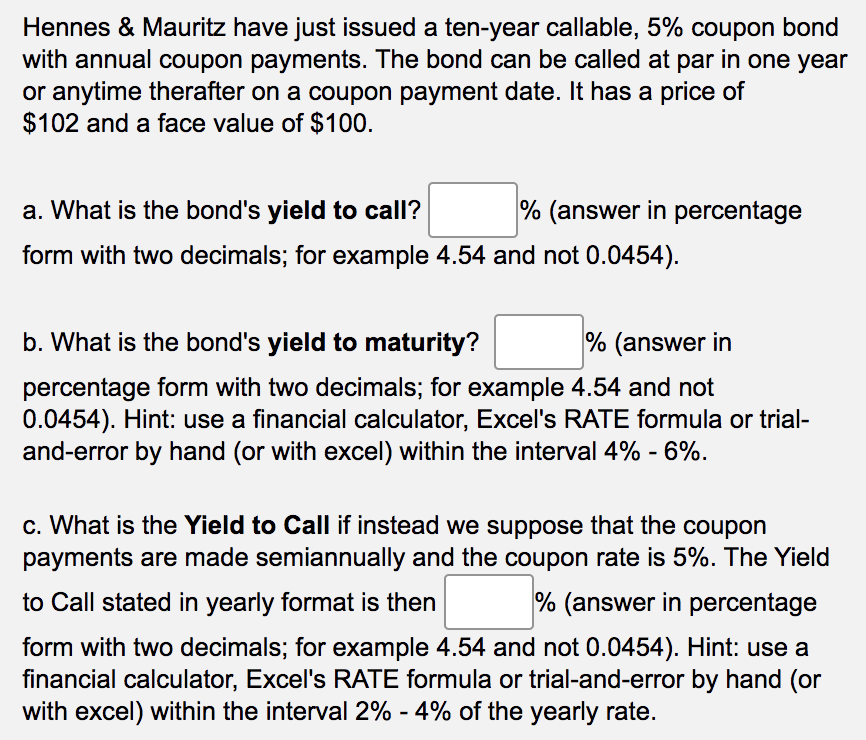

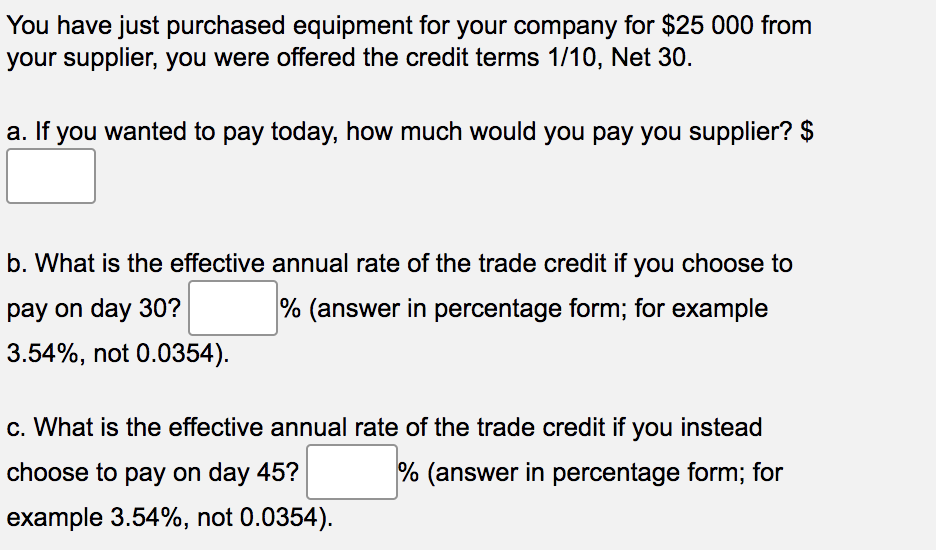

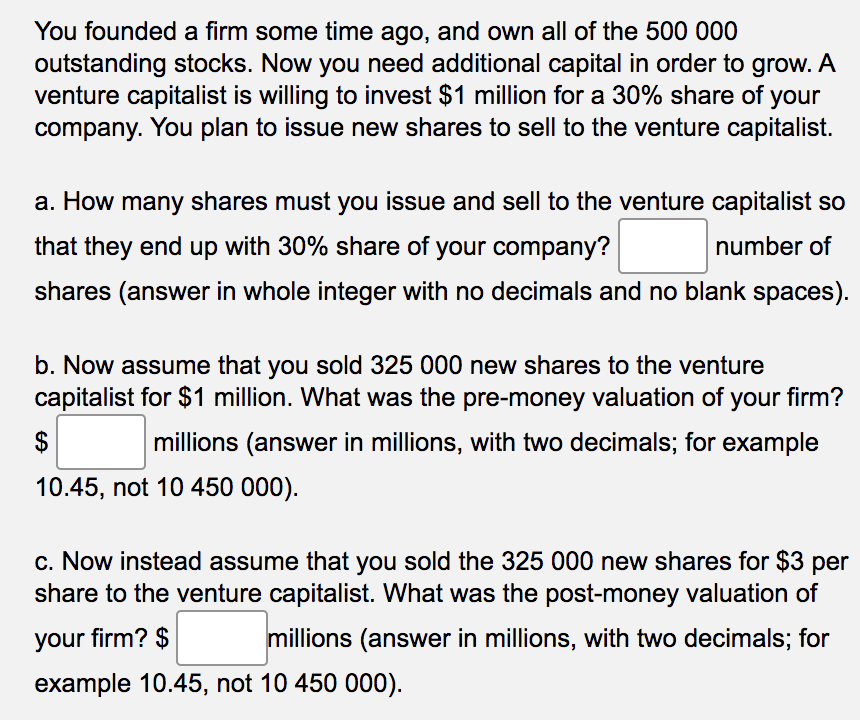

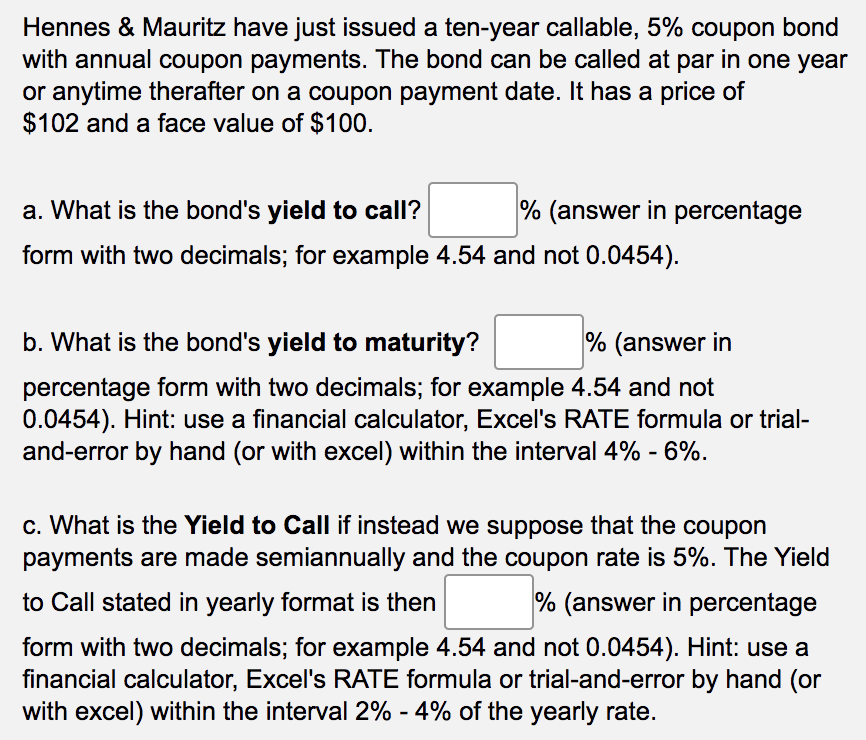

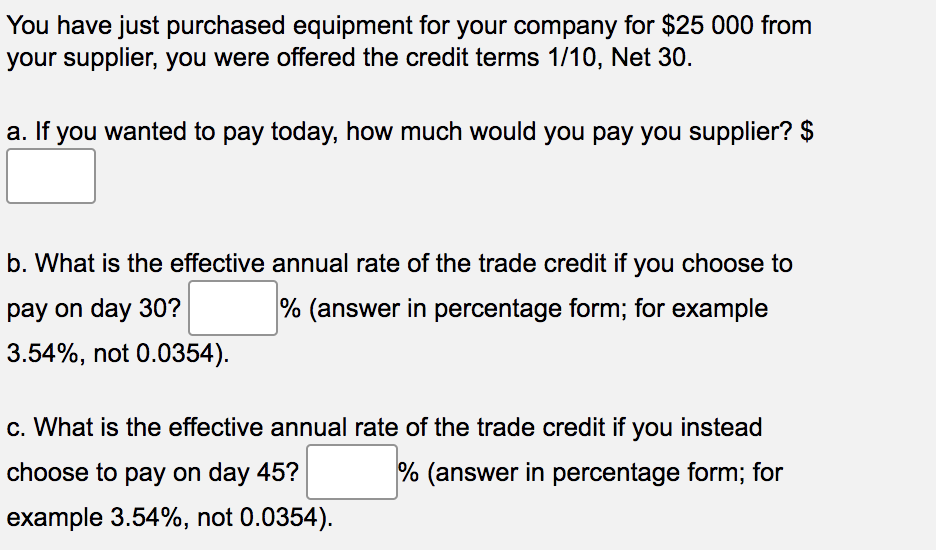

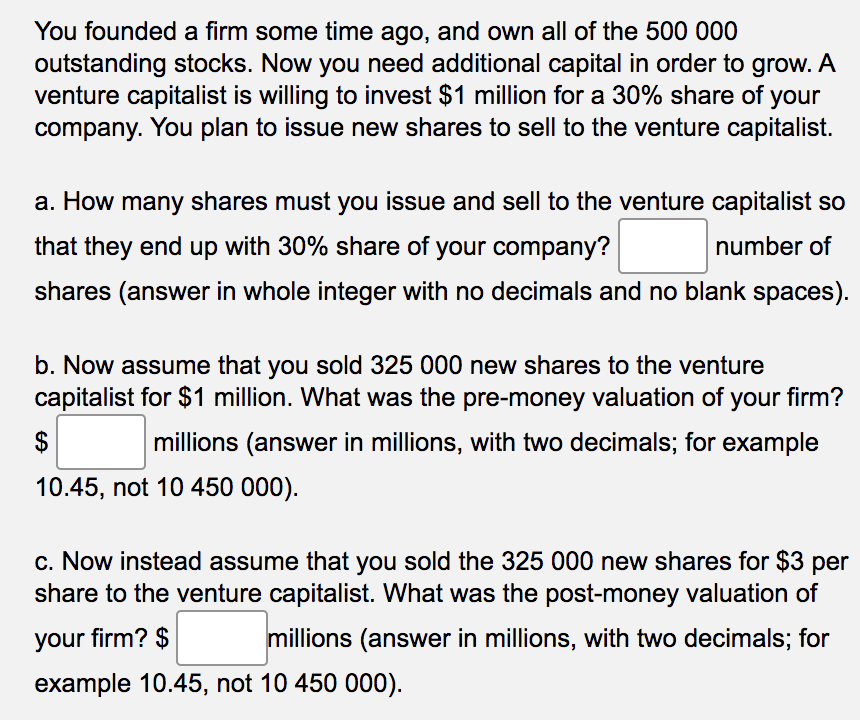

Hennes & Mauritz have just issued a ten-year callable, 5% coupon bond with annual coupon payments. The bond can be called at par in one year or anytime therafter on a coupon payment date. It has a price of $102 and a face value of $100. a. What is the bond's yield to call? % (answer in percentage form with two decimals; for example 4.54 and not 0.0454). b. What is the bond's yield to maturity? % (answer in percentage form with two decimals; for example 4.54 and not 0.0454). Hint: use a financial calculator, Excel's RATE formula or trial- and-error by hand (or with excel) within the interval 4% -6%. c. What is the Yield to Call if instead we