Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help with Estimation of Year 5 Cash Flows (& evaluation.) Any help on this is greatly appreciated along with any explanations. I will post photos

Help with Estimation of Year 5 Cash Flows (& evaluation.)

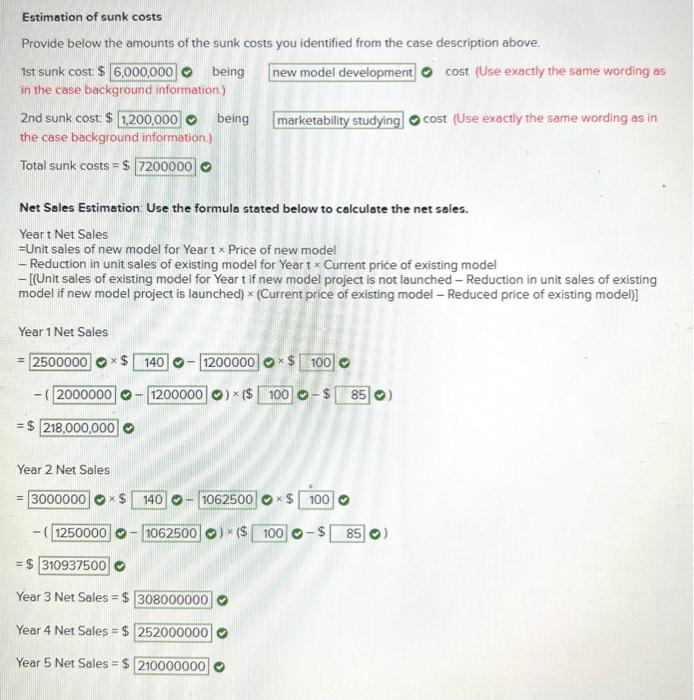

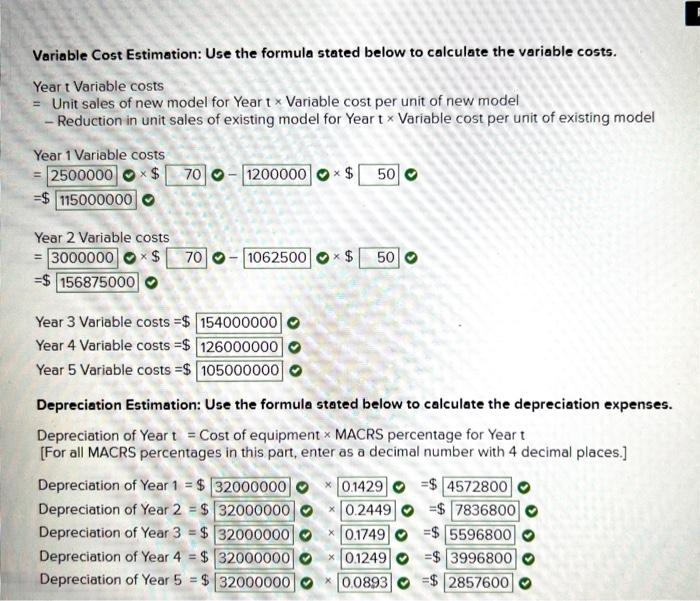

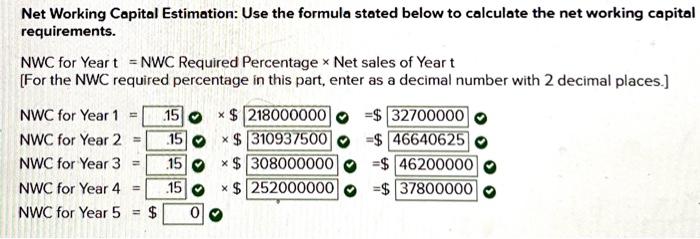

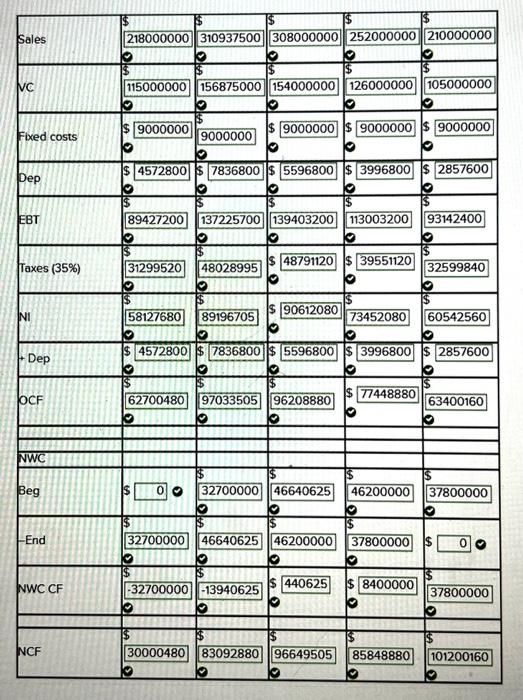

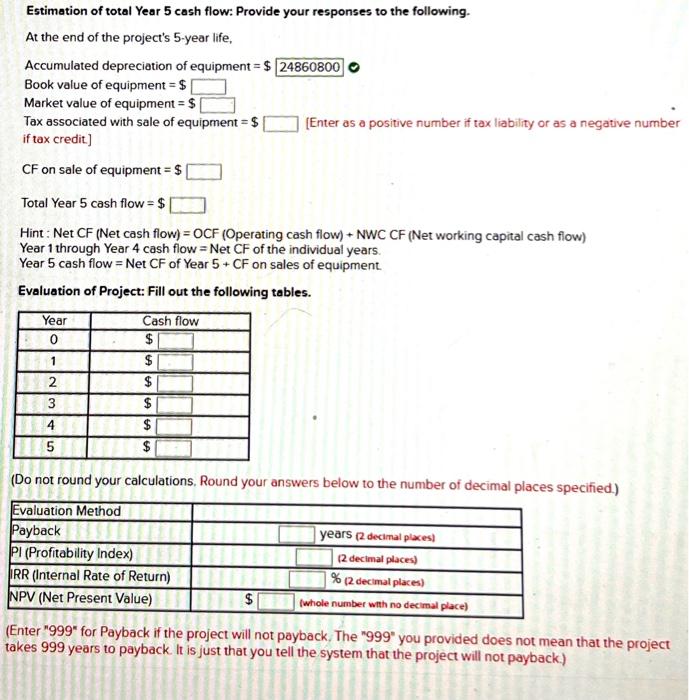

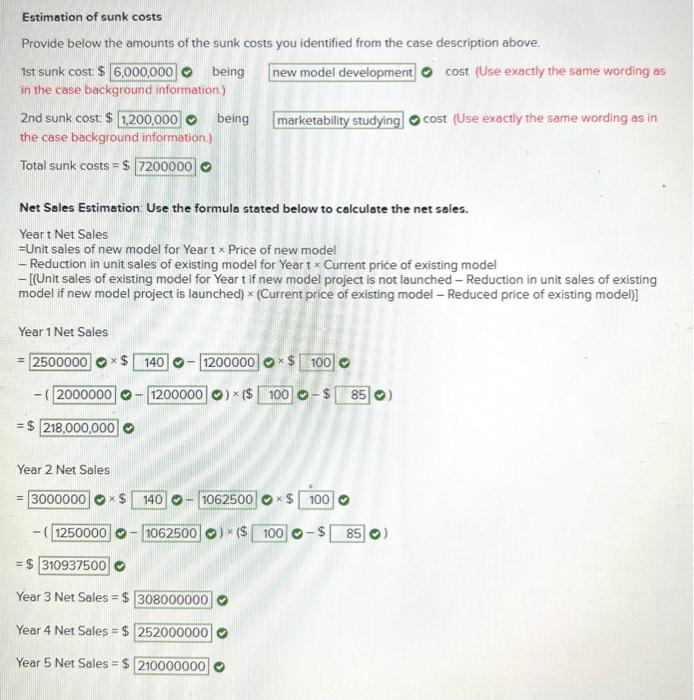

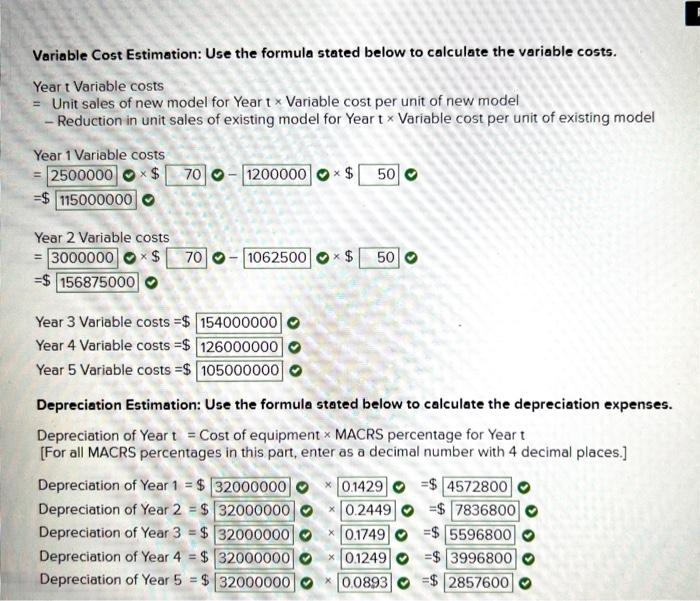

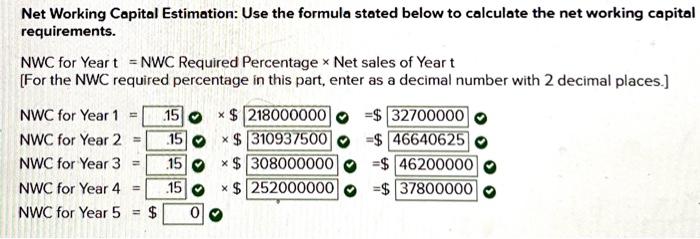

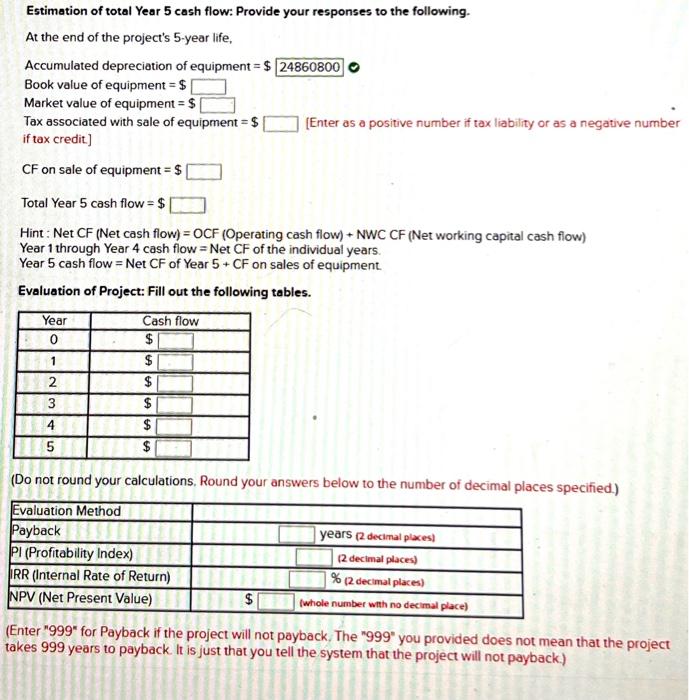

Estimation of sunk costs Provide below the amounts of the sunk costs you identified from the case description above. 1st sunk cost $ being cost (Use exactly the same wording as in the case background information.) 2nd sunk cost $ cost (Use exactly the same wording as in the case background information.) Total sunk costs =$ Net Sales Estimation. Use the formula stated below to calculate the net sales. Year t Net Sales =Unit sales of new model for Year t Price of new model - Reduction in unit sales of existing model for Year t Current price of existing model - [(Unit sales of existing model for Year t if new model project is not launched - Reduction in unit sales of existing model if new model project is launched) * (Current price of existing model - Reduced price of existing model)] Year 1 Net Sales Year 2 Net Sales =$ Year 3 Net Sales =$ Year 4 Net Sales =$ Year 5 Net Sales =$ Variable Cost Estimation: Use the formula stated below to calculate the variable costs. Year t Variable costs = Unit sales of new model for Year t Variable cost per unit of new model - Reduction in unit sales of existing model for Year t Variable cost per unit of