Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP WITH T-ACCOUNTS... 3 Wright Cola Corporation produces a new soft drink brand, Sweet Spring, using two production departments: mixing and bottling Wright's beginning balances

HELP WITH T-ACCOUNTS...

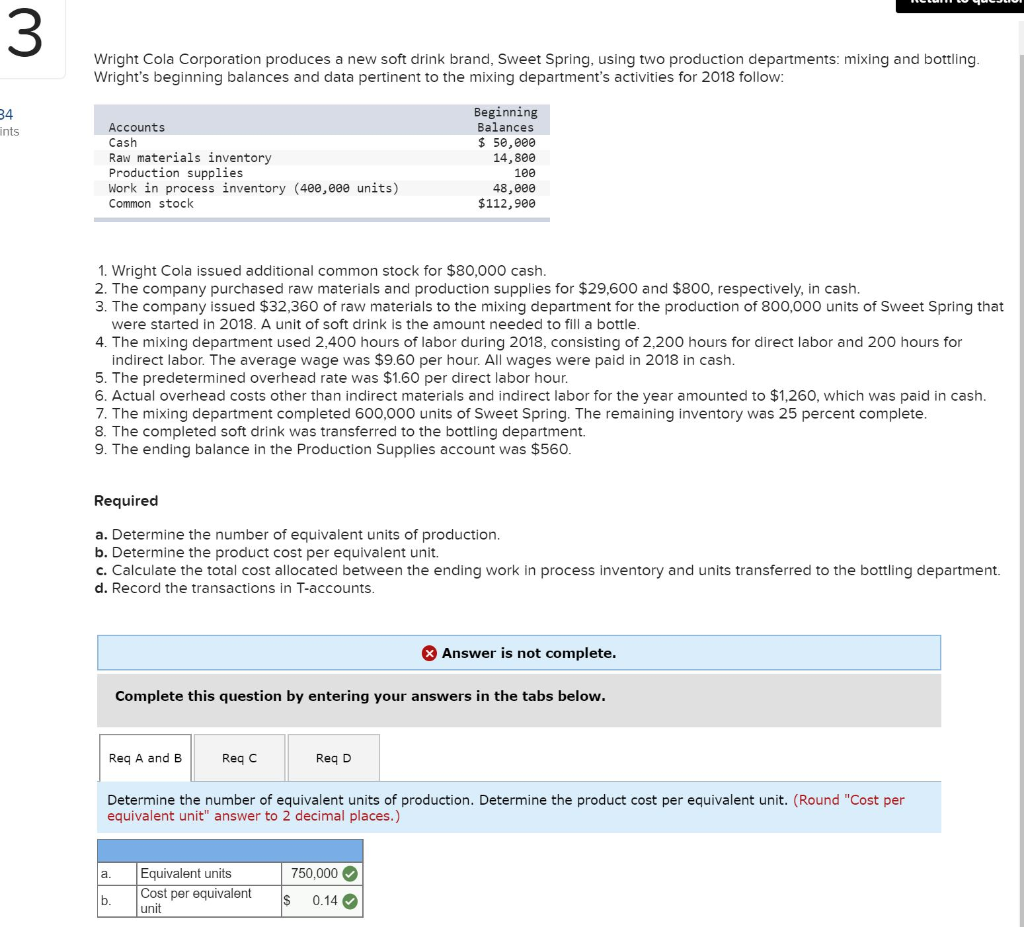

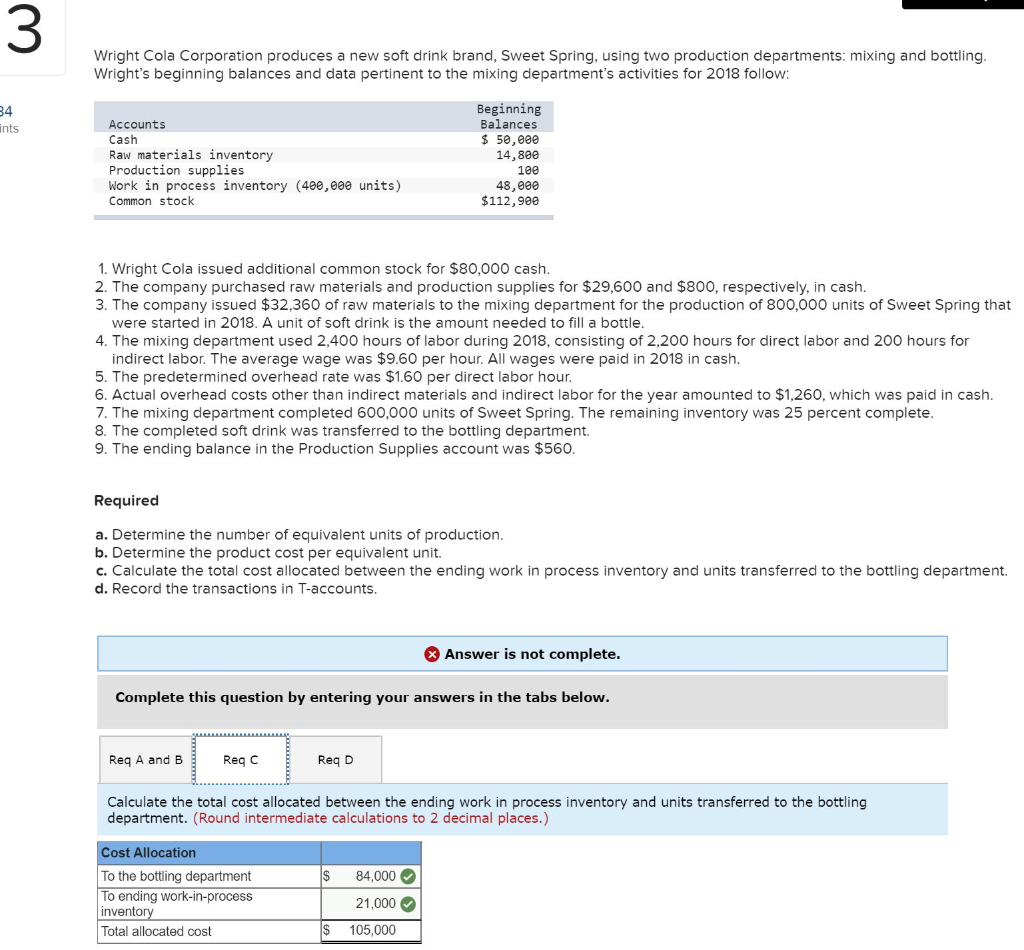

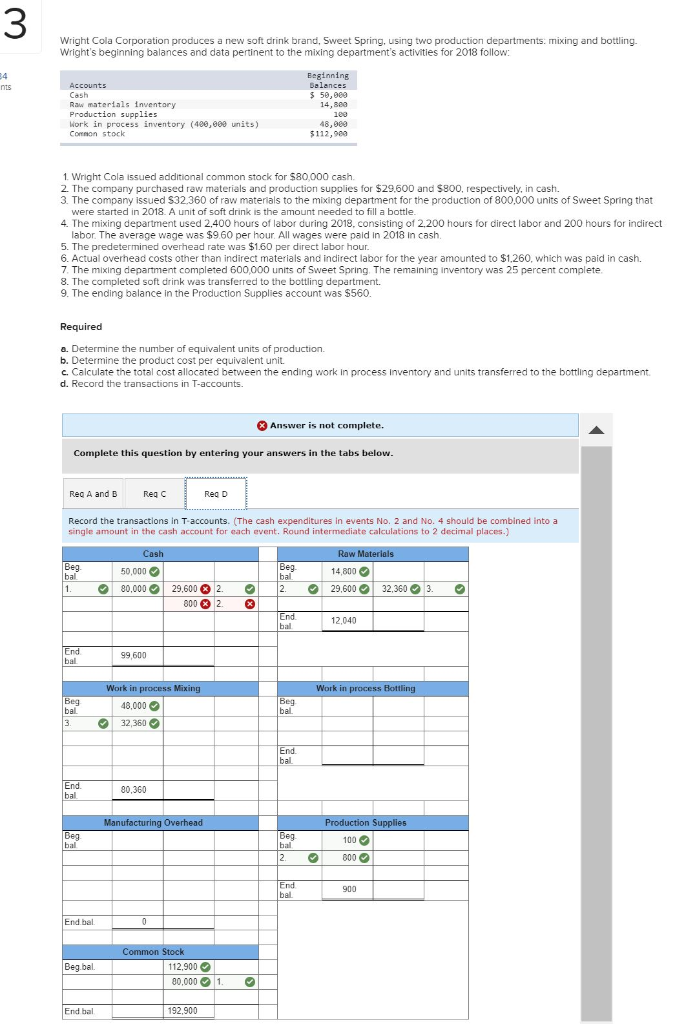

3 Wright Cola Corporation produces a new soft drink brand, Sweet Spring, using two production departments: mixing and bottling Wright's beginning balances and data pertinent to the mixing department's activities for 2018 follow: Beginning Balances $ 5e,000 14,800 34 ints Accounts Cash Raw materials inventory Production supplies Work in process inventory (400,00e units) Common stock 48,900 $112,900 1. Wright Cola issued additional common stock for $80,000 cash 2. The company purchased raw materials and production supplies for $29,600 and $800, respectively, in cash. 3. The company issued $32,360 of raw materials to the mixing department for the production of 800,000 units of Sweet Spring that were started in 2018. A unit of soft drink is the amount needed to fill a bottle 4. The mixing department used 2,400 hours of labor during 2018, consisting of 2,200 hours for direct labor and 200 hours for indirect labor. The average wage was $9.60 per hour. All wages were paid in 2018 in cash 5. The predetermined overhead rate was $1.60 per direct labor hour 6. Actual overhead costs other than indirect materials and indirect labor for the year amounted to $1,260, which was paid in cash 7. The mixing department completed 600,000 units of Sweet Spring. The remaining inventory was 25 percent complete 8. The completed soft drink was transferred to the bottling department. 9. The ending balance in the Production Supplies account was $560 Required a. Determine the number of equivalent units of production. b. Determine the product cost per equivalent unit. c. Calculate the total cost allocated between the ending work in process inventory and units transferred to the bottling department. d. Record the transactions in T-accounts Answer is not complete Complete this question by entering your answers in the tabs below Req A and B Req C Req D Determine the number of equivalent units of production. Determine the product cost per equivalent