suppose that the coupon payments are made semiannually and the coupon rate is 5%. The Yield to Call stated in yearly format is then % (answer in percentage form with two decimals; for example 4.54 and not 0.0454). Hint: use a financial calculator, Excel's RATE formula or trial-and-error by hand (or with excel) within the interval 2% - 4% of the yearly rate. You have just purchased equipment for your company for $25 000 from your supplier, you were offered the credit terms 1/10, Net 30. a. If you wanted to pay today, how much would you pay you supplier? $ b. What is the effective annual rate of the trade credit if you choose to pay on day 30? % (answer in percentage form; for example 3.54%, not 0.0354). c. What is the effective annual rate of the trade credit if you instead choose to pay on day 45? % (answer in percentage form; for example 3.54%, not 0.0354). You founded a firm some time ago, and own all of the 500 000 outstanding stocks. Now you need additional capital in order to grow. A venture capitalist is willing to invest $1 million for a 30% share of your company. You plan to issue new shares to sell to the venture capitalist. a. How many shares must you issue and sell to the venture capitalist so that they end up with 30% share of your company? number of shares (answer in whole integer with no decimals and no blank spaces). b. Now assume that you sold 325 000 new shares to the venture capitalist for $1 million. What was the pre-money valuation of your firm? $ millions (answer in millions, with two decimals; for example 10.45, not 10 450 000). c. Now instead assume that you sold the 325 000 new shares for $3 per share to the venture capitalist. What was the post-money valuation of millions (answer in millions, with two decimals; for example 10.45, not 10 450 000). your firm? $