Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help with direct budget P9-57A (similar to) Question Help i More Info Decker Manufacturing is preparing its master budget for the first (Click the icon

help with direct budget

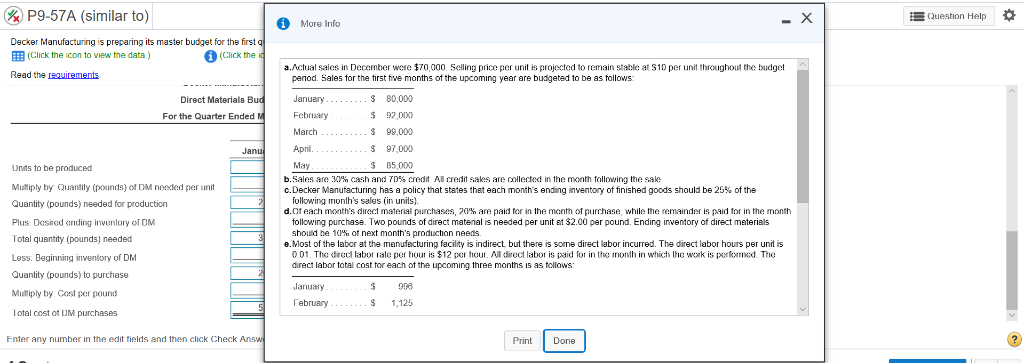

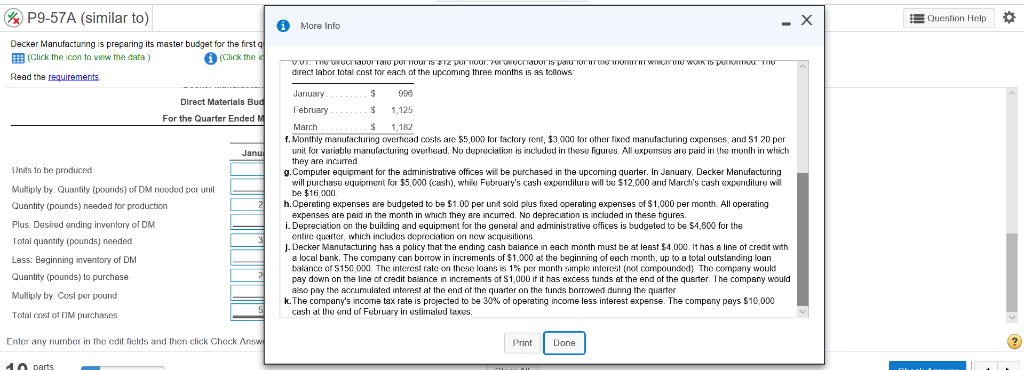

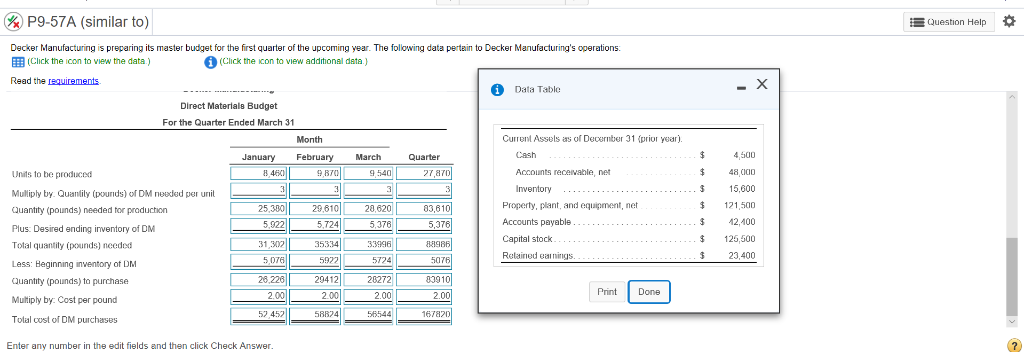

P9-57A (similar to) Question Help i More Info Decker Manufacturing is preparing its master budget for the first (Click the icon to view the data) (Click the Read the requirements a.Actual sales in December were $70,000 Selling price per unit is projected to remain stable at S10 per unit throughout the budget penod. Sales for the first five months of the upcoming year are budgeted to be as follows Direct Materials Bud For the Quarter Ended M Units to be produced Multiply by Quantity (pounds) of DM needed per unit Quantity (pounds) needed for production Plus. Desired ending inventory of DM Total quantity (pounds) needed Less. Beginning inventory of DM Quantity (pounds) to purchase Multiply by Cost per pound January.........S 80,000 February $ 92.000 ....$ 99,000 April............$ 97,000 May $ 35,000 b.Sales are 30% cash and 70% credit All credit sales are collected in the month following the sale c.Decker Manufacturing has a policy that states that each month's ending inventory of finished goods should be 25% of the following month's sales in unils). d. Of each month's direct material purchases, 20% are paid for in the month of purchase, while the remainder is paid for in the month following purchase. Two pounds of direct matenal is needed per unit at $2.00 per pound. Ending inventory of direct materials should be 10% of next month's production needs e. Most of the labor at the manufacturing facility is indirect but there is some direct labor incurred. The direct labor hours per unit is 0.01. The direct laborale per hour is $12 per hour. All direct labor is paid for in the month in which the work is performed. The direct labor total cost for each of the upcoming three months is as follows: January .....$ February .........$ 998 1,125 Total cost of DM purchases Enter any number in the edit fields and then click Check Answ | Print | Done] P9-57A (similar to) Question Help i More Info Decker Manufacturing is preparing its master budget for the first (Click the icon to view the data) Click the Read the requirements WICITUTE WOINTS POTOMTO THE V.VT. THE T W O Tane per hour is per mour. UVOTTS per Tor US mon direct labor total cost for each of the upcoming three months is as follows: Direct Materials Bud For the Quarter Ended M Units to be produced Multiply by Quanlily (pounds) of DM nooded per unit Quantity (pounds) needed for production January.........$ 998 February ........$ 1,125 March ............