Answered step by step

Verified Expert Solution

Question

1 Approved Answer

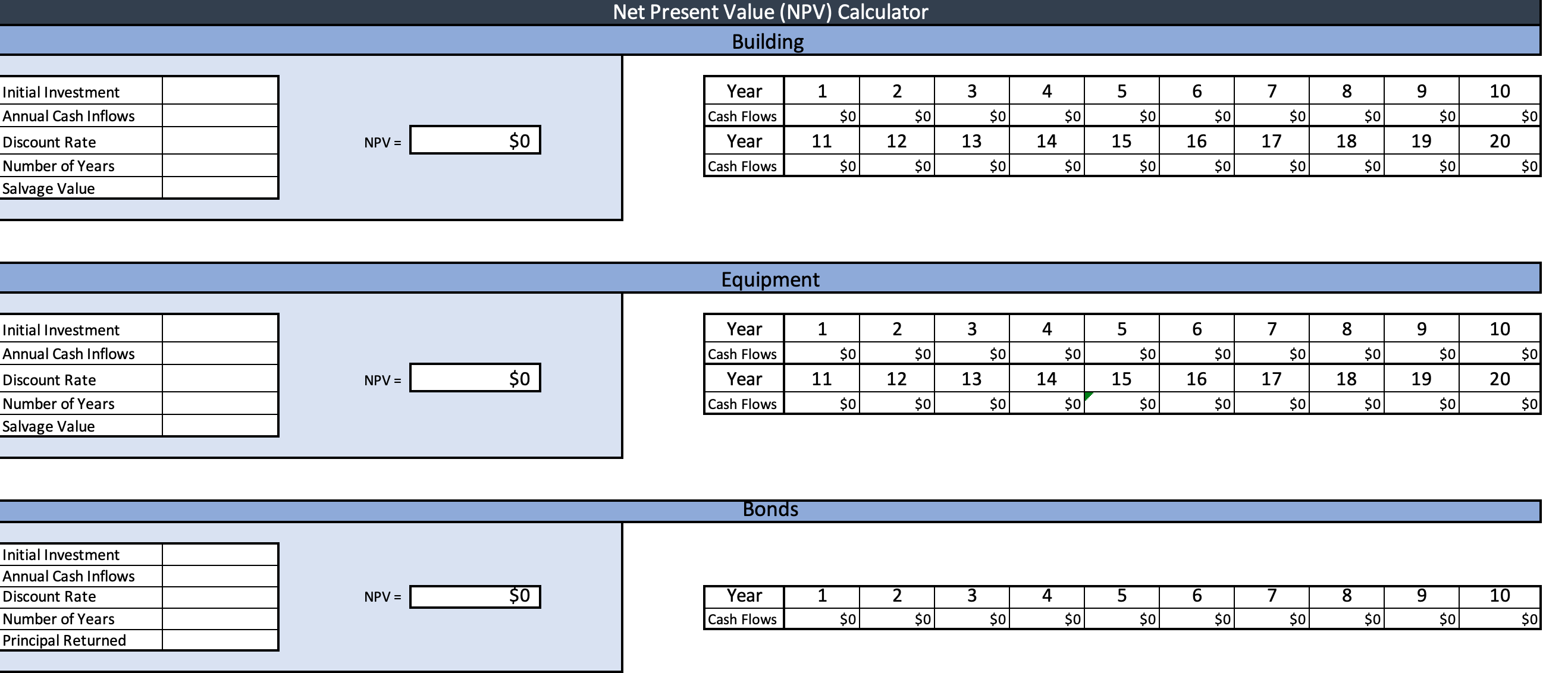

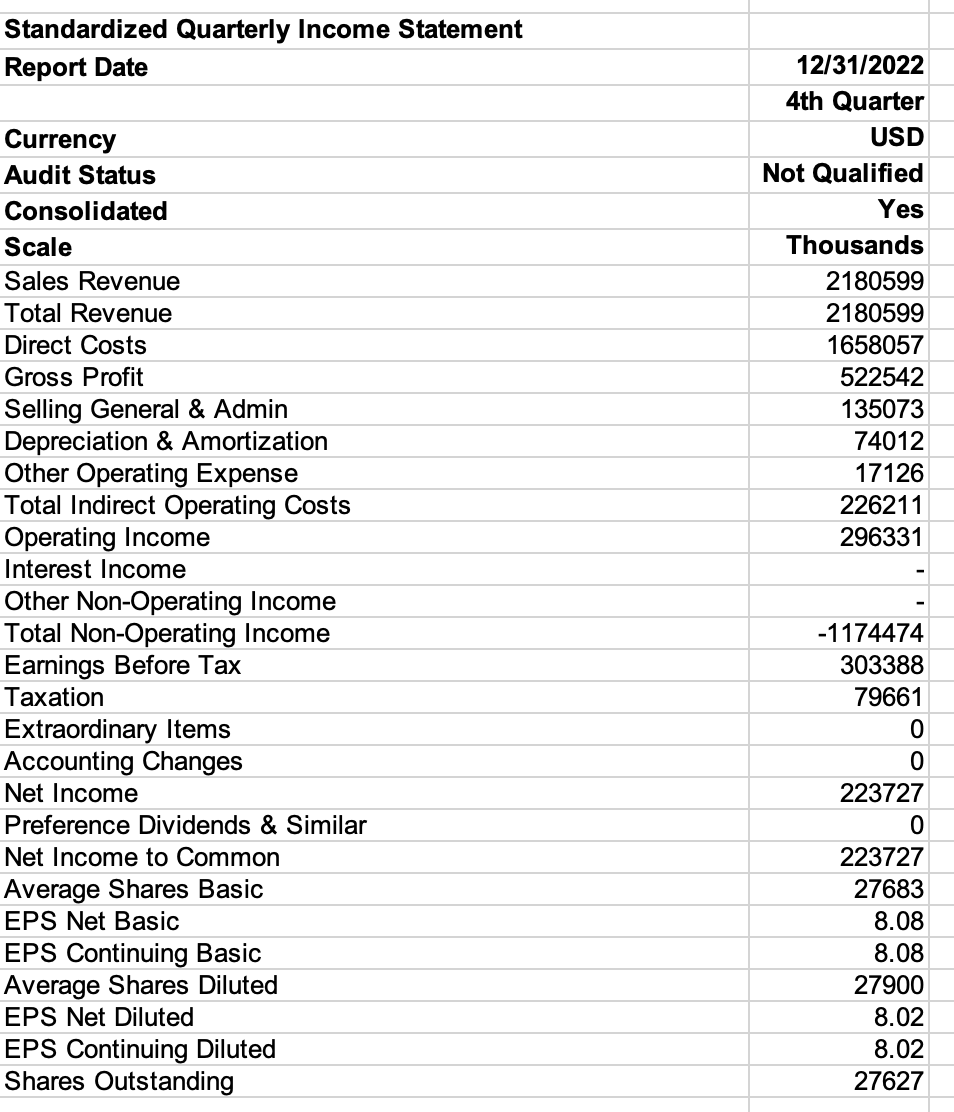

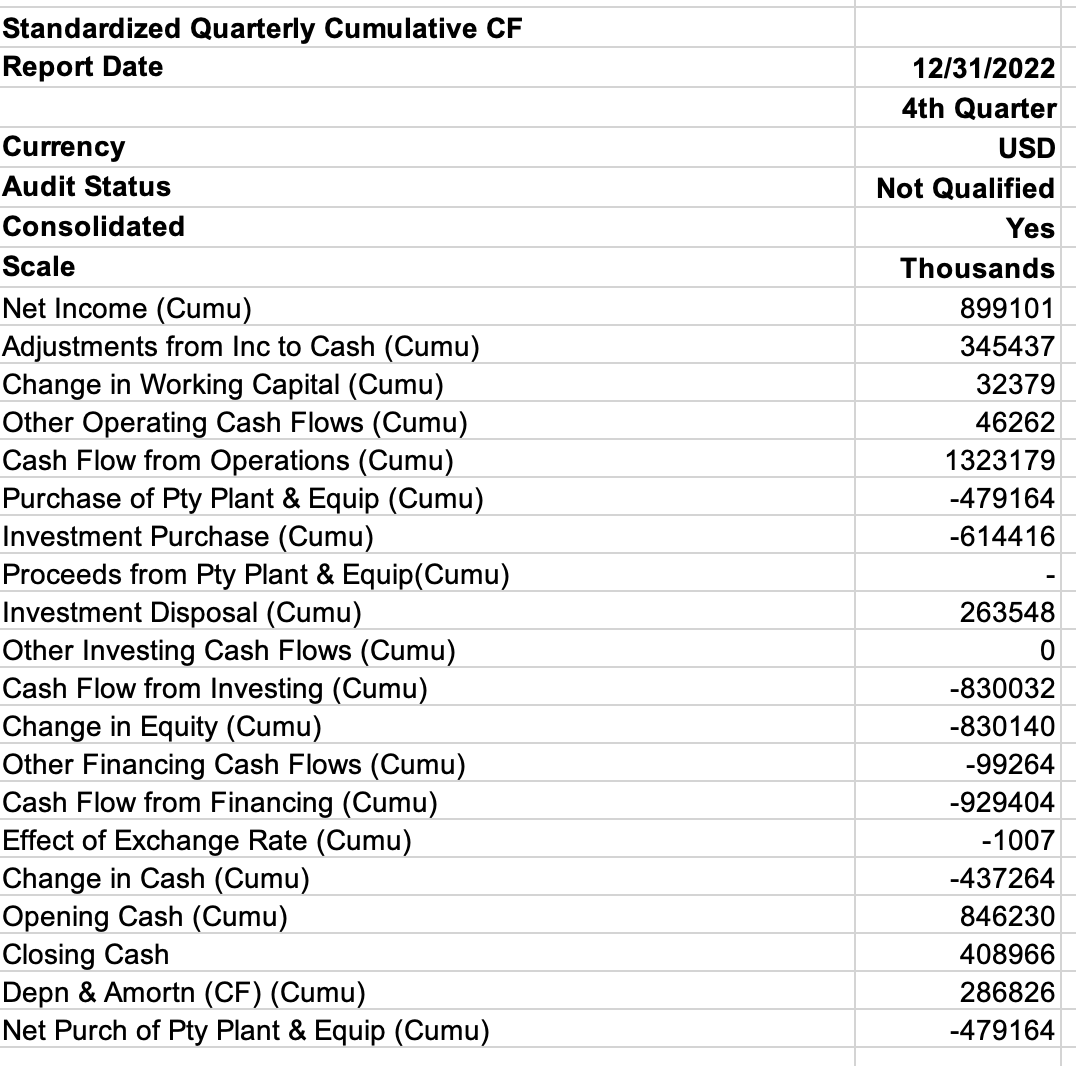