unit. (Round "Cost per equivalent unit" answer to 2 decimal places.) Equivalent units Cost per equivalent 750,000 0.14 $ 0.14 3 Wright Cola Corporation produces a new soft drink brand, Sweet Spring, using two production departments: mixing and bottling Wright's beginning balances and data pertinent to the mixing department's activities for 2018 follow: Beginning Balances 50,00e 14,800 108 48,000 $112,900 34 ints Accounts Cash Raw materials inventory Production supplies Work in process inventory (400,e0e units) Common stock 1. Wright Cola issued additional common stock for $80,000 cash 2. The company purchased raw materials and production supplies for $29,600 and $800, respectively, in cash 3. The company issued $32,360 of raw materials to the mixing department for the production of 800,000 units of Sweet Spring that were started in 2018. A unit of soft drink is the amount needed to fill a bottle 4. The mixing department used 2,400 hours of labor during 2018, consisting of 2,200 hours for direct labor and 200 hours for indirect labor. The average wage was $9.60 per hour. All wages were paid in 2018 in cash 5. The predetermined overhead rate was $1.60 per direct labor hour 6. Actual overhead costs other than indirect materials and indirect labor for the year amounted to $1,260, which was paid in cash. 7. The mixing department completed 600,000 units of Sweet Spring. The remaining inventory was 25 percent complete 8. The completed soft drink was transferred to the bottling department. 9. The ending balance in the Production Supplies account was $560 Required a. Determine the number of equivalent units of production b. Determine the product cost per equivalent unit. c. Calculate the total cost allocated between the ending work in process inventory and units transferred to the bottling department. d. Record the transactions in T-accounts Answer is not complete Complete this question by entering your answers in the tabs below. Req A and B Req C Req D Calculate the total cost allocated between the ending work in process inventory and units transferred to the bottling department. (Round intermediate calculations to 2 decimal places.) Cost Allocation To the bottling department To ending work-in-process $ 84,000 21,000 invento Total allocated cost $ 105,000 3 Wright Cola Corporation produces