Help with these 6 questions using the balance sheet and income statement given below. Number each question and bold each answer would be helpful thank you

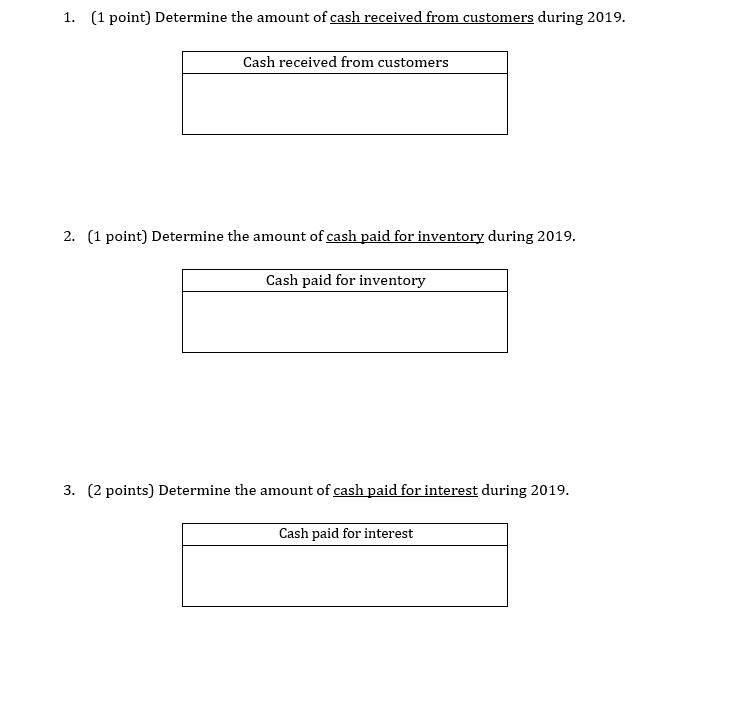

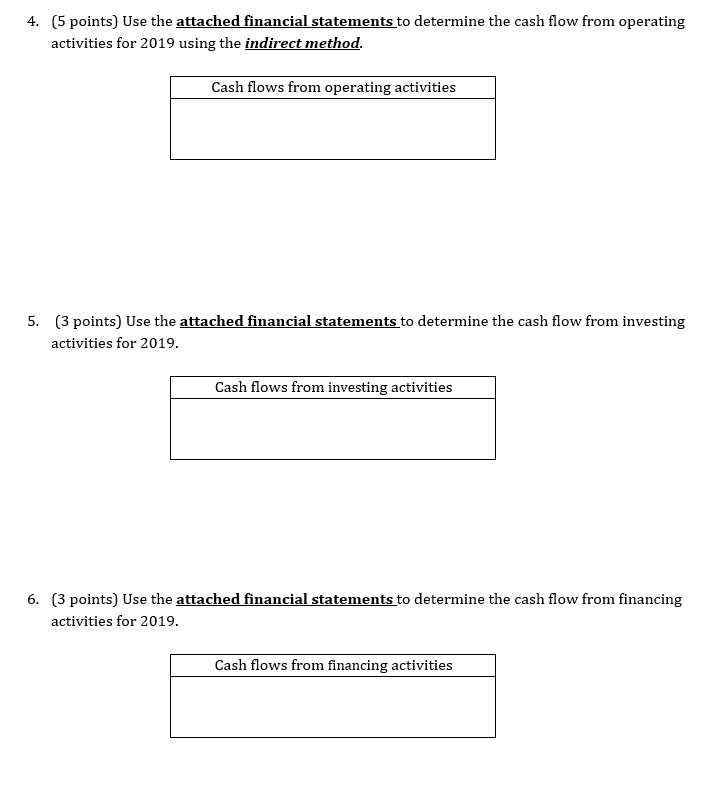

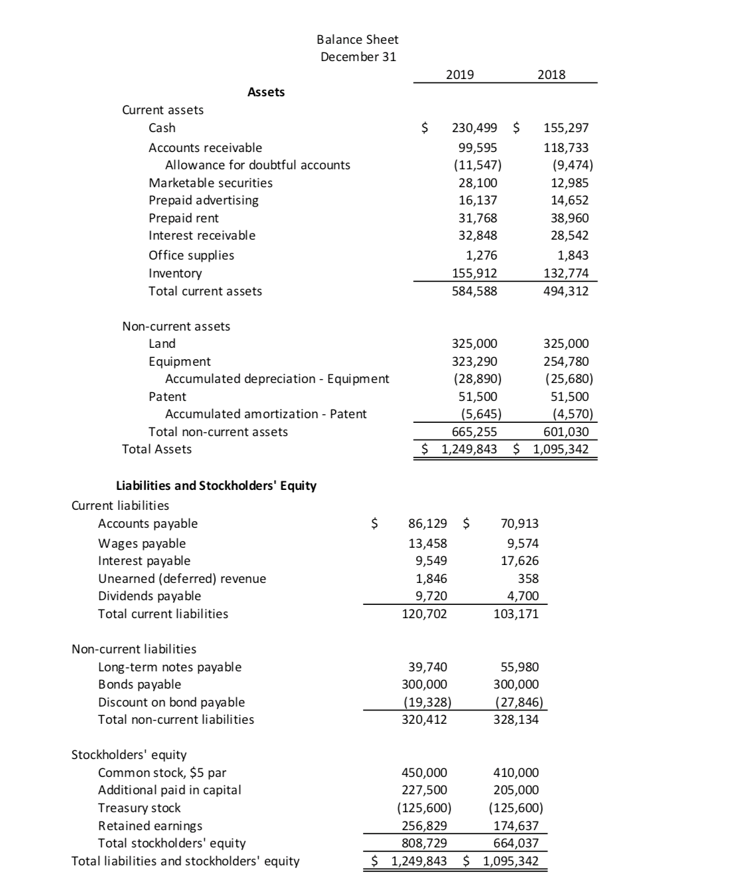

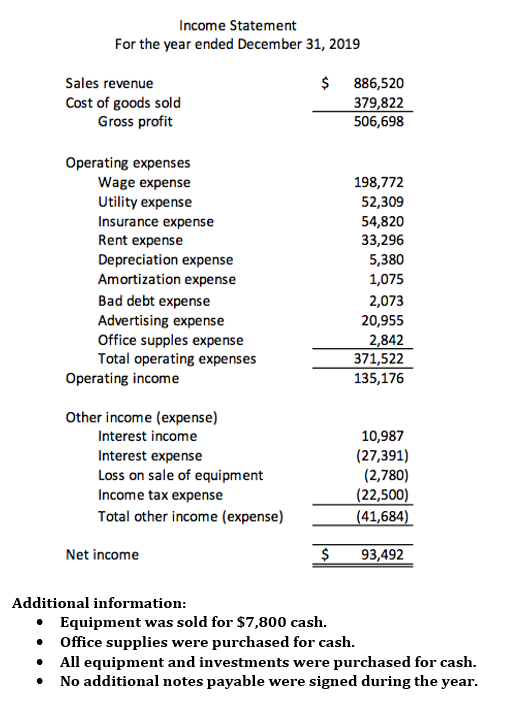

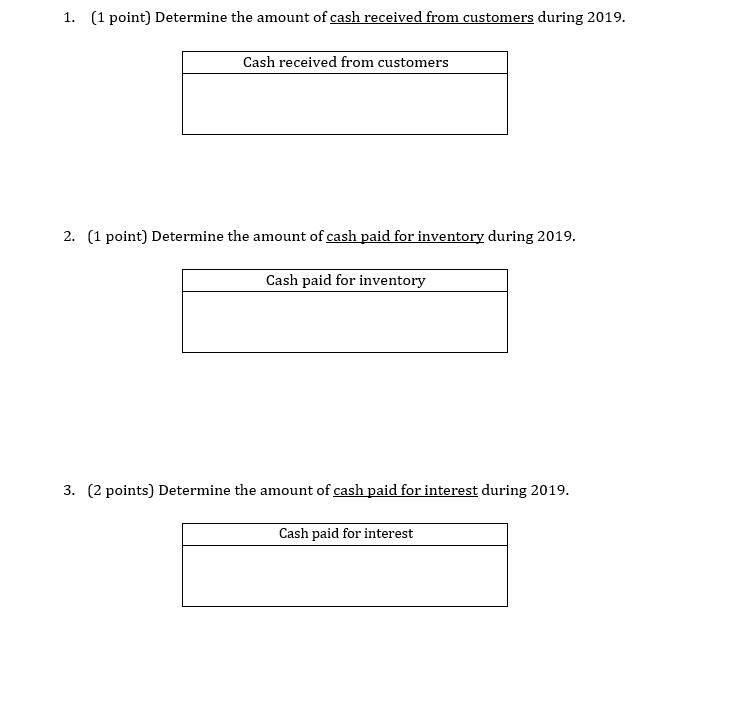

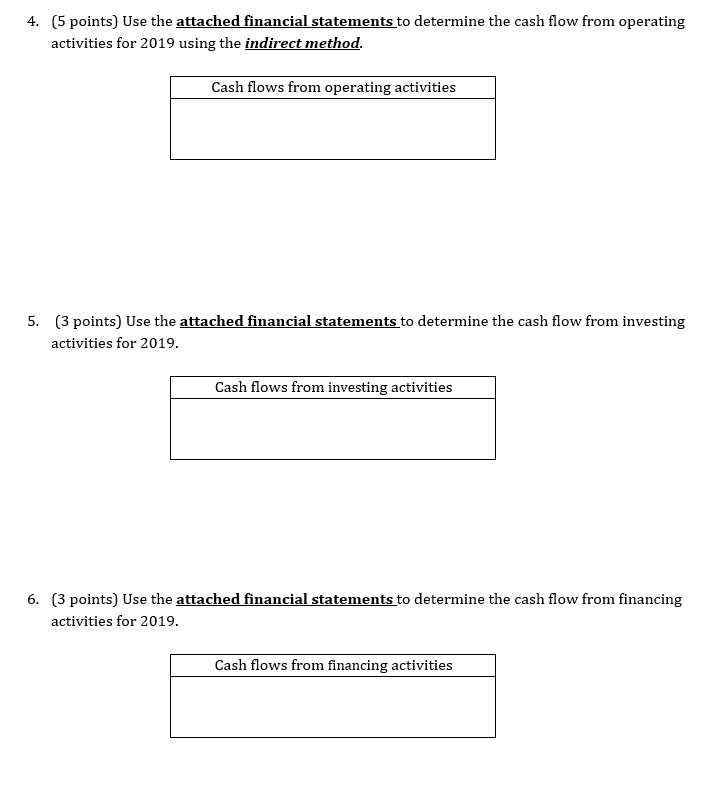

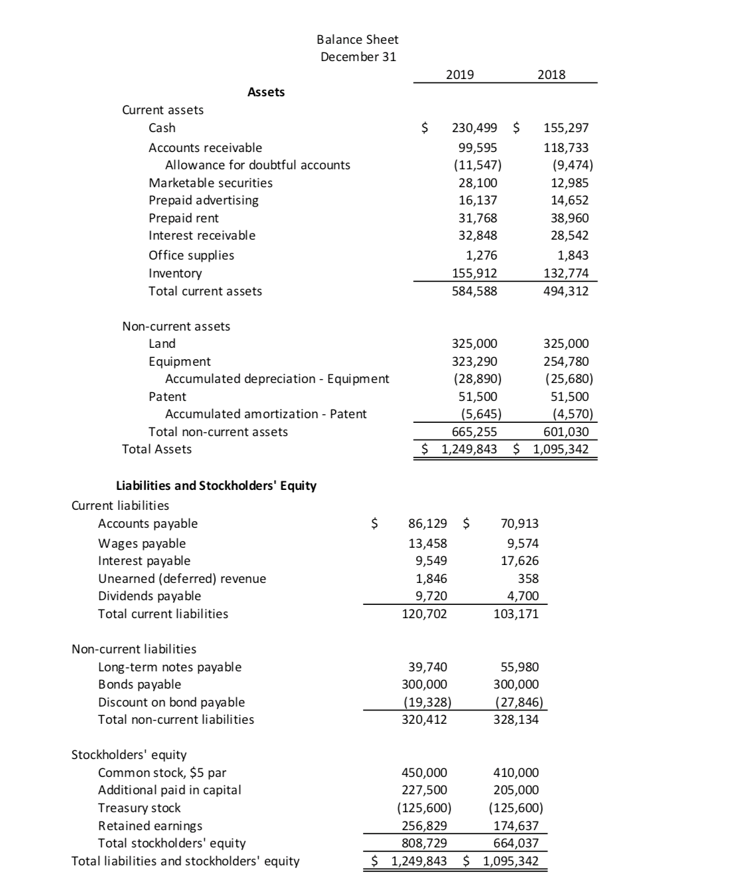

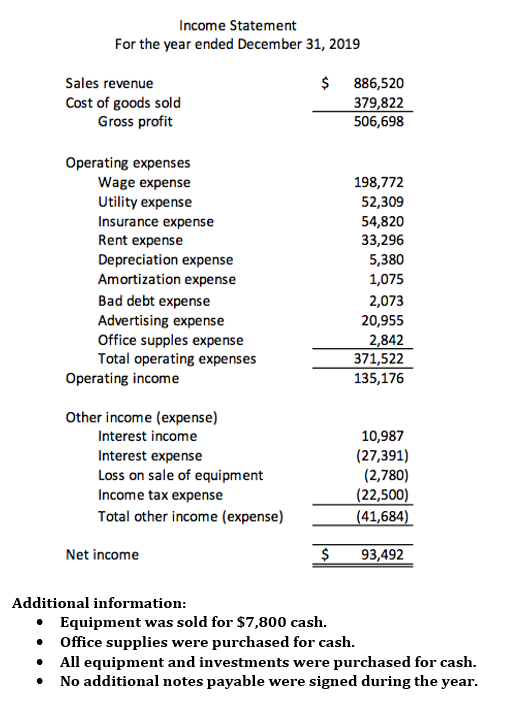

1. (1 point) Determine the amount of cash received from customers during 2019. Cash received from customers 2. (1 point) Determine the amount of cash paid for inventory during 2019. Cash paid for inventory 3. (2 points) Determine the amount of cash paid for interest during 2019. Cash paid for interest 4. (5 points) Use the attached financial statements to determine