Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hemal Thomas is an employee in British Columbia. The net pay calculation is for their first bi - weekly pay of 2 0 2 3

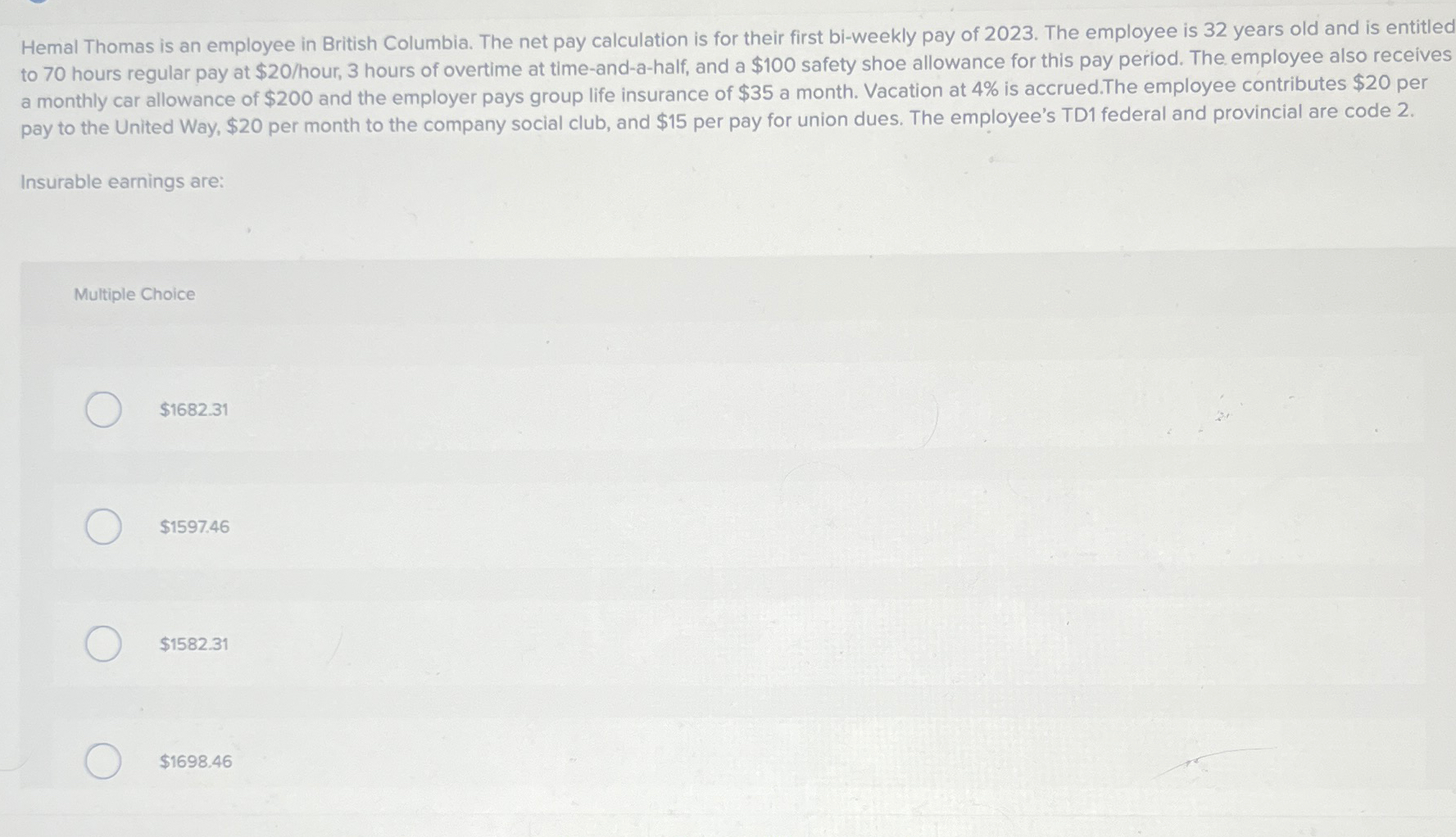

Hemal Thomas is an employee in British Columbia. The net pay calculation is for their first biweekly pay of The employee is years old and is entitled to hours regular pay at $hour hours of overtime at timeandahalf, and a $ safety shoe allowance for this pay period. The employee also receives a monthly car allowance of $ and the employer pays group life insurance of $ a month. Vacation at is accrued.The employee contributes $ per pay to the United Way, $ per month to the company social club, and $ per pay for union dues. The employee's TD federal and provincial are code

Insurable earnings are:

Multiple Choice

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started