Question

Help with Financial Accounting - General Journal/General Ledger. Please, help me put with filling this practice assignment. I need to fill entries to general journal,

Help with Financial Accounting - General Journal/General Ledger.

Please, help me put with filling this practice assignment. I need to fill entries to general journal, unadjusted trial balance, adjusted balance, financial statements, and putting all together in general ledger. I know it sounds like a lot, but it is very straightforward and not much information. I am having issues with understanding it, one full practice solution could help me out greatly. Many thanks in advance.

Instructions:

-

December 2020 is the opening of this companys business.

-

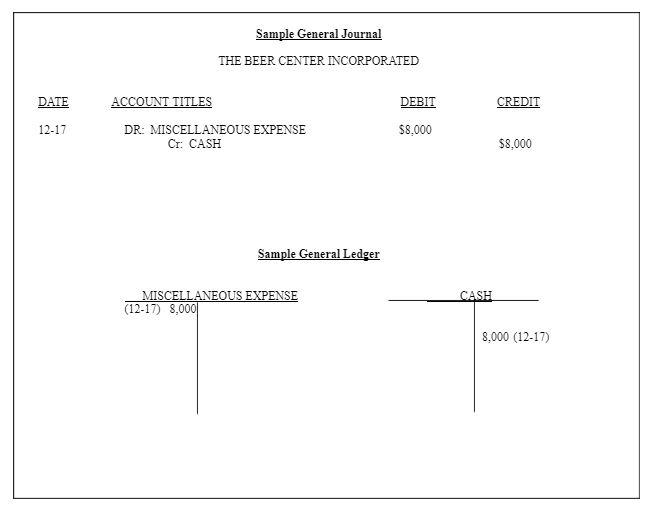

Record the transaction journal entries for the December transactions in the General Journal. A sample General Journal has been illustrated for you.

-

Post the December transaction journal entries into the General Ledger. A sample General Ledger has also been provided.

-

Prepare an UNADJUSTED trial balance at December 31, 2020.

-

Record the necessary adjusting journal entries in the General Journal. See the additional data to determine the adjustments. There are five adjusting entries in total. Please use 12-31-20 as the date for each adjusting entry and show all calculations clearly!

-

Post the adjusting journal entries to the SAME General Ledger (Some account balances will change and some will not)

-

From the updated general ledger, prepare an ADJUSTED trial balance at December 31, 2020.

-

Prepare the Corporations first three financial statements in the correct order for December 2020.

-

Place the completed assignment in the following order:

-

General Journal (include ALL journal entries

-

Unadjusted Trial Balance

-

Adjusted Trial Balance

-

Financial Statements

-

General Ledger (contains ALL of your T accounts)

Problem Information

The Allbeers Inc. started its business on December 1, 2020 , and it was formed by two people, Mrs. Guiness and Mr. Pale. The Allbeers is designed to provide counseling services to those who need a drink. You are asked to go through the entire accounting cycle and prepare the Centers books for the month of December.

The following transactions occurred in December of 2020:

December 1 - Stockholders invested $100,000 cash in exchange for Capital Stock.

December 2 - Cash of $60,000 was received from clients in advance. One-half of this amount relates to services that will provided and completed (earned) by the end of December and the other one-half relates to services to be performed in January of the next year. Record ONLY the transaction journal entry on 12-1. None of the $60,000 was earned on December 2.

December 2 - Five months of liability insurance of $50,000 was paid in advance.

December 2 - Bought new Machinery for $100,000 and signed a two-year note payable. The Machinery was in use for one full month. No payment is due on the note until January and no interest will start to accrue until January 2021.

December 7 - Billed clients $35,000 for services that were performed and the obligation was completed (earned) in December. The company has not yet received any cash payments.

December 15 - Collected $15,000 from the clients billed on December 7.

