Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help with part B please Edward works in the accounting department of a local footwear manufacturer that specializes in clogs and boots. Clogs and boots

help with part B please

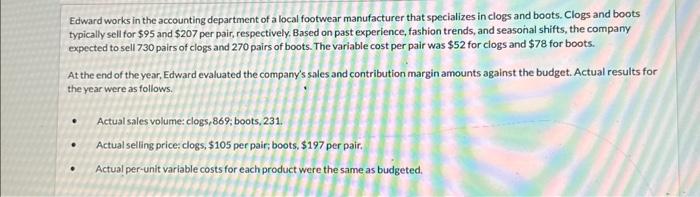

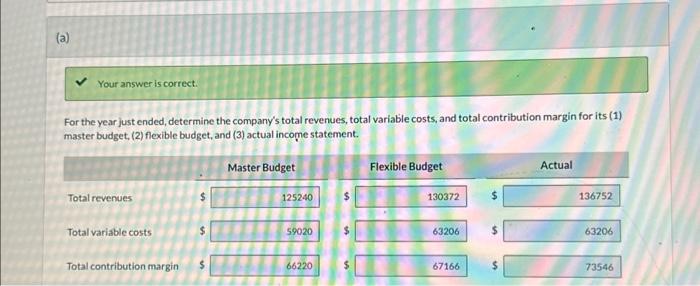

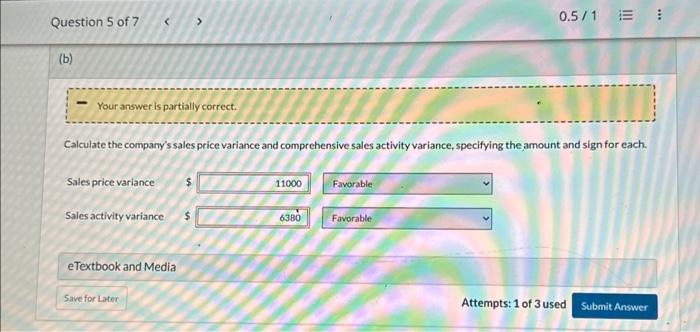

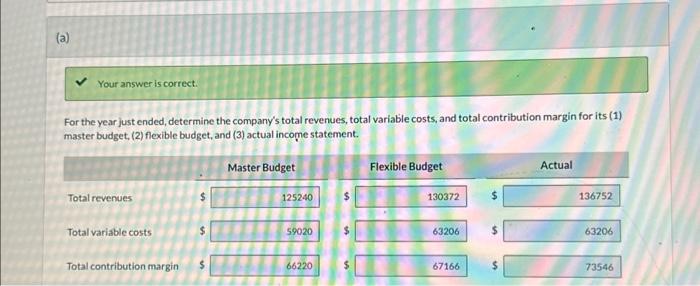

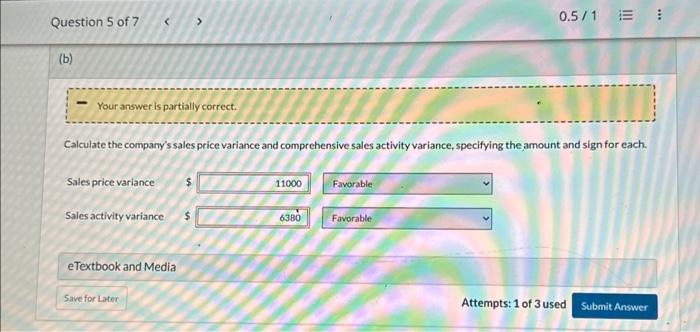

Edward works in the accounting department of a local footwear manufacturer that specializes in clogs and boots. Clogs and boots typically sell for $95 and $207 per pair, respectively. Based on past experience, fashion trends, and seasonal shifts, the company expected to sell 730 pairs of clogs and 270 pairs of boots. The variable cost per pair was $52 for clogs and $78 for boots. At the end of the year, Edward evaluated the company's sales and contribution margin amounts against the budget. Actual results for the year were as follows. - Actual sales volume: clogs, 869 ; boots, 231. - Actual selling price: clogs, $105 per pair; boots, $197 per pair. - Actual per-unit variable costs for each product were the same as budgeted. Your answer is correct. For the year just ended, determine the company's total revenues, total variable costs, and total contribution margin for its (1) master budget, (2) flexible budget, and (3) actual income statement. Calculate the company's sales price variance and comprehensive sales activity variance, specifying the amount and sign for each. Sales price variance Sales activity variance Edward works in the accounting department of a local footwear manufacturer that specializes in clogs and boots. Clogs and boots typically sell for $95 and $207 per pair, respectively. Based on past experience, fashion trends, and seasonal shifts, the company expected to sell 730 pairs of clogs and 270 pairs of boots. The variable cost per pair was $52 for clogs and $78 for boots. At the end of the year, Edward evaluated the company's sales and contribution margin amounts against the budget. Actual results for the year were as follows. - Actual sales volume: clogs, 869 ; boots, 231. - Actual selling price: clogs, $105 per pair; boots, $197 per pair. - Actual per-unit variable costs for each product were the same as budgeted. Your answer is correct. For the year just ended, determine the company's total revenues, total variable costs, and total contribution margin for its (1) master budget, (2) flexible budget, and (3) actual income statement. Calculate the company's sales price variance and comprehensive sales activity variance, specifying the amount and sign for each. Sales price variance Sales activity variance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started