Answered step by step

Verified Expert Solution

Question

1 Approved Answer

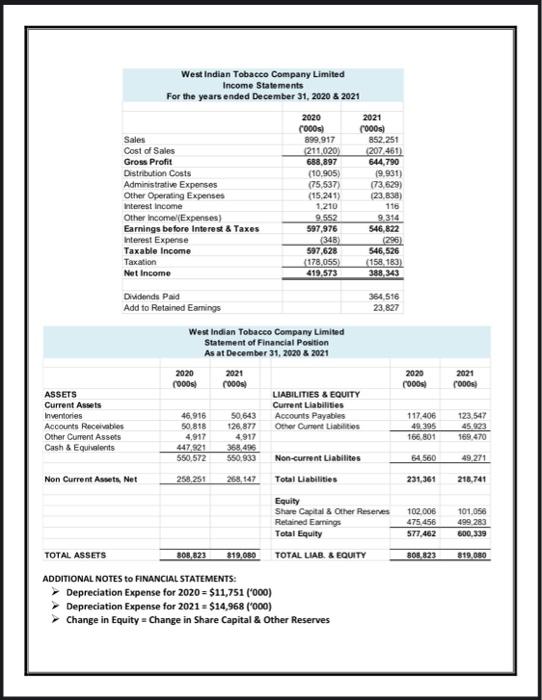

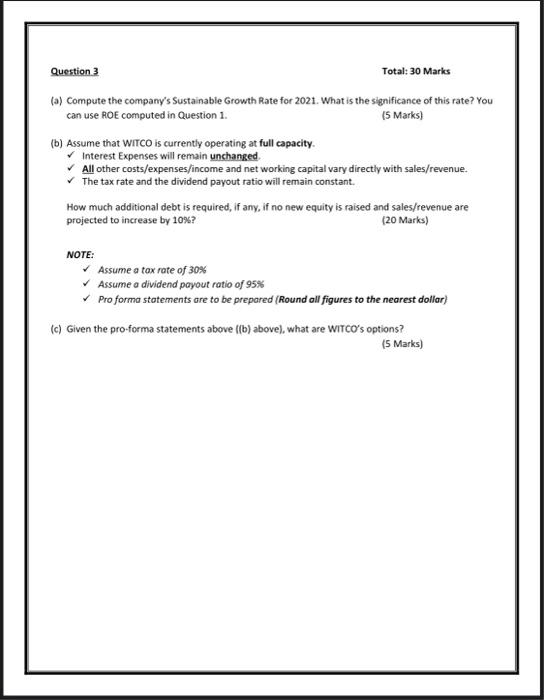

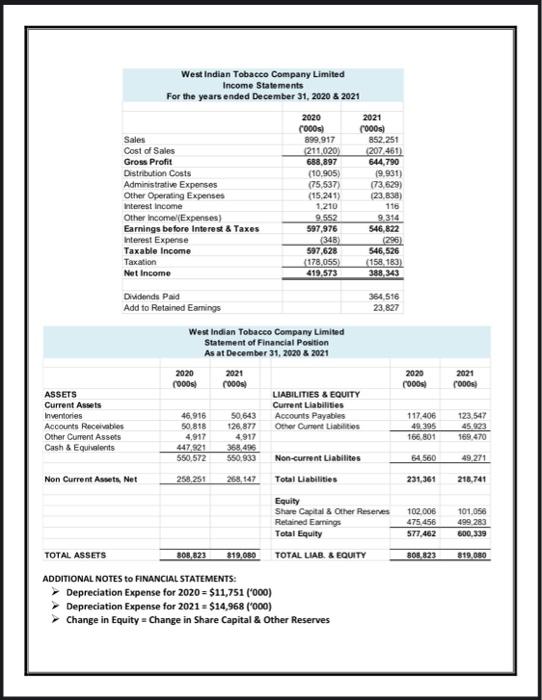

financial accounting question 3 only question 3 West Indian Tobacco Company Limited Income Statements For the years ended December 31, 2020 & 2021 2020 (000s)

