Answered step by step

Verified Expert Solution

Question

1 Approved Answer

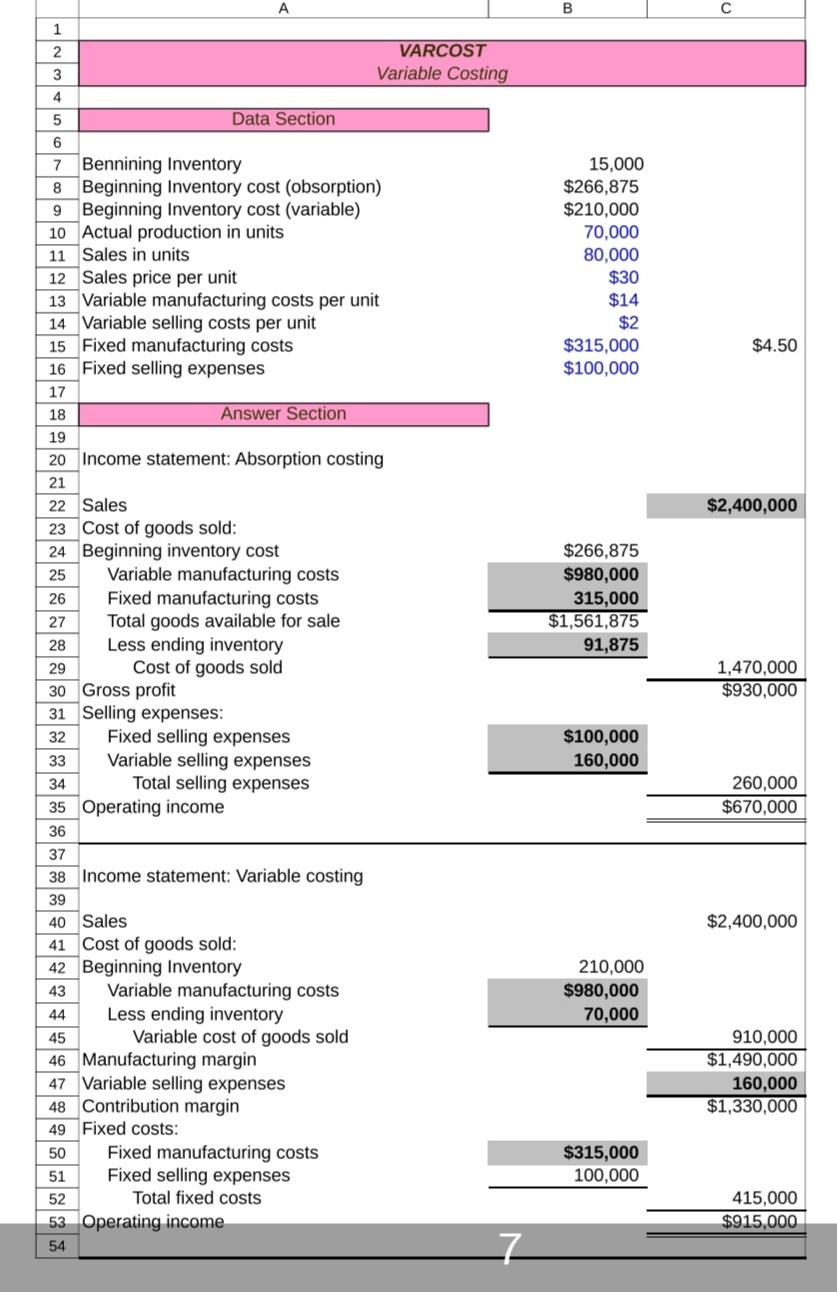

Help with the correct formula for less ending Inventory. How do you get 91,875 The VARCOST2 worksheet is capable of calculating variable and absorption income

Help with the correct formula for less ending Inventory. How do you get 91,875

The VARCOST2 worksheet is capable of calculating variable and absorption income when unit sales are equal to or less than production. An equally common situation (that this worksheet cannot handle) is when beginning inventory is present and sales volume exceeds production volume. Revise the worksheet Data Section to include: Beginning inventory in units 15,000 Beginning inventory cost (absorption) $266,875 Beginning inventory cost (variable) $210,000, Also, change actual production to 70,000. Revise the Answer Section to accommodate this new data. Assume that Anderjak uses the weighted-average costing method for inventory. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Check figure: Absorption income, $670,000. A B 1 2 VARCOST Variable Costing 3 4 5 Data Section 6 15,000 $266,875 $210,000 70,000 80,000 $30 $14 $2 $315,000 $100,000 $4.50 18 $2,400,000 $266,875 $980,000 315,000 $1,561,875 91,875 1,470,000 $930,000 7 Bennining Inventory 8 Beginning Inventory cost (obsorption) 9 Beginning Inventory cost (variable) 10 Actual production in units 11 Sales in units 12 Sales price per unit 13 Variable manufacturing costs per unit 14 Variable selling costs per unit 15 Fixed manufacturing costs 16 Fixed selling expenses 17 Answer Section 19 20 Income statement: Absorption costing 21 22 Sales 23 Cost of goods sold: 24 Beginning inventory cost 25 Variable manufacturing costs 26 Fixed manufacturing costs 27 Total goods available for sale 28 Less ending inventory 29 Cost of goods sold 30 Gross profit 31 Selling expenses: 32 Fixed selling expenses 33 Variable selling expenses 34 Total selling expenses 35 Operating income 36 37 38Income statement: Variable costing 39 40 Sales 41 Cost of goods sold: 42 Beginning Inventory 43 Variable manufacturing costs 44 Less ending inventory 45 Variable cost of goods sold 46 Manufacturing margin 47 Variable selling expenses 48 Contribution margin 49 Fixed costs: 50 Fixed manufacturing costs 51 Fixed selling expenses 52 Total fixed costs 53 Operating income 54 $100,000 160,000 260,000 $670,000 $2,400,000 210,000 $980,000 70,000 910,000 $1,490,000 160,000 $1,330,000 $315,000 100,000 415,000 $915,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started