help with review 7 questions:

Q1:

Q2:

Q3:

Q4:

Q5:

Q6:

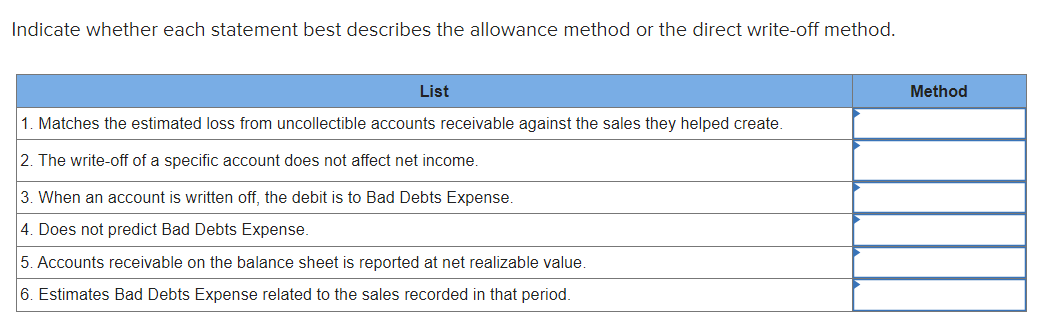

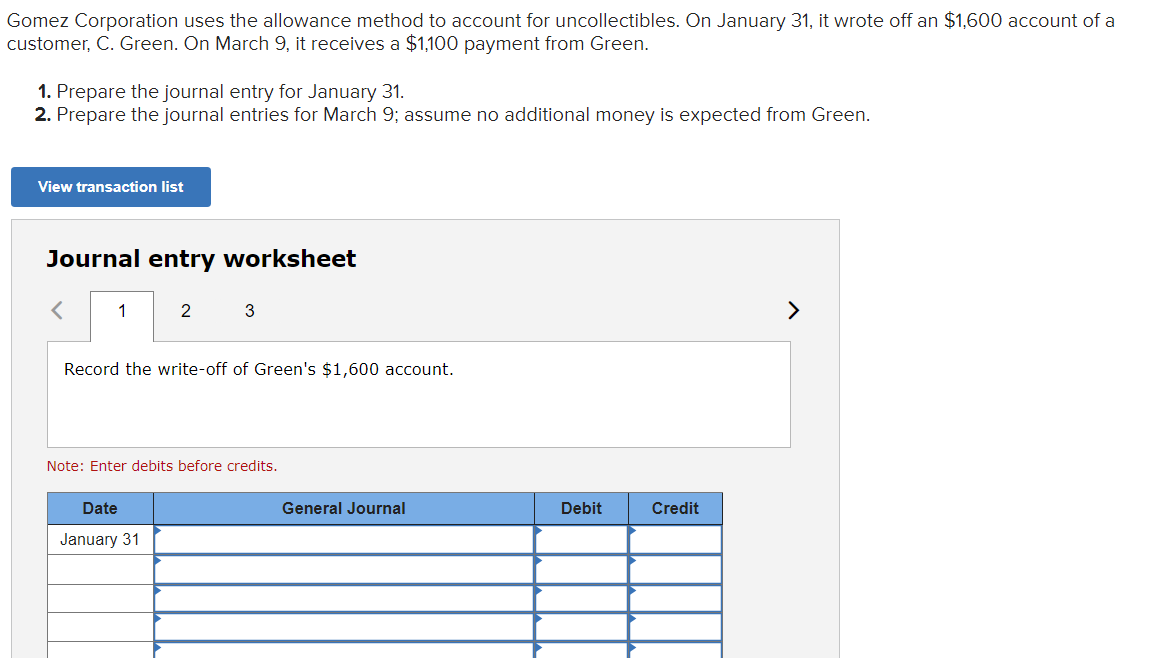

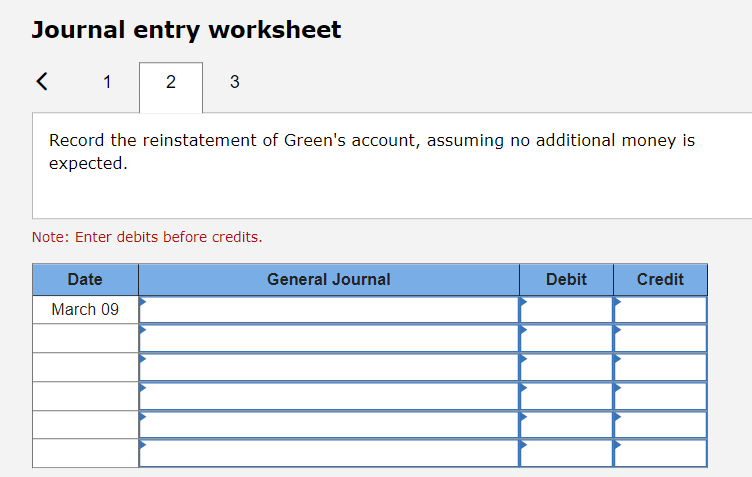

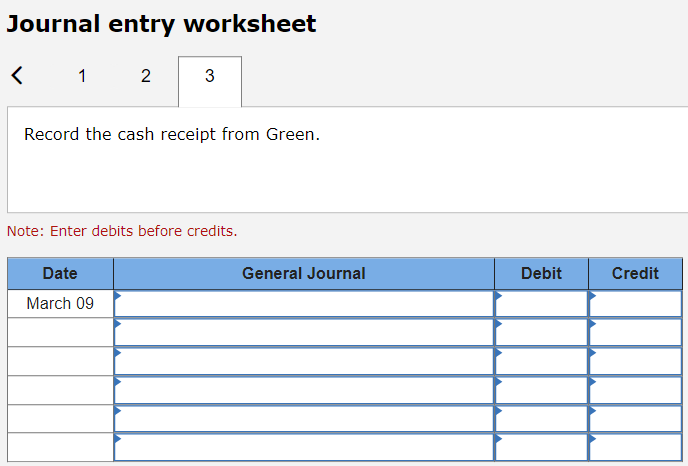

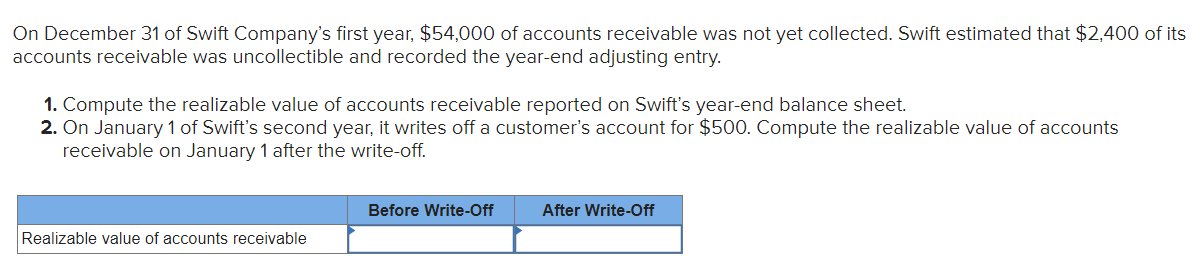

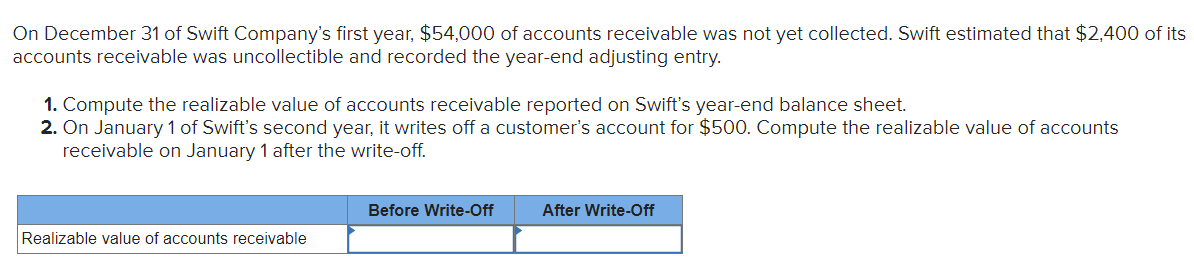

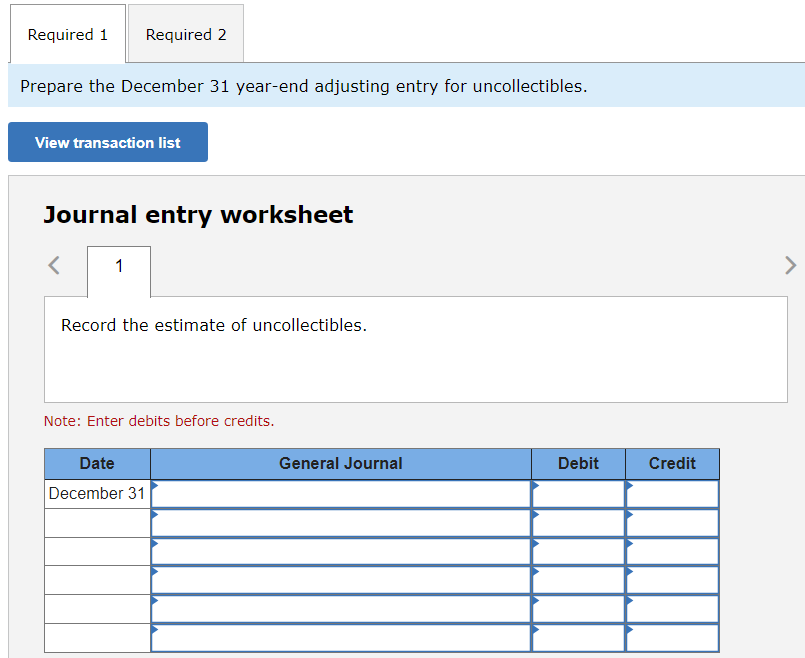

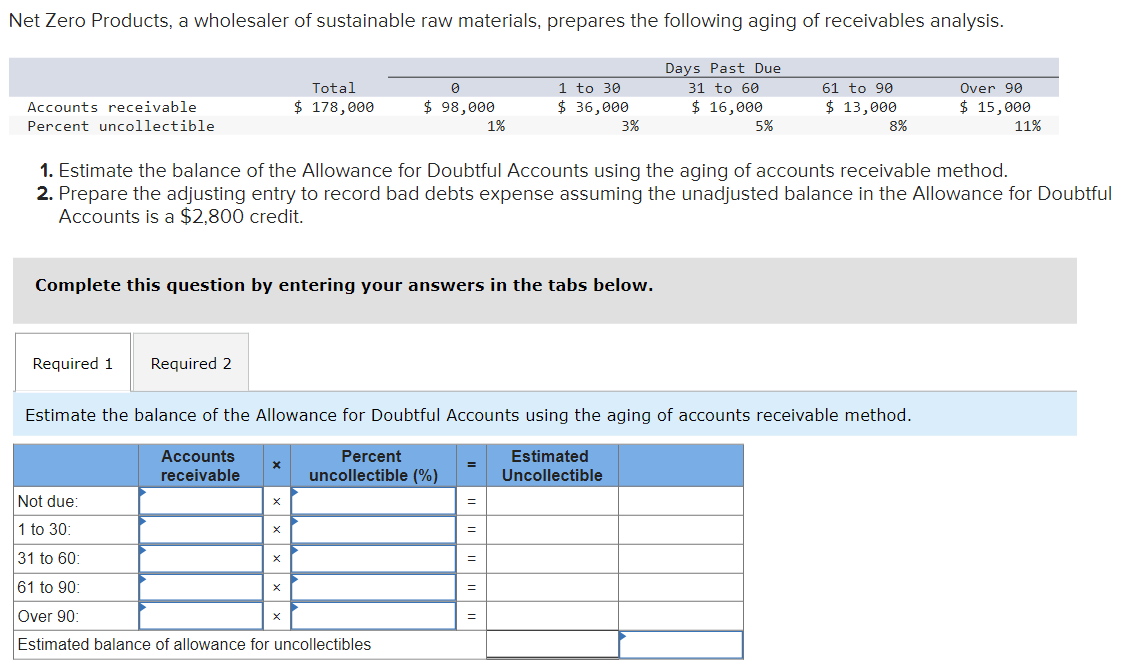

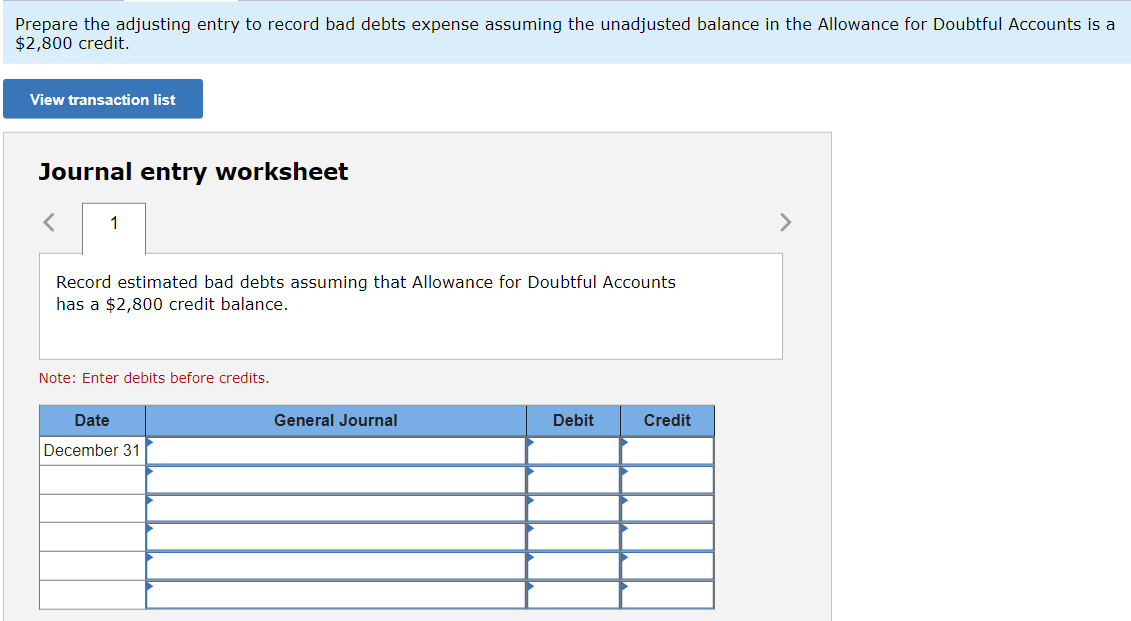

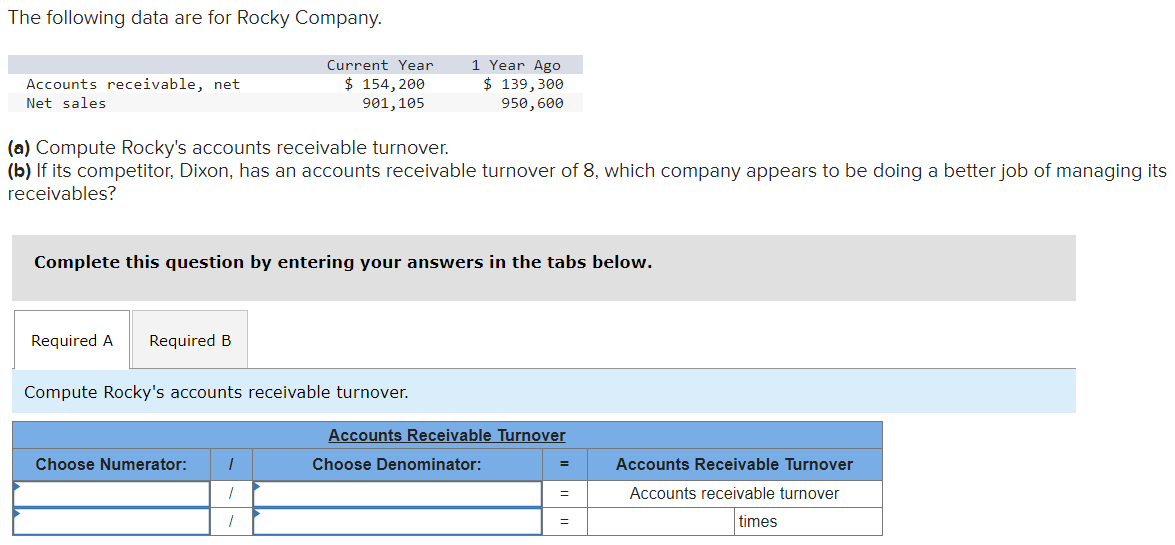

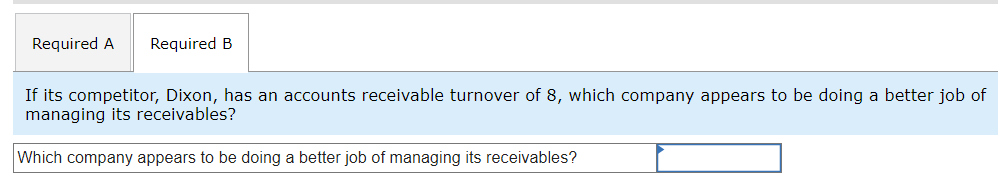

