Answered step by step

Verified Expert Solution

Question

1 Approved Answer

helppp 1. Performed counseling services for $24,400 cash. 2. On February 1, Year 1, paid $16,800 cash to rent office space for the coming year.

helppp

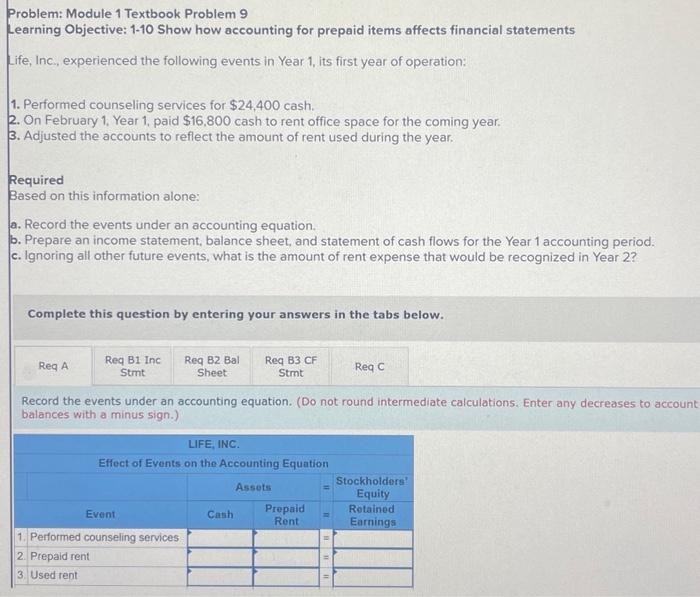

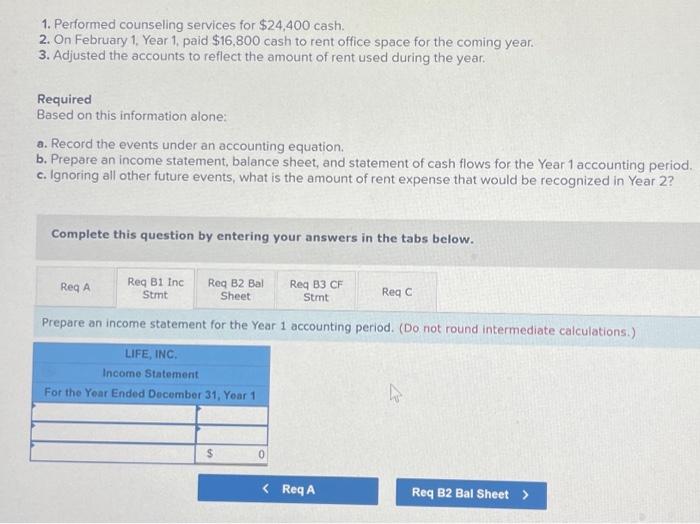

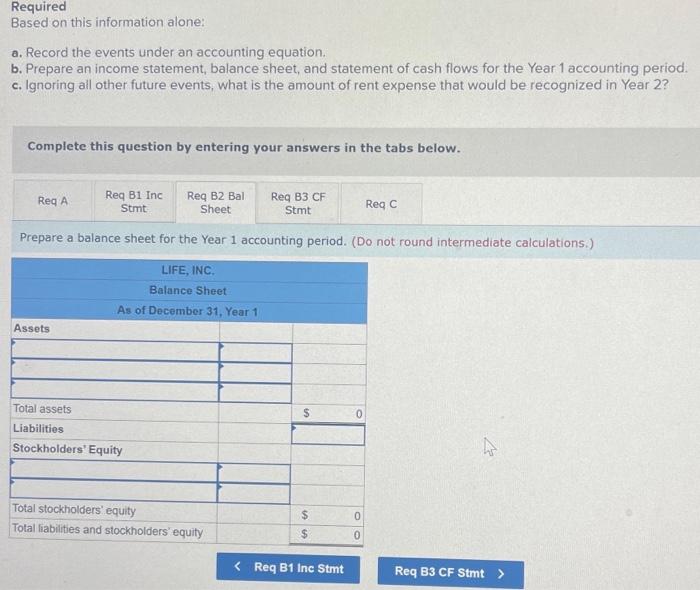

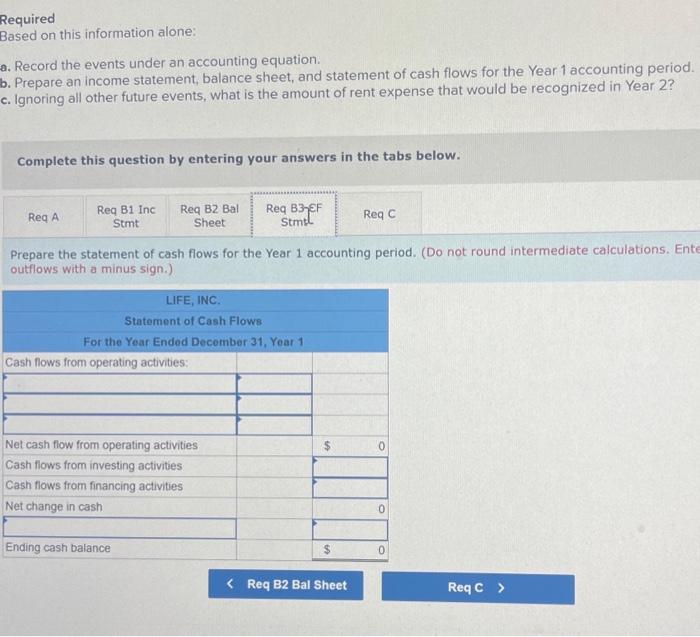

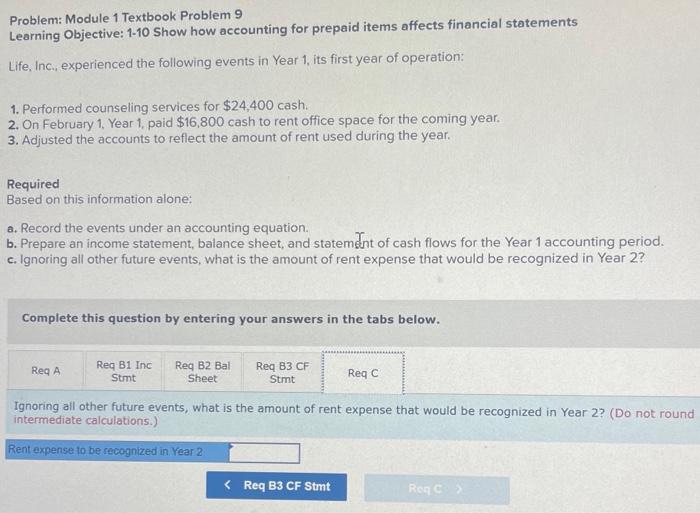

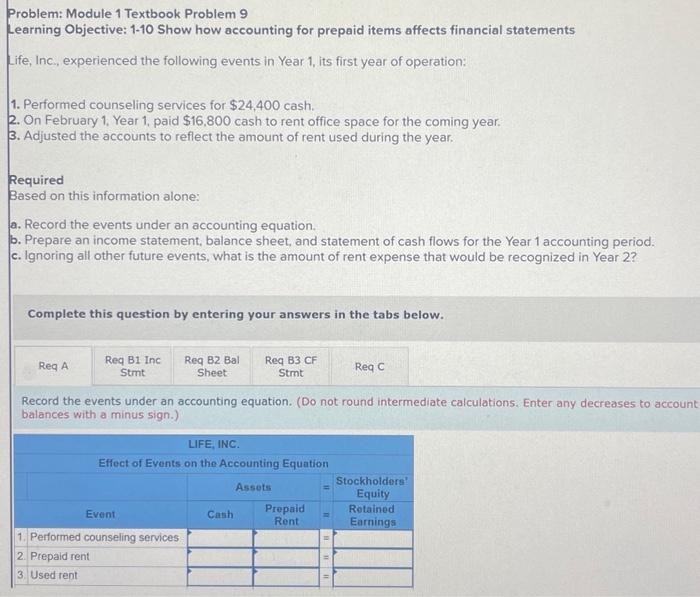

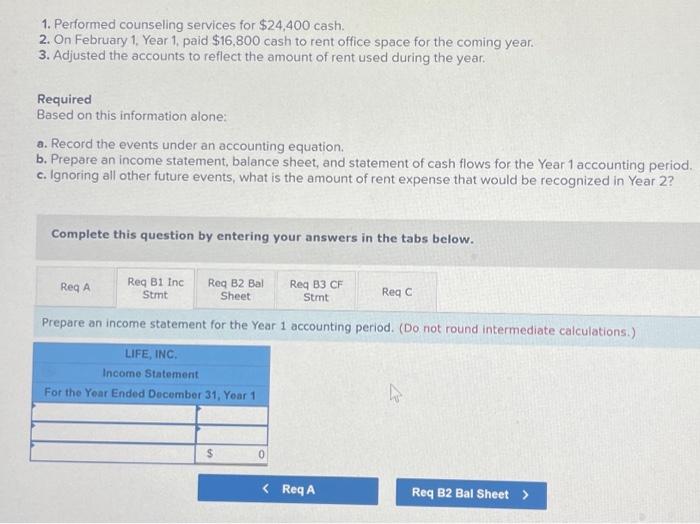

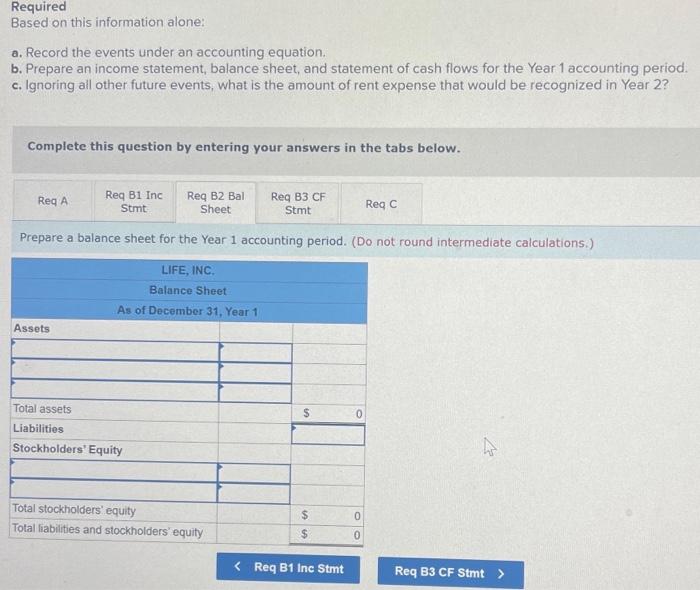

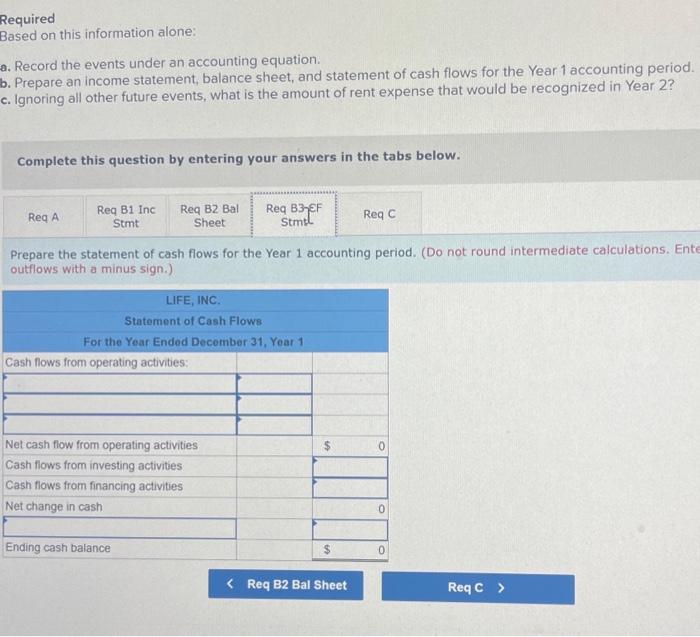

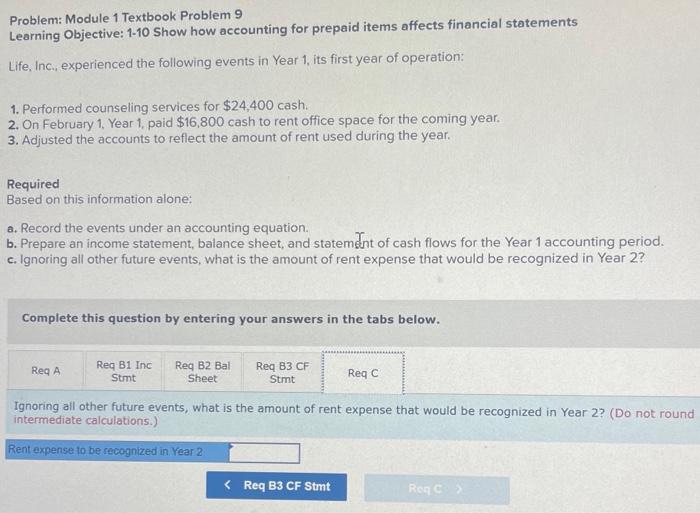

1. Performed counseling services for $24,400 cash. 2. On February 1, Year 1, paid $16,800 cash to rent office space for the coming year. 3. Adjusted the accounts to reflect the amount of rent used during the year. Required Based on this information alone: a. Record the events under an accounting equation. b. Prepare an income statement, balance sheet, and statement of cash flows for the Year 1 accounting