a new soft drink brand, Sweet Spring, using two production departments: mixing and bottling. Wright's beginning balances and data pertinent to the mixing department's activities for 2018 follow: Eeginning Balances 50,000 14,883 4 nts Cash Raw materials inventory supplies Work in process inventory (486,90 units) Common stock 48,989 $112,983 1. Wright Cola issued additional common stock for $80,000 cash. 2. The company purchased raw materials and production supplies for $29,500 and $800, respectively, in cash. 3. The company issued $32.360 of raw materials to the mixing department for the production of 800,000 units of Sweet Spring that were started in 2018. A unit of soft drink is the amount needed to fill a bottle 4. The mixing department used 2,400 hours of labor during 2018, consisting of 2,200 hours for direct labor and 200 hours for indirect labor. The average wage was $960 per hour. All wages were paid in 2018 in cash 5. The predetermined overhead rate was $1.60 per direct labor hour. 6. Actual overhead costs other than indirect materials and indirect labor for the year amounted to $1,260, which was paid in cash. 7. The mixing department completed 600,000 units of Sweet Spring. The remaining inventory was 25 percent complete 8. The completed soft drink was transferred to the bottling department. 9. The ending balance in the Production Supplies account was $560. Required a. Determine the number of equivalent units of production. b. Determine the product cost per equivalent unit. c. Calculate the total cost allocated between the ending work in process inventory and units transferred to the bottling department d. Record the transactions in T-accounts. 3Answer is not complete. Complete this question by entering your answers in the tabs below Req A and B Req c Req D Record the transactions in T-accounts. (The cash expenditures in events No. 2 and No. 4 should be combined into a single amount in the cash account for each event. Round intermediate calculations to 2 decimal places.) Beg. bal 50,000 80.000| 29,60002. 14,800 29.600. bal 1. |2. 32.360 3. 800 2. 2,040 bal 99,600 bal Work in Work in p Beg Beg bal 48,000 2,360 End bal 90,360 bal uction Supplies 100 bal bal 800 900 bal End bal 112.900 0,0001 Begbal. End bal 192,900Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started