Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help with this question! Its 9 parts! Thank You More info The company is considering two possible expansion plans. Plan A would open eight smaller

help with this question! Its 9 parts!

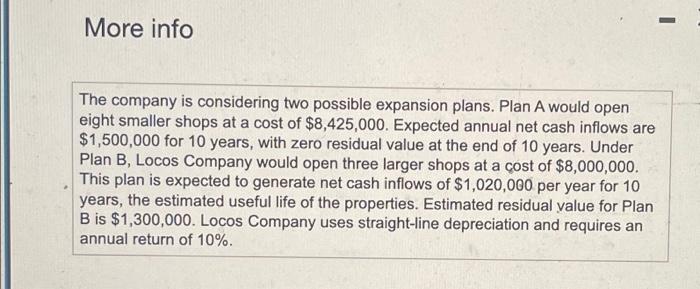

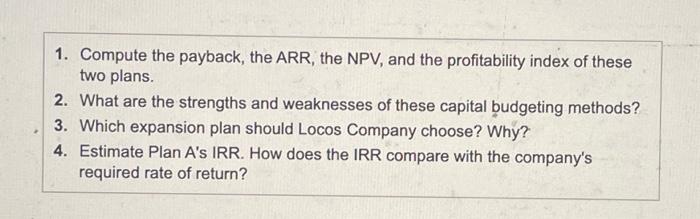

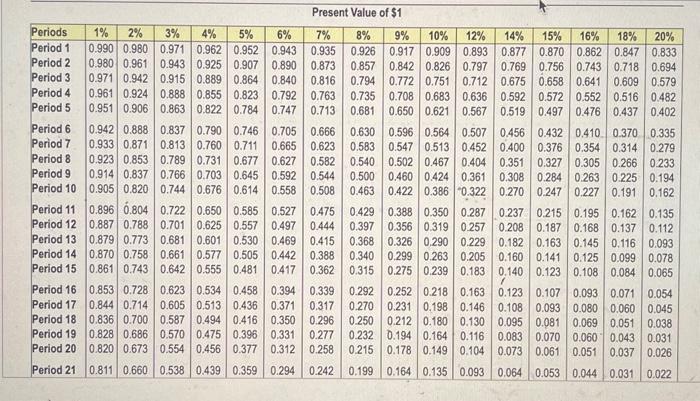

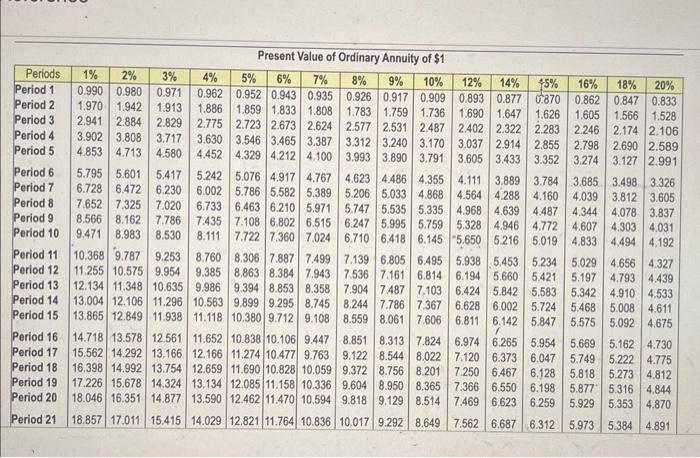

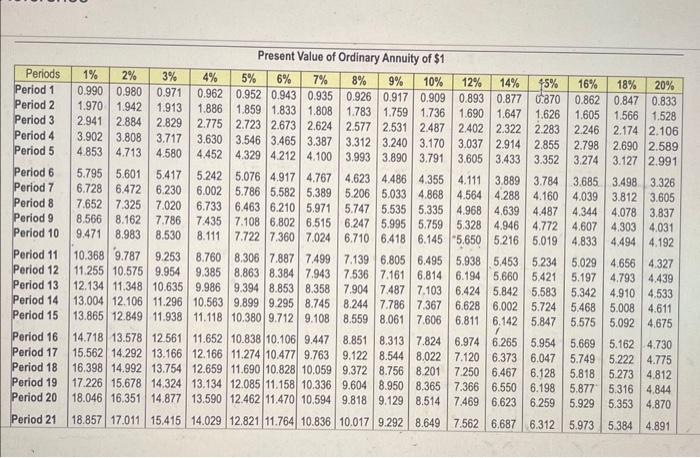

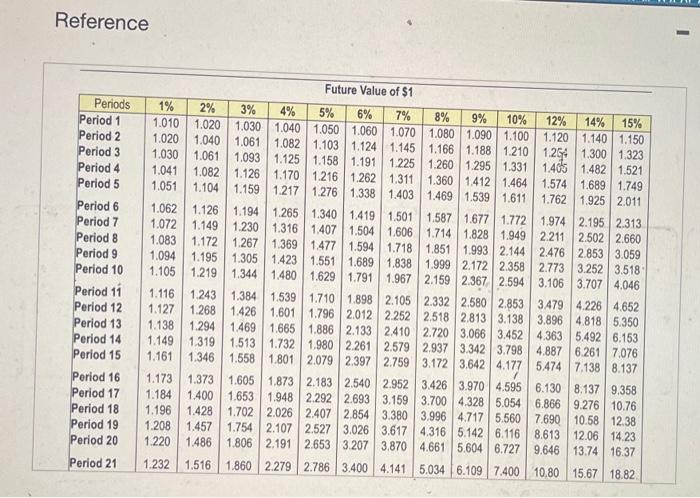

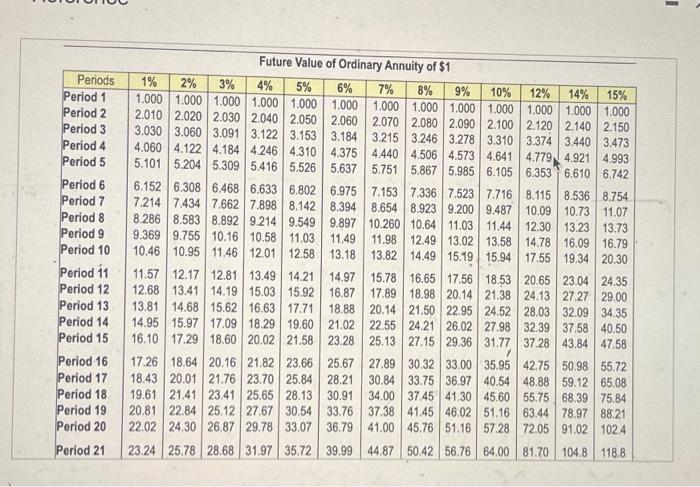

