Answered step by step

Verified Expert Solution

Question

1 Approved Answer

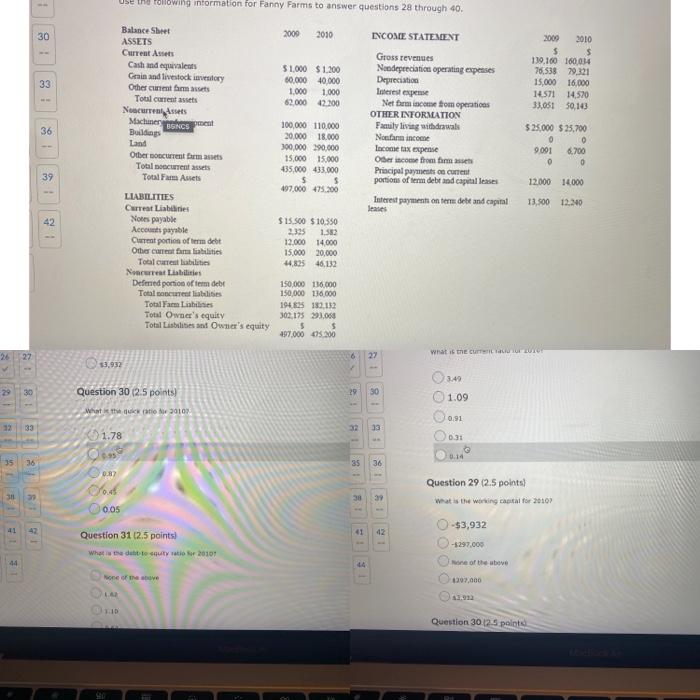

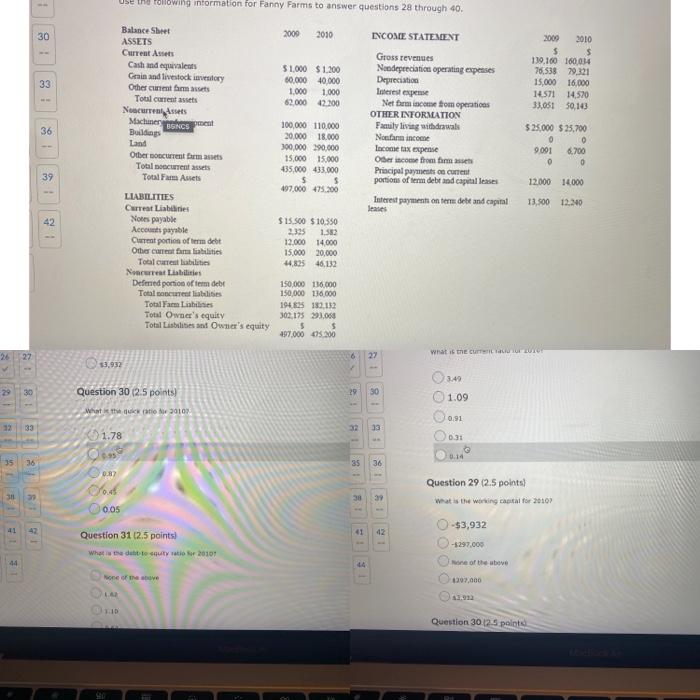

help with this question -- 30 2009 2010 $ $ 139,160 160,014 76,538 79.321 15,000 16,000 14.571 14,520 33,051 50,143 33 36 $25.000 $25,700 0

help with this question

-- 30 2009 2010 $ $ 139,160 160,014 76,538 79.321 15,000 16,000 14.571 14,520 33,051 50,143 33 36 $25.000 $25,700 0 9001 6.700 0 0 Use the following information for Fanny Farms to answer questions 28 through 40. Balance Sheet 2000 2010 INCOME STATEMENT ASSETS Current Ames Gross revenues Cash and equales $1,000 $1.200 Nendepreciation operating expenses Gain and livestock investory 60.000 40.000 Depreciation Other current mats 1.000 1.000 Interest expense Total current assets 62000 42.200 Net Dorm income from operations Noncurrentes OTHER INFORMATION Machinery pment BANCS 100,000 110.000 Buildings Family living withdrawals 20.000 18.000 Norfa income Land 300.000 290.000 Income tax expense Other current armas 15.000 15.000 Ober income from me Total current assets 435,000 433.000 Principal payments on current Total Fam Assets S $ portion of term debt and capital leases 497.000 475.200 LIABILITIES Interest payment on tem debe and capital Current Liabilities Jeases Notes payable $15.500 $10.550 Accounts payable 2.325 1.582 Current portion of term det 12.000 14.000 Other crear liabilities 15.000 20,000 Total current abilities 44.82546,232 Narratibles Defend portion of fem debe 150,000 110.000 Totalcibilities 150,000 136,000 Total Face Libilis 194.825 182.132 Total Owa's equity 302.175 293.068 Total Liabilities Owner's equity 5 $ 197.000 45.200 39 12.000 14.000 13,500 12.20 42 27 What is THE CUTULO 6 27 3.49 30 Question 30 (2.5 points) 29 30 01.09 0.91 What the 2010 12 33 32 13 1.78 36 35 36 Question 29 (2.5 points) wat is the woring capital for 2010 38 39 0.87 Com 0.05 Question 31 2.5 points Where due to say ito sa 2010 more of a sve -$3,932 11 42 41 12 -$297.000 44 None of the above 107,600 . Question 30 (2.5 palota

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started