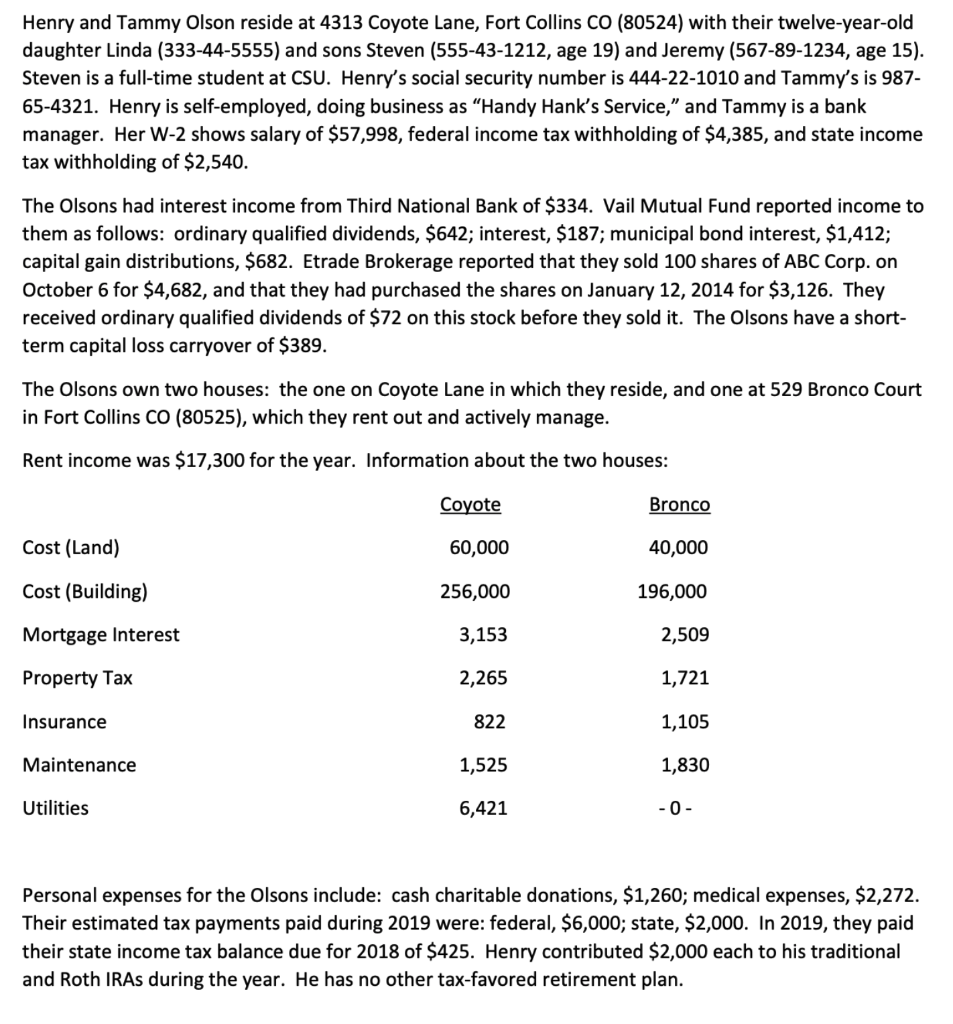

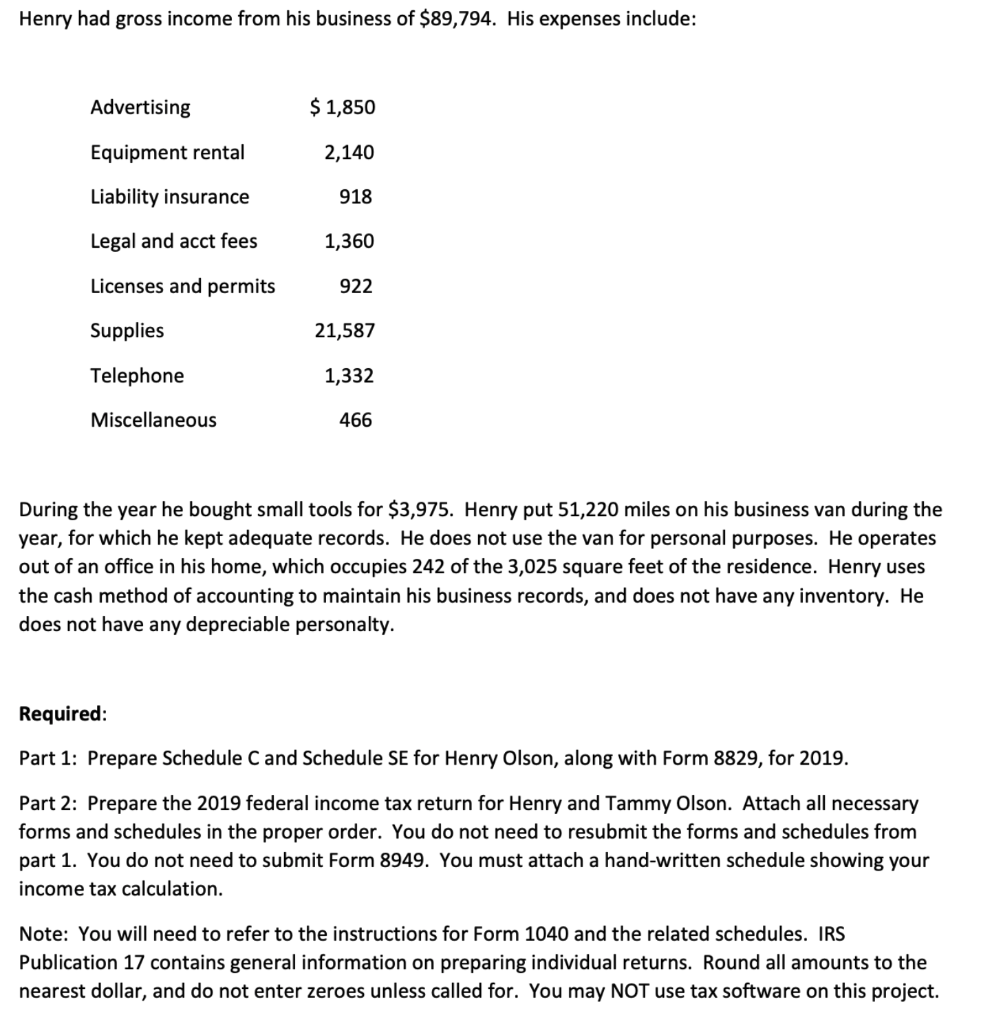

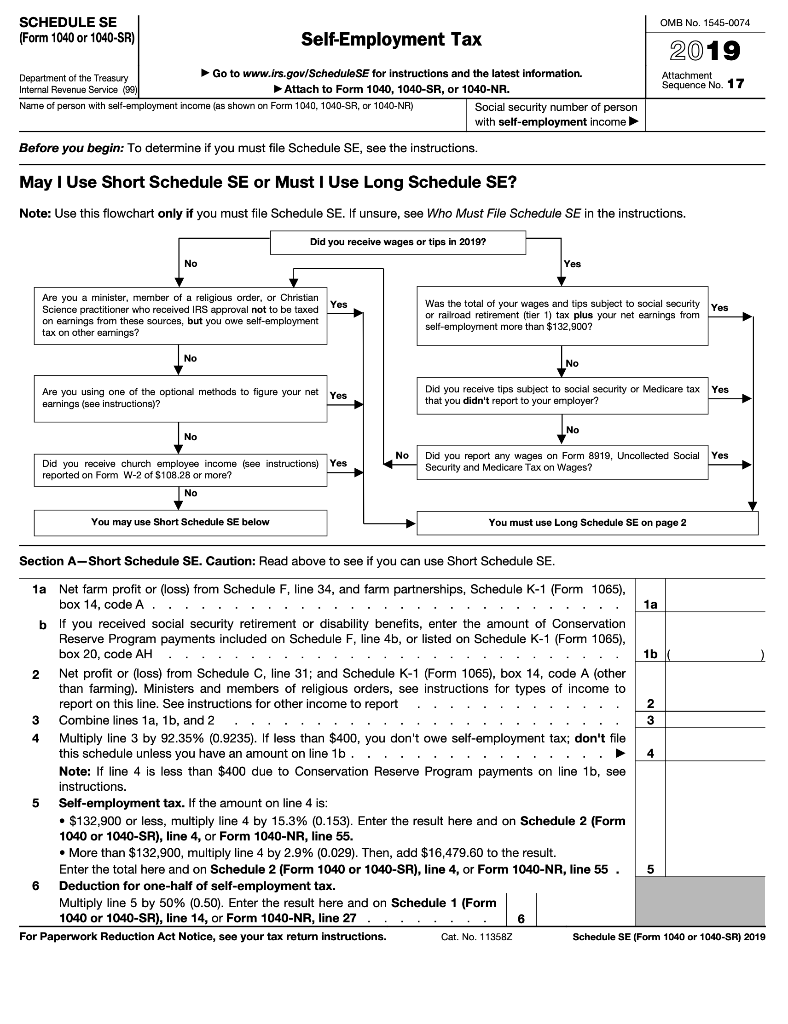

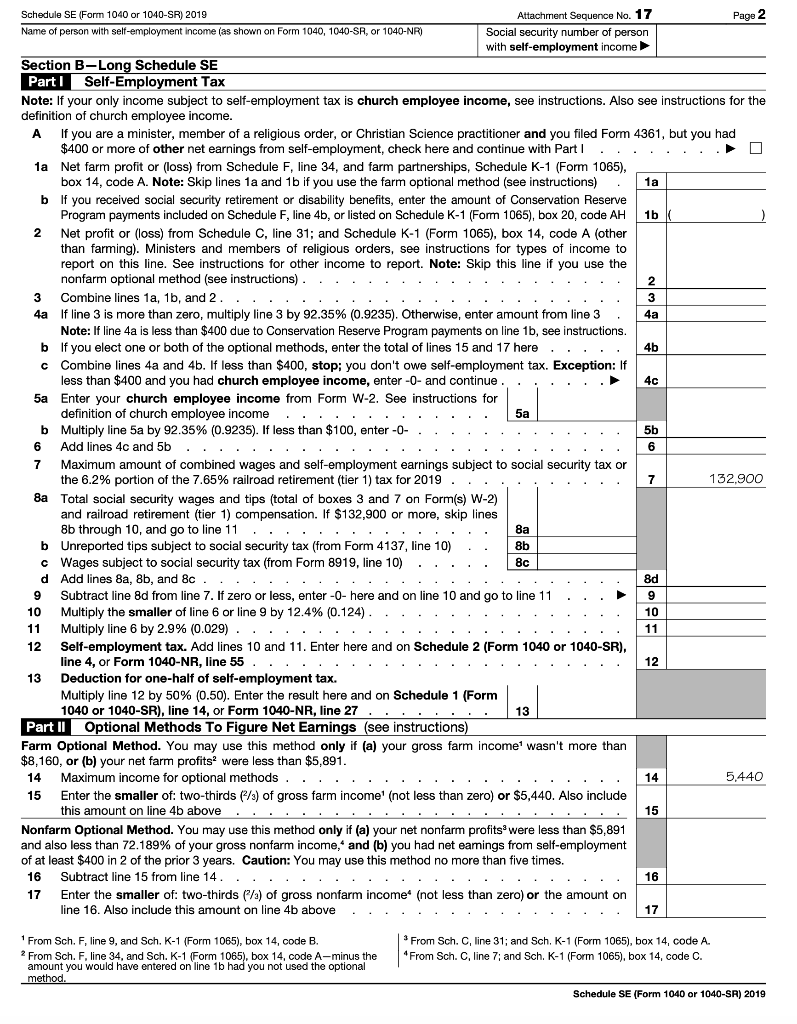

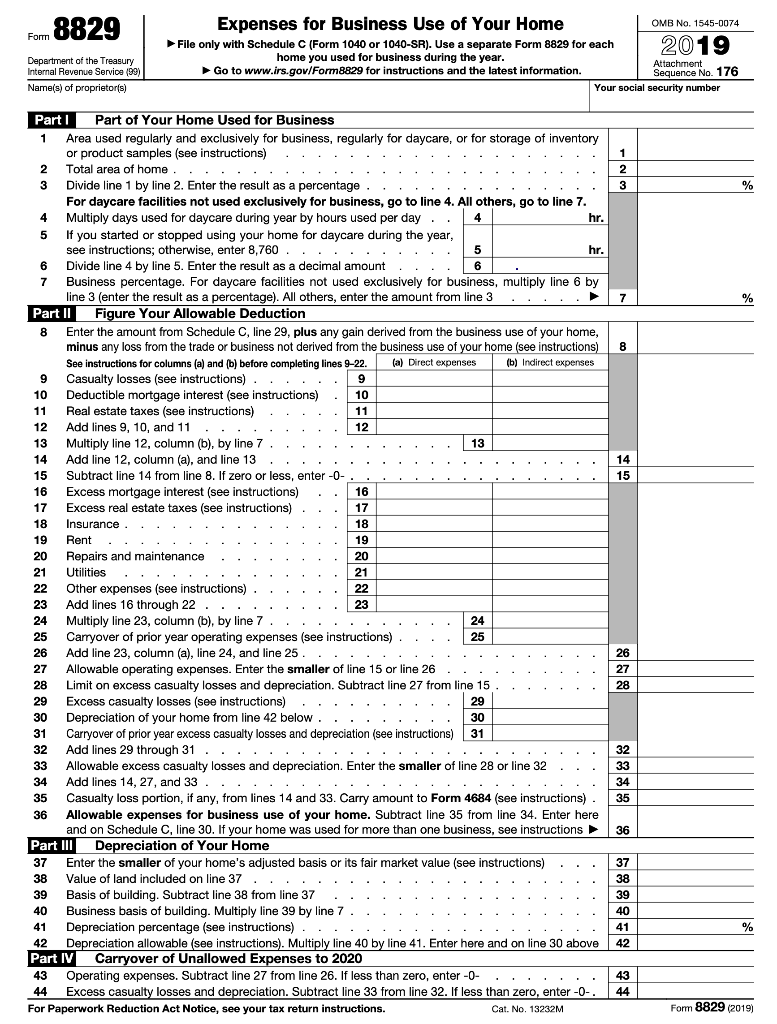

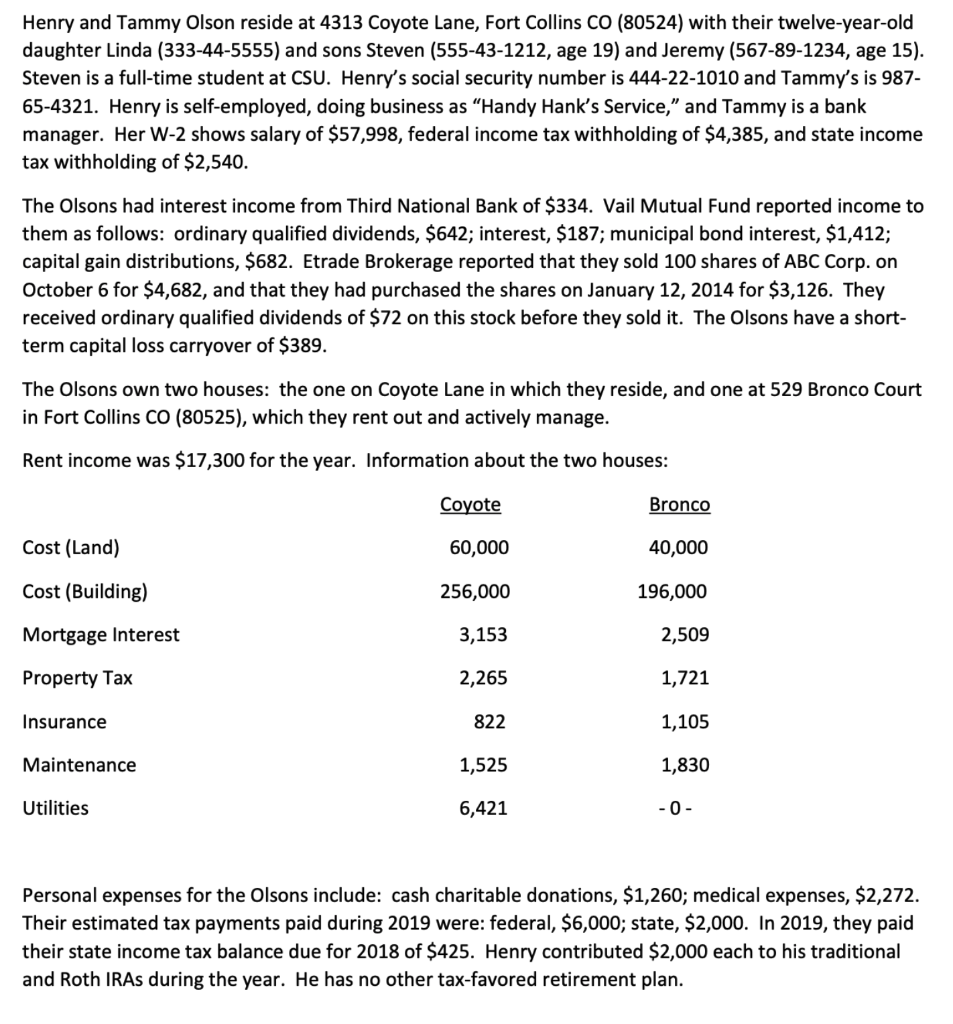

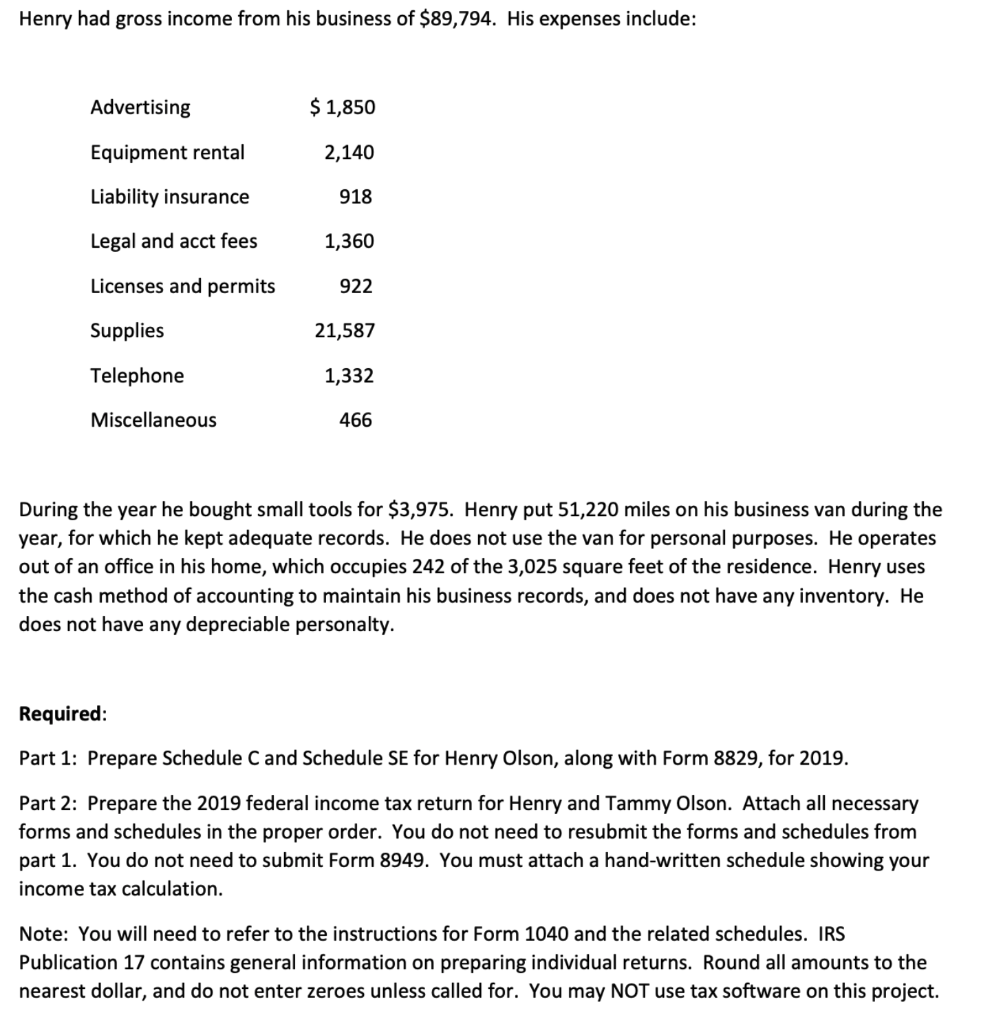

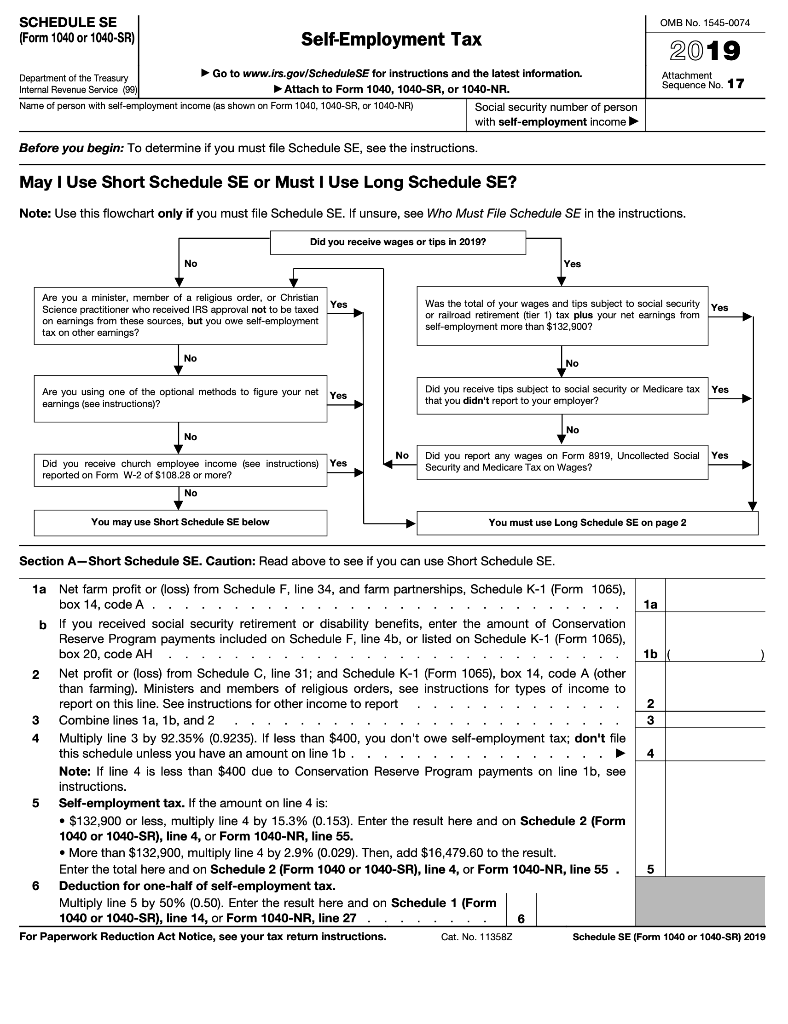

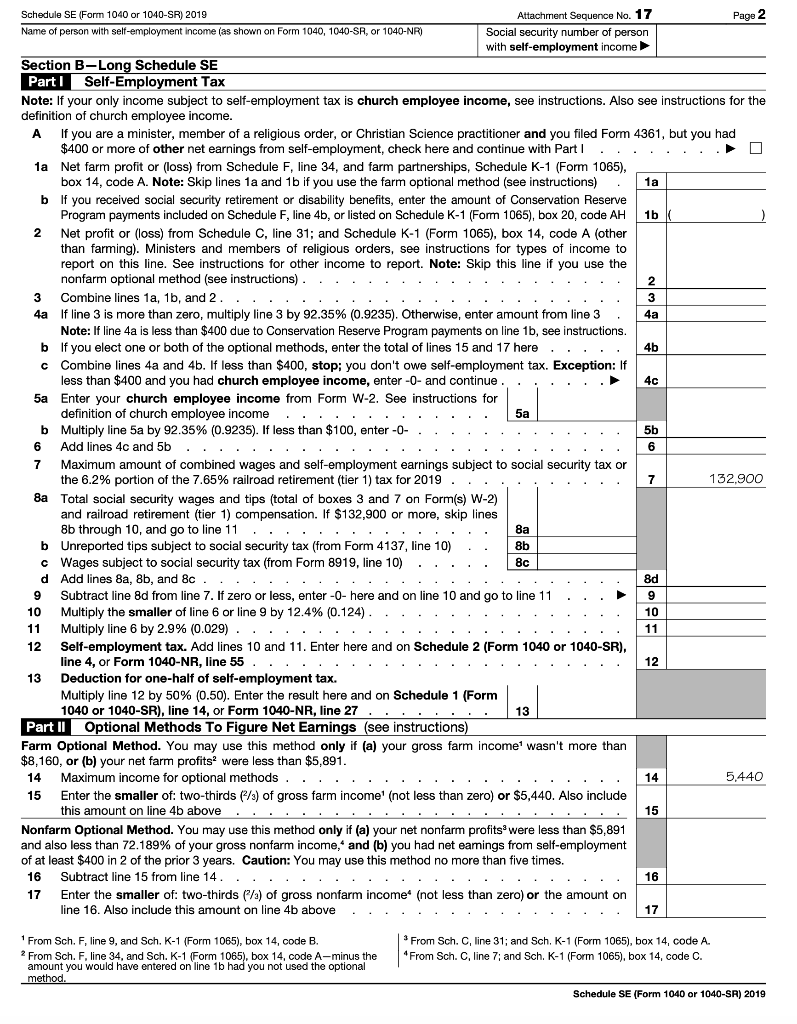

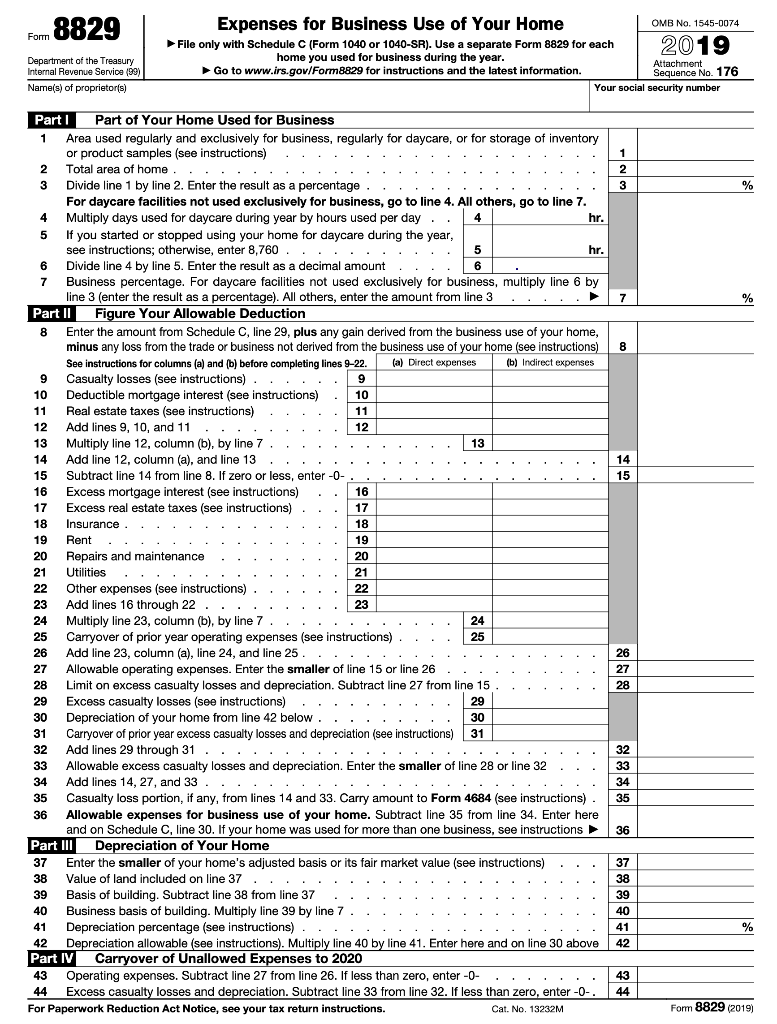

Henry and Tammy Olson reside at 4313 Coyote Lane, Fort Collins CO (80524) with their twelve-year-old daughter Linda (333-44-5555) and sons Steven (555-43-1212, age 19) and Jeremy (567-89-1234, age 15). Steven is a full-time student at CSU. Henry's social security number is 444-22-1010 and Tammy's is 987- 65-4321. Henry is self-employed, doing business as "Handy Hank's Service," and Tammy is a bank manager. Her W-2 shows salary of $57,998, federal income tax withholding of $4,385, and state income tax withholding of $2,540. The Olsons had interest income from Third National Bank of $334. Vail Mutual Fund reported income to them as follows: ordinary qualified dividends, $642; interest, $187; municipal bond interest, $1,412; capital gain distributions, $682. Etrade Brokerage reported that they sold 100 shares of ABC Corp. on October 6 for $4,682, and that they had purchased the shares on January 12, 2014 for $3,126. They received ordinary qualified dividends of $72 on this stock before they sold it. The Olsons have a short- term capital loss carryover of $389. The Olsons own two houses: the one on Coyote Lane in which they reside, and one at 529 Bronco Court in Fort Collins CO (80525), which they rent out and actively manage. Rent income was $17,300 for the Information about the two houses: Coyote Bronco Cost (Land) 60,000 40,000 Cost (Building) 256,000 196,000 Mortgage Interest 3,153 2,509 Property Tax 2,265 1,721 Insurance 822 1,105 Maintenance 1,525 1,830 Utilities 6,421 -O- Personal expenses for the Olsons include: cash charitable donations, $1,260; medical expenses, $2,272. Their estimated tax payments paid during 2019 were: federal, $6,000; state, $2,000. In 2019, they paid their state income tax balance due for 2018 of $425. Henry contributed $2,000 each to his traditional and Roth IRAs during the year. He has no other tax-favored retirement plan. Henry had gross income from his business of $89,794. His expenses include: Advertising $ 1,850 Equipment rental 2,140 Liability insurance 918 Legal and acct fees 1,360 Licenses and permits 922 Supplies 21,587 Telephone 1,332 Miscellaneous 466 During the year he bought small tools for $3,975. Henry put 51,220 miles on his business van during the year, for which he kept adequate records. He does not use the van for personal purposes. He operates out of an office in his home, which occupies 242 of the 3,025 square feet of the residence. Henry uses the cash method of accounting to maintain his business