Answered step by step

Verified Expert Solution

Question

1 Approved Answer

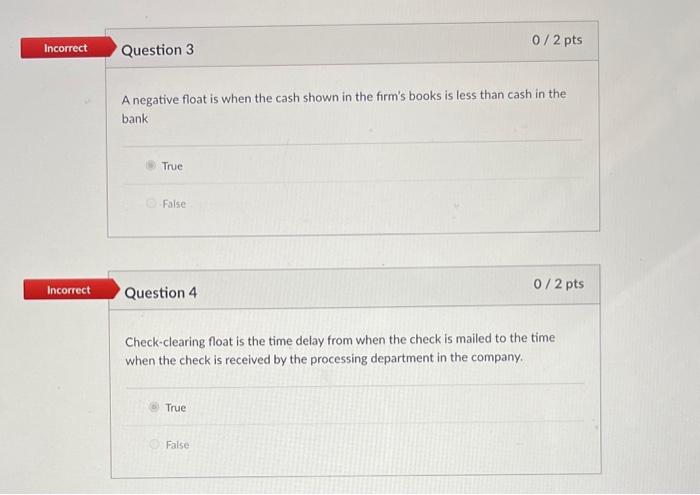

Help with work please! A negative float is when the cash shown in the firm's books is less than cash in the bank True False

Help with work please!

