Answered step by step

Verified Expert Solution

Question

1 Approved Answer

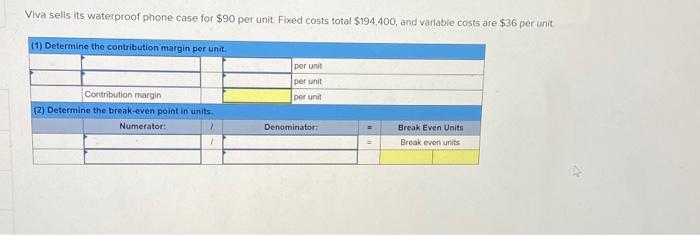

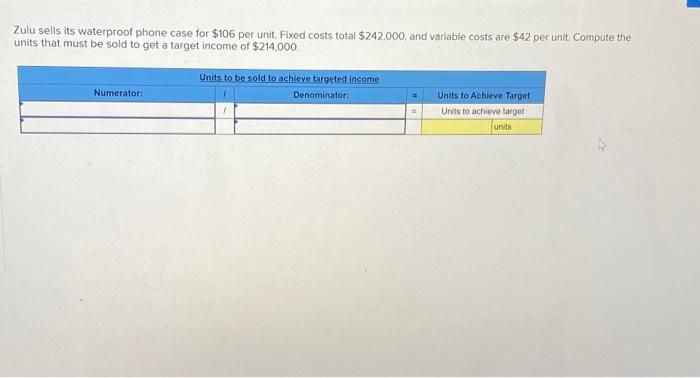

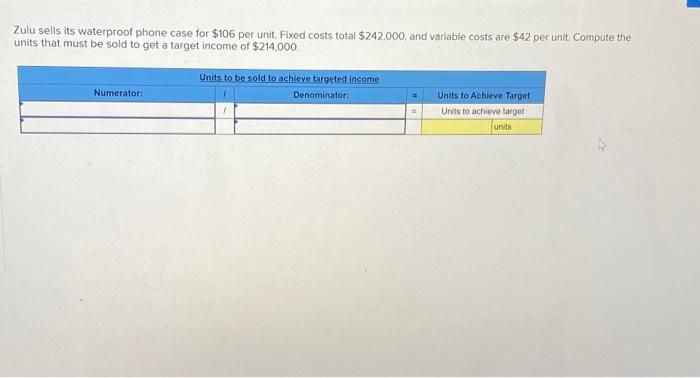

help Zulu sells its waterproof phone case for $106 per unit. Fixed costs total $242,000, and variable costs are $42 per unit Compute the units