existing model Year 1 Variable costs =0$0$ =$ Year 2 Variable costs =0$00$ =$ Year 3 Variable costs =$ Year 4 Variable costs =$ Year 5 Variable costs =$ Depreciation Estimation: Use the formula stated below to calculate the depreciation expenses. Depreciation of Year t = Cost of equipment MACRS percentage for Year t [For all MACRS percentages in this part, enter as a decimal number with 4 decimal places.] Depreciation of Year 1=$ Depreciation of Year 2=$ Depreciation of Year 3=$ Depreciation of Year 4=$ Depreciation of Year 5=$ Net Working Capital Estimation: Use the formula stated below to calculate the net working capital requirements. NWC for Year t= NWC Required Percentage Net sales of Year t [For the NWC required percentage in this part, enter as a decimal number with 2 decimal places.] NWC for Year 1=0$=$ Estimation of total Year 5 cash flow: Provide your responses to the following. At the end of the project's 5-year life, Accumulated depreciation of equipment =$ Book value of equipment =$ Market value of equipment =$ Tax associated with sale of equipment =$ [Enter as a positive number if tax liability or as a negative number if tax credit] CF on sale of equipment =$ Total Year 5 cash flow =$ Hint: Net CF (Net cash flow) = OCF (Operating cash flow) + NWC CF (Net working capital cash flow) Year 1 through Year 4 cash flow = Net CF of the individual years. Year 5 cash flow = Net CF of Year 5+CF on sales of equipment. Evaluation of Project: Fill out the following tables. (Do not round your calculations, Round your answers below to the number of decimal places specified.) (Enter "999" for Payback if the project will not payback. The "999" you provided does not mean that the project takes 999 years to payback. It is just that you tell the system that the project will not payback.) Estimation of sunk costs Provide below the amounts of the sunk costs you identified from the case description above. 