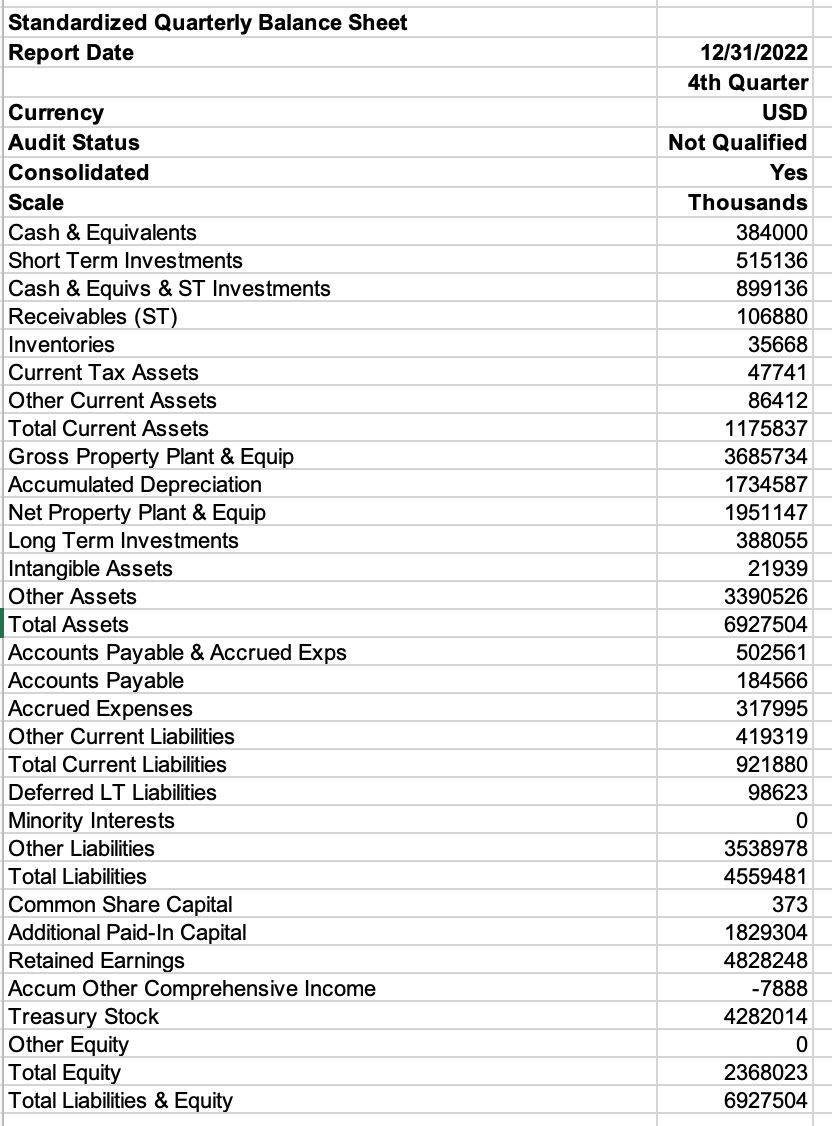

Help with the below NPV - Attached are the balance sheet, income sheet, and cash flow sheets for Chipotles 12/31/2021 and 12/31/2022 Quarters - please

Help with the below NPV - Attached are the balance sheet, income sheet, and cash flow sheets for Chipotles 12/31/2021 and 12/31/2022 Quarters - please let me know if you need anymore information.