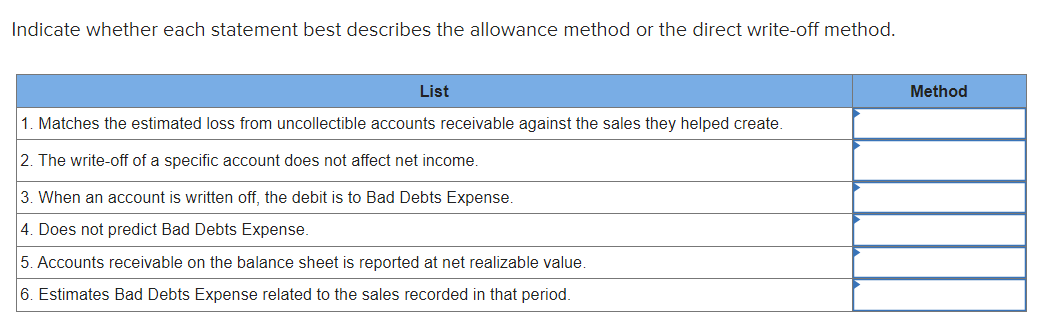

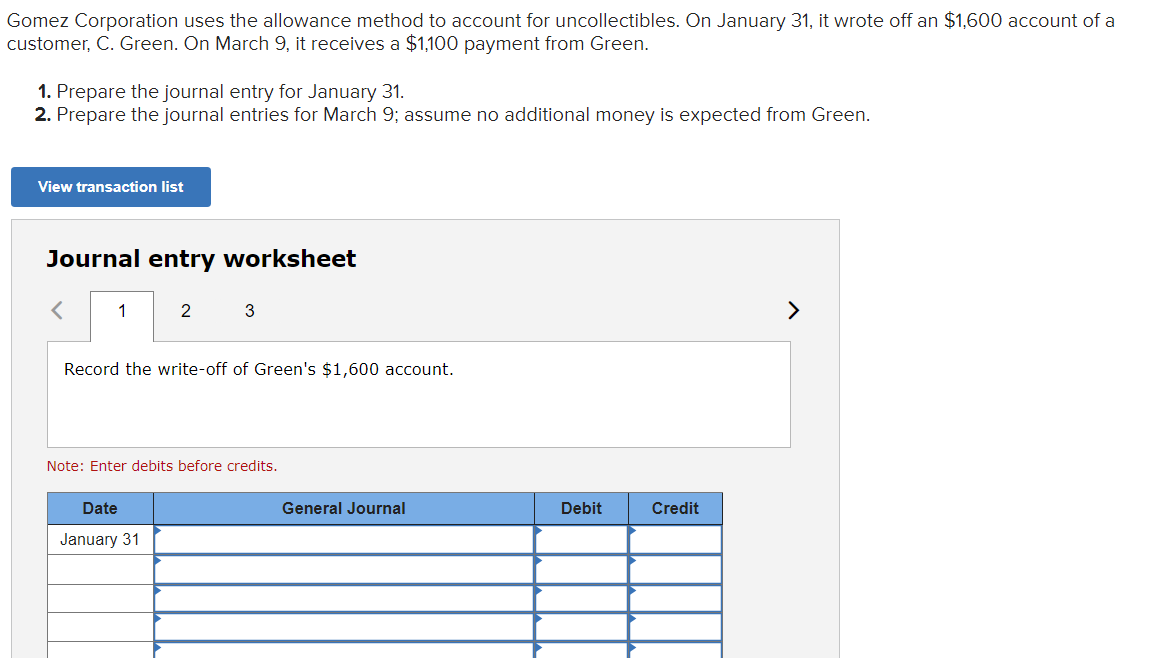

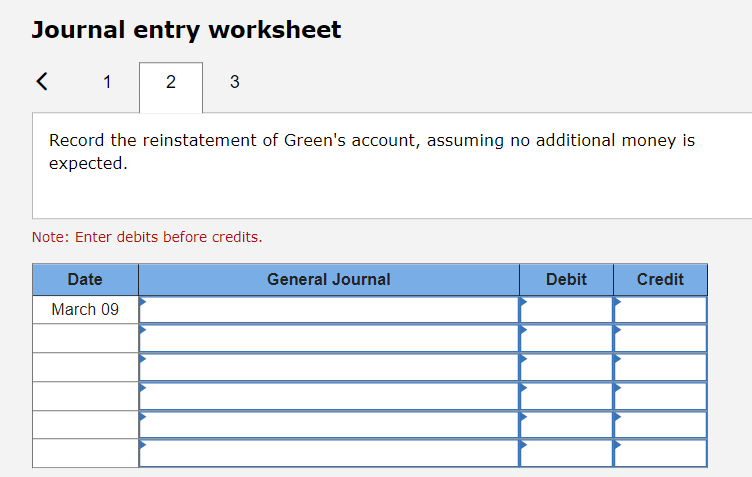

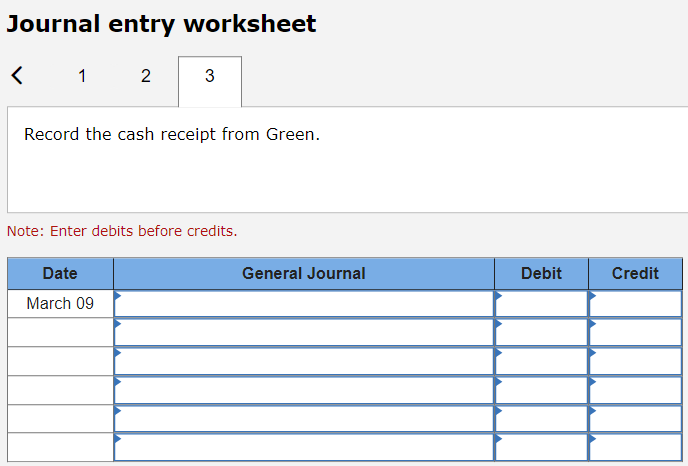

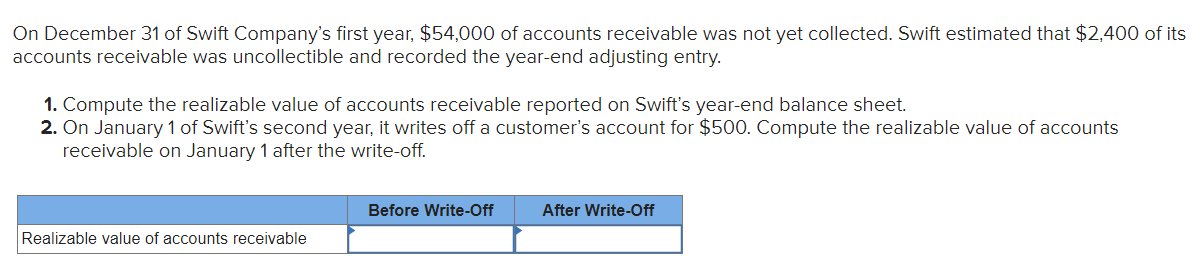

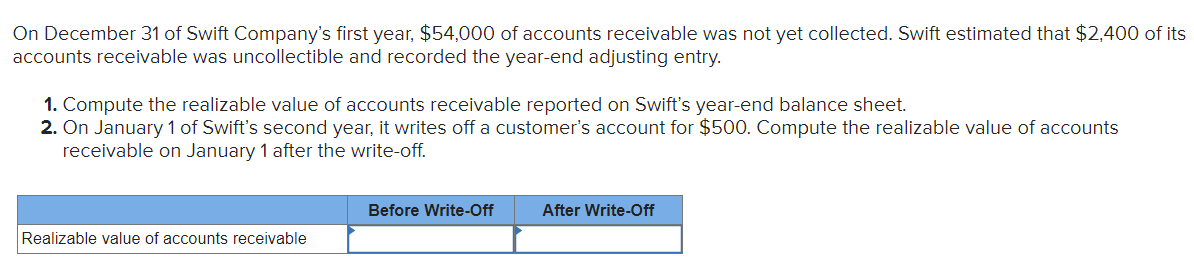

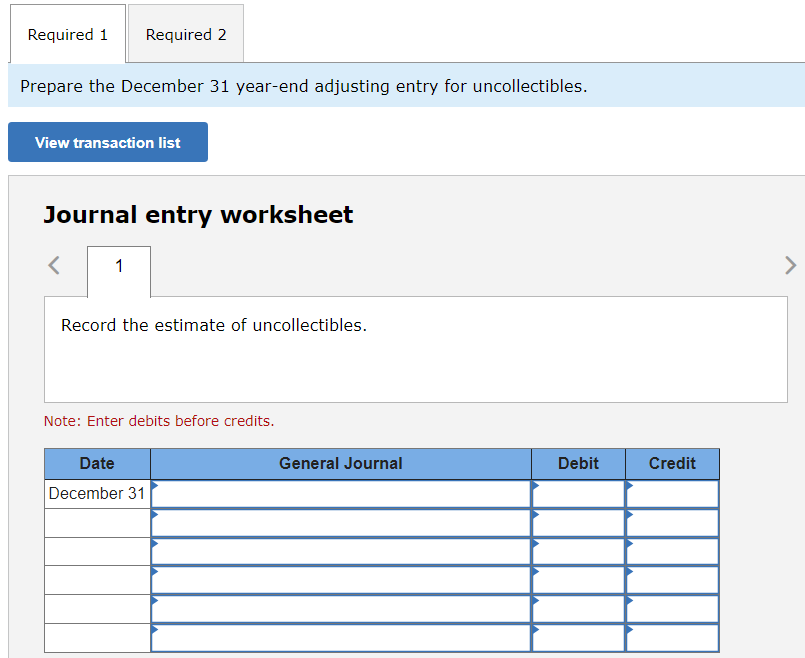

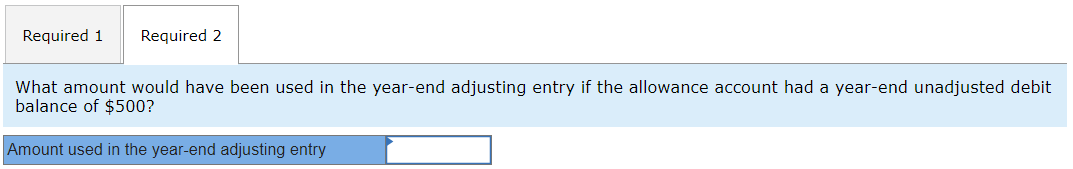

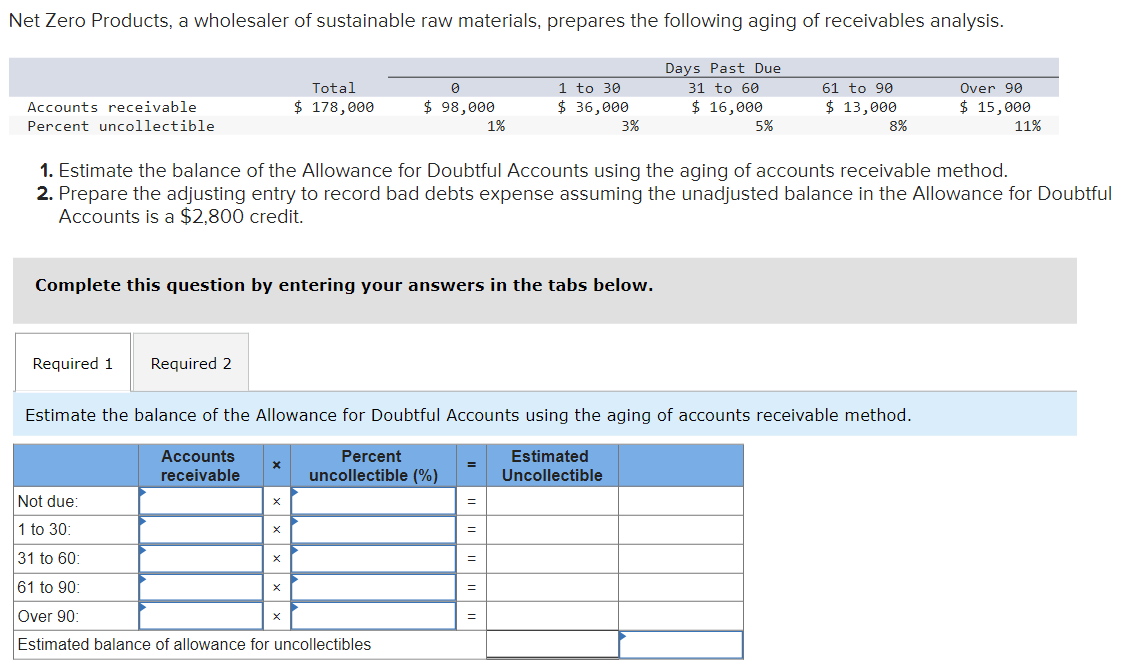

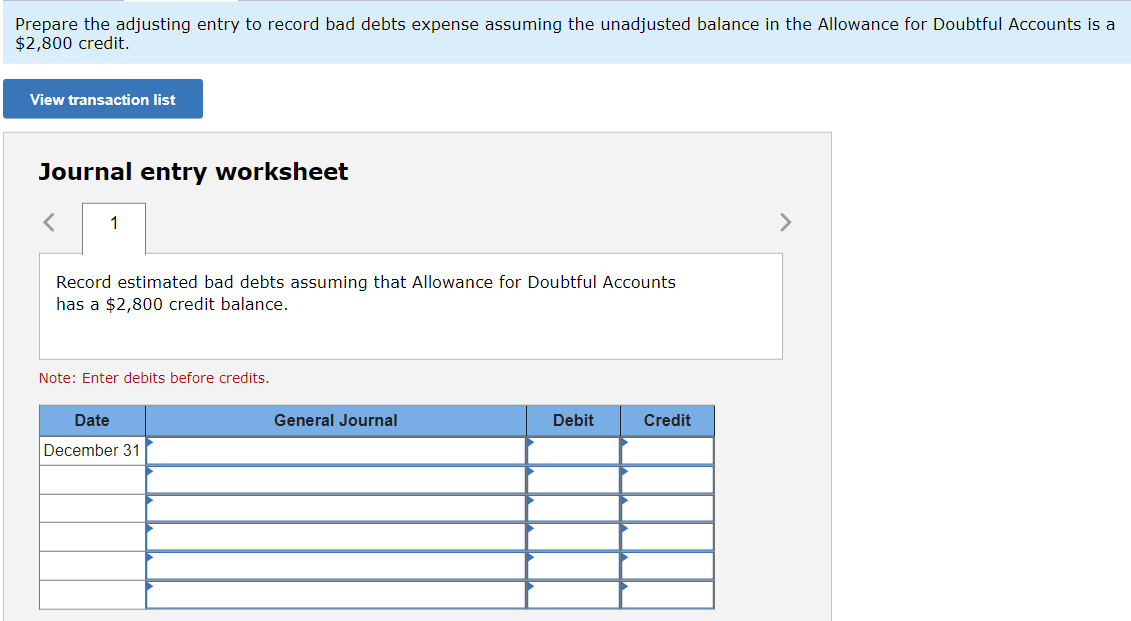

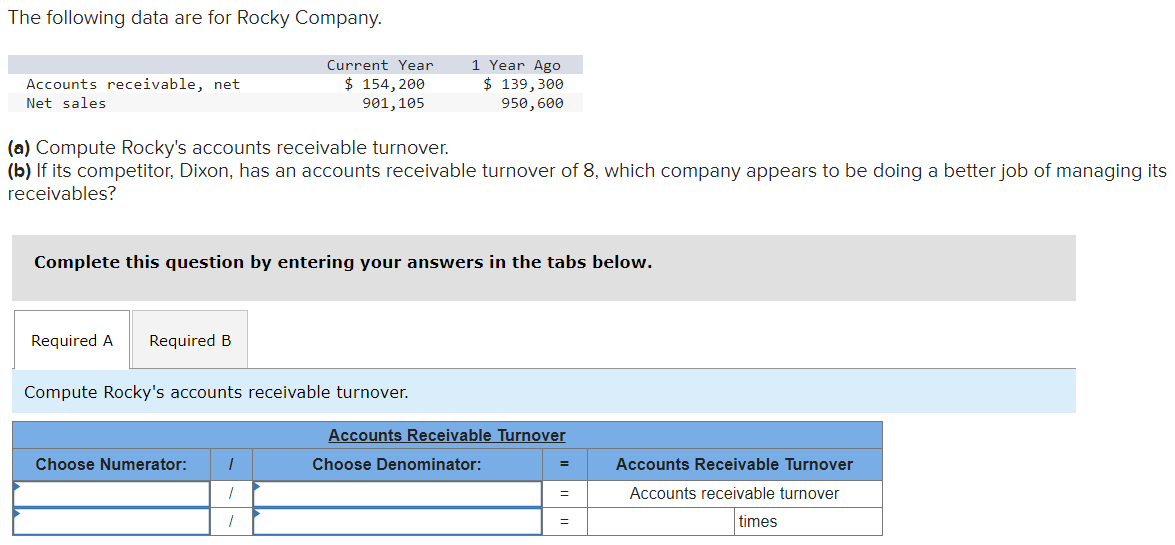

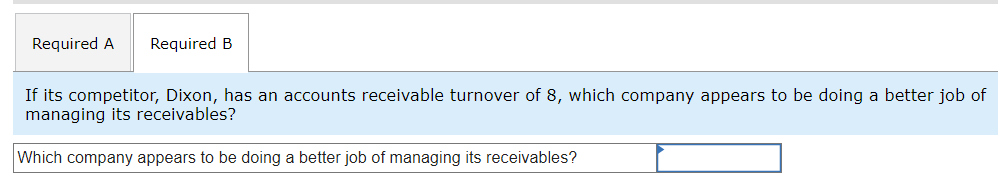