records, and does not have any inventory. He does not have any depreciable personalty. Required: Part 1: Prepare Schedule C and Schedule SE for Henry Olson, along with Form 8829, for 2019. Part 2: Prepare the 2019 federal income tax return for Henry and Tammy Olson. Attach all necessary forms and schedules in the proper order. You do not need to resubmit the forms and schedules from part 1. You do not need to submit Form 8949. You must attach a hand-written schedule showing your income tax calculation. Note: You will need to refer to the instructions for Form 1040 and the related schedules. IRS Publication 17 contains general information on preparing individual returns. Round all amounts to the nearest dollar, and do not enter zeroes unless called for. You may NOT use tax software on this project. OMB No. 1545-0074 SCHEDULE SE (Form 1040 or 1040-SR) Self-Employment Tax 2019 Attachment Sequence No. 17 Department of the Treasury Go to www.irs.gov/ScheduleSE for instructions and the latest information. Internal Revenue Service (99) Attach to Form 1040, 1040-SR, or 1040-NR. Name of person with self-employment income (as shown on Form 1040,1010-SR, or 1040-NR) Social security number of person with self-employment income Before you begin: To determine if you must file Schedule SE, see the instructions. May I Use Short Schedule SE or Must I Use Long Schedule SE? Note: Use this flowchart only if you must file Schedule SE. If unsure, see Who Must File Schedule SE in the instructions. Did you receive wages or tips in 2019? No Yes Yes Are you a minister, member of a religious order, or Christian Science practitioner who received IRS approval not to be taxed on earnings from these sources, but you owe self-employment tax on other earnings? Was the total of your wages and tips subject to social security Yes or railroad retirement (tier 1) tax plus your net earnings from self-employment more than $132,900? No No Yes Are you using one of the optional methods to figure your net earnings (see instructions)? Yes Did you receive tips subject to social security or Medicare tax that you didn't report to your employer? No No No Yes Yes Did you report any wages on Form 8919, Uncollected Social Security and Medicare Tax on Wages? Did you receive church employee income (see instructions) reported on Form W-2 of $108.28 or more? No You may use Short Schedule SE below You must use Long Schedule SE on page 2 Section A-Short Schedule SE. Caution: Read above to see if you can use Short Schedule SE. b 2 3 3 1a Net farm profit or loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A.. 1a If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 1b 2 Net profit or (loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than farming). Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report Combine lines 1a, 1b, and 2. 