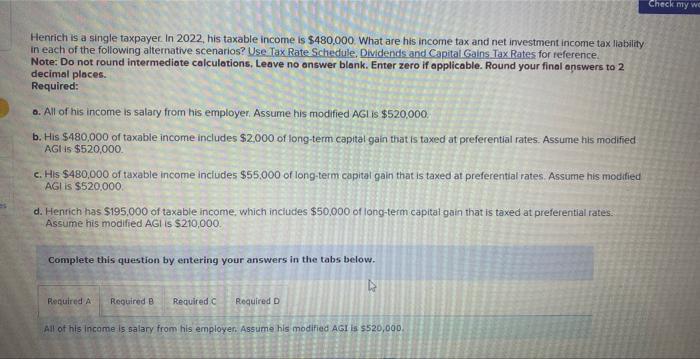

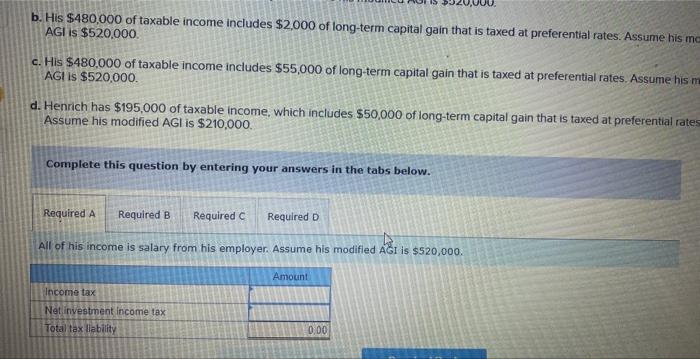

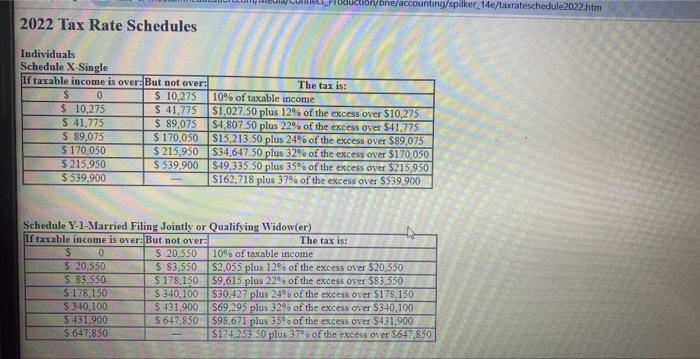

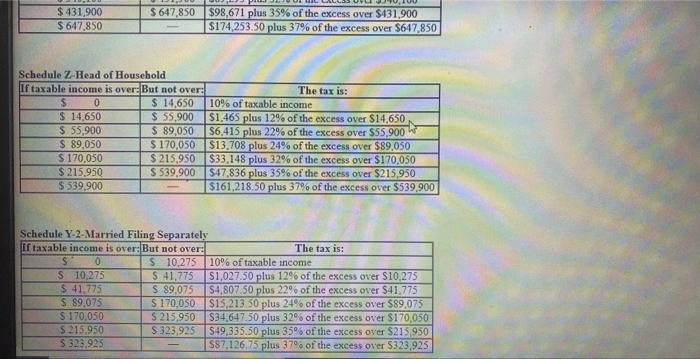

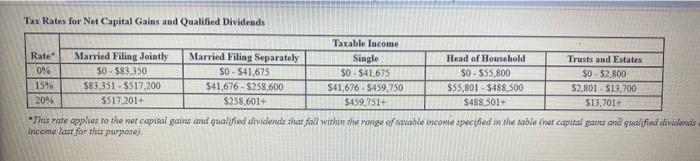

Henrich is a single taxpayer in 2022 , his taxable income is $480,000. What are his income tax and net investment income tax llability in each of the following altemative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains. Tax Rates for reference. Note: Do not round intermediate calculations, Leave no answer blank. Enter zero if applicable. Round your final answers ta 2 decimal ploces. Required: a. All of his income is salary from his employer. Assume his modified AGI is $520,000. b. His $480,000 of taxable income includes $2,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGl is $520,000 c. His $480,000 of taxable income includes $55,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGl is $520.000 d. Henrich has $195,000 of taxable income, which inciudes $50,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGl is $210,000. Complete this question by entering your answers in the tabs below. All of his income is salary from his employer. Assume his modified AGI is 5520,000 . b. His $480,000 of taxable income includes $2,000 of long-term capital gain that is taxed at preferential rates. Assume his mo AGI is $520,000 c. His $480,000 of taxable income includes $55,000 of long-term capital gain that is taxed at preferential rates. Assume his m AGI is $520,000. d. Henrich has $195,000 of taxable income, which includes $50,000 of long-term capital gain that is taxed at preferential rates Assume his modified AGl is $210,000. Complete this question by entering your answers in the tabs below. All of his income is salary from his employer. Assume his modified AGI is $520,000. 2022 Tax Rate Schedules Individuals Schedule X-Single \begin{tabular}{|c|c|c|} \hline$431,900 & $647,850 & $98,671 plus 35% of the excess over $431,900 \\ \hline$647,850 & & $174,253.50 plus 37% of the excess over $647,850 \\ \hline \end{tabular} Schedule Z-Head of Household \begin{tabular}{|c|c|l|l|} \hline If taxable income is over: But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$514,650 & 10% of taxable income \\ \hline$14,650 & $55,900 & $1,465 plus 12% of the excess over $14,650 \\ \hline$55,900 & $89,050 & $6,415 plus 22% of the excess over $55,900 \\ \hline$89,050 & $170,050 & $13,708 plus 24% of the excess over $89,050 \\ \hline$170,050 & $215,950 & $33,148 plus 32% of the excess over $170,050 \\ \hline$215,950 & $539,900 & $47,836 plus 35% of the excess over $215,950 \\ \hline$539,900 & & $161,218.50 plus 37% of the excess over $539,900 \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately Tax Rates for Net Capital Gains and Qualified Dividends - This rate applies to the net capital gains and qualifled dividends that fall within the roptse of tavable income spectfied in she fable (net capital gains ana quajified dividen income last for this purposej