Answered step by step

Verified Expert Solution

Question

1 Approved Answer

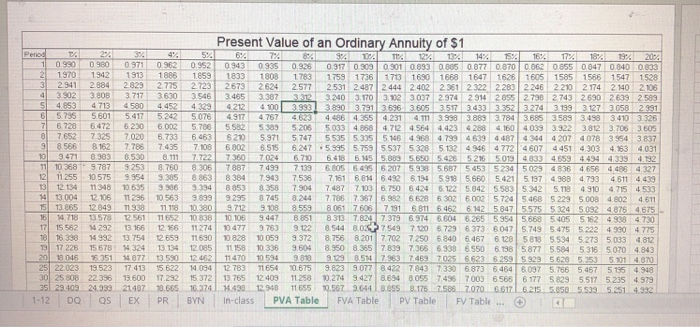

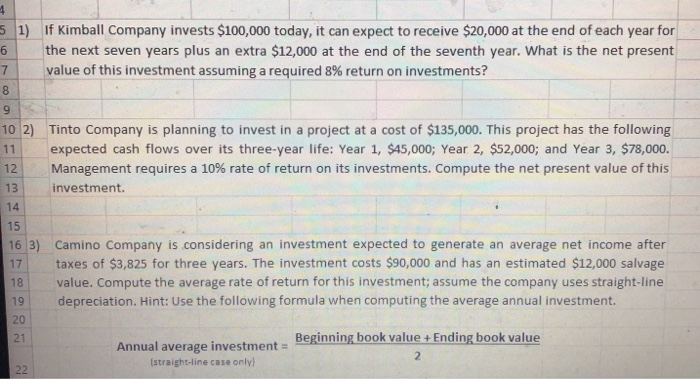

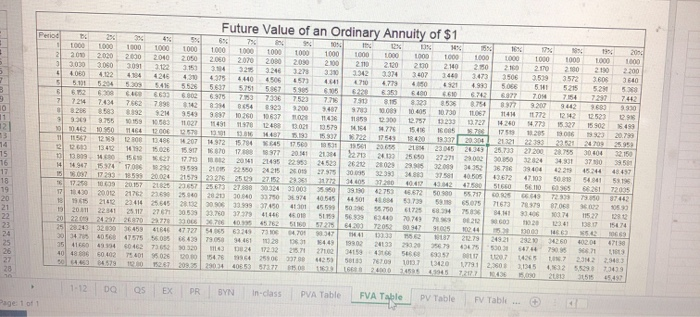

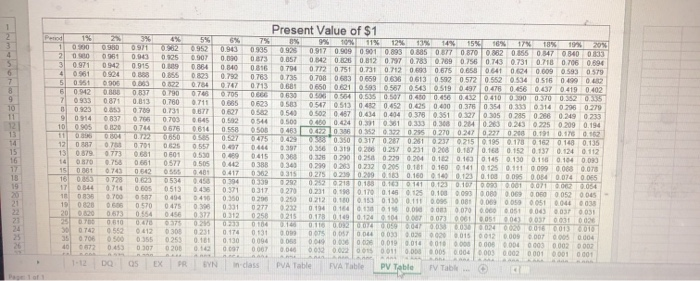

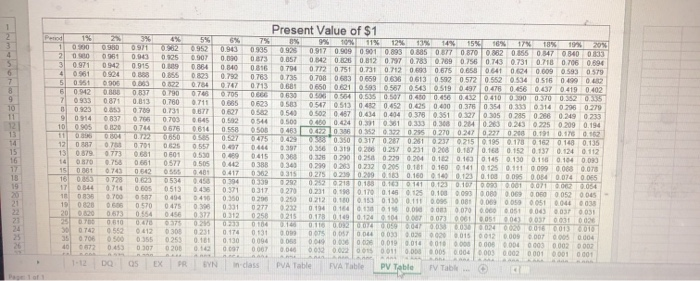

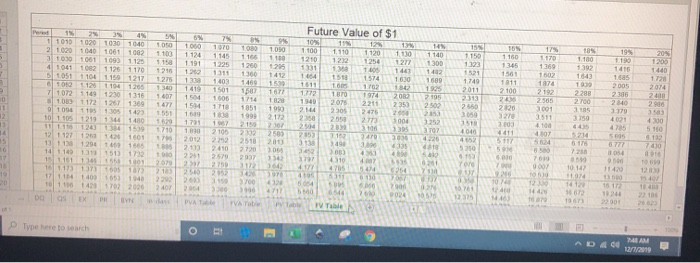

help with QS. provided is the PVA, FVA, PV,FV tables needed to conplete the problem. Period 2% 10.900 0.980 2 1.970 1942 3 2.941 2.884

help with QS. provided is the PVA, FVA, PV,FV tables needed to conplete the problem.