4 Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax; don't file this schedule unless you have an amount on line 1b 4 Note: If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. . Self-employment tax. If the amount on line 4 is: $132,900 or less, multiply line 4 by 15.3% (0.153). Enter the result here and on Schedule 2 (Form 1040 or 1040-SR), line 4, or Form 1040-NR, line 55. More than $132,900, multiply line 4 by 2.9% (0.029). Then, add $16,479.60 to the result. Enter the total here and on Schedule 2 (Form 1040 or 1040-SR), line 4, or Form 1040-NR, line 55. 6 Deduction for one-half of self-employment tax. Multiply line 5 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040 or 1040-SR), line 14, or Form 1040-NR, line 27 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11358Z Schedule SE (Form 1040 or 1040-SR) 2019 5 5 6 A 3 5b 6 6 Schedule SE (Form 1040 or 1040-SR) 2019 Attachment Sequence No. 17 Page 2 Name of person with self-employment income shown on Form 1040, 1040-SR, or 1040-NR) Social security number of person with self-employment income Section B-Long Schedule SE Part1 Self-Employment Tax Note: If your only income subject to self-employment tax is church employee income, see instructions. Also see instructions for the definition of church employee income. If you are minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had $400 or more of other net earnings from self-employment, check here and continue with Part 1a Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A. Note: Skip lines 1a and 1b if you use the farm optional method (see instructions) 1a b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 1b 2 Net profit or loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than farming). Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report. Note: Skip this line if you use the nonfarm optional method (see instructions) 2 3 Combine lines 1a, 1b, and 2 4a If line 3 is more than zero, multiply line 3 by 92.35% (0.9235). Otherwise, enter amount from line 3 4a Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. b If you elect one or both of the optional methods, enter the total of lines 15 and 17 here 4b c Combine lines 4a and 4b. If less than $400, stop: you don't owe self-employment tax. Exception: If less than $400 and you had church employee income, enter-O- and continue. 4c 5a Enter Enter your church employee income from Form W-2. See instructions for definition of church employee income 5a b Multiply line 5a by 92.35% (0.9235). If less than $100, enter-O- Add lines 4c and 5b 7 Maximum amount of combined wages and self-employment earnings subject to social security tax or the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2019.. 