Helpp

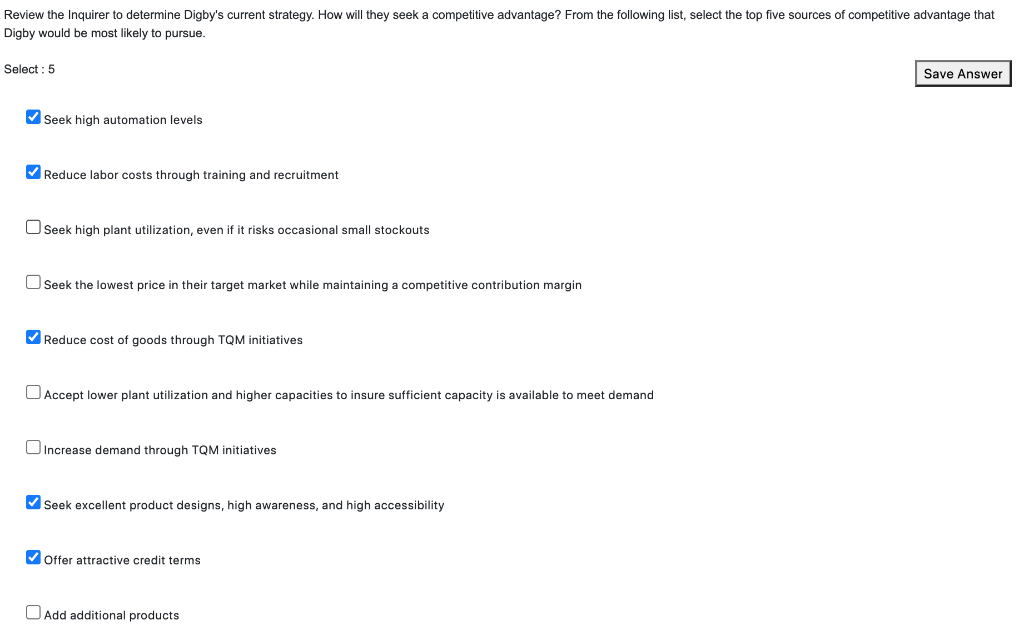

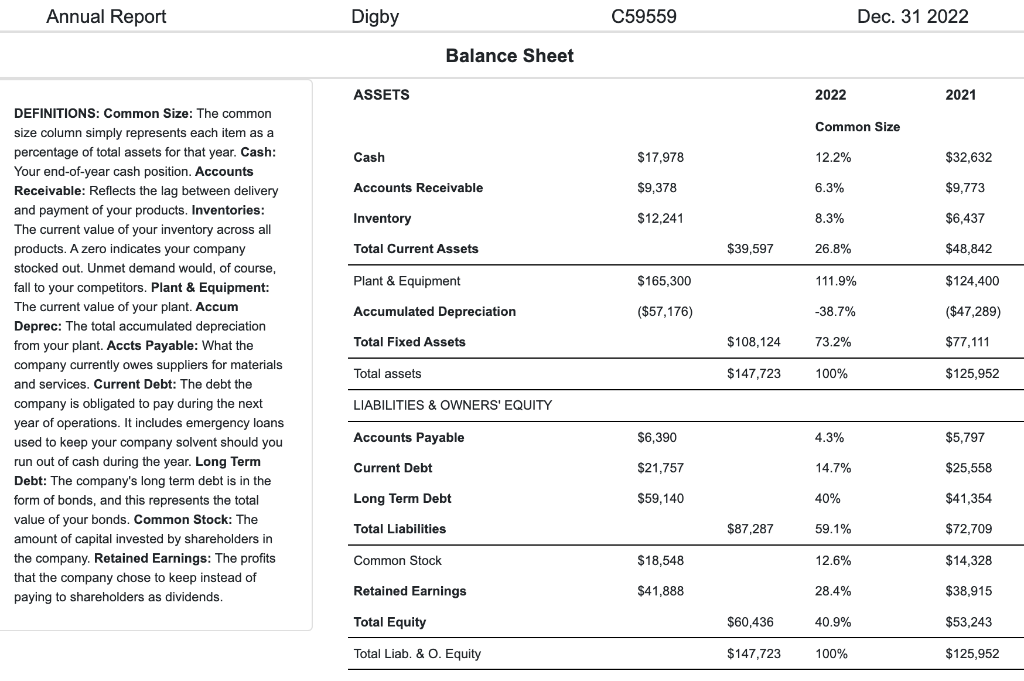

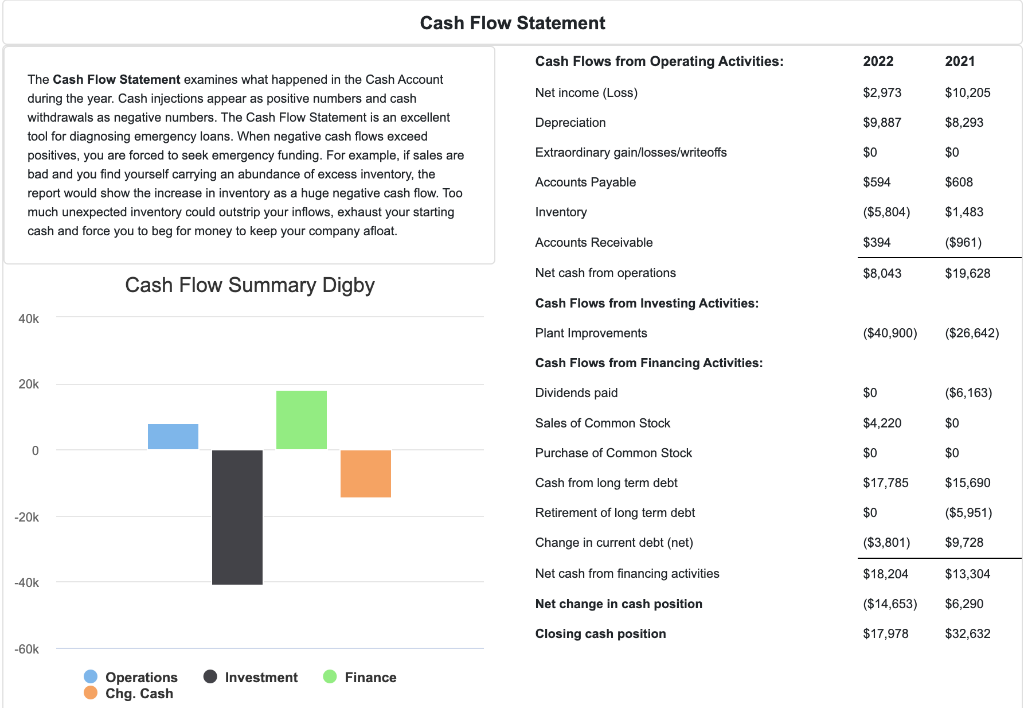

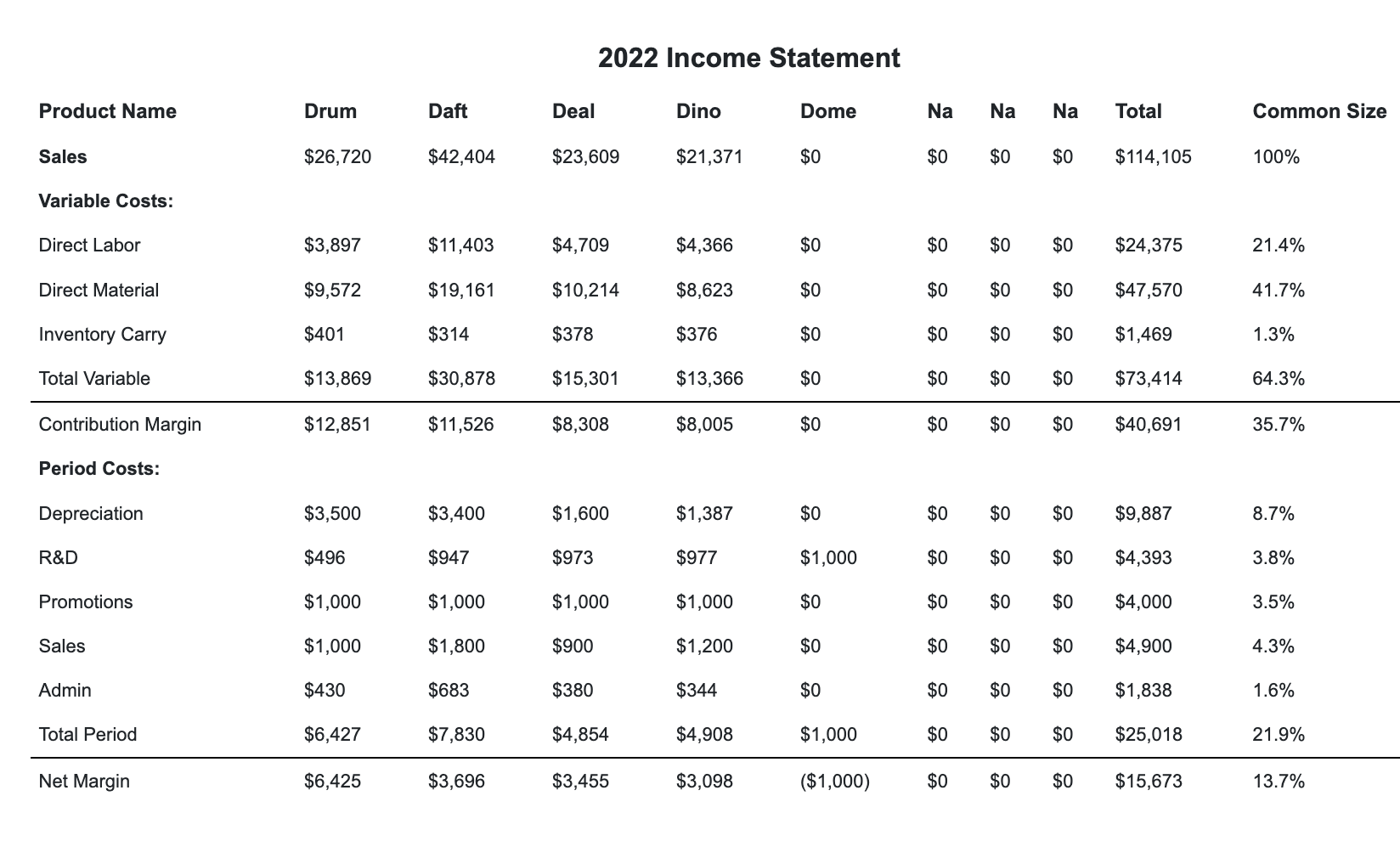

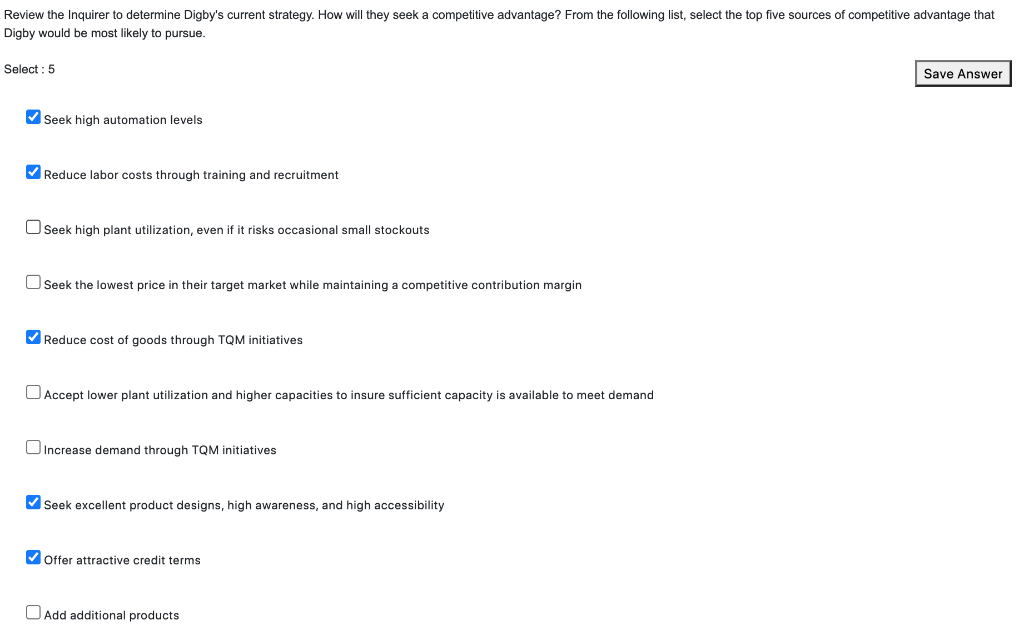

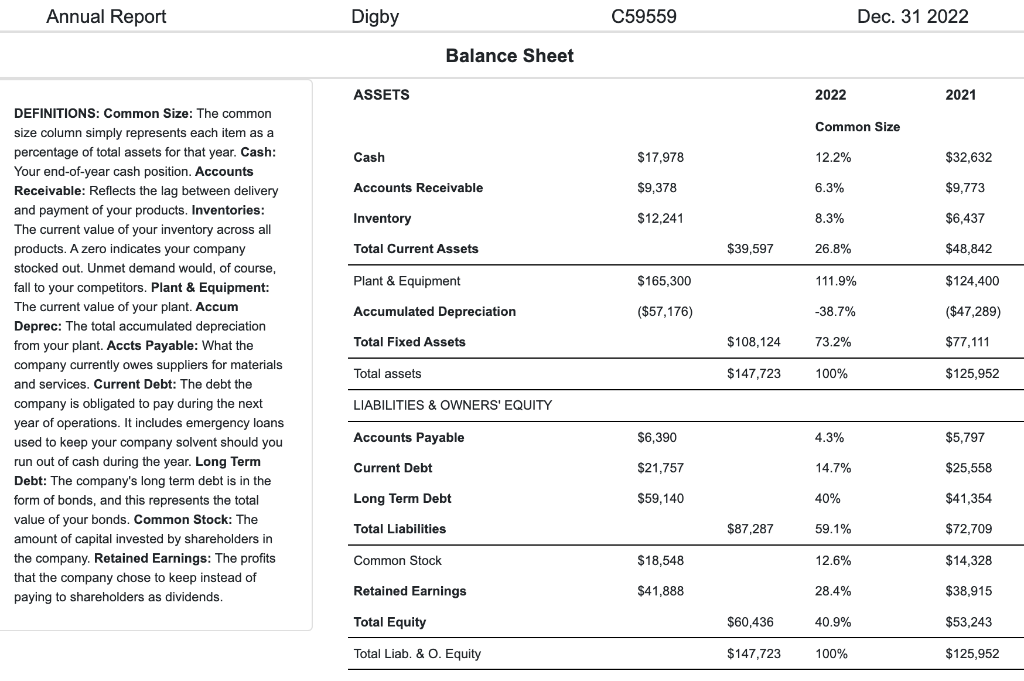

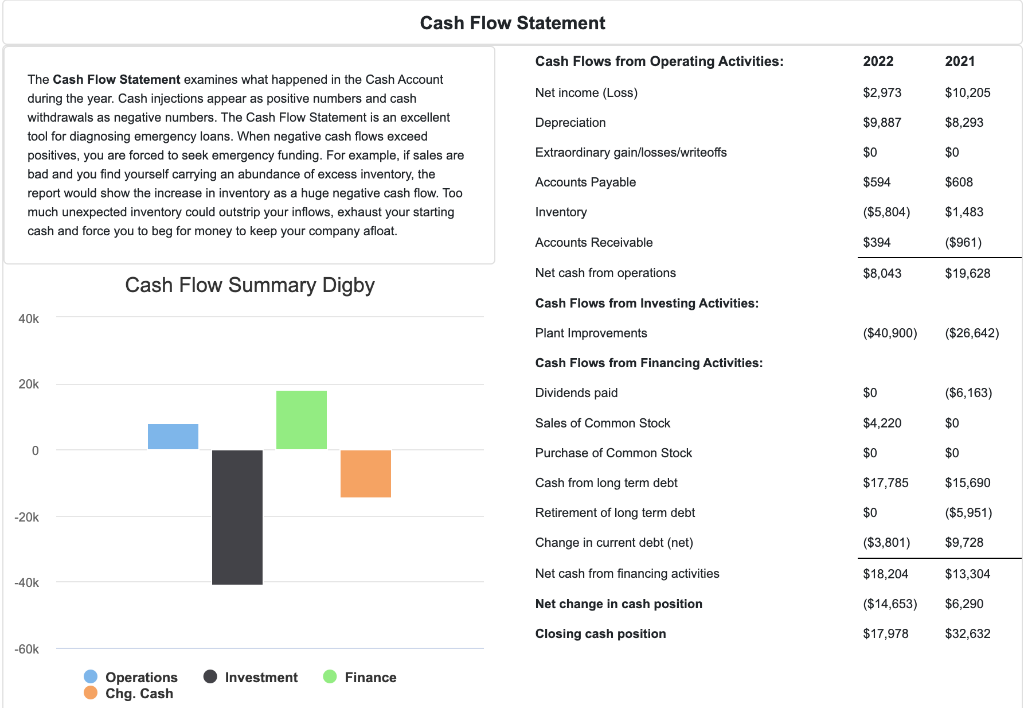

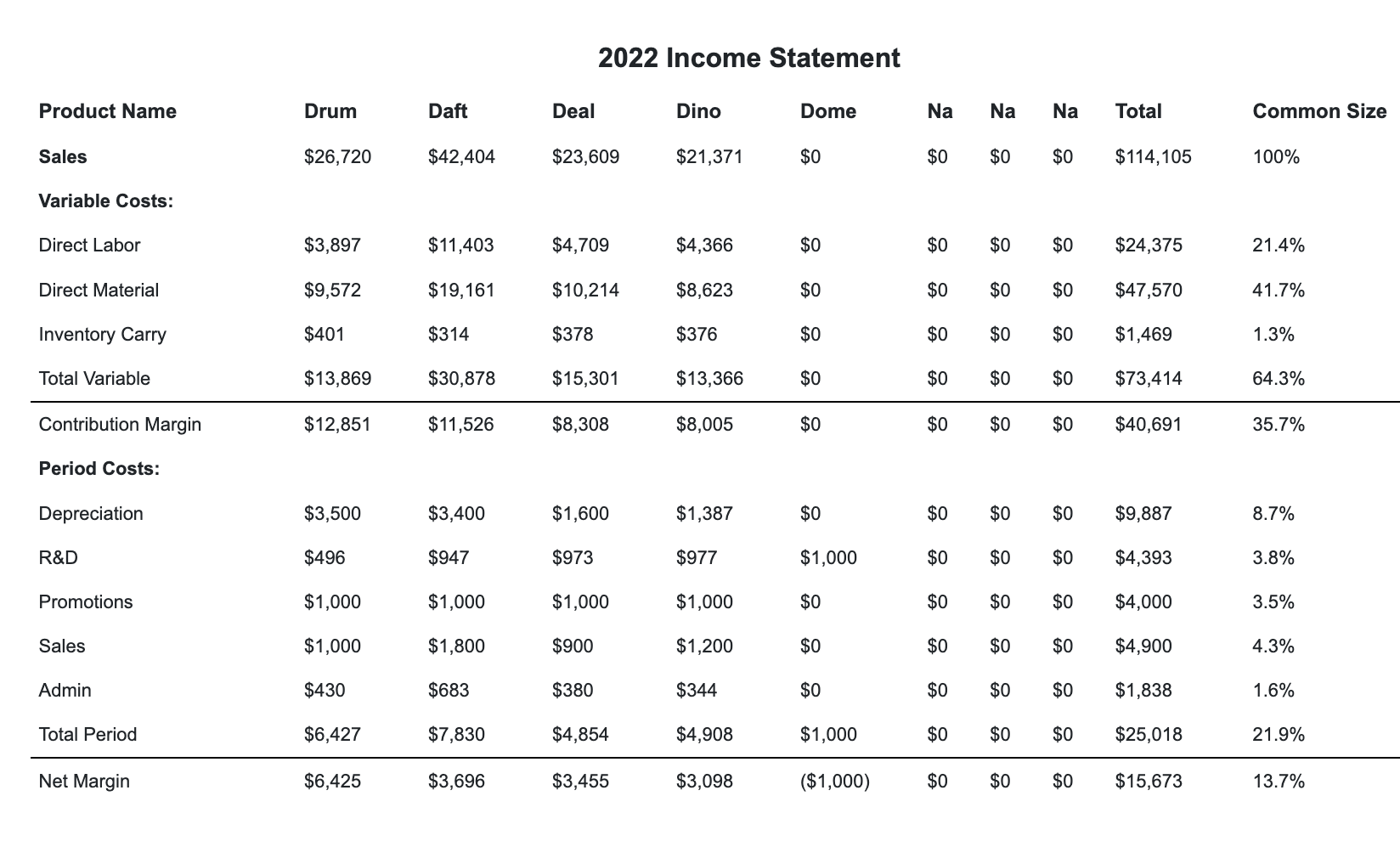

Review the Inquirer to determine Digby's current strategy. How will they seek a competitive advantage? From the following list, select the top five sources of competitive advantage that Digby would be most likely to pursue. Select : 5 Seek high automation levels Reduce labor costs through training and recruitment Seek high plant utilization, even if it risks occasional small stockouts Seek the lowest price in their target market while maintaining a competitive contribution margin Reduce cost of goods through TQM initiatives Accept lower plant utilization and higher capacities