Question

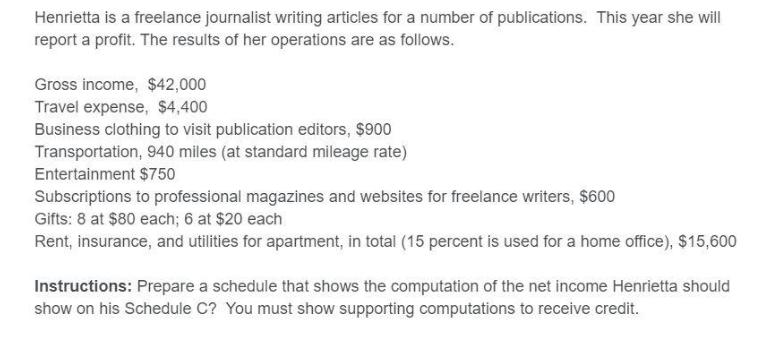

Henrietta is a freelance journalist writing articles for a number of publications. This year she will report a profit. The results of her operations

Henrietta is a freelance journalist writing articles for a number of publications. This year she will report a profit. The results of her operations are as follows. Gross income, $42,000 Travel expense, $4,400 Business clothing to visit publication editors, $900 Transportation, 940 miles (at standard mileage rate) Entertainment $750 Subscriptions to professional magazines and websites for freelance writers, $600 Gifts: 8 at $80 each; 6 at $20 each Rent, insurance, and utilities for apartment, in total (15 percent is used for a home office), $15,600 Instructions: Prepare a schedule that shows the computation of the net income Henrietta should show on his Schedule C? You must show supporting computations to receive credit.

Step by Step Solution

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

And compulation of that income Particular Gross inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Microeconomics

Authors: Hal R. Varian

9th edition

978-0393123975, 393123979, 393123960, 978-0393919677, 393919676, 978-0393123968

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App