help with these questions

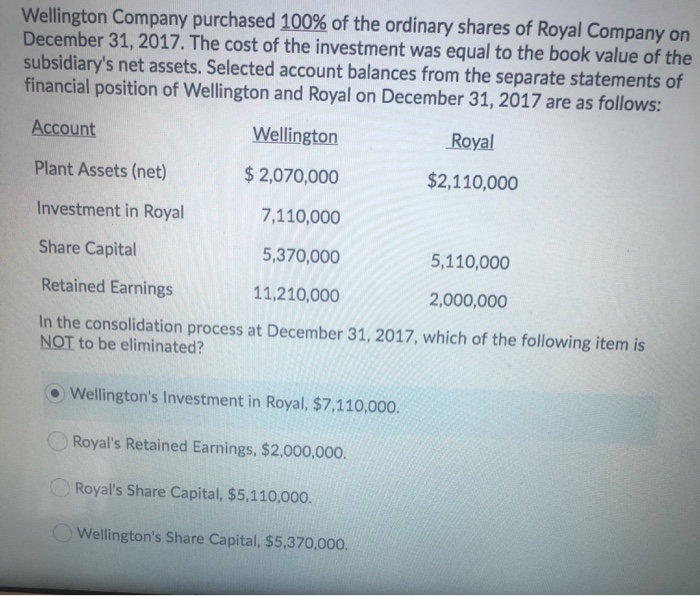

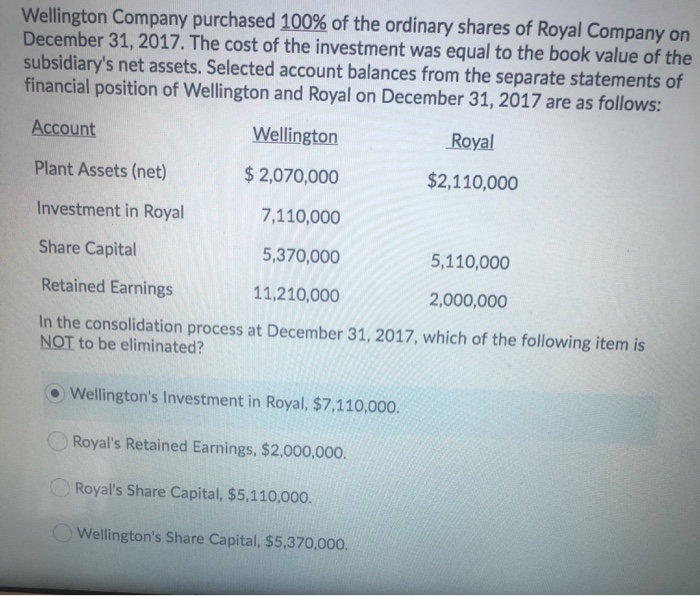

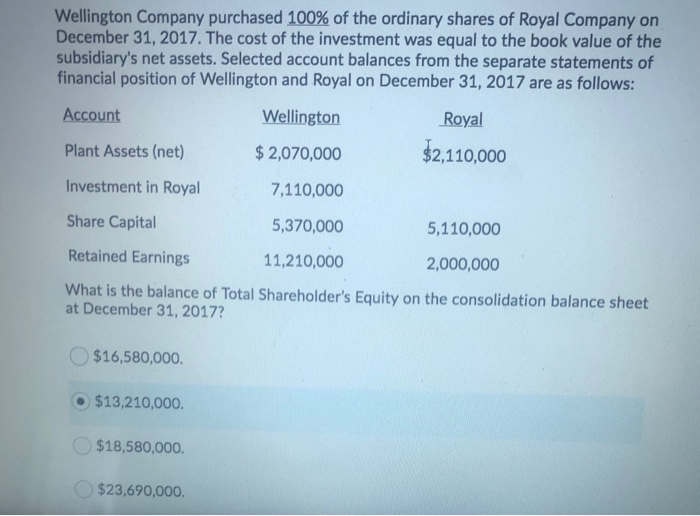

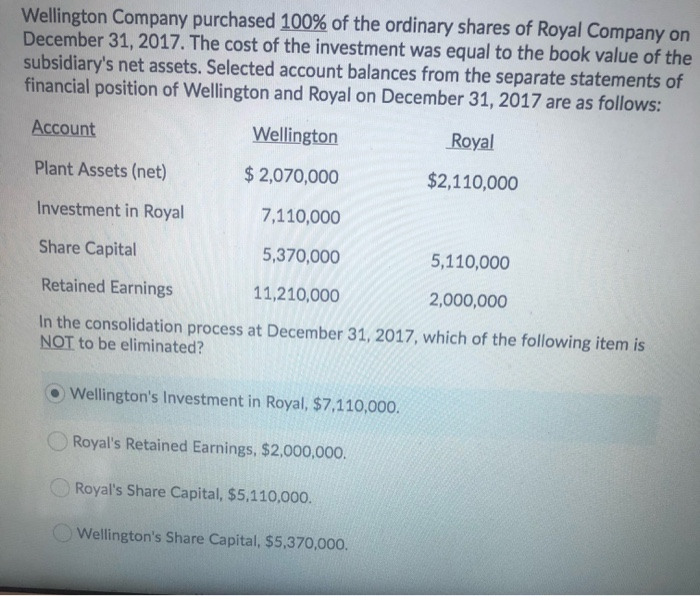

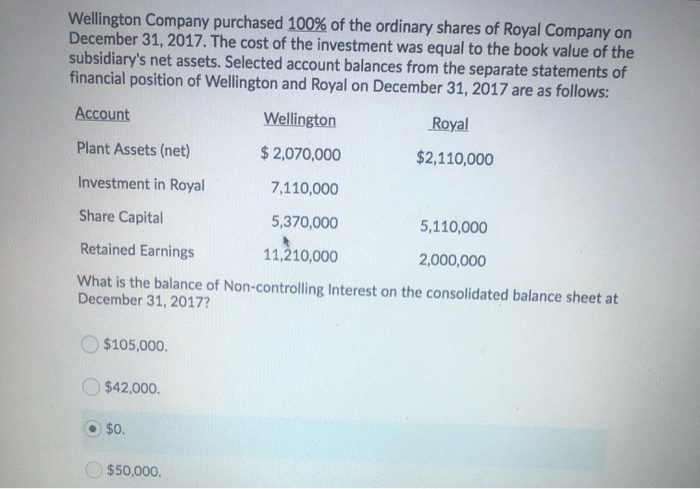

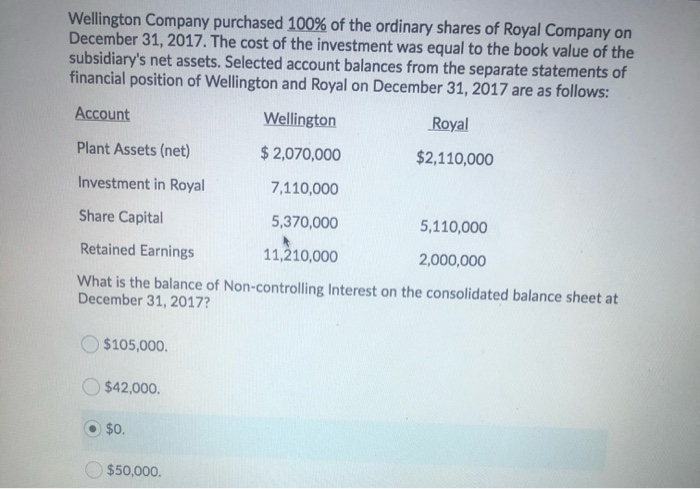

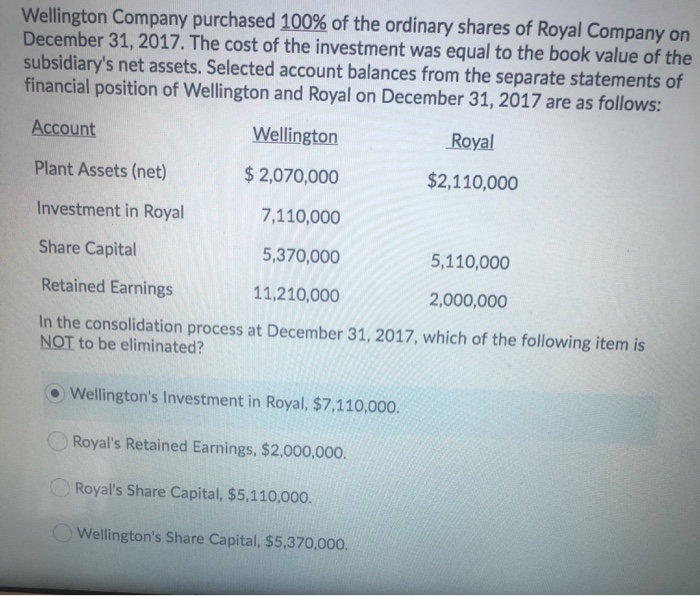

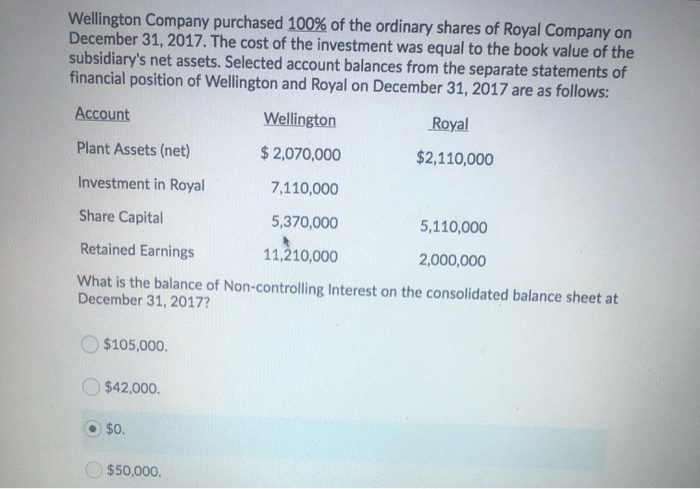

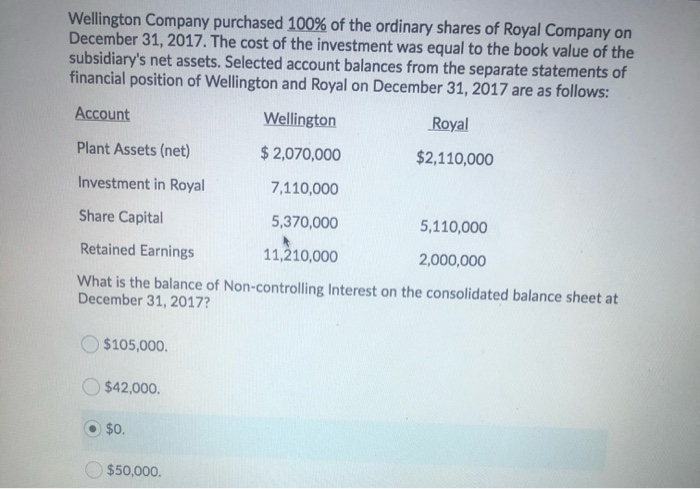

Wellington Company purchased 100% of the ordinary shares of Royal Company on December 31, 2017. The cost of the investment was equal to the book value of the subsidiary's net assets. Selected account balances from the separate statements of financial position of Wellington and Royal on December 31, 2017 are as follows: Account Royal Wellington $ 2,070,000 Plant Assets (net) $2,110,000 Investment in Royal 7,110,000 Share Capital 5,370,000 5,110,000 Retained Earnings 11,210,000 2,000,000 In the consolidation process at December 31, 2017, which of the following item is NOT to be eliminated? Wellington's Investment in Royal, $7,110,000 Royal's Retained Earnings, $2,000,000. Royal's Share Capital, $5,110,000. Wellington's Share Capital, $5,370,000. Wellington Company purchased 100% of the ordinary shares of Royal Company on December 31, 2017. The cost of the