help

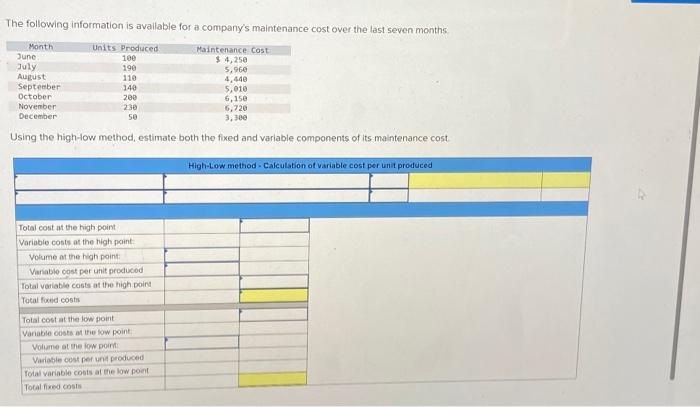

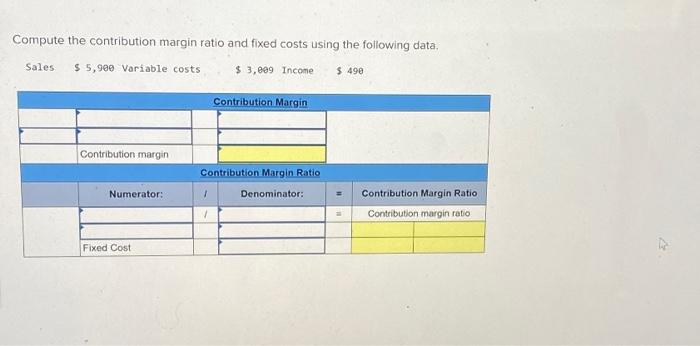

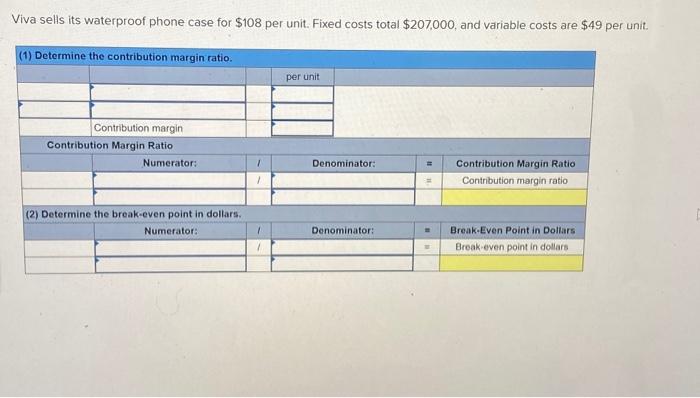

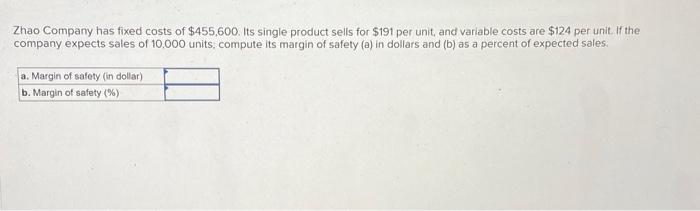

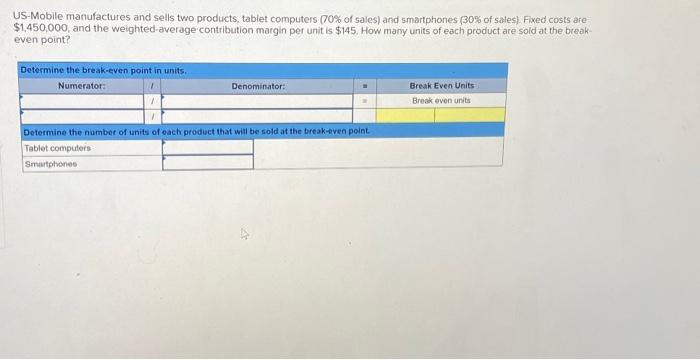

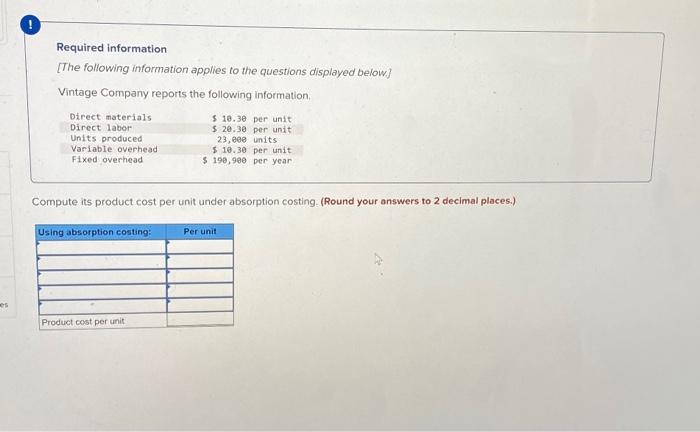

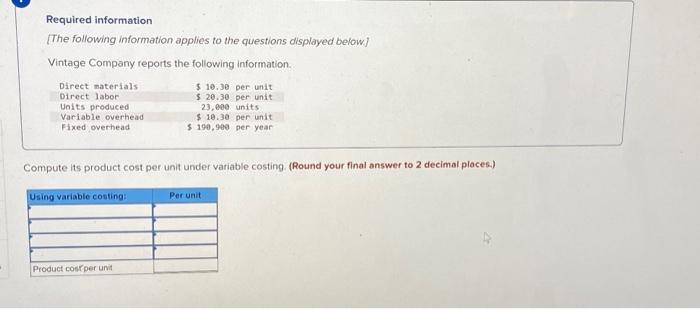

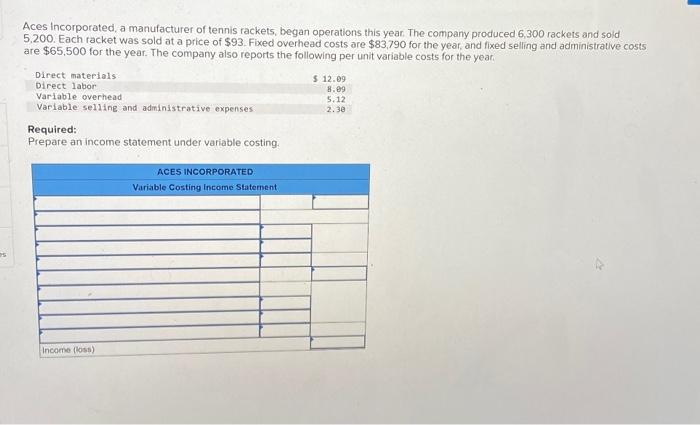

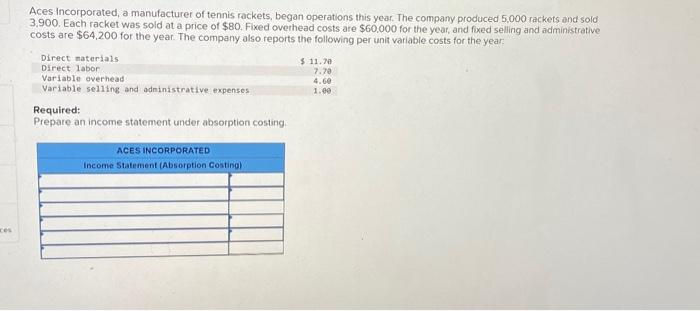

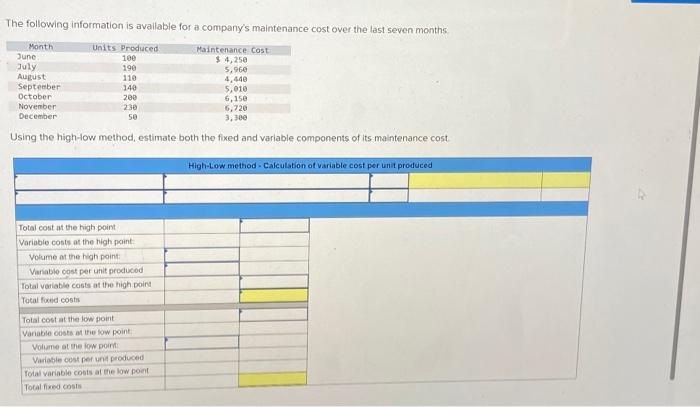

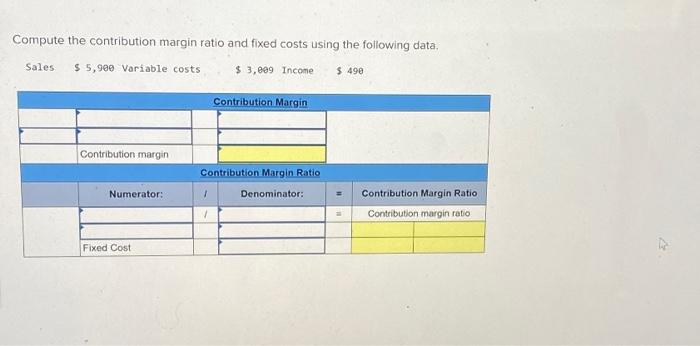

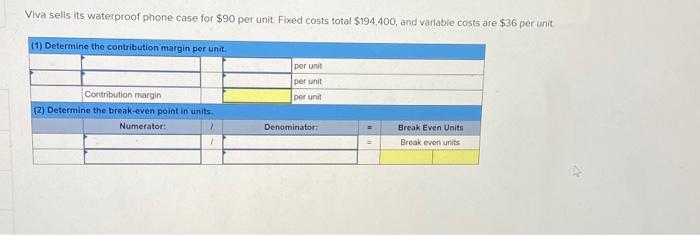

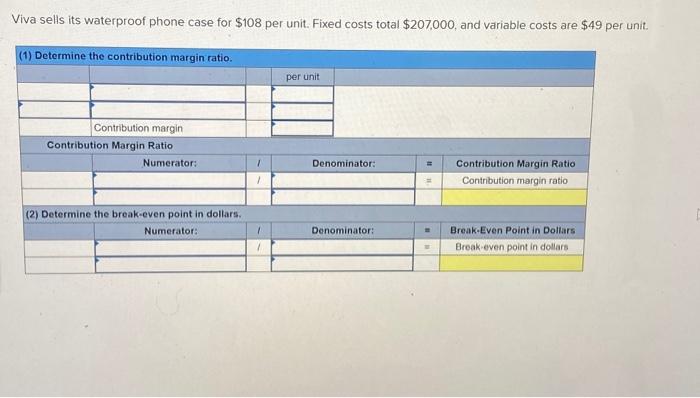

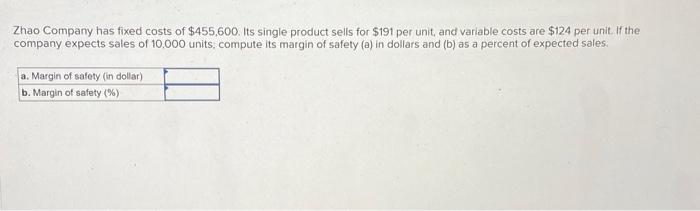

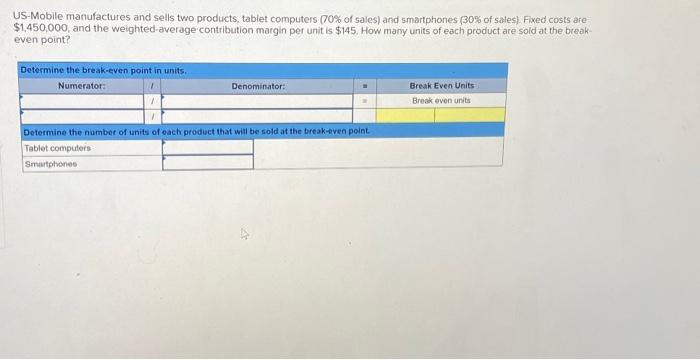

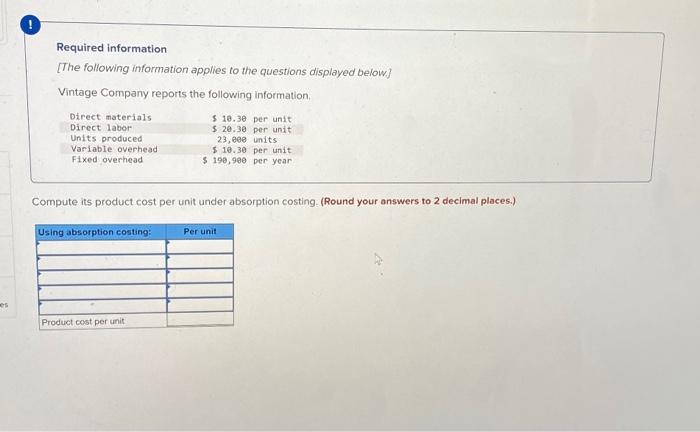

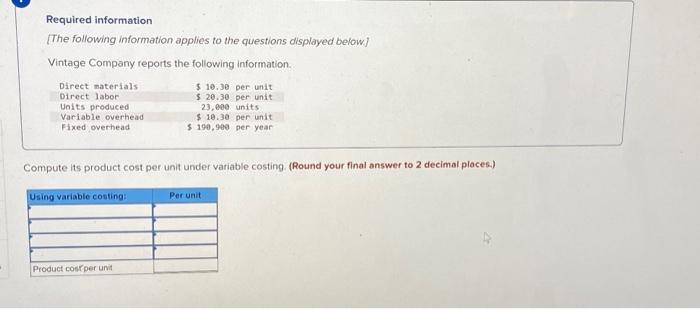

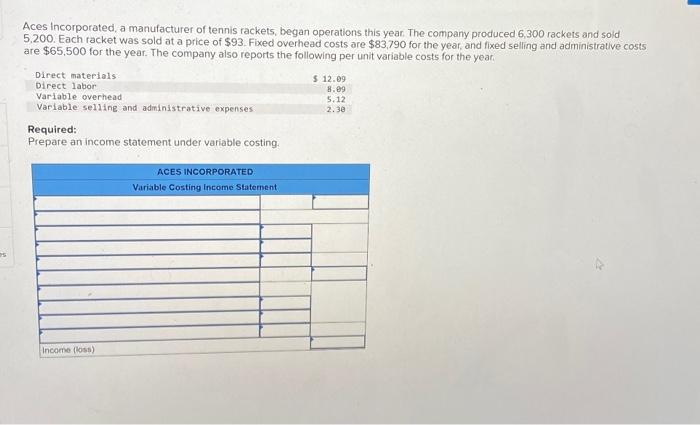