financial accounting question 3

only question 3

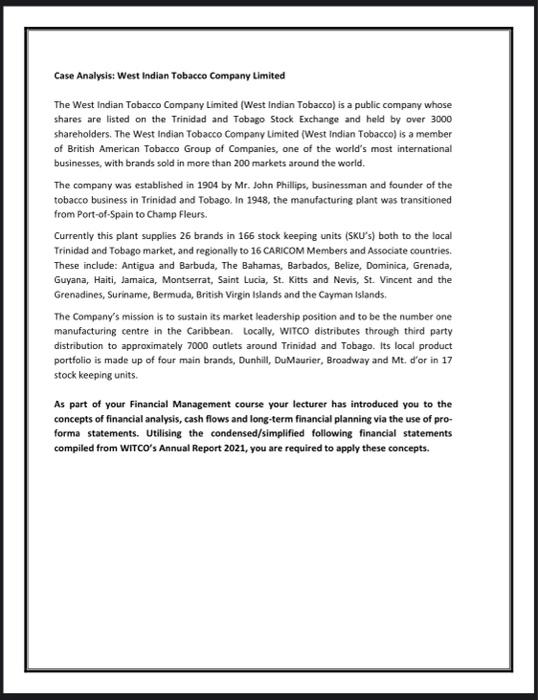

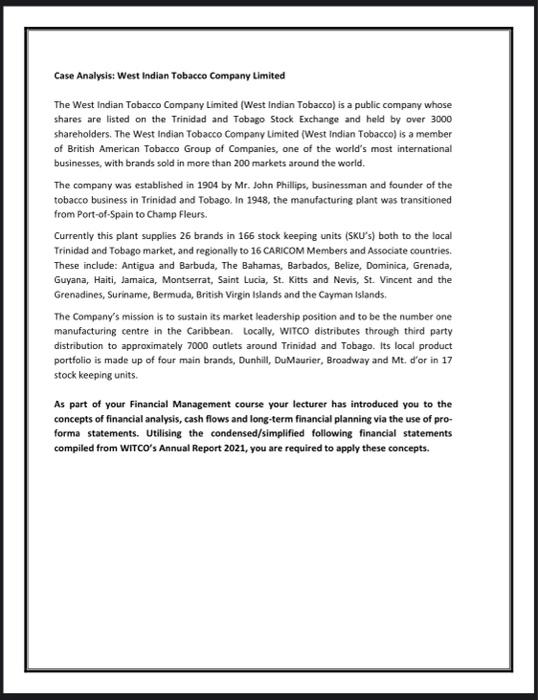

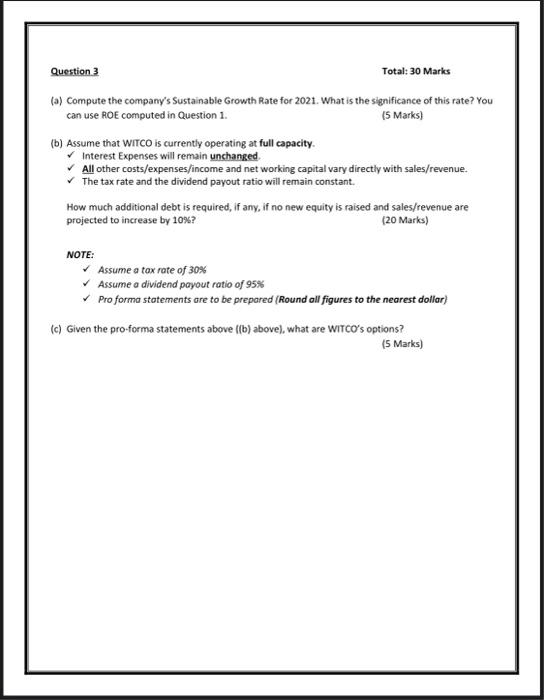

West Indian Tobacco Company Limited Income Statements For the years ended December 31, 2020 & 2021 2020 (000s) Sales Cost of Sales Gross Profit Distribution Costs Administrative Expenses Other Operating Expenses Interest Income Other income (Expenses) Earnings before Interest & Taxes Interest Expense Taxable income Taxation Net Income Dividends Paid Add to Retained Earnings 899.917 (211,020) 688,897 (10,905) (75,537) (15,241) 1,210 9.552 597,976 597,628 (178,055) 419.573 West Indian Tobacco Company Limited Statement of Financial Position As at December 31, 2020 & 2021 2020 2021 (000s) (000) (348) 2021 (000s) ASSETS Current Assets Inventories 46,916 50,643 Accounts Receivables 50,818 126,877 Other Current Assets 4,917 4,917 Cash & Equivalents 447.921 368,496 550,572 550.933 Non Current Assets, Net 258,251 268,147 TOTAL ASSETS 808,823 $19.080 ADDITIONAL NOTES to FINANCIAL STATEMENTS: Depreciation Expense for 2020 = $11,751 ('000) Depreciation Expense for 2021= $14,968 ('000) Change in Equity = Change in Share Capital & Other Reserves 852.251 (207.461) 644,790 (9,931) (73,629) (23,838) 116 9.314 546,822 546,526 (158.183) 388,343 364,516 23,827 (296) LIABILITIES & EQUITY Current Liabilities Accounts Payables Other Current Liabilities Non-current Liabilites Total Liabilities Equity Share Capital & Other Reserves Retained Earnings Total Equity TOTAL LIAB. & EQUITY 2020 (000) 117,406 49.395 166.801 64,560 231,361 102.006 475 456 577,462 808.823 2021 (000) 123,547 45.923 169,470 49,271 218,741 101,056 499.283 600,339 819.080 Case Analysis: West Indian Tobacco Company Limited The West Indian Tobacco Company Limited (West Indian Tobacco) is a public company whose shares are listed on the Trinidad and Tobago Stock Exchange and held by over 3000 shareholders. The West Indian Tobacco Company Limited (West Indian Tobacco) is a member of British American Tobacco Group of Companies, one of the world's most international businesses, with brands sold in more than 200 markets around the world. The company was established