Indicate whether each statement best describes the allowance method or the direct write-off method. Journal entry worksheet Record the cash receipt from Green. Note: Enter debits before credits. What amount would have been used in the year-end adjusting entry if the allowance account had a year-end unadjusted debit balance of $500? On December 31 of Swift Company's first year, $54,000 of accounts receivable was not yet collected. Swift estimated that $2,400 of its accounts receivable was uncollectible and recorded the year-end adjusting entry. 1. Compute the realizable value of accounts receivable reported on Swift's year-end balance sheet. 2. On January 1 of Swift's second year, it writes off a customer's account for $500. Compute the realizable value of accounts receivable on January 1 after the write-off. On December 31 of Swift Company's first year, $54,000 of accounts receivable was not yet collected. Swift estimated that $2,400 of its accounts receivable was uncollectible and recorded the year-end adjusting entry. 1. Compute the realizable value of accounts receivable reported on Swift's year-end balance sheet. 2. On January 1 of Swift's second year, it writes off a customer's account for $500. Compute the realizable value of accounts receivable on January 1 after the write-off. Journal entry worksheet Record the reinstatement of Green's account, assuming no additional money is expected. Note: Enter debits before credits. 1. Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method. 2. Prepare the adjusting entry to record bad debts expense assuming the unadjusted balance in the Allowance for Doubtfi Accounts is a $2,800 credit. Complete this question by entering your answers in the tabs below. Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method. If its competitor, Dixon, has an accounts receivable turnover of 8 , which company appears to be doing a better job of managing its receivables? The following data are for Rocky Company. (a) Compute Rocky's accounts receivable turnover. (b) If its competitor, Dixon, has an accounts receivable turnover of 8 , which company appears to be doing a better job of managing its receivables? Complete this question by entering your answers in the tabs below. Compute Rocky's accounts receivable turnover. Prepare the December 31 year-end adjusting entry for uncollectibles. Journal entry worksheet Note: Enter debits before credits. Prepare the adjusting entry to record bad debts expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is a $2,800 credit. Journal entry worksheet Record estimated bad debts assuming that Allowance for Doubtful Accounts has a $2,800 credit balance. Note: Enter debits before credits. Gomez Corporation uses the allowance method to account for uncollectibles. On January 31 , it wrote off an $1,600 account of a customer, C. Green. On March 9, it receives a \$1,100 payment from Green. 1. Prepare the journal entry for January 31. 2. Prepare the journal entries for March 9; assume no additional money is expected from Green. Journal entry worksheet Record the write-off of Green's $1,600 account. Note: Enter debits before credits