to insure sufficient capacity is available to meet demand Increase demand through TQM initiatives Seek excellent product designs, high awareness, and high accessibility Offer attractive credit terms Add additional products DEFINITIONS: Common Size: The common size column simply represents each item as a percentage of total assets for that year. Cash: Your end-of-year cash position. Accounts Receivable: Reflects the lag between delivery and payment of your products. Inventories: The current value of your inventory across all products. A zero indicates your company stocked out. Unmet demand would, of course, fall to your competitors. Plant \& Equipment: The current value of your plant. Accum Deprec: The total accumulated depreciation from your plant. Accts Payable: What the company currently owes suppliers for materials and services. Current Debt: The debt the company is obligated to pay during the next year of operations. It includes emergency loans used to keep your company solvent should you run out of cash during the year. Long Term Debt: The company's long term debt is in the form of bonds, and this represents the total value of your bonds. Common Stock: The amount of capital invested by shareholders in the company. Retained Earnings: The profits that the company chose to keep instead of paying to shareholders as dividends. The Cash Flow Statement examines what happened in the Cash Account during the year. Cash injections appear as positive numbers and cash withdrawals as negative numbers. The Cash Flow Statement is an excellent tool for diagnosing emergency loans. When negative cash flows exceed positives, you are forced to seek emergency funding. For example, if sales are bad and you find yourself carrying an abundance of excess inventory, the report would show the increase in inventory as a huge negative cash