132.900 8a Total social security wages and tips (total of boxes 3 and 7 on Form(s) W-2) and railroad retirement (tier 1) compensation. If $132,900 or more, skip lines 8b through 10, and go to line 11 b Unreported tips subject to social security tax (from Form 4137, line 10) Wages subject to social security tax (from Form 8919, line 10) 8c Add lines 8a, 8b, and 8c 8d Subtract line 8d from line 7. If zero or less, enter-O- here and on line 10 and go to line 11 9 10 Multiply the smaller of line 6 or line 9 by 12.4% (0.124) 10 11 Multiply line 6 by 2.9% (0.029) 11 12 Self-employment tax. Add lines 10 and 11. Enter here and on Schedule 2 (Form 1040 or 1040-SR), line 4, or Form 1040-NR, line 55 12 13 Deduction for one-half of self-employment tax. Multiply line 12 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040-SR). line 14, or Form 1040-NR, line 27 Part II Optional Methods To Figure Net Earnings (see instructions) Farm Optional Method. You may use this method only if (a) your gross farm income wasn't more than $8,160, or (b) your net farm profits? were less than $5,891. 14 Maximum income for optional methods 14 5,440 15 Enter the smaller of: two-thirds (1/3) of gross farm income (not less than zero) or $5,440. Also include this amount on line 4b above .................... 15 Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits were less than $5,891 and also less than 72.189% of your gross nonfarm income, and (b) you had net earnings from self-employment of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than five times. 16 Subtract line 15 from line 14 16 17 Enter the smaller of: two-thirds (/) of gross nonfarm income (not less than zero) or the amount on line 16. Also include this amount on line 4b above 17 7 8 8b d 9 1040 or 13 From Sch. F, line 9, and Sch. K-1 (Form 1065), box 14, code ? From Sch. F, line 34, and Sch. K-1 (Form 1065), box 14, code A-minus the amount you would have entered on line 1b had you not used the optional method. * From Sch. C, line 31; and Sch. K-1 (Form 1065), box 14, code A. From Sch. C, line 7; and Sch. K-1 (Form 1065), box 14, code C. Schedule SE (Form 1040 or 1040-SR) 2019 Fom 8829 Department of the Treasury Internal Revenue Service (99) Name(s) of proprietor(s) Expenses for Business Use of Your Home OMB No. 1545-0074 File only with Schedule C (Form 1040 or 1040-SR). Use a separate Form 8829 for each 2019 home you used for business during the year. Attachment Go to www.irs.gov/Form8829 for instructions and the latest information. Sequence No. 176 Your social security number Part 1 2 3 % 5 7 % 8 14 15 17 18 19 Part of Your Home Used for Business 1 Area used regularly and exclusively for business, regularly for daycare, or for storage of inventory or product samples (see instructions) 2 Total area of home 3 Divide line 1 by line 2. Enter the result as a percentage For daycare facilities not used exclusively for business, go to line 4. All others, go to line 7. 4. Multiply days used for daycare during year by hours used per day 4 hr. If you started or stopped using your home for daycare during the year, see instructions; otherwise, enter 8,760 ......... 