Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP WITH ALL (Present-value comparison) Much to your surprise, you were selected to appear on the TV show The Price is Right. As a result

HELP WITH ALL

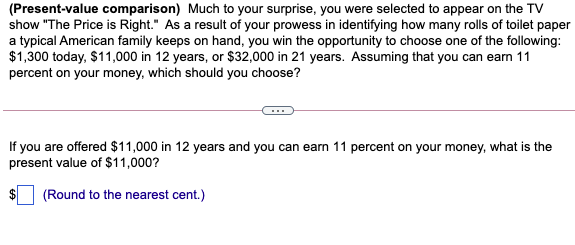

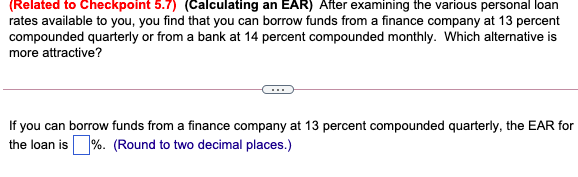

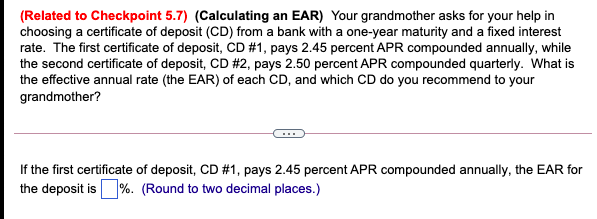

(Present-value comparison) Much to your surprise, you were selected to appear on the TV show "The Price is Right." As a result of your prowess in identifying how many rolls of toilet paper a typical American family keeps on hand, you win the opportunity to choose one of the following: $1,300 today, $11,000 in 12 years, or $32,000 in 21 years. Assuming that you can earn 11 percent on your money, which should you choose? If you are offered $11,000 in 12 years and you can earn 11 percent on your money, what is the present value of $11,000? (Round to the nearest cent.) (Related to Checkpoint 5.7) (Calculating an EAR) After examining the various personal loan rates available to you, you find that you can borrow funds from a finance company at 13 percent compounded quarterly or from a bank at 14 percent compounded monthly. Which alternative is more attractive? If you can borrow funds from a finance company at 13 percent compounded quarterly, the EAR for the loan is %. (Round to two decimal places.) (Related to Checkpoint 5.7) (Calculating an EAR) Your grandmother asks for your help in choosing a certificate of deposit (CD) from a bank with a one-year maturity and a fixed interest rate. The first certificate of deposit, CD #1, pays 2.45 percent APR compounded annually, while the second certificate of deposit, CD #2, pays 2.50 percent APR compounded quarterly. What is the effective annual rate (the EAR) of each CD, and which CD do you recommend to your grandmother? If the first certificate of deposit, CD #1, pays 2.45 percent APR compounded annually, the EAR for the deposit is %. (Round to two decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started