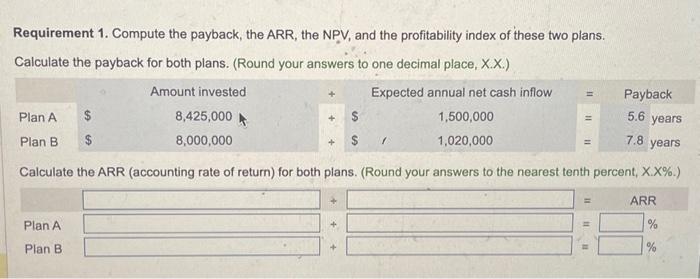

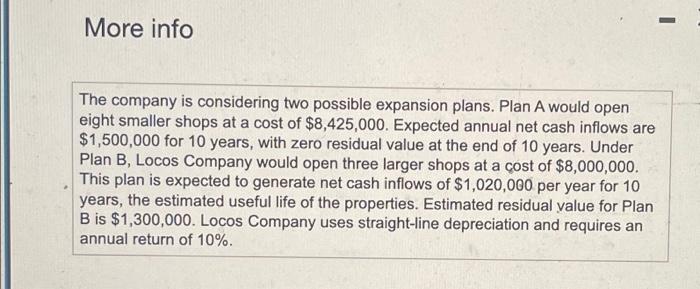

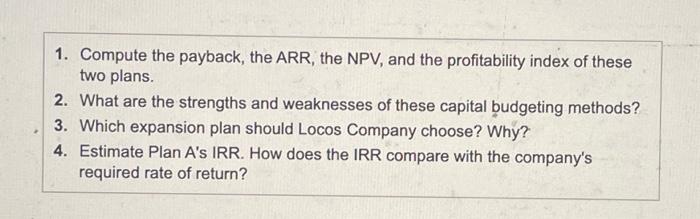

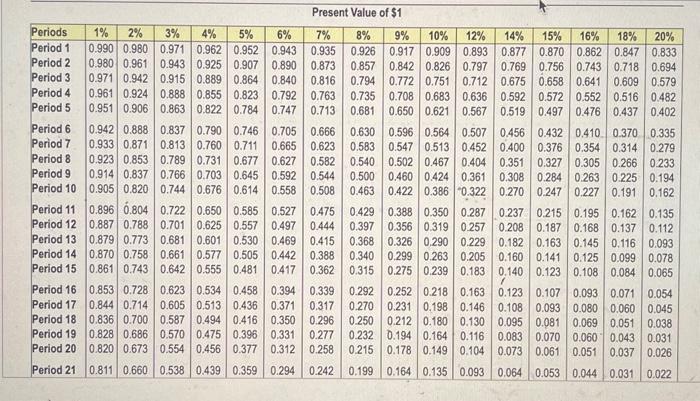

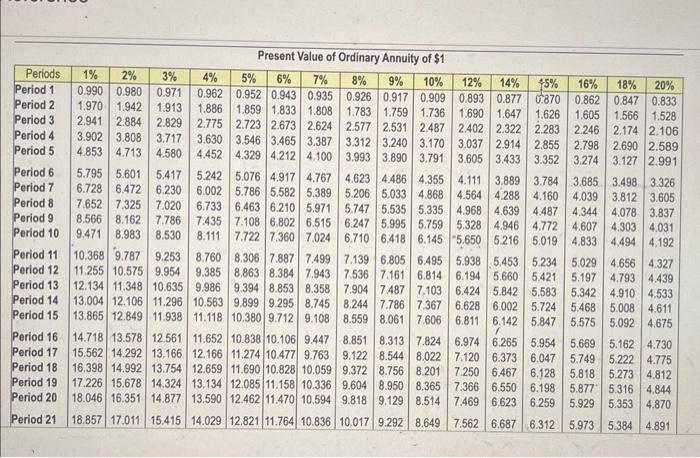

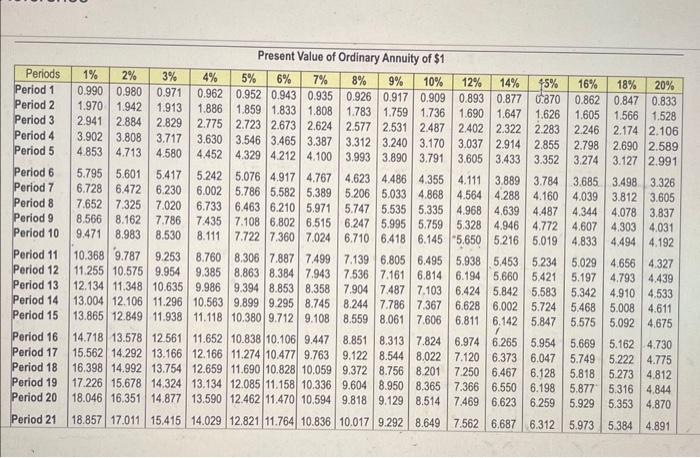

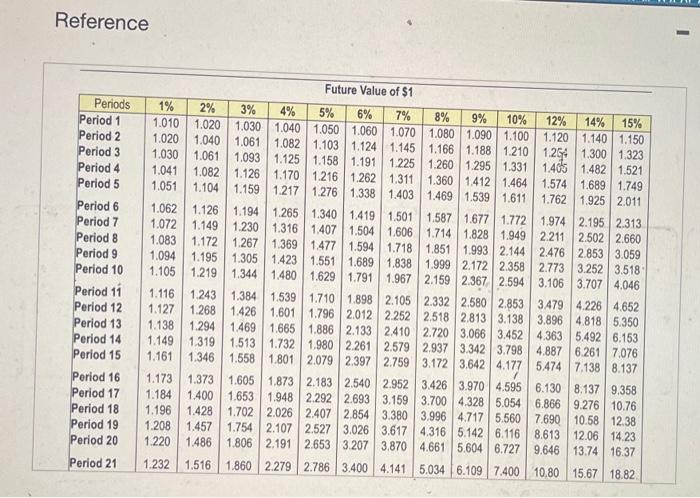

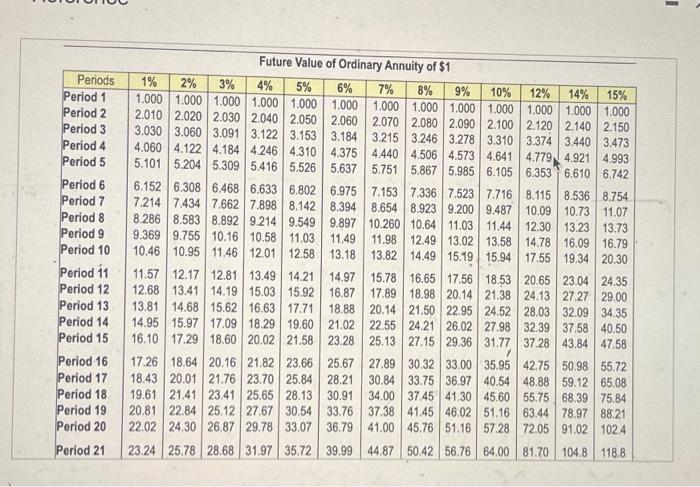

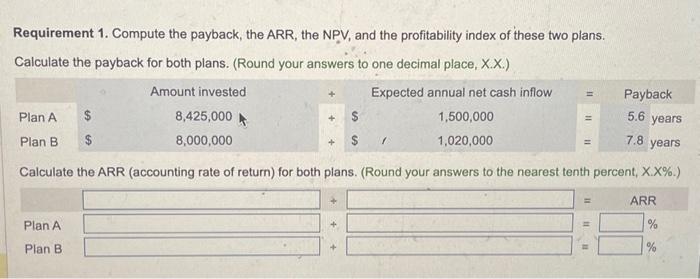

More info The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,425,000. Expected annual net cash inflows are $1,500,000 for 10 years, with zero residual value at the end of 10 years. Under Plan B, Locos Company would open three larger shops at a cost of $8,000,000. This plan is expected to generate net cash inflows of $1,020,000 per year for 10 years, the estimated useful life of the properties. Estimated residual value for Plan B is $1,300,000. Locos Company uses straight-line depreciation and requires an annual return of 10%. 1. Compute the payback, the ARR, the NPV, and the profitability index of these two plans. 2. What are the strengths and weaknesses of these capital budgeting methods? 3. Which expansion plan should Locos Company choose? Why? 4. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return? Pracant Walie af 61 Present Value of Ordinarv Annuitu of $1 Present Value of Ordinarv Annuitu of $1 Reference Futiura Valiua af nedt Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two plans. Calculate the payback for both plans. (Round your answers to one decimal place, X.X.) Thank You

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started