Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help with these problems 15. Gigi expects to get $30,000 at graduation in two years. She plans to invest at an annual rate of 9%

help with these problems

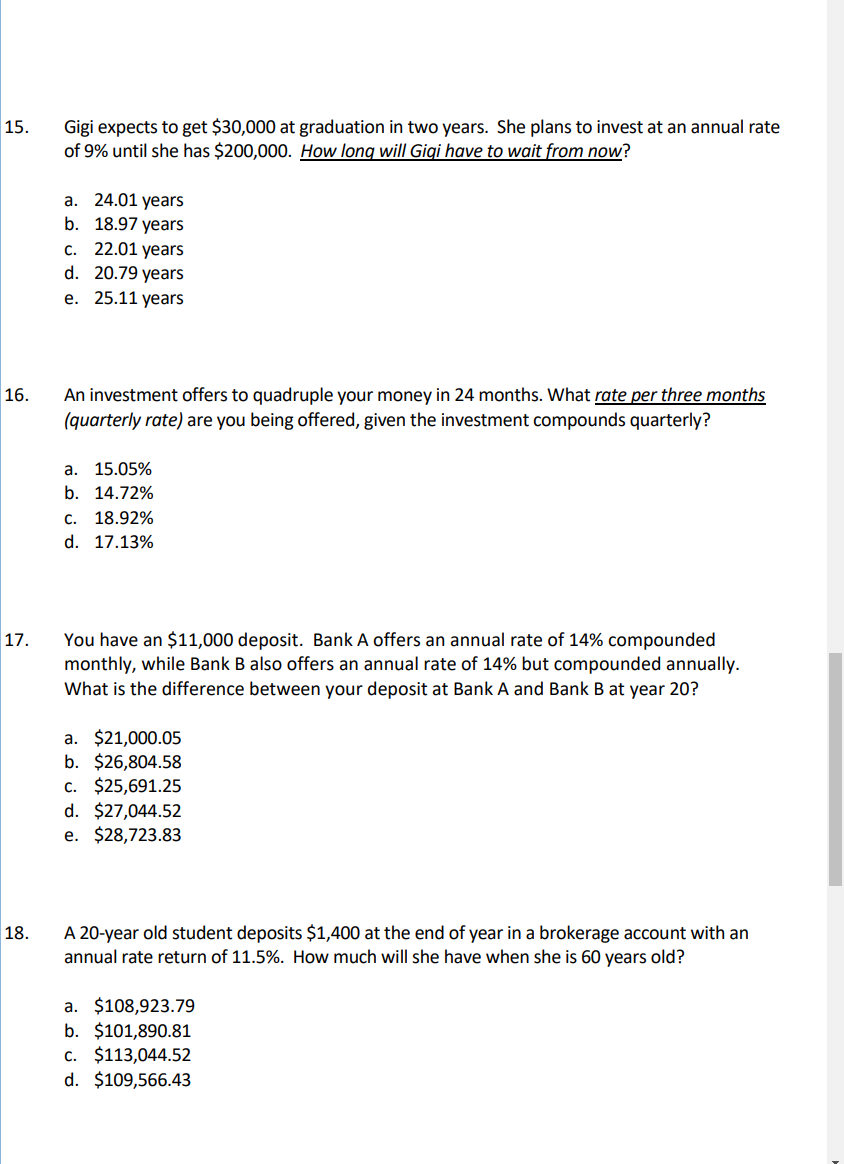

15. Gigi expects to get $30,000 at graduation in two years. She plans to invest at an annual rate of 9% until she has $200,000. How long will Gigi have to wait from now? a. 24.01 years b. 18.97 years c. 22.01 years d. 20.79 years e. 25.11 years 16. An investment offers to quadruple your money in 24 months. What rate per three months (quarterly rate) are you being offered, given the investment compounds quarterly? a. 15.05% b. 14.72% C. 18.92% d. 17.13% 17. You have an $11,000 deposit. Bank A offers an annual rate of 14% compounded monthly, while Bank B also offers an annual rate of 14% but compounded annually. What is the difference between your deposit at Bank A and Bank B at year 20? a. $21,000.05 b. $26,804.58 C. $25,691.25 d. $27,044.52 e. $28,723.83 18. A 20-year old student deposits $1,400 at the end of year in a brokerage account with an annual rate return of 11.5%. How much will she have when she is 60 years old? a. $108,923.79 b. $101,890.81 C. $113,044.52 d. $109,566.43

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started