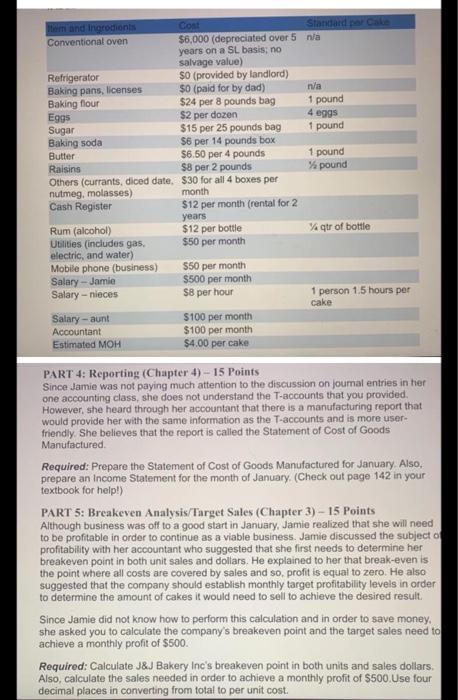

Hem and incrocions Standard percale Conventional oven $6,000 (depreciated over 5 na years on a SL basis, no salvage value) Refrigerator $0 (provided by landlord) Baking pans, licenses $0 (paid for by ded) n/a Baking flour $24 per 8 pounds bag 1 pound Eggs $2 per dozen 4 eggs Sugar $15 per 25 pounds bag 1 pound Baking soda $6 per 14 pounds box Butter $6.50 per 4 pounds 1 pound Raisins $8 per 2 pounds % pound Others (currants, diced date. $30 for all 4 boxes per nutmeg, molasses) month Cash Register 512 per month (rental for 2 years Rum (alcohol) $12 per bottle iqtr of bottle Utilities (includes gas $50 per month electric, and water) Mobile phone (business) $50 per month Salary - Jamie $500 per month Salary - nieces S8 per hour 1 person 1.5 hours per cake Salary-aunt $100 per month Accountant $100 per month Estimated MOH $4.00 per cake PART 4: Reporting (Chapter 4) - 15 Points Since Jamie was not paying much attention to the discussion on journal entries in her one accounting class, she does not understand the T-accounts that you provided However, she heard through her accountant that there is a manufacturing report that would provide her with the same information as the T-accounts and is more user- friendly. She believes that the report is called the Statement of Cost of Goods Manufactured Required: Prepare the Statement of Cost of Goods Manufactured for January. Also, prepare an Income Statement for the month of January (Check out page 142 in your textbook for help!) PART 5: Breakeven Analysis/Target Sales (Chapter 3) - 15 Points Although business was off to a good start in January, Jamie realized that she will need to be profitable in order to continue as a viable business. Jamie discussed the subject o profitability with her accountant who suggested that she first needs to determine her breakeven point in both unit sales and dollars. He explained to her that break-even is the point where all costs are covered by sales and so, profit is equal to zero. He also suggested that the company should establish monthly target profitability levels in order to determine the amount of cakes it would need to sell to achieve the desired result Since Jamie did not know how to perform this calculation and in order to save money she asked you to calculate the company's breakeven point and the target sales need to achieve a monthly profit of $500 Required: Calculate J&J Bakery Inc's breakeven point in both units and sales dollars. Also, calculate the sales needed in order to achieve a monthly profit of $500.Use four decimal places in converting from total to per unit cost. Hem and incrocions Standard percale Conventional oven $6,000 (depreciated over 5 na years on a SL basis, no salvage value) Refrigerator $0 (provided by landlord) Baking pans, licenses $0 (paid for by ded) n/a Baking flour $24 per 8 pounds bag 1 pound Eggs $2 per dozen 4 eggs Sugar $15 per 25 pounds bag 1 pound Baking soda $6 per 14 pounds box Butter $6.50 per 4 pounds 1 pound Raisins $8 per 2 pounds % pound Others (currants, diced date. $30 for all 4 boxes per nutmeg, molasses) month Cash Register 512 per month (rental for 2 years Rum (alcohol) $12 per bottle iqtr of bottle Utilities (includes gas $50 per month electric, and water) Mobile phone (business) $50 per month Salary - Jamie $500 per month Salary - nieces S8 per hour 1 person 1.5 hours per cake Salary-aunt $100 per month Accountant $100 per month Estimated MOH $4.00 per cake PART 4: Reporting (Chapter 4) - 15 Points Since Jamie was not paying much attention to the discussion on journal entries in her one accounting class, she does not understand the T-accounts that you provided However, she heard through her accountant that there is a manufacturing report that would provide her with the same information as the T-accounts and is more user- friendly. She believes that the report is called the Statement of Cost of Goods Manufactured Required: Prepare the Statement of Cost of Goods Manufactured for January. Also, prepare an Income Statement for the month of January (Check out page 142 in your textbook for help!) PART 5: Breakeven Analysis/Target Sales (Chapter 3) - 15 Points Although business was off to a good start in January, Jamie realized that she will need to be profitable in order to continue as a viable business. Jamie discussed the subject o profitability with her accountant who suggested that she first needs to determine her breakeven point in both unit sales and dollars. He explained to her that break-even is the point where all costs are covered by sales and so, profit is equal to zero. He also suggested that the company should establish monthly target profitability levels in order to determine the amount of cakes it would need to sell to achieve the desired result Since Jamie did not know how to perform this calculation and in order to save money she asked you to calculate the company's breakeven point and the target sales need to achieve a monthly profit of $500 Required: Calculate J&J Bakery Inc's breakeven point in both units and sales dollars. Also, calculate the sales needed in order to achieve a monthly profit of $500.Use four decimal places in converting from total to per unit cost