in 1904 by Mr. John Phillips, businessman and founder of the tobacco business in Trinidad and Tobago. In 1948, the manufacturing plant was transitioned from Port-of-Spain to Champ Fleurs. Currently this plant supplies 26 brands in 166 stock keeping units (SKU's) both to the local Trinidad and Tobago market, and regionally to 16 CARICOM Members and Associate countries. These include: Antigua and Barbuda, The Bahamas, Barbados, Belize, Dominica, Grenada, Guyana, Haiti, Jamaica, Montserrat, Saint Lucia, St. Kitts and Nevis, St. Vincent and the Grenadines, Suriname, Bermuda, British Virgin Islands and the Cayman Islands. The Company's mission is to sustain its market leadership position and to be the number one manufacturing centre in the Caribbean. Locally, WITCO distributes through third party distribution to approximately 7000 outlets around Trinidad and Tobago. Its local product portfolio is made up of four main brands, Dunhill, DuMaurier, Broadway and Mt. d'or in 17 stock keeping units. As part of your Financial Management course your lecturer has introduced you to the concepts of financial analysis, cash flows and long-term financial planning via the use of pro- forma statements. Utilising the condensed/simplified following financial statements compiled from WITCO's Annual Report 2021, you are required to apply these concepts. Question 3 Total: 30 Marks (a) Compute the company's Sustainable Growth Rate for 2021. What is the significance of this rate? You can use ROE computed in Question 1. (5 Marks) (b) Assume that WITCO is currently operating at full capacity. Interest Expenses will remain unchanged. All other costs/expenses/income and net working capital vary directly with sales/revenue. The tax rate and the dividend payout ratio will remain constant. How much additional debt is required, if any, if no new equity is raised and sales/revenue are projected to increase by 10 % ? (20 Marks) NOTE: Assume a tax rate of 30% Assume a dividend payout ratio of 95% Pro forma statements are to be prepared (Round all figures to the nearest dollar) (c) Given the pro-forma statements above ((b) above), what are WITCO's options Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started