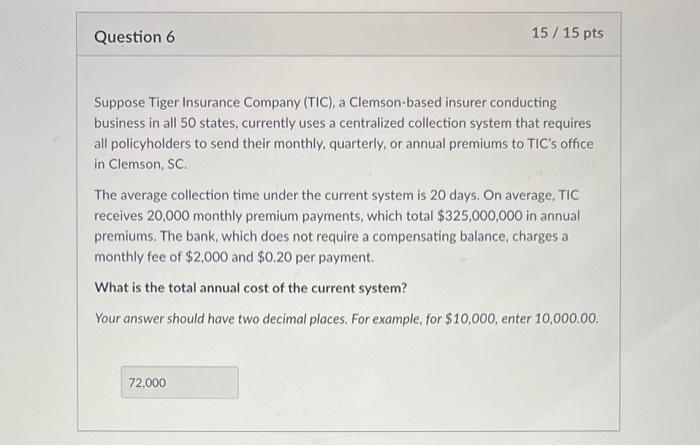

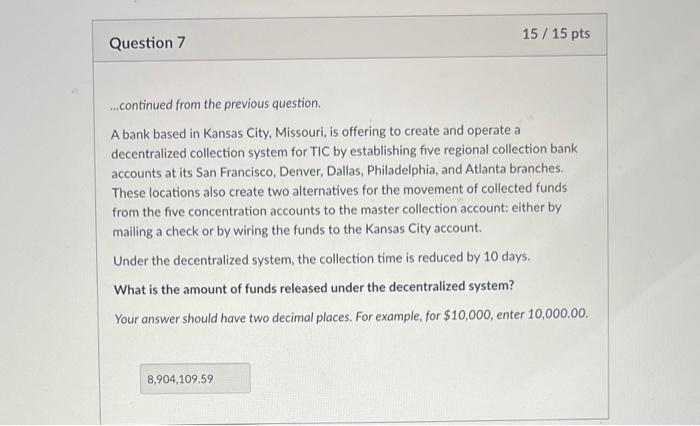

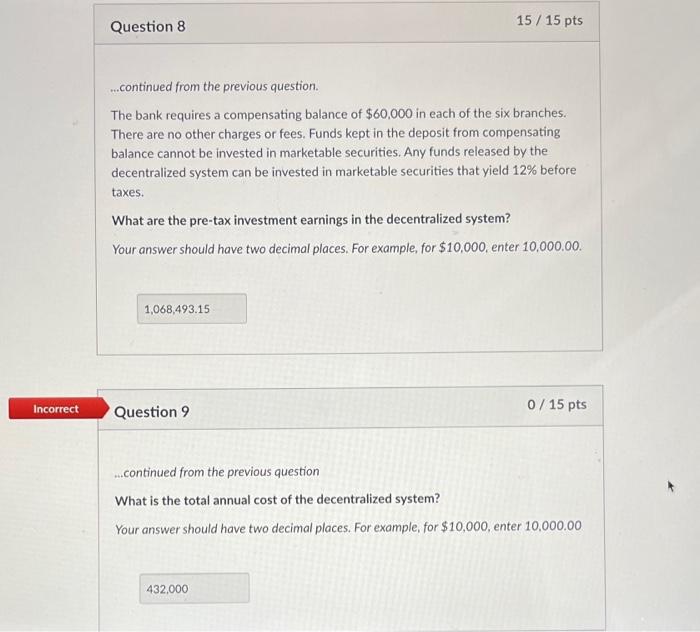

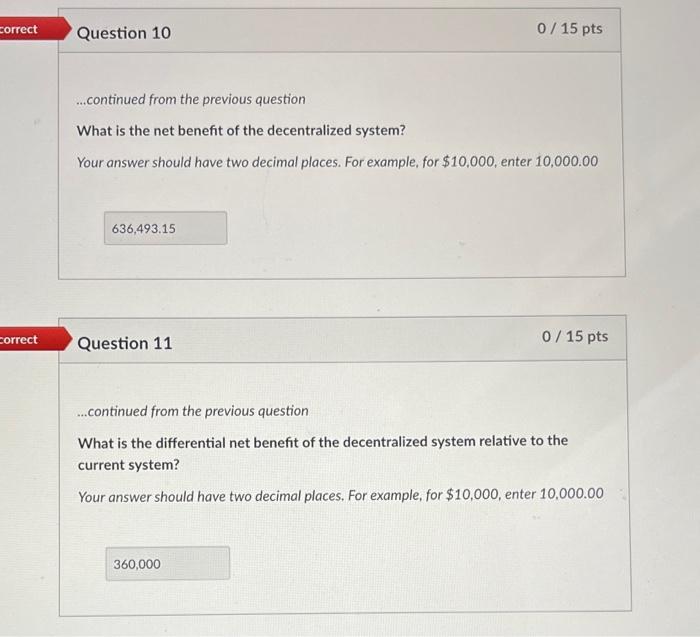

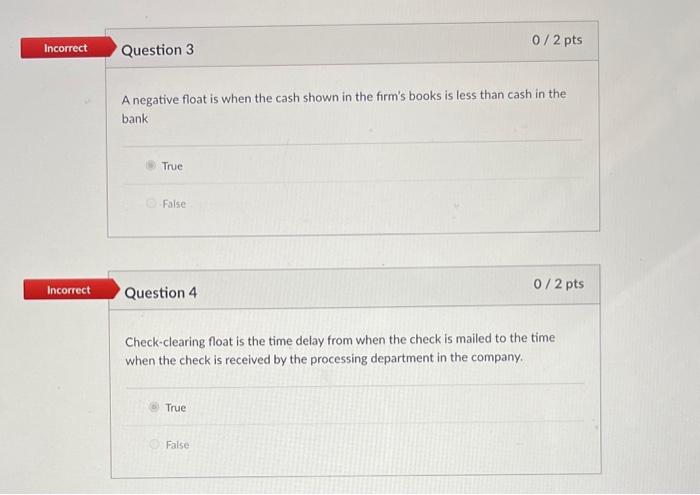

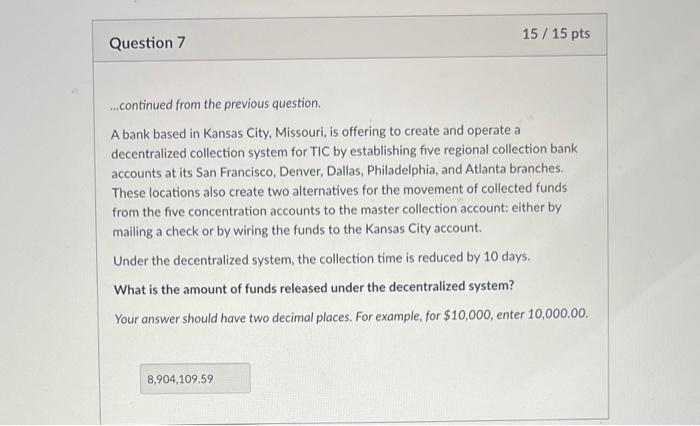

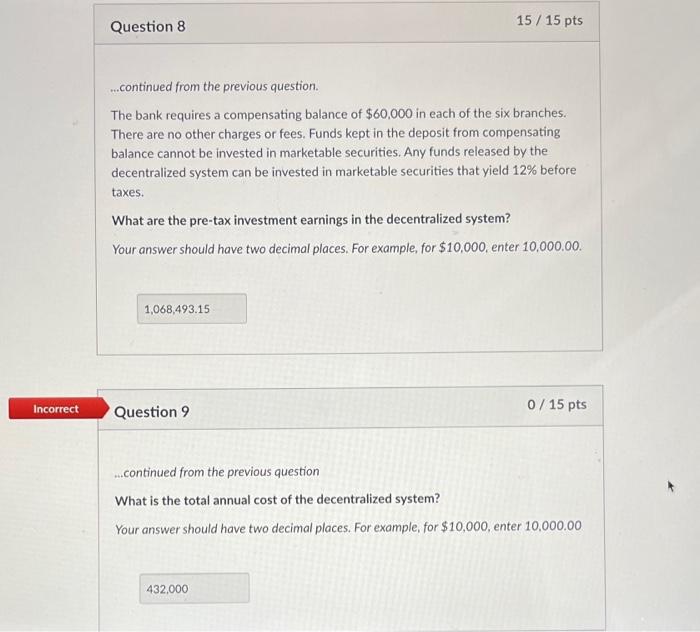

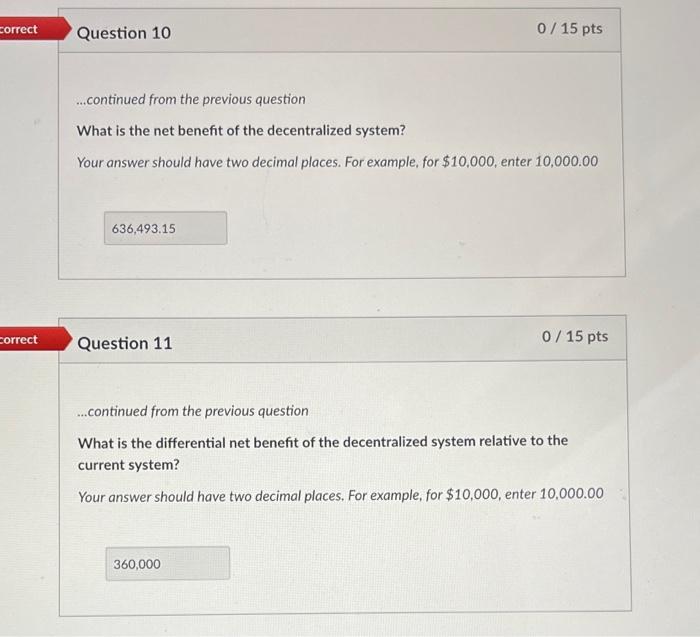

A negative float is when the cash shown in the firm's books is less than cash in the bank True False Question 4 0/2 pts Check-clearing float is the time delay from when the check is mailed to the time when the check is received by the processing department in the company. True False Suppose Tiger Insurance Company (TIC), a Clemson-based insurer conducting business in all 50 states, currently uses a centralized collection system that requires all policyholders to send their monthly, quarterly, or annual premiums to TIC's office in Clemson, SC. The average collection time under the current system is 20 days. On average, TIC receives 20,000 monthly premium payments, which total $325,000,000 in annual premiums. The bank, which does not require a compensating balance, charges a monthly fee of $2,000 and $0.20 per payment. What is the total annual cost of the current system? Your answer should have two decimal places. For example, for $10,000, enter 10,000.00. ...continued from the previous question. A bank based in Kansas City, Missouri, is offering to create and operate a decentralized collection system for TIC by establishing five regional collection bank accounts at its San Francisco, Denver, Dallas, Philadelphia, and Atlanta branches. These locations also create two alternatives for the movement of collected funds from the five concentration accounts to the master collection account: either by mailing a check or by wiring the funds to the Kansas City account. Under the decentralized system, the collection time is reduced by 10 days. What is the amount of funds released under the decentralized system? Your answer should have two decimal places. For example, for $10,000, enter 10,000.00. ...continued from the previous question. The bank requires a compensating balance of $60,000 in each of the six branches. There are no other charges or fees. Funds kept in the deposit from compensating balance cannot be invested in marketable securities. Any funds released by the decentralized system can be invested in marketable securities that yield 12% before taxes. What are the pre-tax investment earnings in the decentralized system? Your answer should have two decimal places. For example, for $10,000, enter 10,000.00. Question 9 0/15 pts continued from the previous question What is the total annual cost of the decentralized system? Your answer should have two decimal places. For example, for $10,000, enter 10,000.00 ...continued from the previous question What is the net benefit of the decentralized system? Your answer should have two decimal places. For example, for $10,000, enter 10,000.00 Question 11 0/15 pts ...continued from the previous question What is the differential net benefit of the decentralized system relative to the current system? Your answer should have two decimal places. For example, for $10,000, enter 10,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started