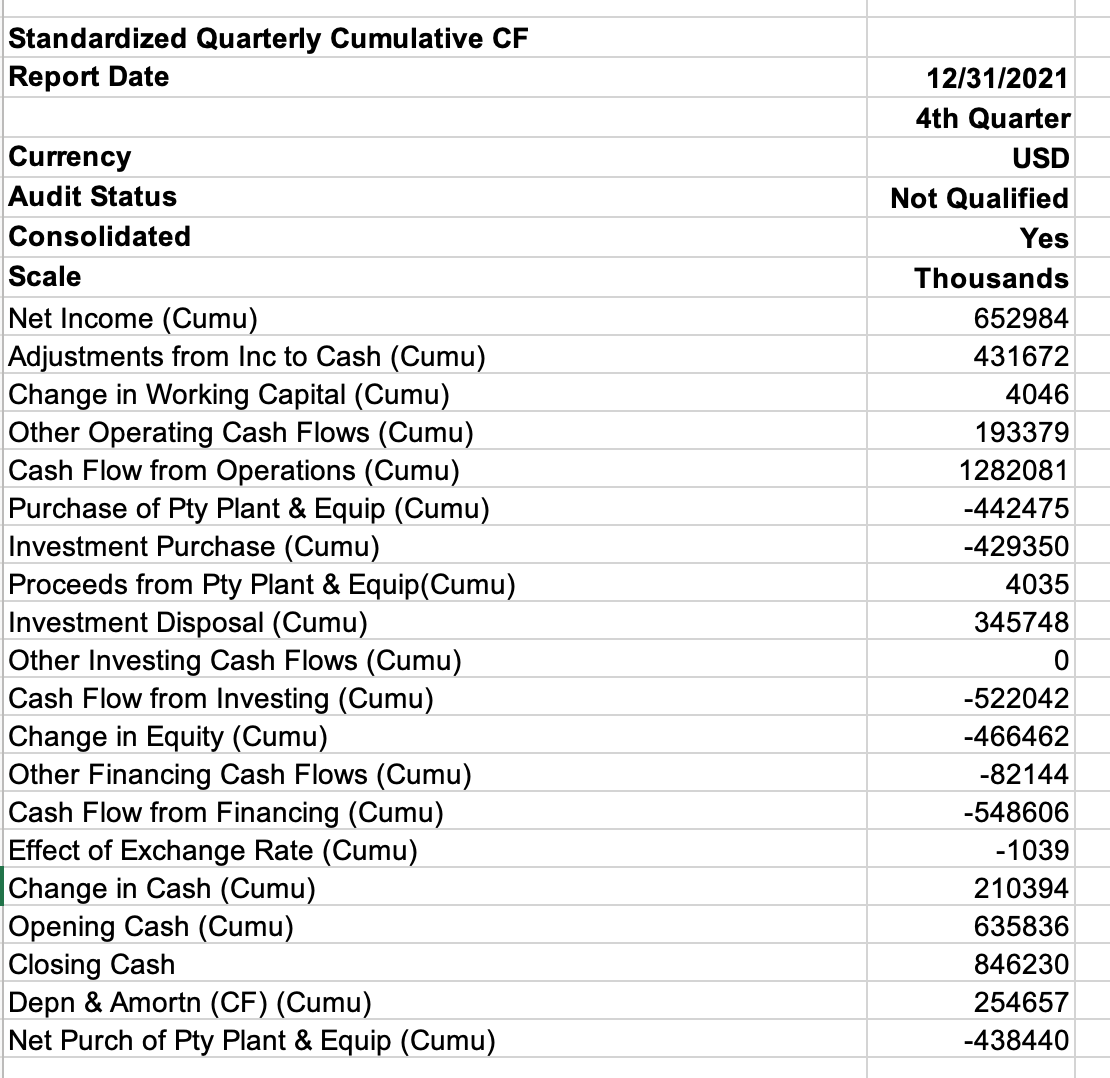

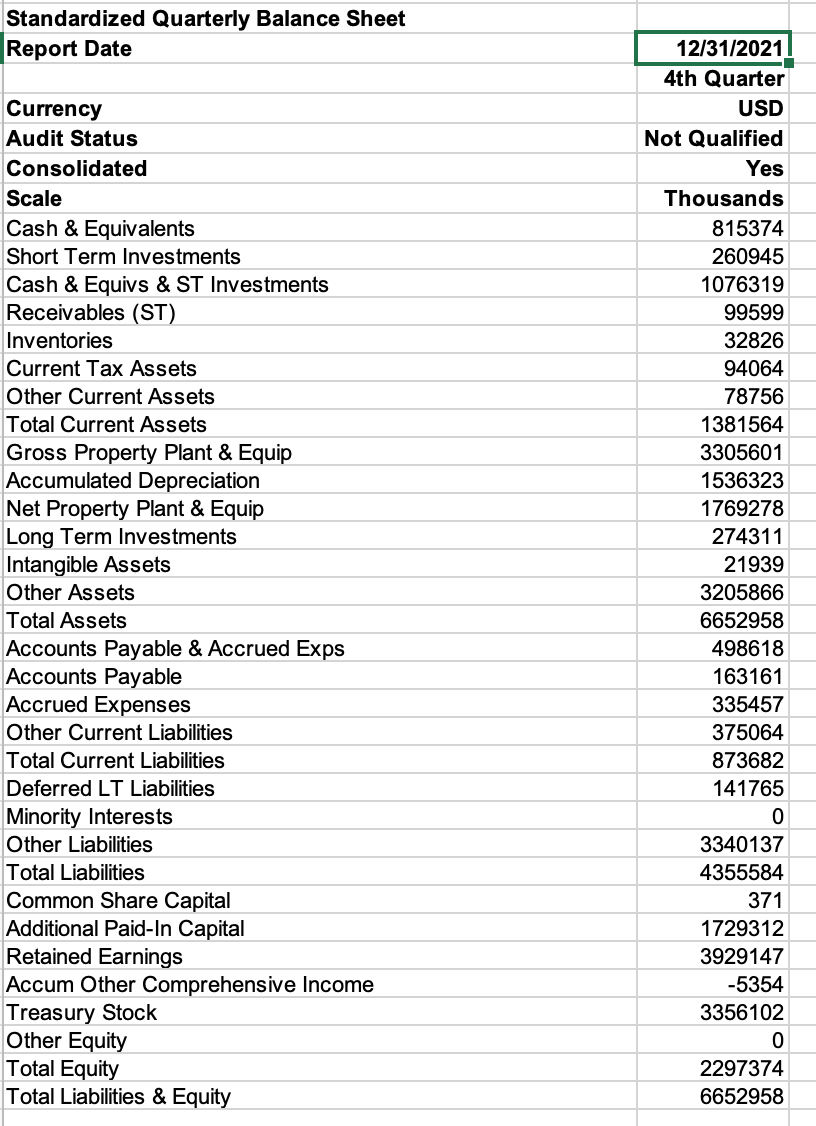

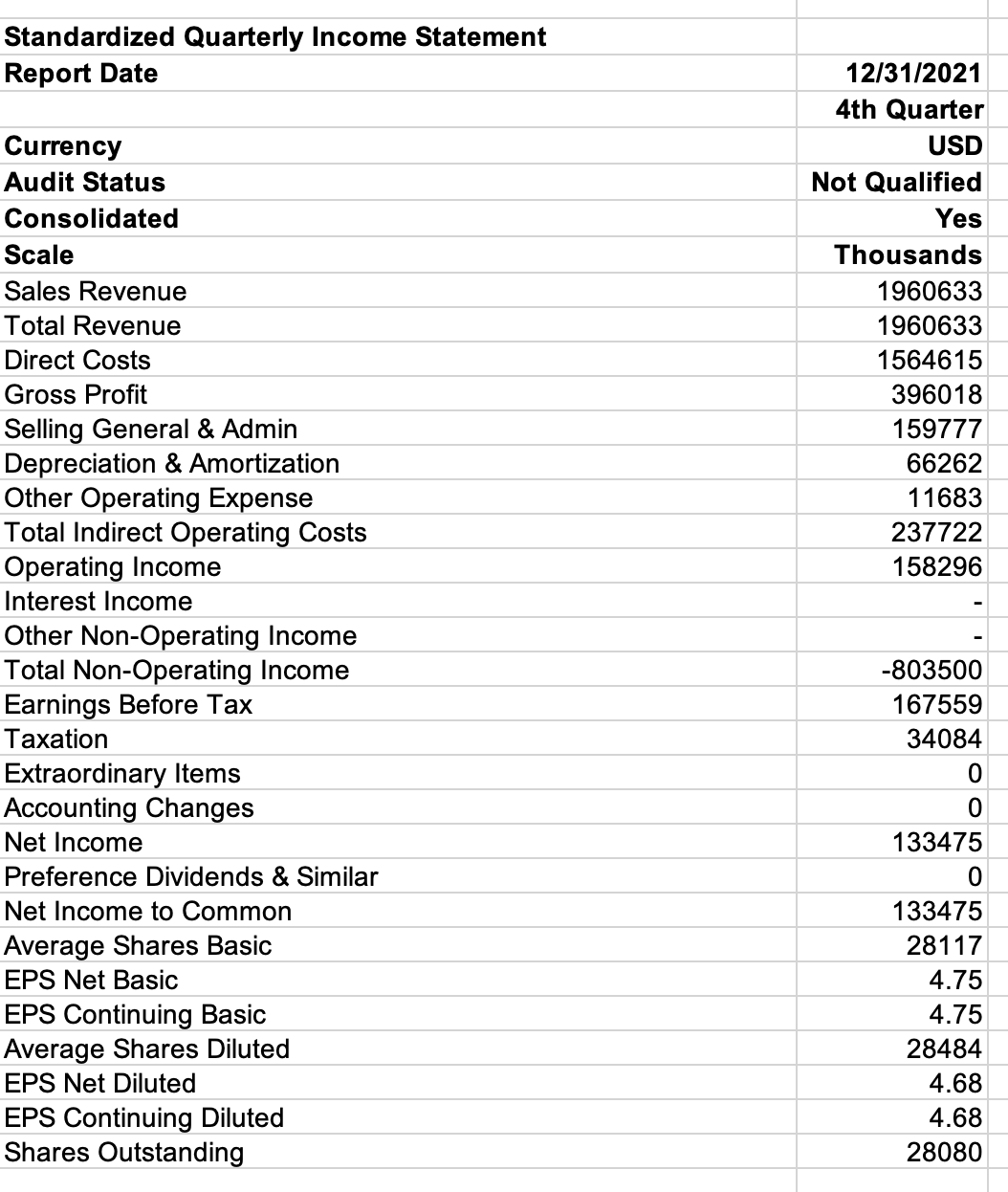

Net Present Value (NPV) Calculator Building \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|r|} \hline Year & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & \multicolumn{1}{|c|}{9} & \multicolumn{1}{l|}{10} \\ \hline Cash Flows & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline Year & 11 & 12 & 13 & 14 & 15 & 16 & 17 & 18 & 19 & 20 \\ \hline Cash Flows & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline \end{tabular} Equipment \begin{tabular}{|l|l|} \hline Initial Investment & \\ \hline Annual Cash Inflows & \\ \hline Discount Rate & \\ \hline Number of Years & \\ \hline Salvage Value & \\ \hline \end{tabular} NPV= $0 \begin{tabular}{|c|c|c|c|r|r|r|r|r|r|r|} \hline Year & 1 & 2 & 3 & 4 & 5 & 6 & 7 & \multicolumn{1}{|c|}{8} & \multicolumn{1}{c|}{9} & 10 \\ \hline Cash Flows & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline Year & 11 & 12 & 13 & 14 & 15 & 16 & 17 & 18 & 19 & 20 \\ \hline Cash Flows & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline \end{tabular} Bonds \begin{tabular}{|l|l|} \hline Initial Investment & \\ \hline Annual Cash Inflows & \\ \hline Discount Rate & \\ \hline Number of Years & \\ \hline Principal Returned & \\ \hline \end{tabular} NPV= $0 \begin{tabular}{|c|r|r|r|r|r|r|r|r|r|r|r|} \hline Year & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & 9 & 10 \\ \hline Cash Flows & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline \end{tabular} Standardized Quarterly Cumulative CF \begin{tabular}{|l|r|} \hline Report Date & 12/31/2021 \\ \hline Currency & 4th Quarter \\ \hline USD \\ \hline Consolidated & Not Qualified \\ \hline Scale & Yes \\ \hline Net Income (Cumu) & Thousands \\ \hline Adjustments from Inc to Cash (Cumu) & 652984 \\ \hline Change in Working Capital (Cumu) & 431672 \\ \hline Other Operating Cash Flows (Cumu) & 4046 \\ \hline Cash Flow from Operations (Cumu) & 193379 \\ \hline Purchase of Pty Plant \& Equip (Cumu) & 1282081 \\ \hline Investment Purchase (Cumu) & -442475 \\ \hline Proceeds from Pty Plant \& Equip(Cumu) & -429350 \\ \hline Investment Disposal (Cumu) & 4035 \\ \hline Other Investing Cash Flows (Cumu) & 345748 \\ \hline Cash Flow from Investing (Cumu) & 0 \\ Change in Equity (Cumu) & -522042 \\ \hline Other Financing Cash Flows (Cumu) & -466462 \\ \hline Cash Flow from Financing (Cumu) & -82144 \\ \hline Effect of Exchange Rate (Cumu) & -548606 \\ \hline Change in Cash (Cumu) & -1039 \\ \hline Opening Cash (Cumu) & 210394 \\ \hline