Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help You are a relatively recent hire to Hartz & Company, a local manufacturer of plumbing supply products. You have been asked to prepare a

help

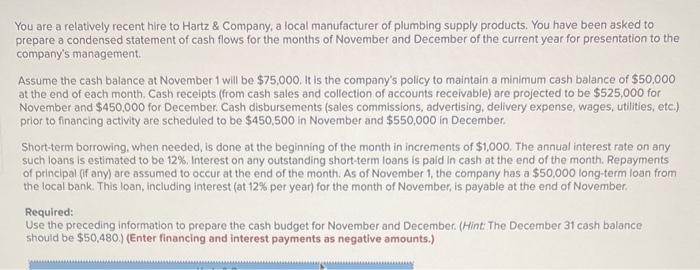

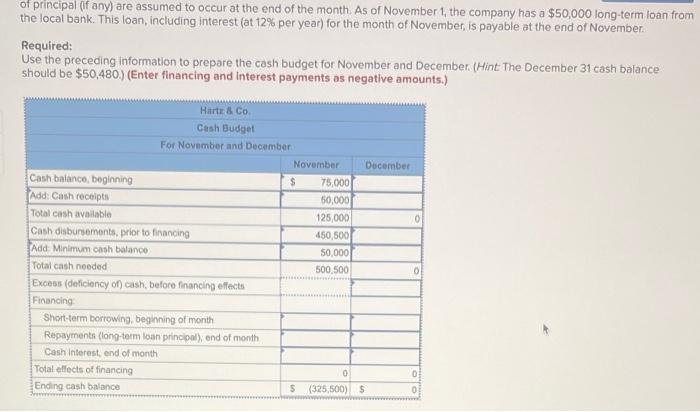

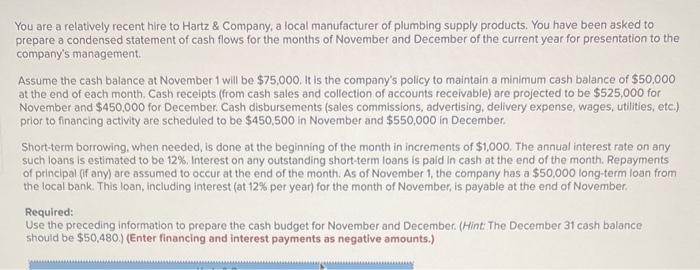

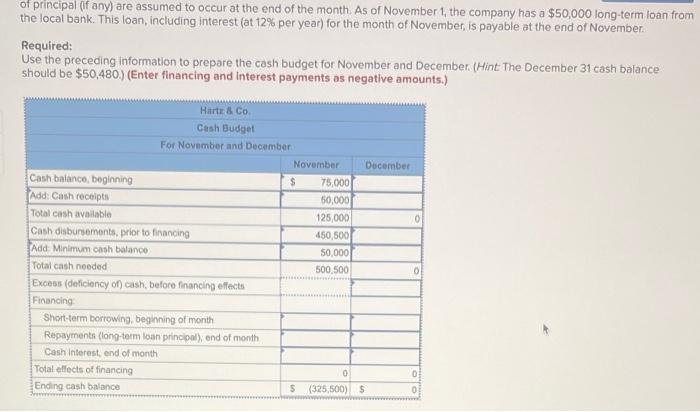

You are a relatively recent hire to Hartz \& Company, a local manufacturer of plumbing supply products. You have been asked to prepare a condensed statement of cash flows for the months of November and December of the current year for presentation to the company's management. Assume the cash balance at November 1 will be $75,000. It is the company's policy to maintain a minimum cash balance of $50.000 at the end of each month. Cash receipts (from cash sales and collection of accounts receivable) are projected to be $525,000 for. November and $450,000 for December. Cash disbursements (sales commissions, advertising, delivery expense, wages, utilities, etc.) prior to financing activity are scheduled to be $450,500 in November and $550,000 in December. Short-term borrowing, when needed, is done at the beginning of the month in increments of $1,000. The annual interest rate on any such loans is estimated to be 12%. Interest on any outstanding short-term loans is paid in cash at the end of the month. Repayments of princlpal (ff any) are assumed to occur at the end of the month. As of November 1 , the company has a $50,000 long-term loan from the local bank. This loan, including interest (at 12% per year) for the month of November, is payable at the end of November. Required: Use the preceding information to prepare the cash budget for November and December. (Hint. The December 31 cash balance should be $50,480.) (Enter financing and interest payments as negative amounts.) of principal (if any) are assumed to occur at the end of the month. As of November 1 , the company has a $50,000 long-term loan from the local bank. This loan, including interest (at 12% per year) for the month of November, is payable at the end of November. Required: Use the preceding information to prepare the cash budget for November and December. (Hint The December 31 cash balance should be $50,480.) (Enter financing and interest payments as negative amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started