Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help with question 15. Is it 2000 or 3000? I've gotten both answers thus far. Mr. and Mrs. David file a joint tax return. They

Help with question 15. Is it 2000 or 3000? I've gotten both answers thus far.

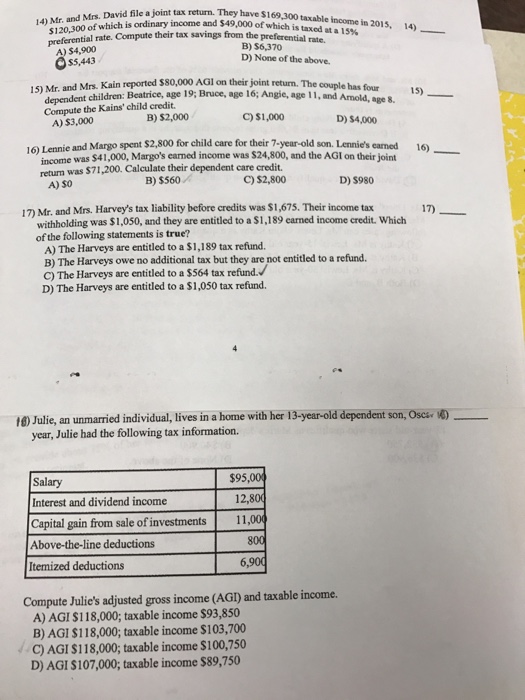

Mr. and Mrs. David file a joint tax return. They have $169, 300 taxable income in 2015, $120, 300 of which is ordinary income and $49,000 of which is taxed at a 15% preferential rate. Compute their tax savings from the preferential rate. A) $4, 900 B) $6, 370 C) $5, 443 D) None of the above. Mr. and Mrs. Kain reported $80,000 AGI on their joint return. The couple has four dependent children: Beatrice, age 19: Bruce age 16: Angle age 11: and Arnold age 8. Compute the Kains' child credit. A) $3,000 B) $2,000 C) $1,000 D) $4,000 Lennie and Margo spent $2, 800 for child care for their 7-year-old son. Lennie's earned income was $41,000. Margo's earned income was $24, 800 and the AGI on their joint return was $71, 200. Calculate their dependent care credit. A) $0 B) $560 C) $2, 800 D) $980 Mr. and Mrs. Harvey's tax liability before credit was $1, 675. Their income tax withholding was $1, 050, and they are entitled to a $1, 189 earned income credit. Which of the following statements is true? A) The Harveys are entitled to a $1, 189 tax refund. B) The Harveys owe no additional tax but they are not entitled to a refund. C) The Harveys are entitled to a $564 tax refund. D) The Harveys are entitled to a $1, 050 tax refund. Julie, an unmarried individual, lives in a home with her 13-year-old dependent son, year. Julie had the following tax information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started