help with savings with this case study

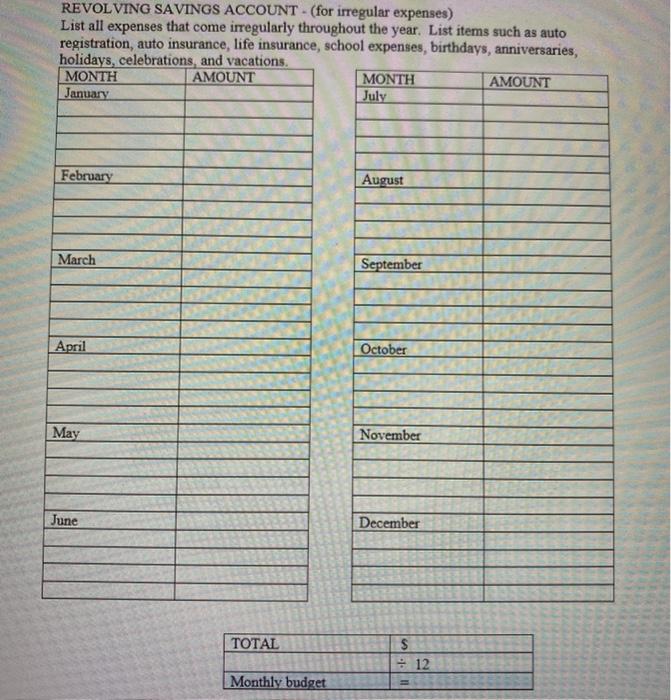

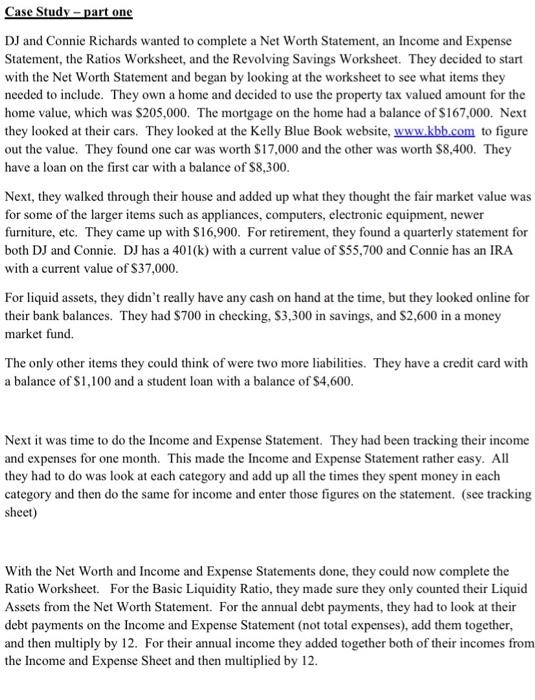

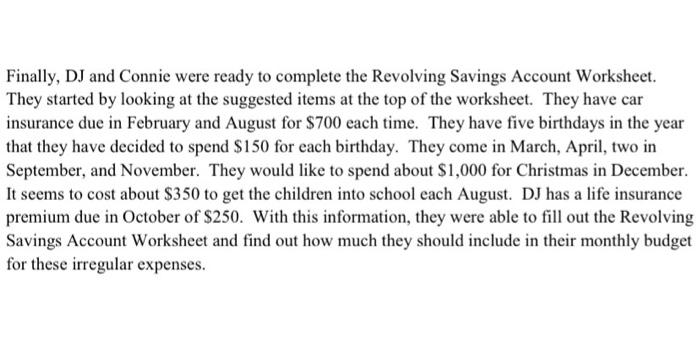

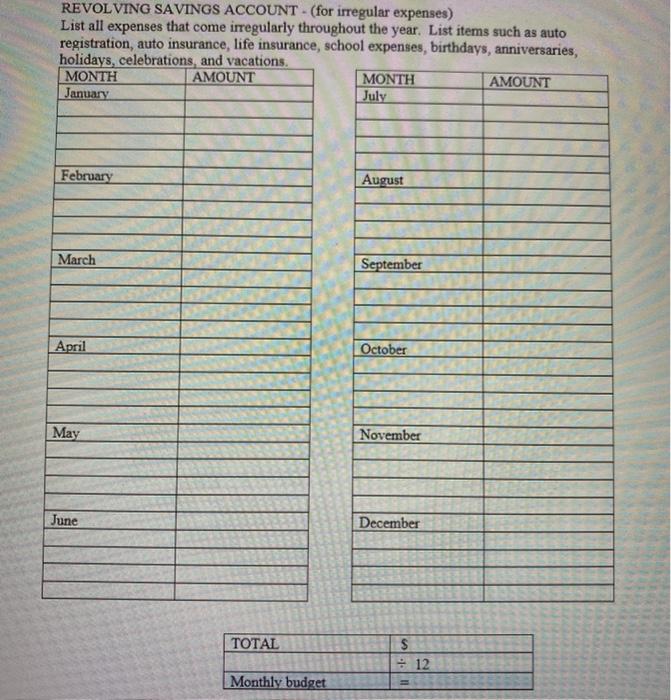

Case Study - part one DJ and Connie Richards wanted to complete a Net Worth Statement, an Income and Expense Statement, the Ratios Worksheet, and the Revolving Savings Worksheet. They decided to start with the Net Worth Statement and began by looking at the worksheet to see what items they needed to include. They own a home and decided to use the property tax valued amount for the home value, which was $205,000. The mortgage on the home had a balance of $167,000. Next they looked at their cars. They looked at the Kelly Blue Book website, www.kbb.com to figure out the value. They found one car was worth $17,000 and the other was worth $8,400. They have a loan on the first car with a balance of $8,300. Next, they walked through their house and added up what they thought the fair market value was for some of the larger items such as appliances, computers, electronic equipment, newer furniture, etc. They came up with $16,900. For retirement, they found a quarterly statement for both DJ and Connie. DJ has a 401(k) with a current value of $55,700 and Connie has an IRA with a current value of $37,000. For liquid assets, they didn't really have any cash on hand at the time, but they looked online for their bank balances. They had $700 in checking, $3,300 in savings, and $2,600 in a money market fund. The only other items they could think of were two more liabilities. They have a credit card with a balance of $1,100 and a student loan with a balance of $4,600. Next it was time to do the Income and Expense Statement. They had been tracking their income and expenses for one month. This made the Income and Expense Statement rather easy. All they had to do was look at each category and add up all the times they spent money in each category and