5 5 hr. 6 Divide line 4 by line 5. Enter the result as a decimal amount 6 7 Business percentage. For daycare facilities not used exclusively for business, multiply line 6 by line 3 (enter the result as a percentage). All others, enter the amount from line 3 Part II Figure Your Allowable Deduction 8 Enter the amount from Schedule C, line 29, plus any gain derived from the business use of your home, minus any loss from the trade or business not derived from the business use of your home (see instructions) See instructions for columns (a) and (b) before completing lines 9-22. (a) Direct expenses (b) Indirect expenses 9 9 Casualty losses (see instructions) 9 10 Deductible mortgage interest (see instructions) 10 11 Real estate taxes (see instructions) 11 12 Add lines 9, 10, and 11 ... 12 13 Multiply line 12, column (b), by line 7 13 14 Add line 12, column (a), and line 13 15 10 Subtract line 14 from line 8. If zero or less, enter-O- 16 10 Excess mortgage interest (see instructions) 16 17 " Excess real estate taxes (see instructions) 18 Insurance 10 19 Rent nom 20 20 Repairs and maintenance 20 21 Utilities 2 21 22 Other expenses (see instructions) 22 23 Add lines 16 through 22 23 24 Multiply line 23, column (b), by line 7 25 25 Carryover of prior year operating expenses (see instructions) 25 26 26 Add line 23, column (a), line 24, and line 25 27 Allowable operating expenses. Enter the smaller of line 15 or line 26 28 99 Limit on excess casualty losses and depreciation. Subtract line 27 from line 15 29 Excess casualty losses (see instructions) ) 29 30 20 Depreciation of your home from line 42 below. 30 31 24 Carryover of prior year excess casualty losses and depreciation (see instructions) 31 20 32 Add lines 29 through 31 22 33 Allowable excess casualty losses and depreciation. Enter the smaller of line 28 or line 32 34 Add lines 14, 27, and 33 . 25 35 Casualty loss portion, if any, from lines 14 and 33. Carry amount to Form 4684 (see instructions) 36 Allowable expenses for business use of your home. Subtract line 35 from line 34. Enter here and on Schedule C, line 30. If your home was used for more than one business, see instructions Part III Depreciation of Your Home 37 Enter the smaller of your home's adjusted basis or its fair market value (see instructions) 38 Value of land included on line 37 :: 39 Basis of building. Subtract line 38 from line 37 40 Business basis of building. Multiply line 39 by line 7. 41 Depreciation percentage (see instructions) 42 Depreciation allowable (see instructions). Multiply line 40 by line 41. Enter here and on line 30 above Part IV Carryover of Unallowed Expenses to 2020 43 Operating expenses. Subtract line 27 from line 26. If less than zero, enter-O- 44 Excess casualty losses and depreciation. Subtract line 33 from line 32. If less than zero, enter -0-. For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 13232M 24 26 27 28 32 33 34 35 36 