The comparative balance sheet and P237 LD2. 4) BCF Deal and indirect Methods from Comparative Financial Statements Chapean Company, a major retailer of bicycles and Incare statement for Chapman as of May 31, 2000, we asoow The company preparing is een of cash flows Chapman Company Comparative Balance Sheet As of May 31 2000 2019 Hacounts receivable Inventory Prepaid expenses Total curs Plantes Parts Less: Accumulated depreciation plans Nel plantes $ 28,250 $ 20.000 75,000 58.000 220,000 250.000 9,000000 360 250 335.000 600 000 502 000 190.000 125.000 450,000 377.000 73350 5712.000 Current Accounts payable Sales and we payable e payable Tourettes Longe debe Bonds payable Totalbes Stockholders en Common stock 510 par 5123.000 $115.000 47.250 72.000 27000 700 197250 212.000 20000000 207200 312000 Total Woches qui e s and stock equity 37000 200.000 145 120.000 515.000 400.000 5762.250 372.000 Toal Chapman Company Income Statement For the Year Ended May 31, 2020 51.255.250 722.000 533 250 Sales revenue Cost of goods sold Gross profit Expenses Salaries and wages expense interest expense Depreciation expense Other expenses Total expenses Operating income Income taxe 252, 100 75.000 25,000 8.150 360 250 173,000 1000 $ 130,000 The following is additional information concerning Chapman's transactions during the year ended May 31, 2020. 1. All sales during the year were made on account 2. All merchandrawas purchased on account comprising the total accounts payable account 3. Plant assets costing 500.000 were purchased by paying 12.000 in cash and issuing 7,000 shares of stock. 4. The other expenses are related to prepaid items 5. Al income incurred during the year were paid during the year 6. In order to supplementits cash, Chapman issued 2,000 shares of common stock at par value 7. Cash dividends of $105.000 were declared and paid at the end of the fiscal year Instructions a. Compare and contrast the direct method and the indirect method for reporting cash flows from operating activities. b. Prepare a statement of cash fows for Chapman Company for the year ended May 31, 2000, using the direct method. Be sure to support the statement with appropriate calculation (A reconciliation required) 6. Using the Indirect method, calculate only the net cash fow from operating activities for Chapman Company for the year ended May 31, 2020, so operates several stores and is a publicly traded company. The comparative balance sheet and P237 LD2. 4) BCF Deal and indirect Methods from Comparative Financial Statements Chapean Company, a major retailer of bicycles and Incare statement for Chapman as of May 31, 2000, we asoow The company preparing is een of cash flows Chapman Company Comparative Balance Sheet As of May 31 2000 2019 Hacounts receivable Inventory Prepaid expenses Total curs Plantes Parts Less: Accumulated depreciation plans Nel plantes $ 28,250 $ 20.000 75,000 58.000 220,000 250.000 9,000000 360 250 335.000 600 000 502 000 190.000 125.000 450,000 377.000 73350 5712.000 Current Accounts payable Sales and we payable e payable Tourettes Longe debe Bonds payable Totalbes Stockholders en Common stock 510 par 5123.000 $115.000 47.250 72.000 27000 700 197250 212.000 20000000 207200 312000 Total Woches qui e s and stock equity 37000 200.000 145 120.000 515.000 400.000 5762.250 372.000 Toal Chapman Company Income Statement For the Year Ended May 31, 2020 51.255.250 722.000 533 250 Sales revenue Cost of goods sold Gross profit Expenses Salaries and wages expense interest expense Depreciation expense Other expenses Total expenses Operating income Income taxe 252, 100 75.000 25,000 8.150 360 250 173,000 1000 $ 130,000 The following is additional information concerning Chapman's transactions during the year ended May 31, 2020. 1. All sales during the year were made on account 2. All merchandrawas purchased on account comprising the total accounts payable account 3. Plant assets costing 500.000 were purchased by paying 12.000 in cash and issuing 7,000 shares of stock. 4. The other expenses are related to prepaid items 5. Al income incurred during the year were paid during the year 6. In order to supplementits cash, Chapman issued 2,000 shares of common stock at par value 7. Cash dividends of $105.000 were declared and paid at the end of the fiscal year Instructions a. Compare and contrast the direct method and the indirect method for reporting cash flows from operating activities. b. Prepare a statement of cash fows for Chapman Company for the year ended May 31, 2000, using the direct method. Be sure to support the statement with appropriate calculation (A reconciliation required) 6. Using the Indirect method, calculate only the net cash fow from operating activities for Chapman Company for the year ended May 31, 2020