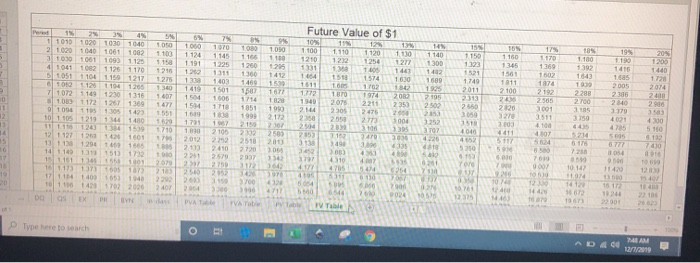

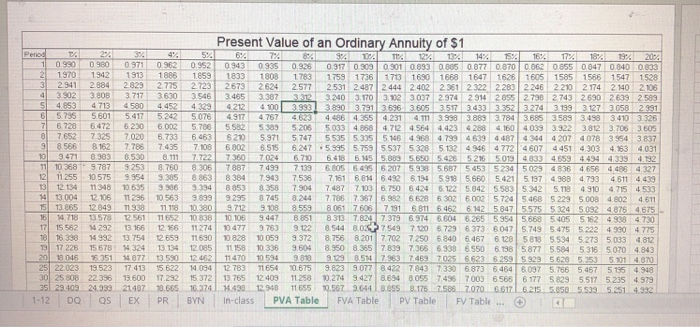

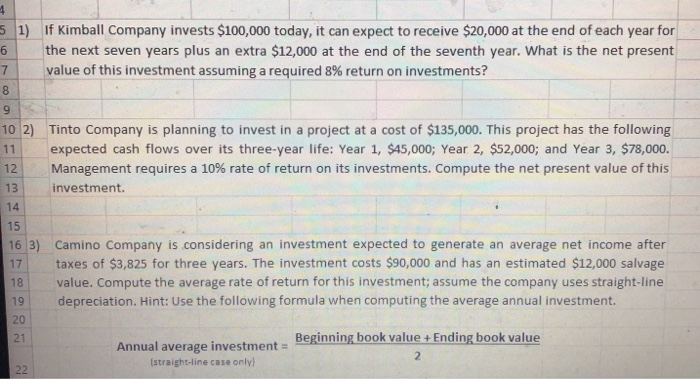

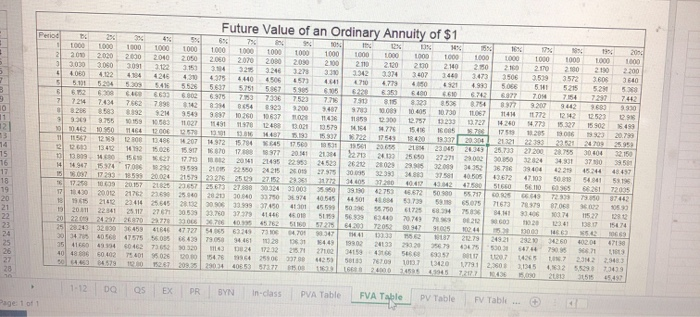

Period 2% 10.900 0.980 2 1.970 1942 3 2.941 2.884 4 3.302 3.803 S 4953 4 713 6 5.795 5601 7 6.728 6472 8 7652 7325 9 8 566 8162 10 9471 8383 111 10.3689.787 12111255 10.575 13 12.134 11348 14 13 004 12 106 15 13.865 12 949 1614.718 13578 17 15 552 14 292 10 16 338 14 992 1917 225 75 578 2013.045 351 25 22.023 13 523 30 25 808 22 336 352940324933 1-12 DO OS Present Value of an Ordinary Annuity of $1 3% 4% 5% 6% 7 6 9 1 2 13% 14% 15% 16% 17% 18% 19% 20% 0371 0.962 0.952 0943 09350.9250.317 099 0801 0.893 0.8050 877 0.870 00620055 0.047 0.840 0.833 1913 1886 1859 1833 1808 1783 1759 1736 1713 1690 1668 1647 1626 1605 1585 1586 1547 1528 2823 2.775 2.723 2673 2624 2577 2531 2487 2444 2402 2381 2322 223 2246 2210 2174 2140 2106 3717 3630 3.546 34653387 3312 320 37701 302 3037 2.974 2914 2855 2730 2743 2690 2639 2589 4580 4452 43294212 4900 3.993 3890 3.791 3696 3 605 3517 3433 3352 3.274 31993 .127 3.058 2.991 5417 5242 507649174767 463 4 486 4355 4231 4. 3.998 3.889 3.784 3.685 3.589 3.498 3.410 3.326 6230 6 002 5.786 55825395 205 5033 4.858 4.712 4564 4423 4288 4160 4.039 3.322 3812 3.705 3.605 7020 5.733 6.463 520 5.971 5.747 55355.335 5.146 438 47334639 447 444 4 207 4078 3.954 3837 7.705 7.435 7108 68025 515 6.247 595 5.7595 537 5328 5132 4 946 47724 607 4451 4303 4.163 4.031 3530 8.111 7.722 7360 7024 6710 6.418 6.145 5.889 5.650 5.426 5216 5019 4833 4.659 4434 4.333 4.132 3253 8.760 8.3067887 7499 7 133 6.05 5.456 207 5.939 5587 5 453 5 234 5023 4836 4656 4.498 4.327 9 954 93858.863 8 384 7943 7536 7151 68146.492 6194 5.919 5.660 5421 5197 4.908 4.793 4 511 4.433 10.6353 336 3394 88538.358 7.904 7.487 7.103 | 6.750 6.424 5.122 5842 5583 5.342 5.118 4.910 4.715 4533 11236 10.563 3.89992958745 8.244 7.706 7.357 6.982 6 628 6302 6002 5 7245 468 5229 5008 4.802 4.511 119 1110 10309712 9.108 8.559 8061 7608 7 191 68115462 6142 58475575 524 5092 4.875 4.675 2561 11652 10 338 10 105 9.447 8.851 8.313 7.824 7.379 6.374 6604 6 265 5354 568 5.405 S162 4 988 4.730 13 166 12 16 1127410477 9763 9.122 8.544 8.02 7.549 7.120 5.729 6373 6047 5.749 5.475 5.222 4990 4775 3.754 2659 11630 828 10.059 9.372 8.756 8201 7.702 7250 5840 5467 6120 581 5.534 5.273 5.033 4.812 W324 13 134 12085 1158 10.336 9.604 8.950 8.365 7.839 7365 333 6550 6 1985877 5584 5316 5.070 4.843 077 13 530 12 462 11470 10 534 