37 38 39 40 41 42 % 43 44 For 8829 (2019) Henry and Tammy Olson reside at 4313 Coyote Lane, Fort Collins CO (80524) with their twelve-year-old daughter Linda (333-44-5555) and sons Steven (555-43-1212, age 19) and Jeremy (567-89-1234, age 15). Steven is a full-time student at CSU. Henry's social security number is 444-22-1010 and Tammy's is 987- 65-4321. Henry is self-employed, doing business as "Handy Hank's Service," and Tammy is a bank manager. Her W-2 shows salary of $57,998, federal income tax withholding of $4,385, and state income tax withholding of $2,540. The Olsons had interest income from Third National Bank of $334. Vail Mutual Fund reported income to them as follows: ordinary qualified dividends, $642; interest, $187; municipal bond interest, $1,412; capital gain distributions, $682. Etrade Brokerage reported that they sold 100 shares of ABC Corp. on October 6 for $4,682, and that they had purchased the shares on January 12, 2014 for $3,126. They received ordinary qualified dividends of $72 on this stock before they sold it. The Olsons have a short- term capital loss carryover of $389. The Olsons own two houses: the one on Coyote Lane in which they reside, and one at 529 Bronco Court in Fort Collins CO (80525), which they rent out and actively manage. Rent income was $17,300 for the Information about the two houses: Coyote Bronco Cost (Land) 60,000 40,000 Cost (Building) 256,000 196,000 Mortgage Interest 3,153 2,509 Property Tax 2,265 1,721 Insurance 822 1,105 Maintenance 1,525 1,830 Utilities 6,421 -O- Personal expenses for the Olsons include: cash charitable donations, $1,260; medical expenses, $2,272. Their estimated tax payments paid during 2019 were: federal, $6,000; state, $2,000. In 2019, they paid their state income tax balance due for 2018 of $425. Henry contributed $2,000 each to his traditional and Roth IRAs during the year. He has no other tax-favored retirement plan. Henry had gross income from his business of $89,794. His expenses include: Advertising $ 1,850 Equipment rental 2,140 Liability insurance 918 Legal and acct fees 1,360 Licenses and permits 922 Supplies 21,587 Telephone 1,332 Miscellaneous 466 During the year he bought small tools for $3,975. Henry put 51,220 miles on his business van during the year, for which he kept adequate records. He does not use the van for personal purposes. He operates out of an office in his home, which occupies 242 of the 3,025 square feet of the residence. Henry uses the cash method of accounting to maintain his business records, and does not have any inventory. He does not have any depreciable personalty. Required: Part 1: Prepare Schedule C and Schedule SE for Henry Olson, along with Form 8829, for 2019. Part 2: Prepare the 2019 federal income tax return for Henry and Tammy Olson. Attach all necessary forms and schedules in the proper order. You do not need to resubmit the forms and schedules