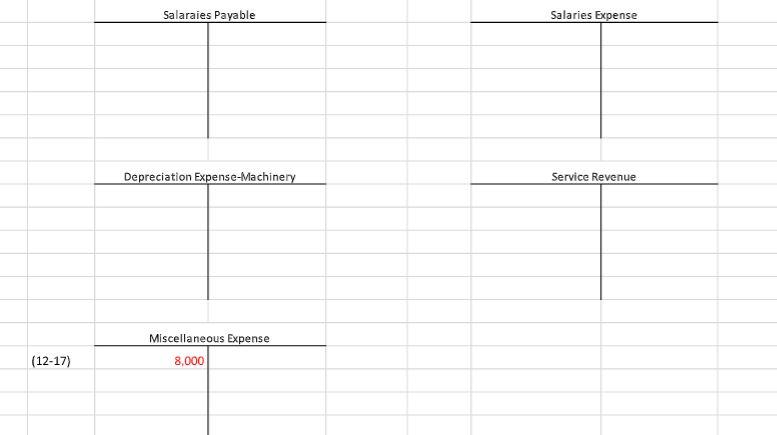

December 17 - Miscellaneous expenses for the month were $8,000, paid in cash.

December 20 - Bought supplies on credit for $5,000. These supplies have not yet been used yet.

December 27 - The Company declared a $2,000 cash dividend on this date. It will not be paid until January.

December 30 - Paid salaries of $11,000 to employees for the month of December.

Additional Information: (Use this information to prepare the FIVE adjusting entries.)

-

The Machinery is expected to last for ten years, with a $16,000 salvage value at the end of the period.

-

$3,000 of the total supplies are still on hand at months end.

-

The company owes its employees $6,000 for salaries they earned during the last week of December. These salaries will be paid in January.

-

Two more adjusting entries are also needed based on the transactions that took place on December 2. Below is the sample General journal and empty general ledger.

-

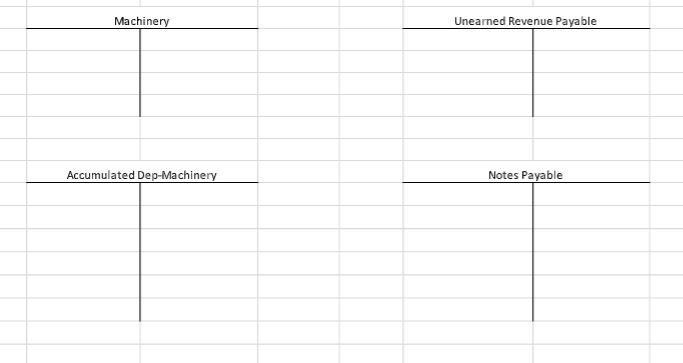

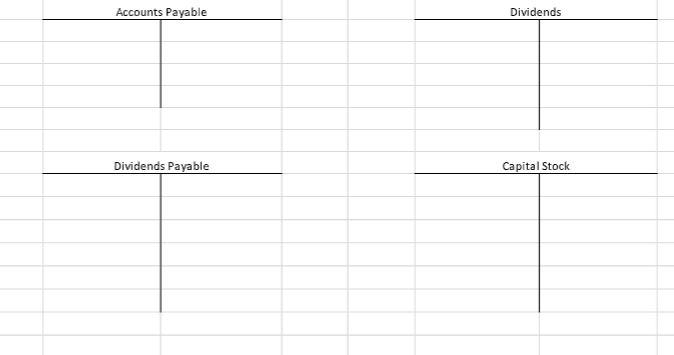

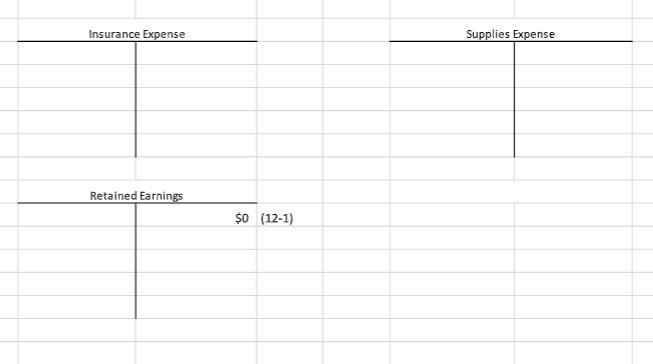

General Ledger

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started