Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help You've made the decision to purchase an item that is affordable only with a loan. When shopping for a loan, there are many aspects

help

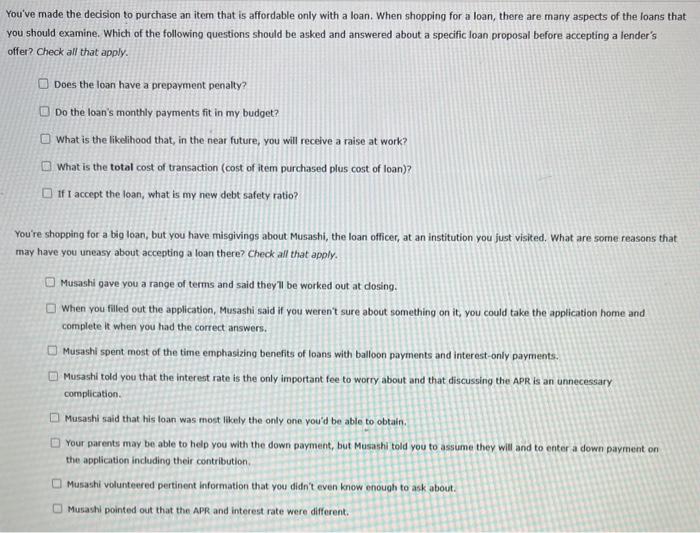

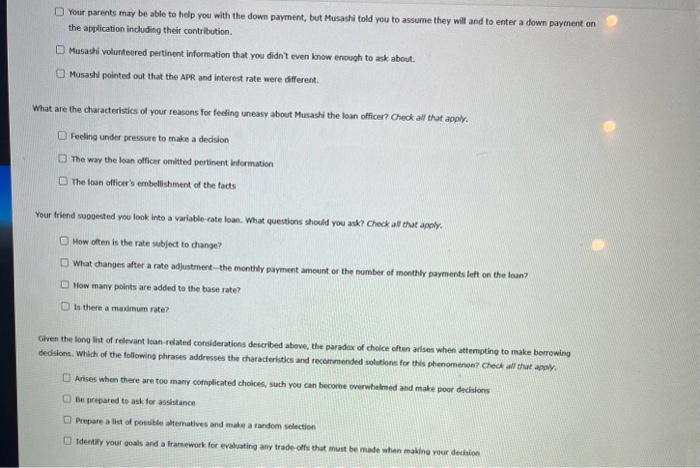

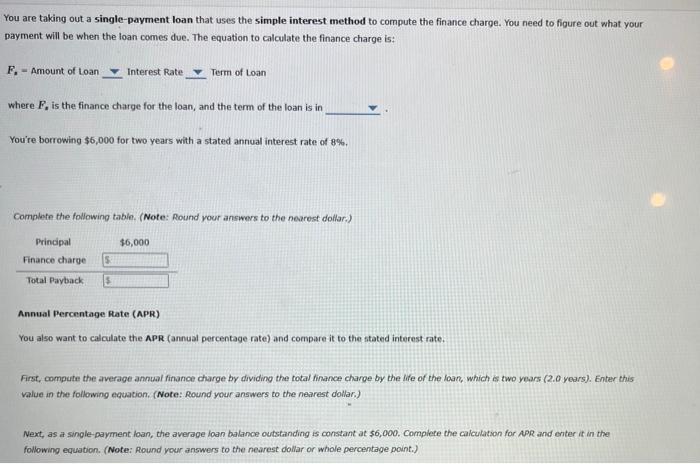

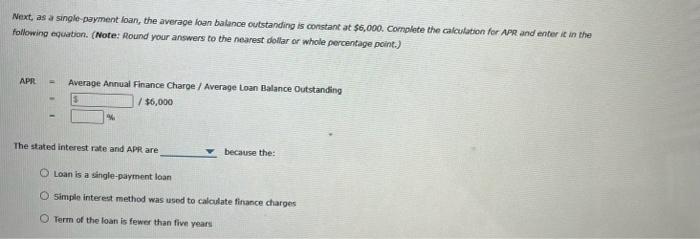

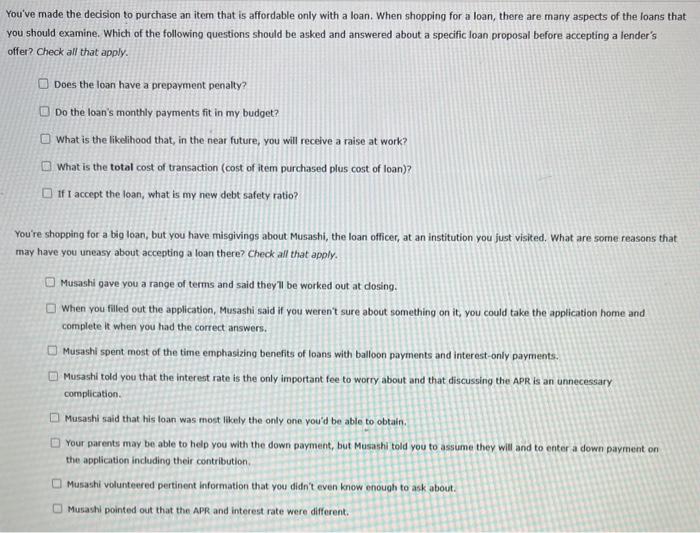

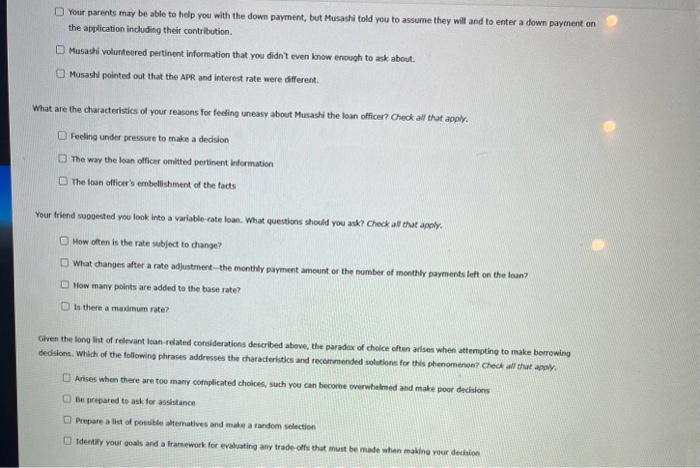

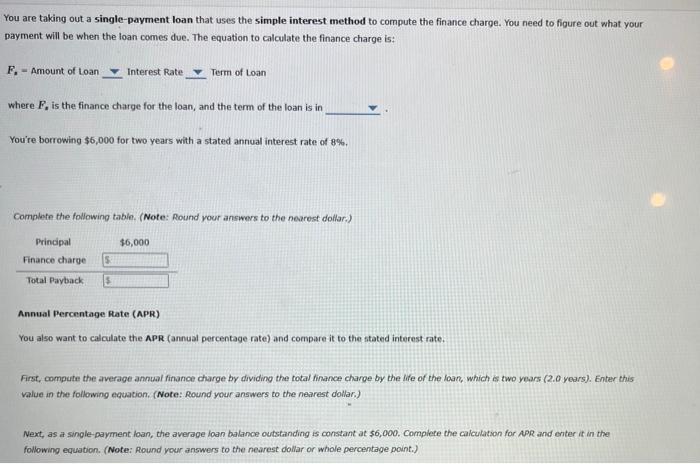

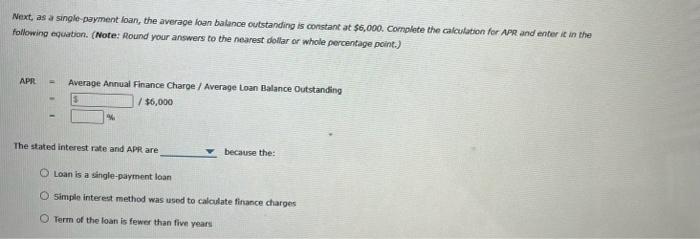

You've made the decision to purchase an item that is affordable only with a loan. When shopping for a loan, there are many aspects of the loans that you should examine. Which of the following questions should be asked and answered about a specific loan proposal before accepting a lender's offer? Check all that apply. Does the loan have a prepayment penalty? Do the loan's monthly payments fit in my budget? What is the likelihood that, in the near future, you will receive a raise at work? What is the total cost of transaction (cost of item purchased plus cost of loan)? If I accept the loan, what is my new debt safety ratio? You're shopping for a big loan, but you have misgivings about Musashi, the loan officer, at an institution you just visited. What are some reasons that. may have you unieasy about accepting a loan there? Check all that apply. Musashi gave you a range of terms and said they'll be worked out at dosing. When you filled out the application, Musashi said if you weren't sure about something on it, you could take the application home and complete it when you had the correct answers. Musashi spent most of the time emphasizing benefits of loans with balloon payments and interest-only payments. Musashi told you that the interest rate is the only important fee to worry about and that