$ 1,182 f. Monthly manufacturing overhead costs are $5,000 for factory rent, $3 000 for other foxed manufacturing expenses and 51 20 per unit for variable manufacturing overhead. Nu depreciation is included in these figures. All expenses are paid in the month in which they are incurred g.Computer equipment for the administrative offices will be purchased in the upcoming quarter. In January, Decker Manufacturing will purchase equipment for $5.000 (cash), while February's cash extindilure will be $12.000 and March's cash expenditure will be $16.XIO h.Operating expenses are budgeted to be $1.00 per unit sold plus fixed operating expenses of $1.000 per month. All operating expenses are paid in the month in which they are incurred. No depreciation is included in these figures. i. Depreciation on the building and equipment for the general and administrative offices is budgeted to be $4,800 for the entire quarter which includas preciation on new acquisitions J. Decker Manufacturing has a policy that the ending cash balance in each month must be at least $4,000. It has a line of credit with a local bank. The company can borrow in increments of $1.000 at the beginning of each month, up to a total outstanding loan balance of S150 000 The interest rate on these loans is 1% per month simple interest (not compounded). The company would pay down on the line of credit balance in increments of $1,000 if it has excess funds at the end of the quarter. The company would also pay the accumulated interest at the end of the quarter on the funds borrowed during the quarter k. The company's income tax rate is projected to be 30% of operating income less interest expense. The company pays $10,000 cash at the end of February in estimated laxes. Plus. Desired ending inventory of DM Total quantity (pounds) needed Less: Beginning inventory of DM Quantity (pounds) to purchase Mulliply by. Cost per pound Total cost of DM purchases Enter any number in the edit fields and then click Check Answ Print | Done 10 parts P9-57A (similar to) Question Help Decker Manufacturing is preparing its master budget for the first quarter of the upcoming year. The following data pertain to Decker Manufacturing's operations: (Click the icon to view the data) (Click the icon to view additional data) Read the requirements i Data Table - X March 9540 Quarter 27,870 Direct Materials Budget For the Quarter Ended March 31 Month January February Units to be produced 8.460 9,870 Muilliply by Quantity (pounds) of DM needed per unil L- Quantity (pounds) needed for production 25,390|| 29,610 Plus: Desired ending inventory of DM 5,922 5.724 Total quantity (pounds) needed 31 30211 35334 Less: Beginning inventory of DM 5076 5922 Quantity (pounds) to purchase 28,2281 20.2201 29412 29412 Multiply by: Cost per pound 2.000 2.00 52,452 58824 Total cost of DM purchases Current Assels as of December 31 (prior year). Cash ................$ Accounts receivable, net ..........$ Inventory Property, plant, and equipment, net Accounts payable Capital stock................. Relained earnings....................................$ 20,620 5,376 83,6101 5,376 4,500 48000 15,600 121,500 12,100 125,500 23,400 33996 38986 5724 5076 2 0272 2.00 83910 2.00 167820 Print Done 56544 Enter any number in the edit fields and then click CheckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started