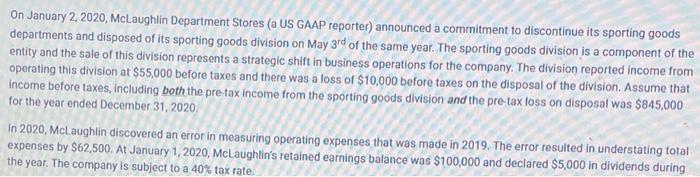

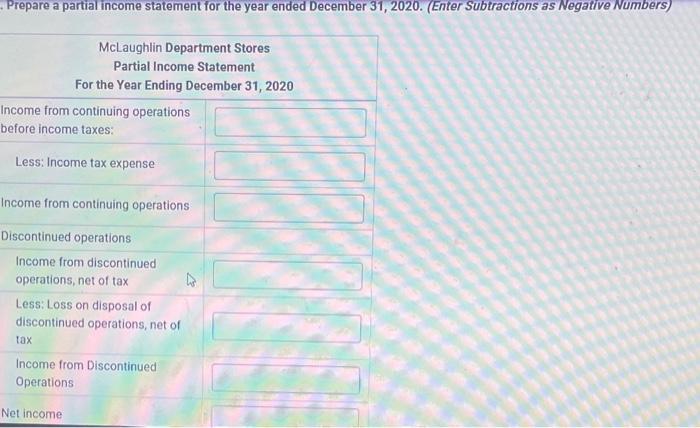

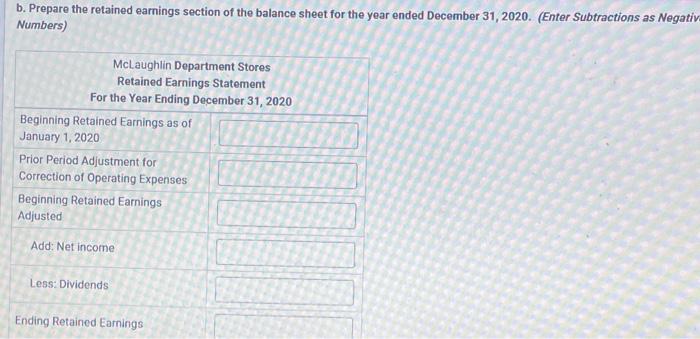

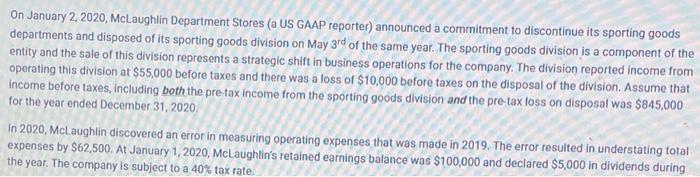

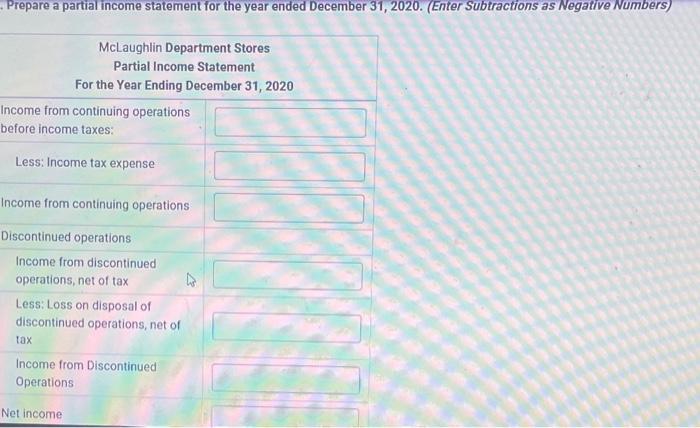

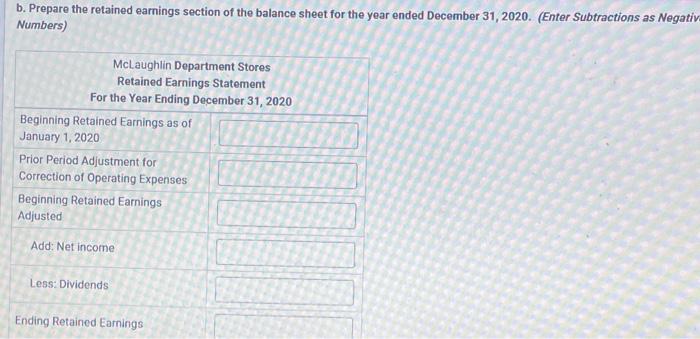

On January 2, 2020, McLaughlin Department Stores (a US GAAP reporter) announced a commitment to discontinue its sporting goods departments and disposed of its sporting goods division on May 3rd of the same year. The sporting goods division is a component of the entity and the sale of this division represents a strategic shift in business operations for the company. The division reported income from operating this division at $55,000 before taxes and there was a loss of $10,000 before taxes on the disposal of the division. Assume that income before taxes, including both the pre-tax income from the sporting goods division and the pre-tax loss on disposal was $845,000 for the year ended December 31,2020 . In 2020, Mclaughlin discovered an error in measuring operating expenses that was made in 2019. The error resulted in understating total expenses by $62,500. At January 1, 2020, McLaughlin's retained earnings balance was $100,000 and declared $5,000 in dividends during the year. The company is subject to a 40% tax rate. Prepare a partial income statement for the year ended December 31, 2020. (Enter Subtractions as Negative Numbers) McLaughlin Department Stores Partial Income Statement For the Year Ending December 31, 2020 Income from continuing operations before income taxes: Less: Income tax expense Income from continuing operations Discontinued operations Income from discontinued operations, net of tax Less: Loss on disposal of discontinued operations, net of tax Income from Discontinued Operations Net income b. Prepare the retained earnings section of the balance sheet for the year ended December 31, 2020. (Enter Subtractions as Negati Numbers) c. How would your answer to Part a change if Mclaughlin was an IFRS reporter? Provide briefly explain why you answer is different fron Part a and how the disposal would be reported on the income statement. (Select all that apply). The income from the discontinued segment would be reported as part of income form continuing operations but shown separately if material The income from the discontinued segment would be reported as part of income from continuing operations but not shown separately, even if material The disposal of the sporting goods division does not qualify as a discontinued operation under IFRS The disposal of the sporting goods division qualifies as a discontinued operation under IFRS, therefore there is no change required