Answered step by step

Verified Expert Solution

Question

1 Approved Answer

helpp Sweet Blog Inc., a US company, could secure a one-year loan in New Zealand at the quoted interest rate of 2 percent or at

helpp

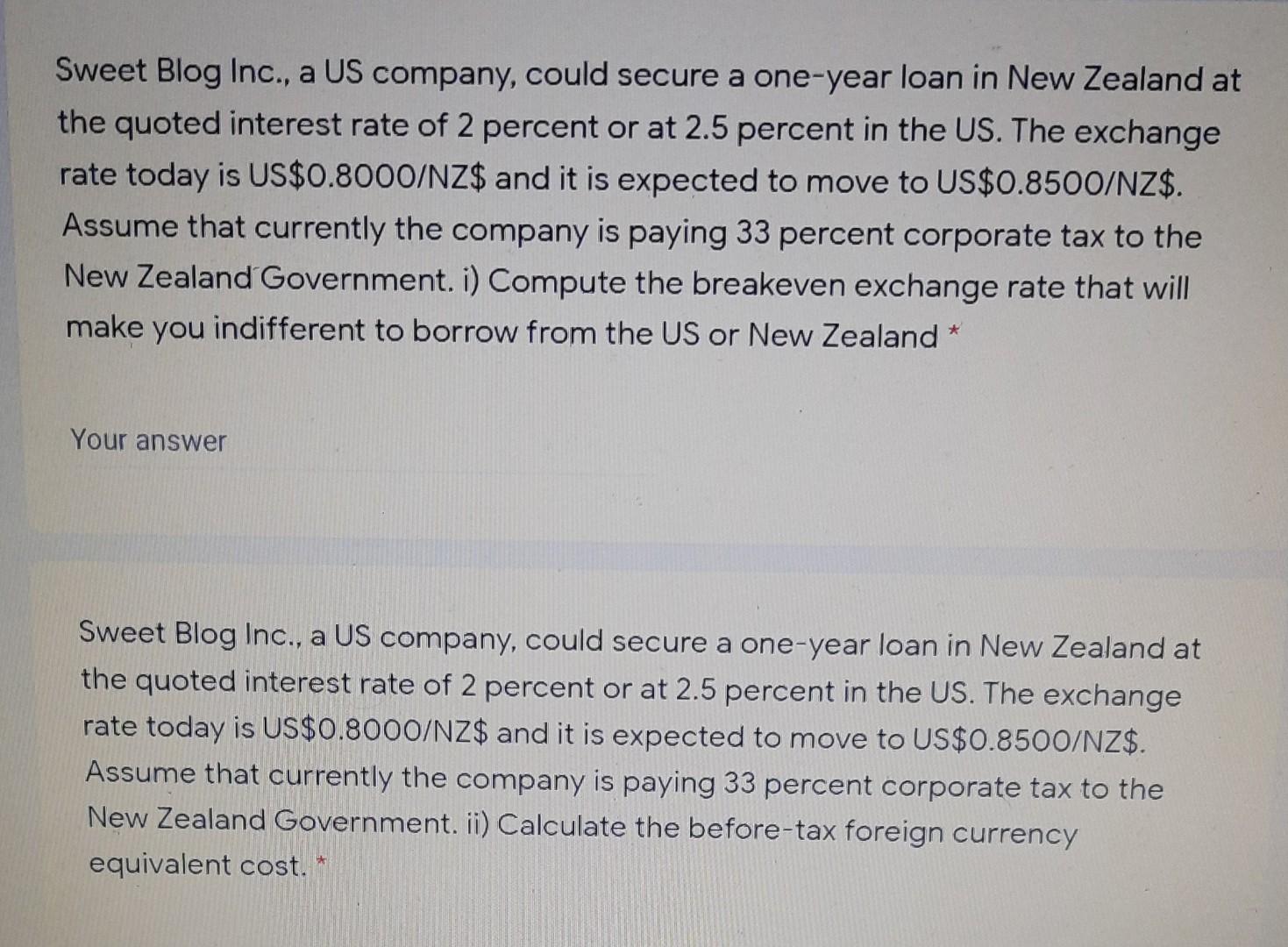

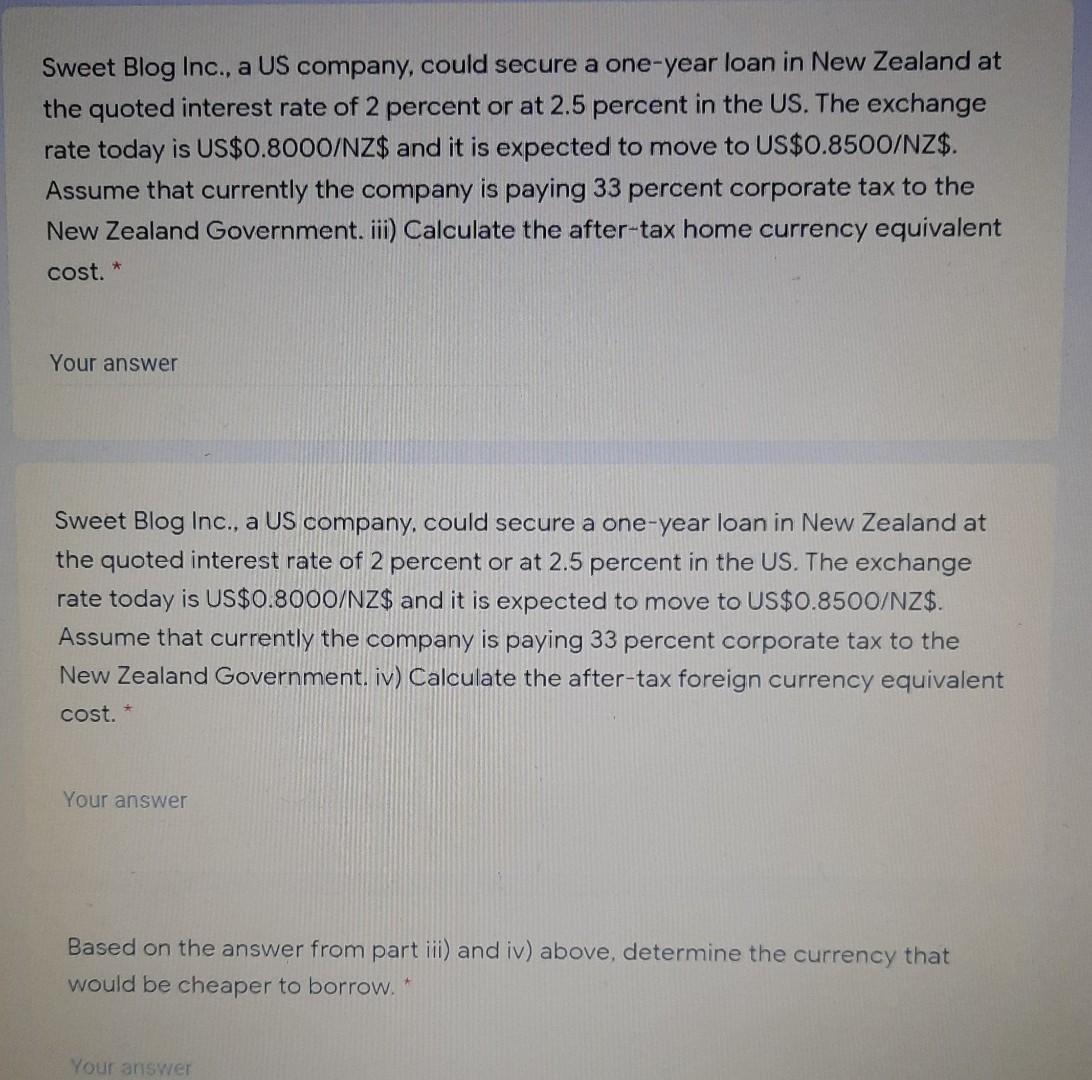

Sweet Blog Inc., a US company, could secure a one-year loan in New Zealand at the quoted interest rate of 2 percent or at 2.5 percent in the US. The exchange rate today is US$0.8000/NZ$ and it is expected to move to US$0.8500/NZ$. Assume that currently the company is paying 33 percent corporate tax to the New Zealand Government. i) Compute the breakeven exchange rate that will make you indifferent to borrow from the US or New Zealand * Your answer Sweet Blog Inc., a US company, could secure a one-year loan in New Zealand at the quoted interest rate of 2 percent or at 2.5 percent in the US. The exchange rate today is US$0.8000/NZ$ and it is expected to move to US$0.8500/NZ$. Assume that currently the company is paying 33 percent corporate tax to the New Zealand Government. ii) Calculate the before-tax foreign currency equivalent cost. Sweet Blog Inc., a US company, could secure a one-year loan in New Zealand at the quoted interest rate of 2 percent or at 2.5 percent in the US. The exchange rate today is US$0.8000/NZ$ and it is expected to move to US$0.8500/NZ$. Assume that currently the company is paying 33 percent corporate tax to the New Zealand Government. iii) Calculate the after-tax home currency equivalent cost. * Your answer Sweet Blog Inc., a US company, could secure a one-year loan in New Zealand at the quoted interest rate of 2 percent or at 2.5 percent in the US. The exchange rate today is US$0.8000/NZ$ and it is expected to move to US$0.8500/NZ$. Assume that currently the company is paying 33 percent corporate tax to the New Zealand Government. iv) Calculate the after-tax foreign currency equivalent cost. Your answer Based on the answer from part iii) and iv) above, determine the currency that would be cheaper to borrow. Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started