investment was equal to the book value of the subsidiary's net assets. Selected account balances from the separate statements of financial position of Wellington and Royal on December 31, 2017 are as follows: Account Wellington Royal Plant Assets (net) $ 2,070,000 $2,110,000 Investment in Royal 7,110,000 Share Capital 5,370,000 5,110,000 Retained Earnings 11,210,000 2,000,000 What is the balance of Total Shareholder's Equity on the consolidation balance sheet at December 31, 2017? $16,580,000. $13,210,000 $18,580,000 $23,690,000 Wellington Company purchased 100% of the ordinary shares of Royal Company on December 31, 2017. The cost of the investment was equal to the book value of the subsidiary's net assets. Selected account balances from the separate statements of financial position of Wellington and Royal on December 31, 2017 are as follows: Account Royal Wellington $ 2,070,000 Plant Assets (net) $2,110,000 Investment in Royal 7,110,000 Share Capital 5,370,000 5,110,000 Retained Earnings 11,210,000 2,000,000 In the consolidation process at December 31, 2017, which of the following item is NOT to be eliminated? Wellington's Investment in Royal, $7,110,000. Royal's Retained Earnings, $2,000,000, Royal's Share Capital, $5,110,000. Wellington's Share Capital, $5,370,000. Wellington Company purchased 100% of the ordinary shares of Royal Company on December 31, 2017. The cost of the investment was equal to the book value of the subsidiary's net assets. Selected account balances from the separate statements of financial position of Wellington and Royal on December 31, 2017 are as follows: Account Wellington Royal Plant Assets (net) $ 2,070,000 $2,110,000 Investment in Royal 7,110,000 Share Capital 5,370,000 5,110,000 Retained Earnings 11,210,000 2,000,000 What is the balance of Non-controlling Interest on the consolidated balance sheet at December 31, 2017? $105,000. $42,000 $0. $50,000 Wellington Company purchased 100% of the ordinary shares of Royal Company on December 31, 2017. The cost of the investment was equal to the book value of the subsidiary's net assets. Selected account balances from the separate statements of financial position of Wellington and Royal on December 31, 2017 are as follows: Account Wellington Royal Plant Assets (net) $ 2,070,000 $2,110,000 Investment in Royal 7,110,000 Share Capital 5,370,000 5,110,000 Retained Earnings 11,210,000 2,000,000 What is the balance of Non-controlling Interest on the consolidated balance sheet at December 31, 2017? $105,000. $42,000 $0. $50,000