Closing Cash & 635836 \\ \hline Depn \& Amortn (CF) (Cumu) & 846230 \\ \hline Net Purch of Pty Plant \& Equip (Cumu) & 254657 \\ \hline \end{tabular} Standardized Quarterly Balance Sheet Report Date \begin{tabular}{|r|} \hline 12/31/2021 \\ \hline 4th Quarter \end{tabular} Currency USD Audit Status Not Qualified Consolidated Yes Scale Thousands Cash \& Equivalents Short Term Investments 815374 260945 Cash \& Equivs \& ST Investments Receivables (ST) 1076319 99599 Inventories Current Tax Assets 32826 Other Current Assets 78756 Total Current Assets Gross Property Plant \& Equip Accumulated Depreciation 3305601 Net Property Plant \& Equip 1763278 Long Term Investments 274311 Intangible Assets 21939 Other Assets Total Assets 6652958 Accounts Payable \& Accrued Exps 498618 Accounts Payable 163161 Accrued Expenses 335457 Other Current Liabilities 375064 Total Current Liabilities 873682 Deferred LT Liabilities Minority Interests 141765 Other Liabilities 3340137 Total Liabilities 4355584 Common Share Capital 371 Additional Paid-In Capital 1729312 Retained Earnings 3929147 Accum Other Comprehensive Income Treasury Stock 5354 Other Equity 0 Total Equity Total Liabilities \& Equity S 6652958 Standardized Quarterly Income Statement Standardized Quarterly Income Statement Standardized Quarterly Cumulative CF \begin{tabular}{l|r} \hline Report Date & 12/31/2022 \\ \hline & 4th Quarter \\ \hline Currency & USD \\ \hline Audit Status & Yot Qualified \\ \hline Consolidated & Thousands \\ \hline Scale & 899101 \\ \hline Net Income (Cumu) & 345437 \\ \hline Adjustments from Inc to Cash (Cumu) & 32379 \\ \hline Change in Working Capital (Cumu) & 46262 \\ \hline Other Operating Cash Flows (Cumu) & 1323179 \\ \hline Cash Flow from Operations (Cumu) & -479164 \\ \hline Purchase of Pty Plant \& Equip (Cumu) & -614416 \\ \hline Investment Purchase (Cumu) & - \\ \hline Investment Disposal (Cumu) & 263548 \\ \hline Other Investing Cash Flows (Cumu) & 0 \\ Cash Flow from Investing (Cumu) & -830032 \\ \hline Change in Equity (Cumu) & -830140 \\ \hline Other Financing Cash Flows (Cumu) & -99264 \\ \hline Cash Flow from Financing (Cumu) & -929404 \\ \hline Effect of Exchange Rate (Cumu) & -1007 \\ \hline Change in Cash (Cumu) & -437264 \\ \hline Opening Cash (Cumu) & 846230 \\ \hline Closing Cash & 408966 \\ \hline Depn \& Amortn (CF) (Cumu) & 286826 \\ \hline Net Purch of Pty Plant \& Equip (Cumu) & -479164 \\ \hline \end{tabular} Standardized Quarterly Balance Sheet \begin{tabular}{|l|r} \hline Report Date & 12/31/2022 \\ \hline & 4th Quarter \\ \hline Currency & USD \\ \hline Audit Status & Not Qualified \\ \hline Consolidated & Yes \\ \hline Scale & Thousands \\ \hline Cash \& Equivalents & 384000 \\ \hline Short Term Investments & 515136 \\ \hline Cash \& Equivs \& ST Investments & 899136 \\ \hline Receivables (ST) & 106880 \\ \hline Inventories & 35668 \\ \hline Current Tax Assets & 47741 \\ \hline Other Current Assets & 86412 \\ \hline Total Current Assets & 1175837 \\ \hline Gross Property Plant \& Equip & 3685734 \\ \hline Accumulated Depreciation & 1734587 \\ \hline Net Property Plant \& Equip & 1951147 \\ \hline Long Term Investments & 388055 \\ \hline Intangible Assets & 21939 \\ \hline Other Assets & 3390526 \\ \hline Total Assets & 6927504 \\ \hline Accounts Payable \& Accrued Exps & 502561 \\ \hline Accounts Payable & 184566 \\ \hline Accrued Expenses & 317995 \\ \hline Other Current Liabilities & 419319 \\ \hline Total Current Liabilities & 921880 \\ \hline Deferred LT Liabilities & 98623 \\ \hline Minority Interests & 0 \\ \hline Other Liabilities & 3538978 \\ \hline Total Liabilities & 4559481 \\ \hline Common Share Capital & 373 \\ \hline Additional Paid-In Capital & 1829304 \\ \hline Retained Earnings & 4828248 \\ \hline Accum Other Comprehensive Income & -7888 \\ \hline Other Equity & 4282014 \\ \hline Total Equity & 2368023 \\ \hline Total Liabilities \& Equity & 6927504 \\ \hline \end{tabular} Net Present Value (NPV) Calculator Building \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|r|} \hline Year & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & \multicolumn{1}{|c|}{9} & \multicolumn{1}{l|}{10} \\ \hline Cash Flows & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline Year & 11 & 12 & 13 & 14 & 15 & 16 & 17 & 18 & 19 & 20 \\ \hline Cash Flows & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline \end{tabular} Equipment \begin{tabular}{|l|l|} \hline Initial Investment & \\ \hline Annual Cash Inflows & \\ \hline Discount Rate & \\ \hline Number of Years & \\ \hline Salvage Value & \\ \hline \end{tabular} NPV= $0 \begin{tabular}{|c|c|c|c|r|r|r|r|r|r|r|} \hline Year & 1 & 2 & 3 & 4 & 5 & 6 & 7 & \multicolumn{1}{|c|}{8} & \multicolumn{1}{c|}{9} & 10 \\ \hline Cash Flows & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline Year & 11 & 12 & 13 & 14 & 15 & 16 & 17 & 18 & 19 & 20 \\ \hline Cash Flows & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline \end{tabular} Bonds \begin{tabular}{|l|l|} \hline Initial Investment & \\ \hline Annual Cash Inflows & \\ \hline Discount Rate & \\ \hline Number of Years & \\ \hline Principal Returned & \\ \hline \end{tabular} NPV= $0 \begin{tabular}{|c|r|r|r|r|r|r|r|r|r|r|r|} \hline