flow. Too much unexpected inventory could outstrip your inflows, exhaust your starting cash and force you to beg for money to keep your company afloat. 2n2? Innomn Gtatamnnt Review the Inquirer to determine Digby's current strategy. How will they seek a competitive advantage? From the following list, select the top five sources of competitive advantage that Digby would be most likely to pursue. Select : 5 Seek high automation levels Reduce labor costs through training and recruitment Seek high plant utilization, even if it risks occasional small stockouts Seek the lowest price in their target market while maintaining a competitive contribution margin Reduce cost of goods through TQM initiatives Accept lower plant utilization and higher capacities to insure sufficient capacity is available to meet demand Increase demand through TQM initiatives Seek excellent product designs, high awareness, and high accessibility Offer attractive credit terms Add additional products DEFINITIONS: Common Size: The common size column simply represents each item as a percentage of total assets for that year. Cash: Your end-of-year cash position. Accounts Receivable: Reflects the lag between delivery and payment of your products. Inventories: The current value of your inventory across all products. A zero indicates your company stocked out. Unmet demand would, of course, fall to your competitors. Plant \& Equipment: The current value of your plant. Accum Deprec: The total accumulated depreciation from your plant. Accts Payable: What the company currently owes suppliers for materials and services. Current Debt: The debt the company is obligated to pay during the next year of operations. It includes emergency loans used to keep your company solvent should you run out of cash during the year. Long Term Debt: The company's long term debt is in the form of bonds, and this represents the total value of your bonds. Common Stock: The amount of capital invested by shareholders in the company. Retained Earnings: The profits that the company chose to keep instead of paying to shareholders as dividends. The Cash Flow Statement examines what happened in the Cash Account during the year. Cash injections appear as positive numbers and cash withdrawals as negative numbers. The Cash Flow Statement is an excellent tool for diagnosing emergency loans. When negative cash flows exceed positives, you are forced to seek emergency funding. For example, if sales are bad and you find yourself carrying an abundance of excess inventory, the report would show the increase in inventory as a huge negative cash flow. Too much unexpected inventory could outstrip your inflows, exhaust your starting cash and force you to beg for money to keep your company afloat. 2n2? Innomn Gtatamnnt