then do the same for income and enter those figures on the statement. (see tracking sheet) With the Net Worth and Income and Expense Statements done, they could now complete the Ratio Worksheet. For the Basic Liquidity Ratio, they made sure they only counted their Liquid Assets from the Net Worth Statement. For the annual debt payments, they had to look at their debt payments on the Income and Expense Statement (not total expenses), add them together, and then multiply by 12. For their annual income they added together both of their incomes from the Income and Expense Sheet and then multiplied by 12. Finally, DJ and Connie were ready to complete the Revolving Savings Account Worksheet. They started by looking at the suggested items at the top of the worksheet. They have car insurance due in February and August for $700 each time. They have five birthdays in the year that they have decided to spend $150 for each birthday. They come in March, April, two in September, and November. They would like to spend about $1,000 for Christmas in December. It seems to cost about $350 to get the children into school each August. DJ has a life insurance premium due in October of $250. With this information, they were able to fill out the Revolving Savings Account Worksheet and find out how much they should include in their monthly budget for these irregular expenses. Description Please attach the Financial Ratio worksheet. Use Case Study 1 to fill out this worksheet. DO NOT use your own information for this activity. Financial Ratios Worksheet - PDF, Word REVOLVING SAVINGS ACCOUNT - (for irregular expenses) List all expenses that come irregularly throughout the year. List items such as auto registration, auto insurance, life insurance, school expenses, birthdays, anniversaries, holidays, celebrations, and vacations, MONTH AMOUNT MONTH AMOUNT January July February August March September April October May November June December TOTAL 12 Monthly budget