1st sunk cost $ being cost (Use exactly the same wording as in the case background information.) 2nd sunk cost $ cost (Use exactly the same wording as in the case background information.) Total sunk costs =$ Net Sales Estimation. Use the formula stated below to calculate the net sales. Year t Net Sales =Unit sales of new model for Year t Price of new model - Reduction in unit sales of existing model for Year t Current price of existing model - [(Unit sales of existing model for Year t if new model project is not launched - Reduction in unit sales of existing model if new model project is launched) * (Current price of existing model - Reduced price of existing model)] Year 1 Net Sales Year 2 Net Sales =$ Year 3 Net Sales =$ Year 4 Net Sales =$ Year 5 Net Sales =$ Variable Cost Estimation: Use the formula stated below to calculate the variable costs. Year t Variable costs = Unit sales of new model for Year t Variable cost per unit of new model - Reduction in unit sales of existing model for Year t Variable cost per unit of existing model Year 1 Variable costs =0$0$ =$ Year 2 Variable costs =0$00$ =$ Year 3 Variable costs =$ Year 4 Variable costs =$ Year 5 Variable costs =$ Depreciation Estimation: Use the formula stated below to calculate the depreciation expenses. Depreciation of Year t = Cost of equipment MACRS percentage for Year t [For all MACRS percentages in this part, enter as a decimal number with 4 decimal places.] Depreciation of Year 1=$ Depreciation of Year 2=$ Depreciation of Year 3=$ Depreciation of Year 4=$ Depreciation of Year 5=$ Net Working Capital Estimation: Use the formula stated below to calculate the net