from part 1. You do not need to submit Form 8949. You must attach a hand-written schedule showing your income tax calculation. Note: You will need to refer to the instructions for Form 1040 and the related schedules. IRS Publication 17 contains general information on preparing individual returns. Round all amounts to the nearest dollar, and do not enter zeroes unless called for. You may NOT use tax software on this project. OMB No. 1545-0074 SCHEDULE SE (Form 1040 or 1040-SR) Self-Employment Tax 2019 Attachment Sequence No. 17 Department of the Treasury Go to www.irs.gov/ScheduleSE for instructions and the latest information. Internal Revenue Service (99) Attach to Form 1040, 1040-SR, or 1040-NR. Name of person with self-employment income (as shown on Form 1040,1010-SR, or 1040-NR) Social security number of person with self-employment income Before you begin: To determine if you must file Schedule SE, see the instructions. May I Use Short Schedule SE or Must I Use Long Schedule SE? Note: Use this flowchart only if you must file Schedule SE. If unsure, see Who Must File Schedule SE in the instructions. Did you receive wages or tips in 2019? No Yes Yes Are you a minister, member of a religious order, or Christian Science practitioner who received IRS approval not to be taxed on earnings from these sources, but you owe self-employment tax on other earnings? Was the total of your wages and tips subject to social security Yes or railroad retirement (tier 1) tax plus your net earnings from self-employment more than $132,900? No No Yes Are you using one of the optional methods to figure your net earnings (see instructions)? Yes Did you receive tips subject to social security or Medicare tax that you didn't report to your employer? No No No Yes Yes Did you report any wages on Form 8919, Uncollected Social Security and Medicare Tax on Wages? Did you receive church employee income (see instructions) reported on Form W-2 of $108.28 or more? No You may use Short Schedule SE below You must use Long Schedule SE on page 2 Section A-Short Schedule SE. Caution: Read above to see if you can use Short Schedule SE. b 2 3 3 1a Net farm profit or loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A.. 1a If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 1b 2 Net profit or (loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than farming). Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report Combine lines 1a, 1b, and 2. 4 Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax; don't file this schedule unless you have an amount on line 1b 4 Note: If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. . Self-employment tax. If the amount on line 4 is: $132,900 or less, multiply line 4 by 15.3% (0.153). Enter the result here and on Schedule 2 (Form 1040 or 1040-SR), line 4, or Form 1040-NR, line 55. More than $132,900, multiply line 4 by 2.9% (0.029). Then, add $16,479.60 to the result. Enter the total here and on Schedule 2 (Form 1040 or 1040-SR), line 4, or Form 1040-NR, line 55. 