Answered step by step

Verified Expert Solution

Question

1 Approved Answer

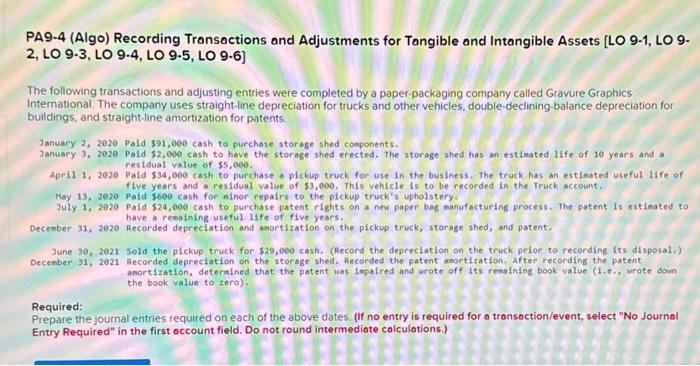

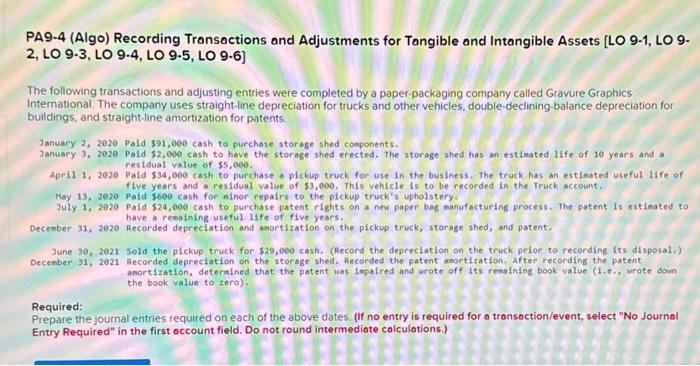

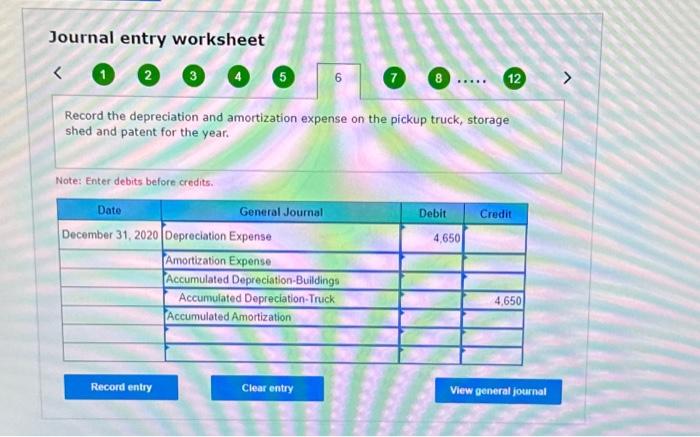

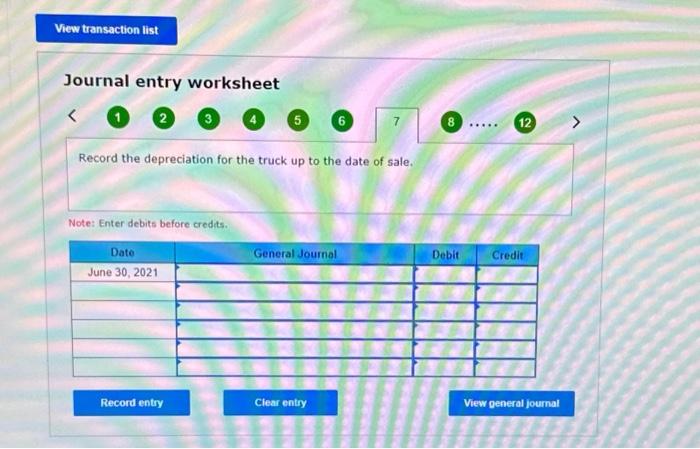

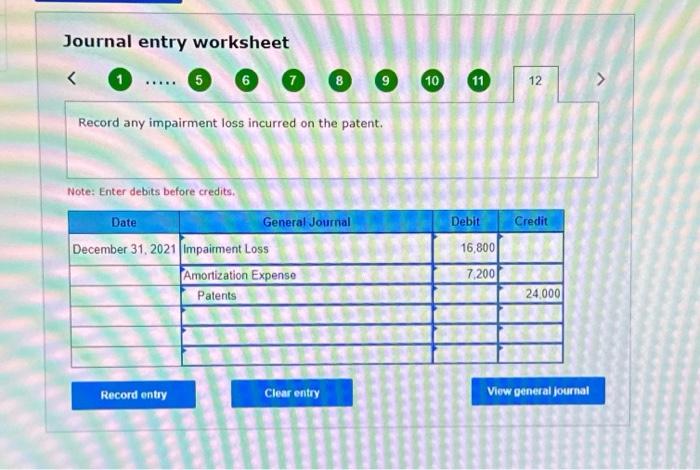

help with all pls PA9.4 (Algo) Recording Transactions and Adjustments for Tangible and Intangible Assets [LO 9-1, LO 9. 2, LO 9-3, LO 9-4, LO

help with all pls

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started