Year & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & 9 & 10 \\ \hline Cash Flows & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline \end{tabular} Standardized Quarterly Cumulative CF \begin{tabular}{|l|r|} \hline Report Date & 12/31/2021 \\ \hline Currency & 4th Quarter \\ \hline USD \\ \hline Consolidated & Not Qualified \\ \hline Scale & Yes \\ \hline Net Income (Cumu) & Thousands \\ \hline Adjustments from Inc to Cash (Cumu) & 652984 \\ \hline Change in Working Capital (Cumu) & 431672 \\ \hline Other Operating Cash Flows (Cumu) & 4046 \\ \hline Cash Flow from Operations (Cumu) & 193379 \\ \hline Purchase of Pty Plant \& Equip (Cumu) & 1282081 \\ \hline Investment Purchase (Cumu) & -442475 \\ \hline Proceeds from Pty Plant \& Equip(Cumu) & -429350 \\ \hline Investment Disposal (Cumu) & 4035 \\ \hline Other Investing Cash Flows (Cumu) & 345748 \\ \hline Cash Flow from Investing (Cumu) & 0 \\ Change in Equity (Cumu) & -522042 \\ \hline Other Financing Cash Flows (Cumu) & -466462 \\ \hline Cash Flow from Financing (Cumu) & -82144 \\ \hline Effect of Exchange Rate (Cumu) & -548606 \\ \hline Change in Cash (Cumu) & -1039 \\ \hline Opening Cash (Cumu) & 210394 \\ \hline Closing Cash & 635836 \\ \hline Depn \& Amortn (CF) (Cumu) & 846230 \\ \hline Net Purch of Pty Plant \& Equip (Cumu) & 254657 \\ \hline \end{tabular} Standardized Quarterly Balance Sheet Report Date \begin{tabular}{|r|} \hline 12/31/2021 \\ \hline 4th Quarter \end{tabular} Currency USD Audit Status Not Qualified Consolidated Yes Scale Thousands Cash \& Equivalents Short Term Investments 815374 260945 Cash \& Equivs \& ST Investments Receivables (ST) 1076319 99599 Inventories Current Tax Assets 32826 Other Current Assets 78756 Total Current Assets Gross Property Plant \& Equip Accumulated Depreciation 3305601 Net Property Plant \& Equip 1763278 Long Term Investments 274311 Intangible Assets 21939 Other Assets Total Assets 6652958 Accounts Payable \& Accrued Exps 498618 Accounts Payable 163161 Accrued Expenses 335457 Other Current Liabilities 375064 Total Current Liabilities 873682 Deferred LT Liabilities Minority Interests 141765 Other Liabilities 3340137 Total Liabilities 4355584 Common Share Capital 371 Additional Paid-In Capital 1729312 Retained Earnings 3929147 Accum Other Comprehensive Income Treasury Stock 5354 Other Equity 0 Total Equity Total Liabilities \& Equity S 6652958 Standardized Quarterly Income Statement Standardized Quarterly Income Statement Standardized Quarterly Cumulative CF \begin{tabular}{l|r} \hline Report Date & 12/31/2022 \\ \hline & 4th