Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Croci Corp. ( CC ) is evaluating the replacement of one of their industrial pasta machines. The new machine can be sold at the end

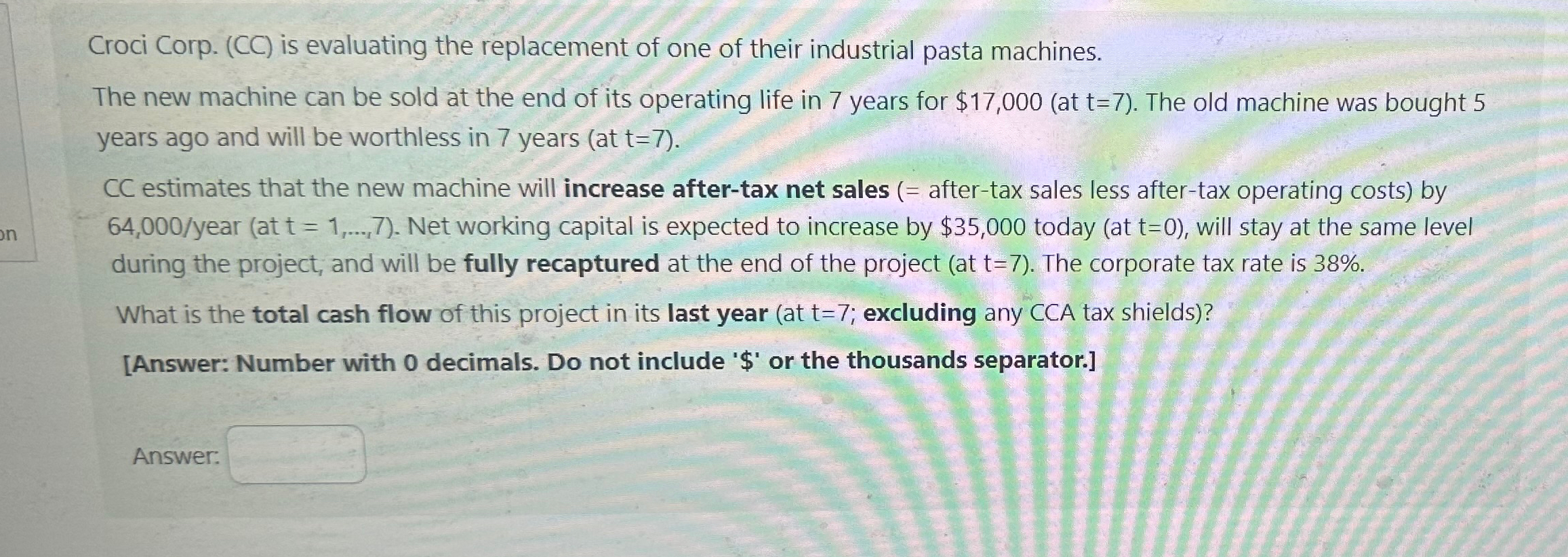

Croci Corp. CC is evaluating the replacement of one of their industrial pasta machines.

The new machine can be sold at the end of its operating life in years for $at The old machine was bought years ago and will be worthless in years at

CC estimates that the new machine will increase aftertax net sales aftertax sales less aftertax operating costs by year at dots, Net working capital is expected to increase by $ today will stay at the same level during the project, and will be fully recaptured at the end of the project at The corporate tax rate is

What is the total cash flow of this project in its last year at ; excluding any CCA tax shields

Answer: Number with decimals. Do not include $ or the thousands separator.

Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started