helpplease show each step

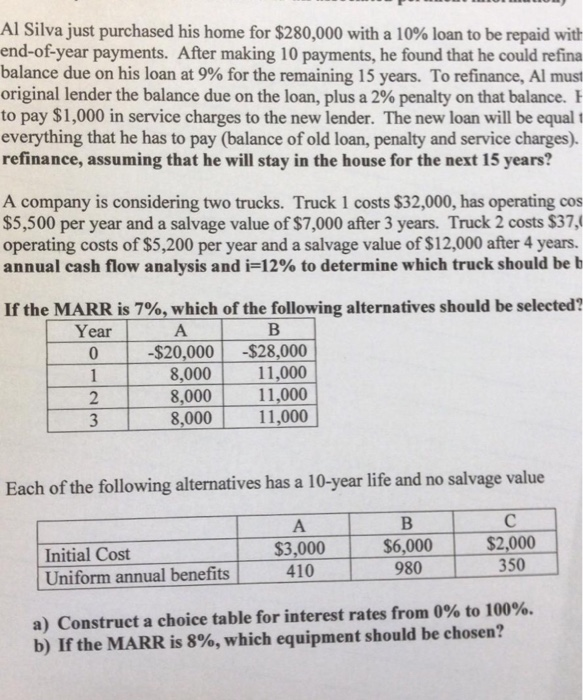

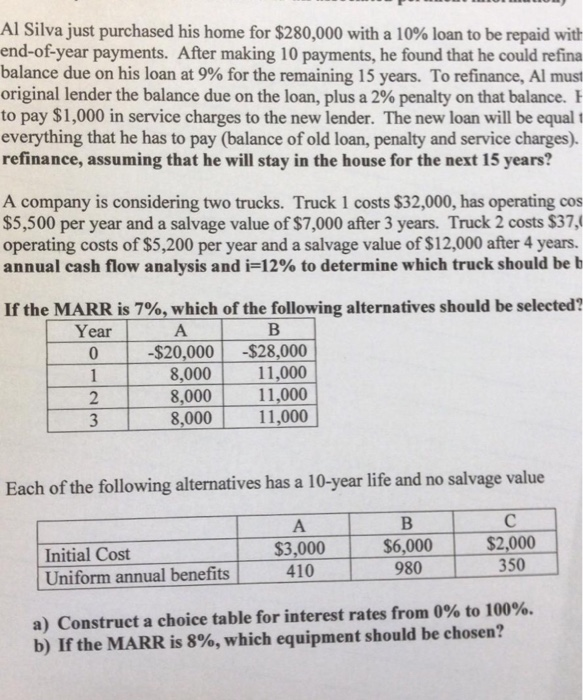

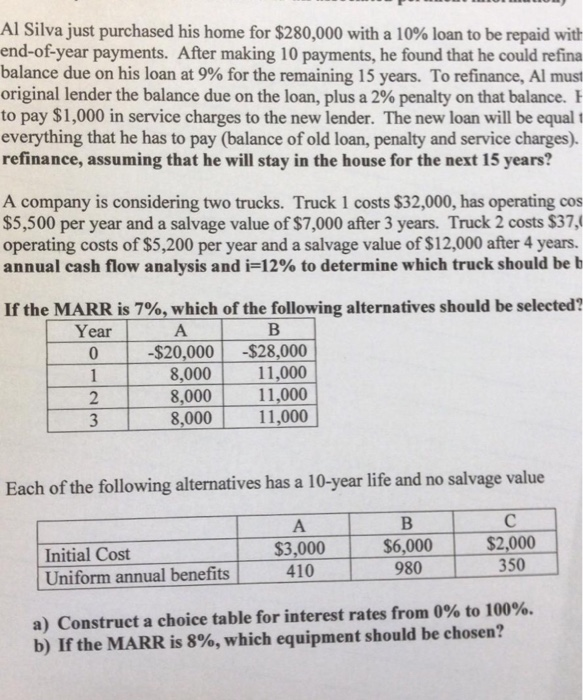

Al Silva just purchased his home for $280,000 with a 10% loan to be repaid with end-of-year payments. After making 10 payments, he found that he could refina balance due on his loan at 9% for the remaining 15 years. To refinance, Al must original lender the balance due on the loan, plus a 2% penalty on that balance to pay $1,000 in service charges to the new lender. The new loan will be equal t everything that he has to pay (balance of old loan, penalty and service charges). refinance, assuming that he will stay in the house for the next 15 years? A company is considering two trucks. Truck 1 costs $32,000, has operating cos $5,500 per year and a salvage value of $7,000 after 3 years. Truck 2 costs $37, operating costs of $5,200 per year and a salvage value of $12,000 after 4 years. annual cash flow analysis and i 12% to determine which truck should be b If the MARR is 7%, which of the following alternatives should be selected? Year $20,000 $28,000 8,000 11,000 11,000 11,000 8,000 8,000 2 Each of the following alternatives has a 10-year life and no salvage value $2,000 350 $3,000 $6,000 Initial Cost Uniform annual benefits10 9803 a) Construct a choice table for interest rates from 0% to 100%. b) If the MARR is 8%, which equipment should be chosen? Al Silva just purchased his home for $280,000 with a 10% loan to be repaid with end-of-year payments. After making 10 payments, he found that he could refina balance due on his loan at 9% for the remaining 15 years. To refinance, Al must original lender the balance due on the loan, plus a 2% penalty on that balance to pay $1,000 in service charges to the new lender. The new loan will be equal t everything that he has to pay (balance of old loan, penalty and service charges). refinance, assuming that he will stay in the house for the next 15 years? A company is considering two trucks. Truck 1 costs $32,000, has operating cos $5,500 per year and a salvage value of $7,000 after 3 years. Truck 2 costs $37, operating costs of $5,200 per year and a salvage value of $12,000 after 4 years. annual cash flow analysis and i 12% to determine which truck should be b If the MARR is 7%, which of the following alternatives should be selected? Year $20,000 $28,000 8,000 11,000 11,000 11,000 8,000 8,000 2 Each of the following alternatives has a 10-year life and no salvage value $2,000 350 $3,000 $6,000 Initial Cost Uniform annual benefits10 9803 a) Construct a choice table for interest rates from 0% to 100%. b) If the MARR is 8%, which equipment should be chosen