Answered step by step

Verified Expert Solution

Question

1 Approved Answer

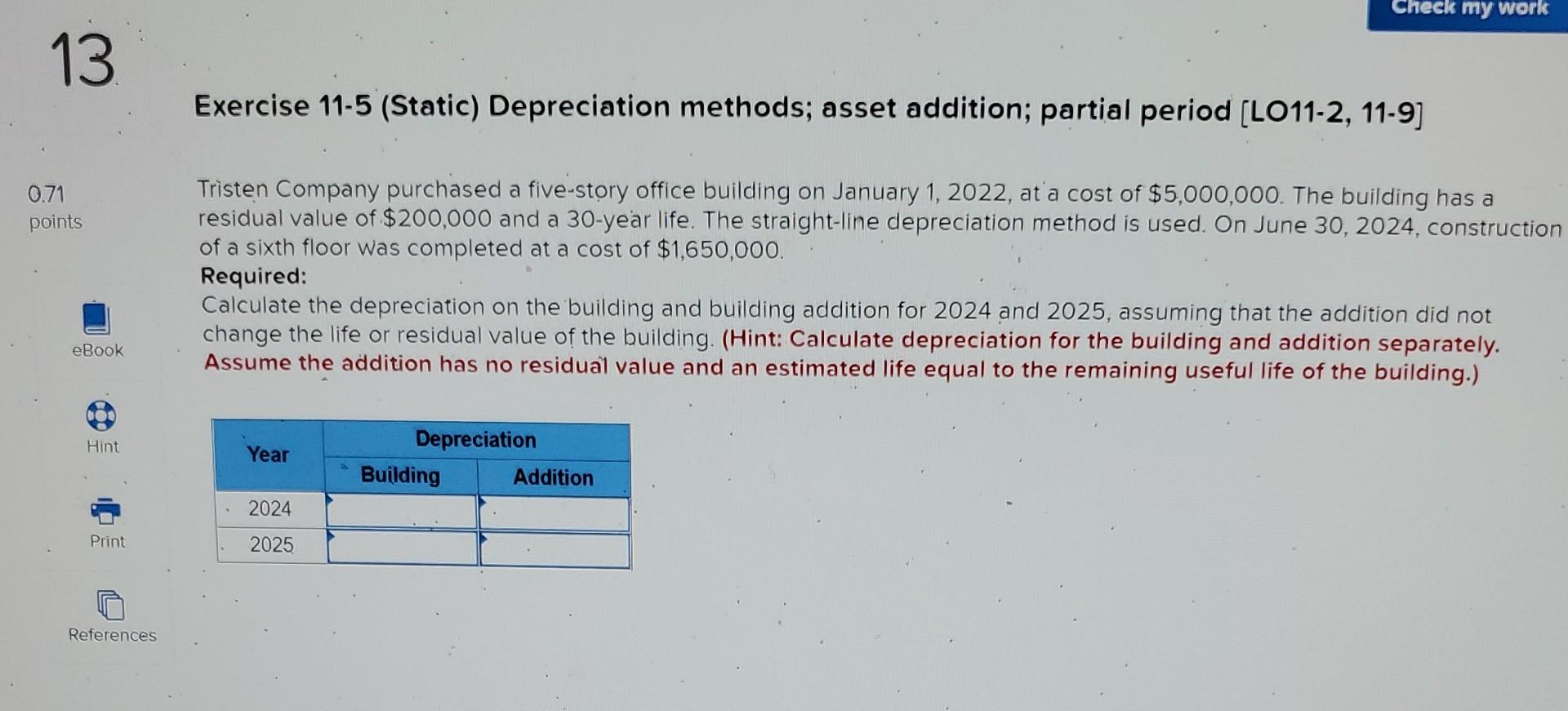

helppp Exercise 11-5 (Static) Depreciation methods; asset addition; partial period [LO11-2, 11-9] Tristen Company purchased a five-story office building on January 1,2022 , at a

helppp

Exercise 11-5 (Static) Depreciation methods; asset addition; partial period [LO11-2, 11-9] Tristen Company purchased a five-story office building on January 1,2022 , at a cost of $5,000,000. The building has a residual value of $200,000 and a 30-year life. The straight-line depreciation method is used. On June 30, 2024, constructio of a sixth floor was completed at a cost of $1,650,000. Required: Calculate the depreciation on the building and building addition for 2024 and 2025 , assuming that the addition did not change the life or residual value of the building. (Hint: Calculate depreciation for the building and addition separately. Assume the addition has no residual value and an estimated life equal to the remaining useful life of the building.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started