discussing the APR is an unnecessary complication. Musashi said that his loan was most likely the only one you'd be able to obtain. Your parents may be able to help you with the down payment, but Musashi told you to assume they will and to enter a down payment on the application including their contribution. Musashi volunteered pertinent information that you didn't even know enough to ask about. Musashi pointed out that the APR and interest rate were different. Your parents may be able to help you with the down payment, but Musashi told you to assume they will and to enter a down payment on the application including their contribution. Musasti volunteered pertinent information that you didn't even know enough to ask about: Musashi pointed out that the APR and interest rate were different. What are the characteristics of your reasons for feeling uneasy about Musashi the loan office? Cheok all that appiy. Fecling under pressure to make a decision The way the lean officer omitted pertinent ieformation The loan officer's embellishinent of the facts Your friend supoested you look into a variable-rate loan, What questions should you ask Check all that appy? How often is the rate wbject to change? What changes after a rate adjustrnent- the monthly paymint ameunt or the number of monthily payments left on the loan? How many points are added to the base rate? Is there a maximum rater Wiven the long list of relevant laan-related coraiderations described above, the paradox of chelce often allses when attenpting to make borrowing dedisions. Which of the following phrares addresses the characteristics and recerrmended solutions for this phenomenon? check all these apoly. Arises when there are too many complicated choioes, such you can become overwhatmed asd make poor dedisions Be nirepared to ask for assistance Prepare a list