Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help with expected rate of return on tylers portfolio over the bext year. (with formula)and is the statemet correct at the end ? company H

help with expected rate of return on tylers portfolio over the bext year. (with formula)and is the statemet correct at the end ? company H has a lower risk

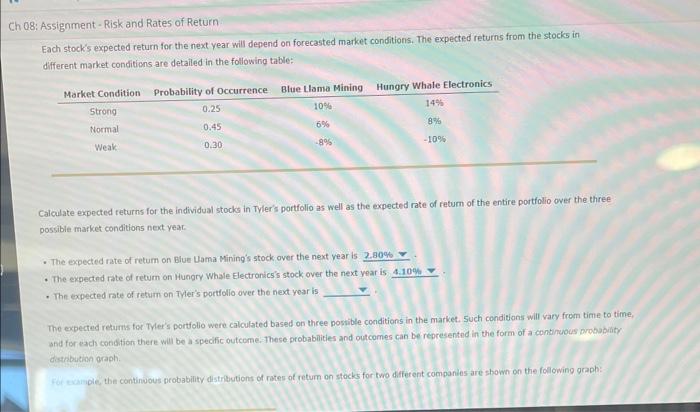

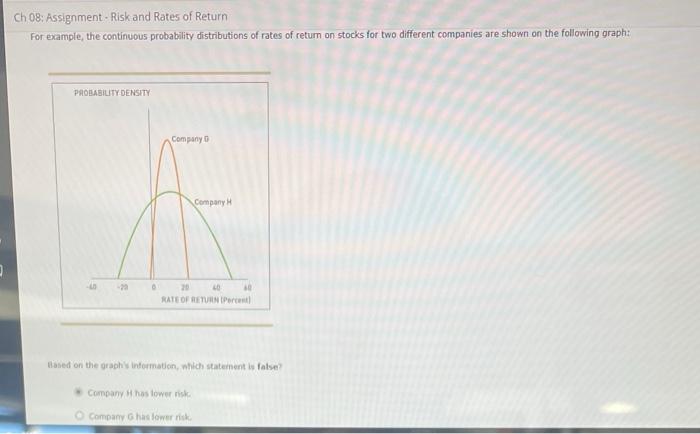

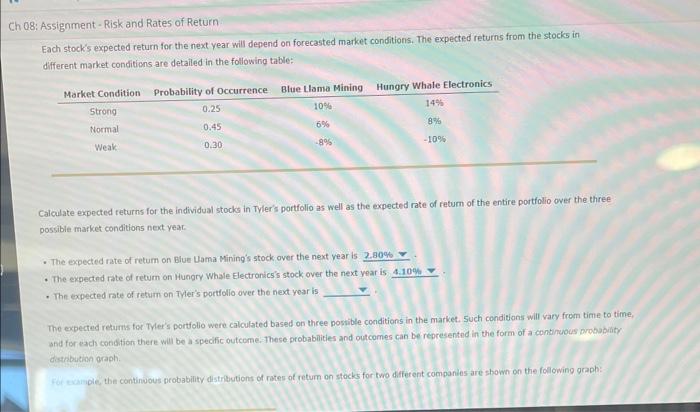

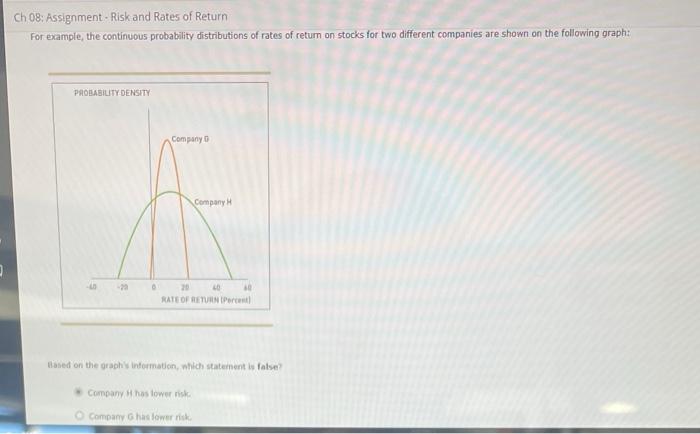

Each stock's expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in different market conditions are detailed in the following table: Calculate expected returns for the individual stocks in Tvier's portfolio as well as the expected rate of retum of the entire portfolio over the three possible market conditions next yeac. - The expected rate of retum on Blue Uama Mining's stock over the next year is - The expected rate of retum on Hungry Whale Electronics's stock over the next year is - The expected rate of retum on Tyer's portfollo over the next year is The expected reaurns for TMer's portfolio were calculated based on three possible conditions in the market. 5 uch conditions will vary from time to time, and for each condition there will be a specific outcome. These probabilities and outcomes can be representid in the form of a continuous probubility. distedbution graph. Fof echimple, the continvous probability distributions of rates of retum on stocks for two different companies are shown on the following graph: h 08: Assignment - Risk and Rates of Return For example, the continuous probability distributions of rates of retum on stocks for two different companies are shown on the following graph: Based on the graphis intermation, which staternent is false? Company 11 has tower risk: Company 6 has lower risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started