the cash flow from operating activities for 2019 using the indirect method. Cash flows from operating activities 5. (3 points) Use the attached financial statements to determine the cash flow from investing activities for 2019. Cash flows from investing activities 6. (3 points) Use the attached financial statements to determine the cash flow from financing activities for 2019. Cash flows from financing activities Balance Sheet December 31 2019 2018 $ Assets Current assets Cash Accounts receivable Allowance for doubtful accounts Marketable securities Prepaid advertising Prepaid rent Interest receivable Office supplies Inventory Total current assets 230,499 $ 99,595 (11,547) 28,100 16,137 31,768 32,848 1,276 155,912 584,588 155,297 118,733 (9,474) 12,985 14,652 38,960 28,542 1,843 132,774 494,312 Non-current assets Land Equipment Accumulated depreciation - Equipment Patent Accumulated amortization - Patent Total non-current assets Total Assets 325,000 325,000 323,290 254,780 (28,890) (25,680) 51,500 51,500 (5,645) (4,570) 665,255 601,030 $ 1,249,843 $ 1,095,342 $ Liabilities and Stockholders' Equity Current liabilities Accounts payable Wages payable Interest payable Unearned (deferred) revenue Dividends payable Total current liabilities 86,129 $ 13,458 9,549 1,846 9,720 120,702 70,913 9,574 17,626 358 4,700 103,171 Non-current liabilities Long-term notes payable Bonds payable Discount on bond payable Total non-current liabilities 39,740 300,000 (19,328) 320,412 55,980 300,000 (27,846) 328,134 Stockholders' equity Common stock, $5 par Additional paid in capital Treasury stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 450,000 410,000 227,500 205,000 (125,600) (125,600) 256,829 174,637 808,729 664,037 $ 1,249,843 $ 1,095,342 Income Statement For the year ended December 31, 2019 Sales revenue Cost of goods sold Gross profit $ 886,520 379,822 506,698 Operating expenses Wage expense Utility expense Insurance expense Rent expense Depreciation expense Amortization expense Bad debt expense Advertising expense Office supples expense Total operating expenses Operating income 198,772 52,309 54,820 33,296 5,380 1,075 2,073 20,955 2,842 371,522 135,176 Other income (expense) Interest income Interest expense Loss on sale of equipment Income tax expense Total other income (expense) 10,987 (27,391) (2,780) (22,500) (41,684) Net income $ 93,492 Additional information: Equipment was sold for $7,800 cash. Office supplies were purchased for cash. All equipment and investments were purchased for cash. No additional notes payable were signed during the year