Answered step by step

Verified Expert Solution

Question

1 Approved Answer

helppp! please 1.50% 3.33% 11.28% 18.25% Question 15 ( 5 points) Mary Chalmers, who lives in Minnesota, purchased 100 shares of Delton Cables, a diversified

helppp! please

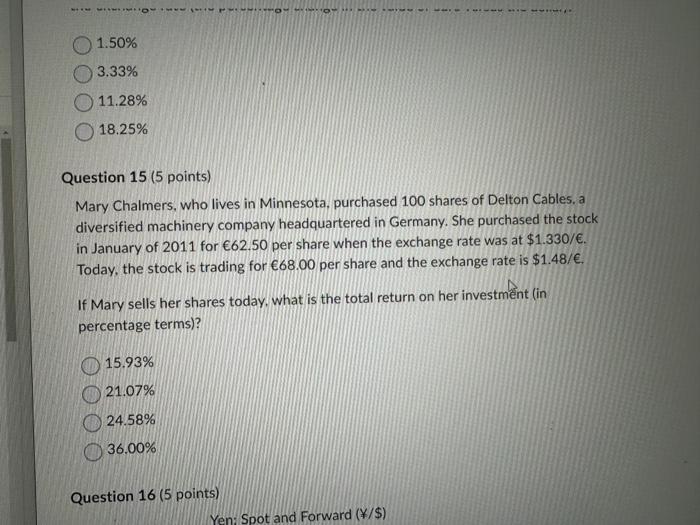

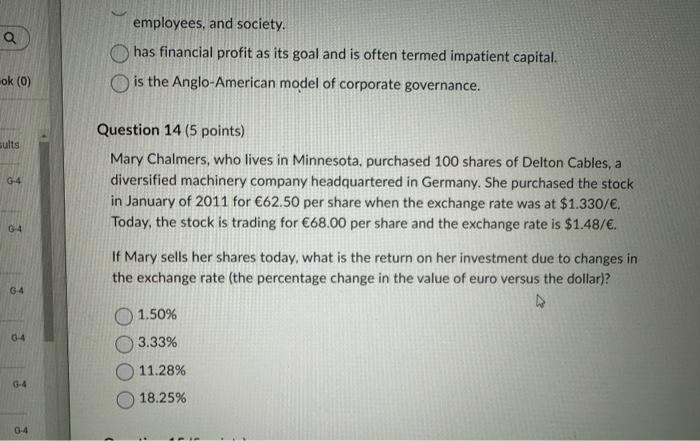

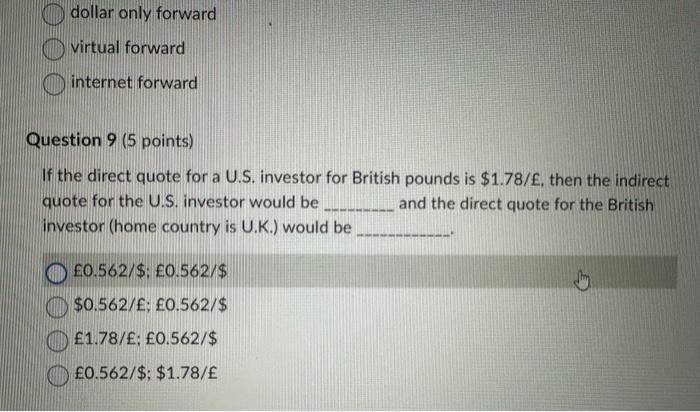

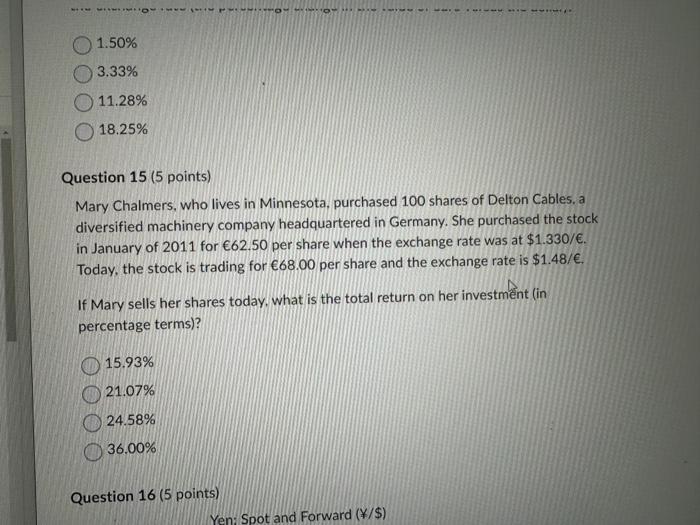

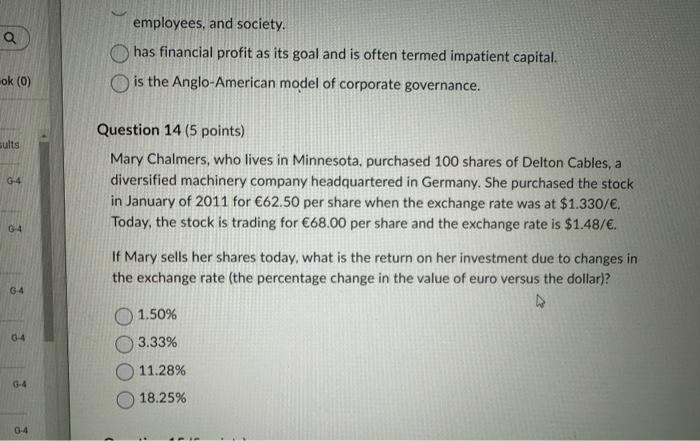

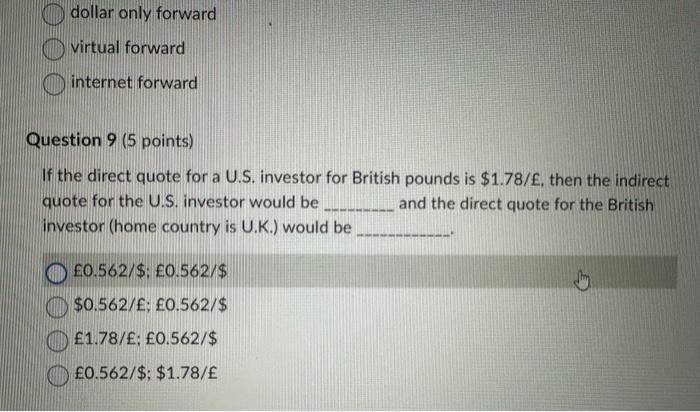

1.50% 3.33% 11.28% 18.25% Question 15 ( 5 points) Mary Chalmers, who lives in Minnesota, purchased 100 shares of Delton Cables, a diversified machinery company headquartered in Germany. She purchased the stock in January of 2011 for 62.50 per share when the exchange rate was at $1.330/. Today, the stock is trading for 68.00 per share and the exchange rate is $1.48/. If Mary sells her shares today, what is the total return on her investment (in percentage terms)? 15.93% 21.07% 24.58% 36.00% employees, and society. has financial profit as its goal and is often termed impatient capital. is the Anglo-American model of corporate governance. Question 14 (5 points) Mary Chalmers, who lives in Minnesota, purchased 100 shares of Delton Cables, a diversified machinery company headquartered in Germany. She purchased the stock in January of 2011 for 62.50 per share when the exchange rate was at $1.330/. Today, the stock is trading for 68.00 per share and the exchange rate is $1.48/. If Mary sells her shares today, what is the return on her investment due to changes in the exchange rate (the percentage change in the value of euro versus the dollar)? 1.50% 3.33% 11.28% 18.25% dollar only forward virtual forward internet forward Question 9 ( 5 points) If the direct quote for a U.S. investor for British pounds is $1.78/E, then the indirect quote for the U.S. investor would be and the direct quote for the British investor (home country is U.K.) would be 0.562/$;0.562/$ $0.562/E;0.562/$ 1.78/E;0.562/$ 0.562/$;$1.78/E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started