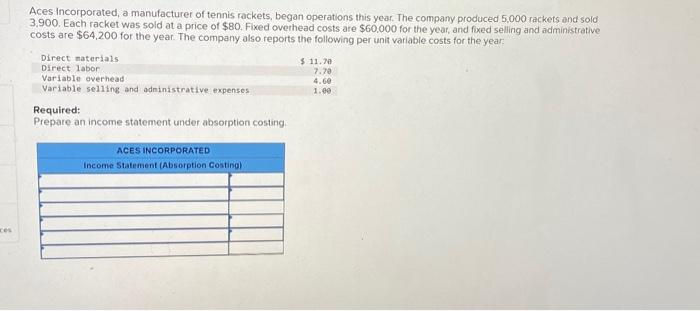

Zulu sells its waterproof phone case for $106 per unit. Fixed costs total $242,000, and variable costs are $42 per unit Compute the units that must be sold to get a target income of $214,000. Compute the contribution margin ratio and fixed costs using the following data, Sales \$ 5,900 Voriable costs $3,809 Income 5490 The following information is avallable for a company's maintenance cost over the last seven months. Using the high-low method, estimate both the fixed and variable components of its maintenance cost. Required information [The following information applies to the questions displayed below] Vintage Company reports the following information. Compute its product cost per unit under absorption costing. (Round your answers to 2 decimal places.) Viva sells its waterproof phone case for $108 per unit. Fixed costs total $207,000, and variable costs are $49 per unit. US-Mobile manufactures and sells two products, tablet computers (70\% of sales) and smartphones ( 30% of sales). Fixed costs are $1,450,000, and the weighted-average contribution margin per unit is $145. How many units of each product are sold at the breakeven point? Aces incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 6,300 rackets and sold 5,200 . Each racket was sold at a price of $93. Fixed overhead costs are $83,790 for the year, and fixed selling and administrative costs are $65,500 for the year. The company also reports the following per unit variable costs for the year. Required: Prepare an income statement under variable costing. Zhao Company has fixed costs of $455,600. Its single product sells for $191 per unit, and variable costs are $124 per unit. If the company expects sales of 10,000 units, compute its margin of safety (a) in dollars and (b) as a percent of expected sales. Aces incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 5,000 rackets and sold 3.900. Each racket was sold at a price of $80. Fixed overhead costs are $60,000 for the year, and fixed selling and administrative costs are $64,200 for the year. The company also reports the following per unit variable costs for the year: Required: Prepare an income statement under absorption costing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started