working capital requirements. NWC for Year t= NWC Required Percentage Net sales of Year t [For the NWC required percentage in this part, enter as a decimal number with 2 decimal places.] NWC for Year 1=0$=$ Estimation of total Year 5 cash flow: Provide your responses to the following. At the end of the project's 5-year life, Accumulated depreciation of equipment =$ Book value of equipment =$ Market value of equipment =$ Tax associated with sale of equipment =$ [Enter as a positive number if tax liability or as a negative number if tax credit] CF on sale of equipment =$ Total Year 5 cash flow =$ Hint: Net CF (Net cash flow) = OCF (Operating cash flow) + NWC CF (Net working capital cash flow) Year 1 through Year 4 cash flow = Net CF of the individual years. Year 5 cash flow = Net CF of Year 5+CF on sales of equipment. Evaluation of Project: Fill out the following tables. (Do not round your calculations, Round your answers below to the number of decimal places specified.) (Enter "999" for Payback if the project will not payback. The "999" you provided does not mean that the project takes 999 years to payback. It is just that you tell the system that the project will not payback.) Any help on this is greatly appreciated along with any explanations.

I will post photos of all the previous calcuations and information that have been checked for accuracy. ( All are correct!)

I just need help on the last portion as mentioned (the one with empty blanks.)

Information Below:

Sunk Costs & Net Sales (all correct)

Variable Costs & Depreciation (all correct)

NWC (all correct)

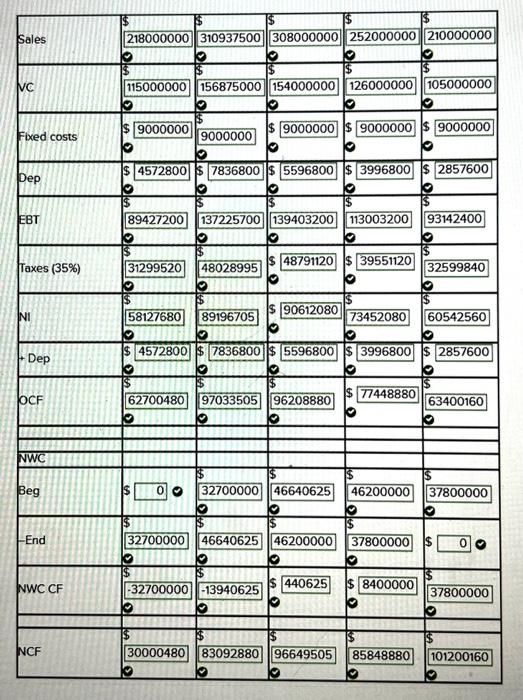

Estimation of Cash Flows (all correct)

and heres the portion i need help on. (Thanks in advance!)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started