Question

Hempstead Corporation plans to manufacture 8,000 units over the next month at the following costs: direct materials, $480,000; direct labor, $60,000; variable manufacturing overhead, $150,000;

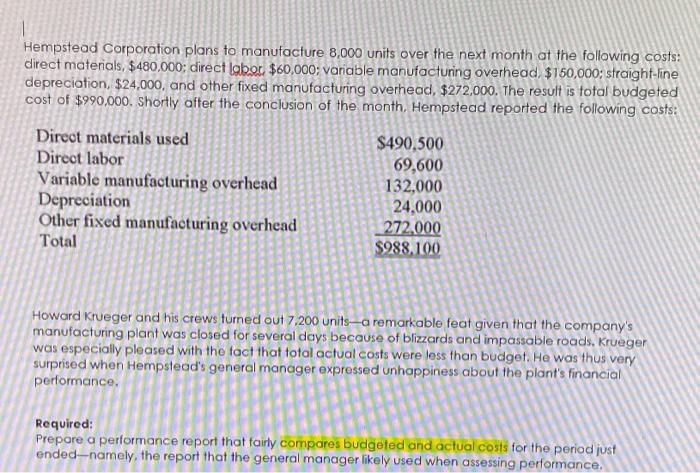

Hempstead Corporation plans to manufacture 8,000 units over the next month at the following costs: direct materials, $480,000; direct labor, $60,000; variable manufacturing overhead, $150,000; straight-line depreciation, $24,000, and other fixed manufacturing overhead, $272,000. The result is total budgeted cost of $990,000. Shortly after the conclusion of the month, Hempstead reported the following costs:

Direct Materials used $490,500 Direct Labor 69,600 Variable manufacturing overhead 132,000 Depreciation 24,000

Howard Krueger and his crews turned out 7,200 unitsa remarkable feat given that the company's manufacturing plant was closed for several days because of blizzards and impassable roads. Krueger was especially pleased with the fact that total actual costs were less than budget. He was thus very surprised when Hempstead's general manager expressed unhappiness about the plant's financial performance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started