Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help with Investment Homework I need help with these questions, showing work with be much appreciated so I can learn from it. Thank you 6)

Help with Investment Homework

I need help with these questions, showing work with be much appreciated so I can learn from it. Thank you

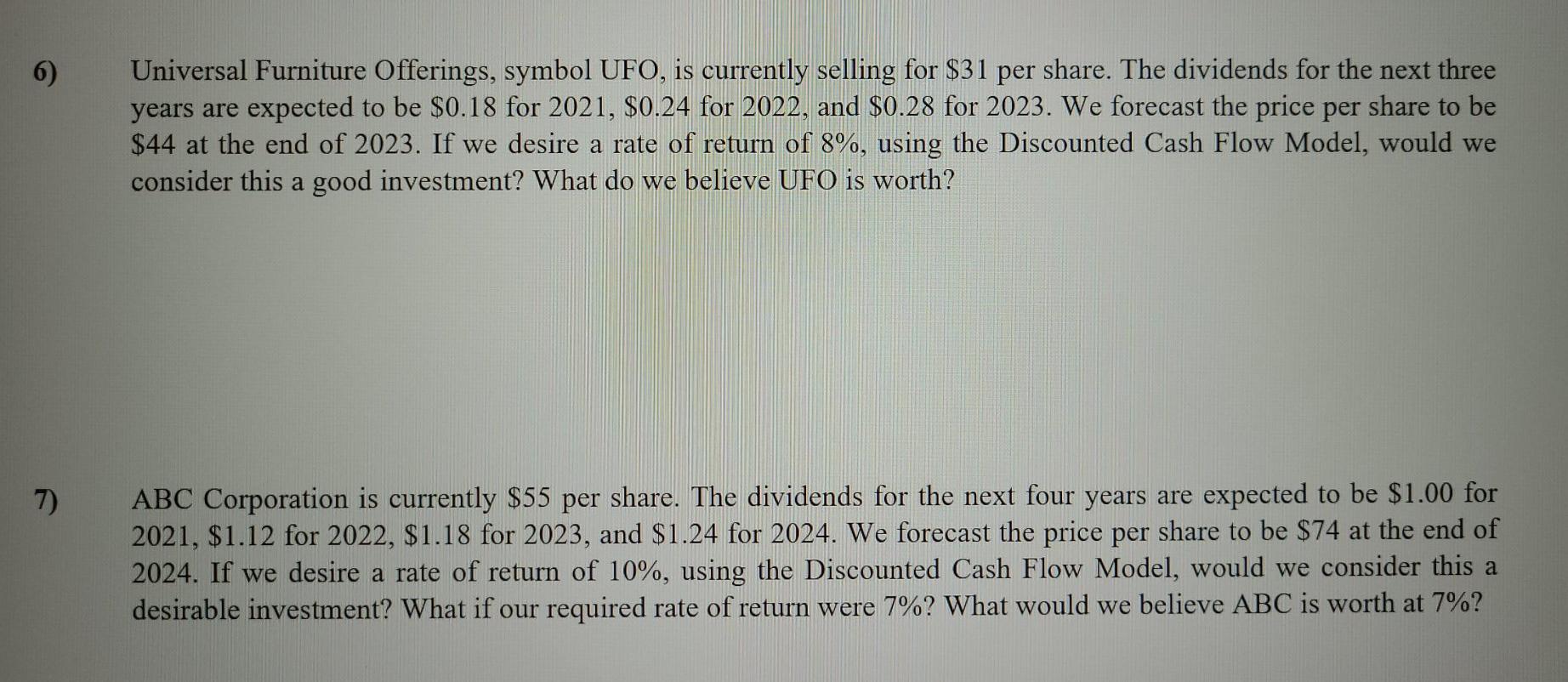

6) Universal Furniture Offerings, symbol UFO, is currently selling for $31 per share. The dividends for the next three years are expected to be $0.18 for 2021, $0.24 for 2022, and $0.28 for 2023. We forecast the price per share to be $44 at the end of 2023. If we desire a rate of return of 8%, using the Discounted Cash Flow Model, would we consider this a good investment? What do we believe UFO is worth? 7) ABC Corporation is currently $55 per share. The dividends for the next four years are expected to be $1.00 for 2021, $1.12 for 2022, $1.18 for 2023, and $1.24 for 2024. We forecast the price per share to be $74 at the end of 2024. If we desire a rate of return of 10%, using the Discounted Cash Flow Model, would we consider this a desirable investment? What if our required rate of return were 7%? What would we believe ABC is worth at 7%? O 8) The price of NanoGene Unlimited, stock symbol NAGU, is currently $65 per share. The company pays no dividends. Justin Tyme expects the price three years from now to be $100 per share. If Justin desires a 13% rate of return, at what price would we consider NAGU to be a good investment for him? Which model did you useStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started