9810 929 8.517.363746970256 623 6.259 5.329 5620 5.35) 5.101 4.870 17 413 15 622 14 034 12.783 1654 90.675 9.8239077 842278437330687364646097 5756 5.467 5155 4.948 13.600 17292 15 372 13.765 12.409 11258 0.274 9.427 8.694 8055 7495 70036565 6177 5829 5.517 5.235 4979 21407 0.665 16374 1499 12.948 11655 9.567 9.644 81855 8.1757.5867070661702155505533 5.251 4.332 EX PR BYN In-class PVA Table FVA Table PV Table FV Table 51) If Kimball Company invests $100,000 today, it can expect to receive $20,000 at the end of each year for the next seven years plus an extra $12,000 at the end of the seventh year. What is the net present value of this investment assuming a required 8% return on investments? 10 2) 12 Tinto Company is planning to invest in a project at a cost of $135,000. This project has the following expected cash flows over its three-year life: Year 1, $45,000; Year 2, $52,000; and Year 3, $78,000. Management requires a 10% rate of return on its investments. Compute the net present value of this investment. 13 17 16 3) Camino Company is considering an investment expected to generate an average net income after taxes of $3,825 for three years. The investment costs $90,000 and has an estimated $12,000 salvage 18 value. Compute the average rate of return for this investment; assume the company uses straight-line depreciation. Hint: Use the following formula when computing the average annual investment. Beginning book value + Ending book value Annual average investment = Istraight-line case only) Future Value of an ordinary Annuity of $1 30 TORS HUN 1000 1000 100000000000000000000000000000000 2020 2030 2040 2050 2050 2020 2020 20902102112402021 20 2 2021 20 3000 3000 3001 302 303 304 325 326 327 30242 3:37 1407 74 1673 904 689 32 506 5 5215 529 57 5.204 530 54 55 56 5751 5867 505 5 220 6351 64904610 6743 7054 727 8 633 5.30 5.975753 2336 7523775790815 81 3536 754 920 92 96 70476627 3 04 054 3 2009 0 0 0 0 0 2 0 383 32 95499 100 1061 16699 300 37 23 274 260 470 157 15 902 549 90 95 159 110 111 1128 0 15911426 1546 5 1 2 3 1349 1920 947 576 0 0 0 15 16 17 7 7 2041 2042 243 25650 27271 0 0050 320243401 370 9 61 1415 2 24 2621 02 03 2 12255026215 275 200 32.390 40 37581 0 2 0 1 0 0 0 43 STEL 110 0 25 0 39130 275 5.572 50900 811 4 2 150 144 2540 20 20 30 40 3370 674 10.545450118843739 589 50357163 0 29 9 0 0 1 0 157 140 2001 217622 9 1 5 0 02224397 70 706 705 5725 SISS4 205 94 105 153202903645966777 56337104700.347 33 2 19 9 1 39404627303 ) 24 22 25.71 