of potilies alternatives and make a random selection Identiy your goals and a framework for evaluating acy trade-olf that munt be made athen mabine rour deunion. You are taking out a single-payment loan that uses the simple interest method to compute the finance charge. You need to figure out what your payment will be when the loan comes due. The equation to calculate the finance charge is: Fs= Amount of Loan Interest Rate Term of Loan where Fs is the finance charge for the loan, and the term of the loan is in You're borrowing $5,000 for two years with a stated annual interest rate of 8%. Complefe the following table. (Note: Round your answers to the nearest dollar.) Annual Percentage Ptate (APR) You also want to calculate the APR (annual percentage rate) and compare it to the sitated interest rate. First, compute the average annwal finance charge by dividing the total finance charge by the life of the foan, which is two years (2.o years). Enter this value in the following equation. (Note: Round your answers to the nearest dollar.) Next, as a single-payment loan, the average foan balance outstanding is constant at 56,000 . Complefe the caiculation for APR and enter it in the following equation. (Note: Aound your answers to the nearest dollar or whole percentage point.) Next, as a single-payment loan, the average loan balance outstanding is constant at $6,000. Complete the calcutation for APR and enter it in the following equabion. (Note: Round your answers to the nearest dollar or whole percentage pcint.) APR = Average Annual Finance Charge/ Average Loan Balance Outstanding The stated interest rate and ApR are because the: Loan is a single-payment laan Simple intereet method was used to calculate fintance charges Term of the loan is fewer than five years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started