Quarter \\ \hline Currency & USD \\ \hline Audit Status & Yot Qualified \\ \hline Consolidated & Thousands \\ \hline Scale & 899101 \\ \hline Net Income (Cumu) & 345437 \\ \hline Adjustments from Inc to Cash (Cumu) & 32379 \\ \hline Change in Working Capital (Cumu) & 46262 \\ \hline Other Operating Cash Flows (Cumu) & 1323179 \\ \hline Cash Flow from Operations (Cumu) & -479164 \\ \hline Purchase of Pty Plant \& Equip (Cumu) & -614416 \\ \hline Investment Purchase (Cumu) & - \\ \hline Investment Disposal (Cumu) & 263548 \\ \hline Other Investing Cash Flows (Cumu) & 0 \\ Cash Flow from Investing (Cumu) & -830032 \\ \hline Change in Equity (Cumu) & -830140 \\ \hline Other Financing Cash Flows (Cumu) & -99264 \\ \hline Cash Flow from Financing (Cumu) & -929404 \\ \hline Effect of Exchange Rate (Cumu) & -1007 \\ \hline Change in Cash (Cumu) & -437264 \\ \hline Opening Cash (Cumu) & 846230 \\ \hline Closing Cash & 408966 \\ \hline Depn \& Amortn (CF) (Cumu) & 286826 \\ \hline Net Purch of Pty Plant \& Equip (Cumu) & -479164 \\ \hline \end{tabular} Standardized Quarterly Balance Sheet \begin{tabular}{|l|r} \hline Report Date & 12/31/2022 \\ \hline & 4th Quarter \\ \hline Currency & USD \\ \hline Audit Status & Not Qualified \\ \hline Consolidated & Yes \\ \hline Scale & Thousands \\ \hline Cash \& Equivalents & 384000 \\ \hline Short Term Investments & 515136 \\ \hline Cash \& Equivs \& ST Investments & 899136 \\ \hline Receivables (ST) & 106880 \\ \hline Inventories & 35668 \\ \hline Current Tax Assets & 47741 \\ \hline Other Current Assets & 86412 \\ \hline Total Current Assets & 1175837 \\ \hline Gross Property Plant \& Equip & 3685734 \\ \hline Accumulated Depreciation & 1734587 \\ \hline Net Property Plant \& Equip & 1951147 \\ \hline Long Term Investments & 388055 \\ \hline Intangible Assets & 21939 \\ \hline Other Assets & 3390526 \\ \hline Total Assets & 6927504 \\ \hline Accounts Payable \& Accrued Exps & 502561 \\ \hline Accounts Payable & 184566 \\ \hline Accrued Expenses & 317995 \\ \hline Other Current Liabilities & 419319 \\ \hline Total Current Liabilities & 921880 \\ \hline Deferred LT Liabilities & 98623 \\ \hline Minority Interests & 0 \\ \hline Other Liabilities & 3538978 \\ \hline Total Liabilities & 4559481 \\ \hline Common Share Capital & 373 \\ \hline Additional Paid-In Capital & 1829304 \\ \hline Retained Earnings & 4828248 \\ \hline Accum Other Comprehensive Income & -7888 \\ \hline Other Equity & 4282014 \\ \hline Total Equity & 2368023 \\ \hline Total Liabilities \& Equity & 6927504 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started