271034159 166546.683357 401 48 950 402 401 502 5475 54 255060700025581337709 07 20 80 6445790 209529034 408535777 1 6600035 45 4 22402 3 17 42 112501 20 32 2,483 69 419 5 2 1-12DQ QSEX PR BYN in-class PVA Table FVA Table PV Table FV Table ... A 1 Present Value of $1 55978 99 2 52 0 0.900 0.971 002 0952 0.93 0935 0.92 0.917 0.909 0.01 0.893 0.885 08770870 0.32 0.856 0.3470340 0333 2 0 0 051 0.90 0.125 0.907 000 0373 08570.542 0208120797 0.78 0.789 0.756 0743 0.731 0.7180 .706 0.694 3 0.971 0942 0.915 0100 0.884 0.840 08160794 07120751 0.731 0.712 0.6 0.675 0.658 0.641 0.24 0.609 0.593 0579 4 0961 0924 083 0855 0823 0.72 0.763 0.735 0.708 06330669 0.636 0.613 0502 0572 0.552 0534 0515 0499 0.42 505 906 0.000 022 0.784 070707130681 0650 3 567 0563 519 0.497 0.478 0.56 0.437 04190 .402 60. 92 OB 083790 0705705 06 07 08 057 056 0.432 010 030 0.3700305 0.665 0523 0.5830 547 0.513 0. 42 0.452 0.2 0.400 0.375 0.354 0.313 0.314 0.296 0.279 0.323 0853 0.709 0.731 0.677 0527 052 054) 050257 0.434 0414038 0351 07 05 0295 0266 0249 0233 90914 837 0.766 0.703 0545 0.502 544 0.500 000 0.4240 1 0333 0.308 0284 0.23 0.243 0 2250 209 0.194 10005 0320 0744 0.575 0614 0.558 508 4630 0 602 2 02550270 0.2470 227 0 206 0.191 0.17 0.162 11 0304 0720650030505274475 0 00287027 021502195178 0.16210 0.135 120 07 791 05055707044637 036 031 025723102080.187001501370124 0112 130.879 773 0681 0801 0.530 09 0415 36302302900 0 2200 204 0.12 0.100 .145 0.130 0.18 0.14 0.00 14 00 758 0.551 0577 0505 042 0388 33 0 219 0 021202050.100 .1500141 0.125 0.1110099 0.008 0.0 TS 15001 070 0642 55 04010417 032 031502750219102090180.160 161 0.123 0.1000096 0.0840074 ODES 1610 0.728 0 0534 450394 0292102 2103 1 0123 001 0 0054 170344 0714 0.605 051304550371 03170270 0.231 0.10 0.10 0.146 0.125 0.1000093 00000069 0.060 00520045 T 0494 490 0.350 0200 0.250 0.212 .180 .13 0.10 0.11 0.095 08 0. 0 0 059 005 004 0038 1908200606 0.570 0475 0.396 01010277 022 0104014010100 01 02 00005100303031 200620 0.673 0.554 0456 0377 0.32 0258 02150178 0.19 0.124010407 0.07300010500400570030026 010 0670 37 02502004001100004059004000000000101010 0742 552 4120301023 0.14 0.131 000 001500570040030 0. 0 002000150012 000900700050004 35706 500 0355 0255 0.16 0.130 0094 053 000 000 002 0010011010 0005 004 0000000003 000 0 000 0000 01100005 004 0000000001010001 12 DQ 05 EXPR SYN n classPVA Table FVA Table PV Table Table Future Value of $1 BSC NE HP WEN Troth AD &

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started