period. c. Ignoring all other future events, what is the amount of rent expense that would be recognized in Year 2 ? Complete this question by entering your answers in the tabs below. Prepare an income statement for the Year 1 accounting period. (Do not round intermediate calculations.) Required Based on this information alone: a. Record the events under an accounting equation. b. Prepare an income statement, balance sheet, and statement of cash flows for the Year 1 accounting period. c. Ignoring all other future events, what is the amount of rent expense that would be recognized in Year 2 ? Complete this question by entering your answers in the tabs below. Prepare a balance sheet for the Year 1 accounting period. (Do not round intermediate calculations.) Required Based on this information alone: . Record the events under an accounting equation. . Prepare an income statement, balance sheet, and statement of cash flows for the Year 1 accounting period. Ignoring all other future events, what is the amount of rent expense that would be recognized in Year 2 ? Complete this question by entering your answers in the tabs below. Prepare the statement of cash flows for the Year 1 accounting period. (Do not round intermediate calculations. Ent outflows with a minus sign.) Problem: Module 1 Textbook Problem 9 Learning Objective: 1-10 Show how accounting for prepaid items affects financial statements Life, Inc, experienced the following events in Year 1, its first year of operation: 1. Performed counseling services for $24,400 cash. 2. On February 1, Year 1, paid $16,800 cash to rent office space for the coming year. 3. Adjusted the accounts to reflect the amount of rent used during the year. Required Based on this information alone: a. Record the events under an accounting equation. b. Prepare an income statement, balance sheet, and statement of cash flows for the Year 1 accounting period. c. Ignoring all other future events, what is the amount of rent expense that would be recognized in Year 2 ? Complete this question by entering your answers in the tabs below. Record the events under an accounting equation. (Do not round intermediate calculations. Enter any decreases to accou balances with a minus sign.) Problem: Module 1 Textbook Problem 9 Learning Objective: 110 Show how accounting for prepaid items affects financial statements Life, Inc, experienced the following events in Year 1, its first year of operation: 1. Performed counseling services for $24,400 cash. 2. On February 1, Year 1, paid $16,800 cash to rent office space for the coming year. 3. Adjusted the accounts to reflect the amount of rent used during the year. Required Based on this information alone: a. Record the events under an accounting equation. b. Prepare an income statement, balance sheet, and statemant of cash flows for the Year 1 accounting period. c. Ignoring all other future events, what is the amount of rent expense that would be recognized in Year 2 ? Complete this question by entering your answers in the tabs below. Ignoring all other future events, what is the amount of rent expense that would be recognized in Year 2? (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started