6 Deduction for one-half of self-employment tax. Multiply line 5 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040 or 1040-SR), line 14, or Form 1040-NR, line 27 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11358Z Schedule SE (Form 1040 or 1040-SR) 2019 5 5 6 A 3 5b 6 6 Schedule SE (Form 1040 or 1040-SR) 2019 Attachment Sequence No. 17 Page 2 Name of person with self-employment income shown on Form 1040, 1040-SR, or 1040-NR) Social security number of person with self-employment income Section B-Long Schedule SE Part1 Self-Employment Tax Note: If your only income subject to self-employment tax is church employee income, see instructions. Also see instructions for the definition of church employee income. If you are minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had $400 or more of other net earnings from self-employment, check here and continue with Part 1a Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A. Note: Skip lines 1a and 1b if you use the farm optional method (see instructions) 1a b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 1b 2 Net profit or loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than farming). Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report. Note: Skip this line if you use the nonfarm optional method (see instructions) 2 3 Combine lines 1a, 1b, and 2 4a If line 3 is more than zero, multiply line 3 by 92.35% (0.9235). Otherwise, enter amount from line 3 4a Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. b If you elect one or both of the optional methods, enter the total of lines 15 and 17 here 4b c Combine lines 4a and 4b. If less than $400, stop: you don't owe self-employment tax. Exception: If less than $400 and you had church employee income, enter-O- and continue. 4c 5a Enter Enter your church employee income from Form W-2. See instructions for definition of church employee income 5a b Multiply line 5a by 92.35% (0.9235). If less than $100, enter-O- Add lines 4c and 5b 7 Maximum amount of combined wages and self-employment earnings subject to social security tax or the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2019.. 132.900 8a Total social security wages and tips (total of boxes 3 and 7 on Form(s) W-2) and railroad retirement (tier 1) compensation. If $132,900 or more, skip lines 8b through 10, and go to line 11 b Unreported tips subject to social security tax (from Form 4137, line 10) Wages subject to social security tax (from Form 8919, line 10) 8c Add lines 8a, 8b, and 8c 8d Subtract line 8d from line 7. If zero or less, enter-O- here and on line 10 and go to line 11 9 10 Multiply the smaller of line 6 or line 9 by 12.4% (0.124) 10 11 Multiply line 6 by 2.9% (0.029) 11 12 Self-employment tax. Add lines 10 and 11. Enter here and on Schedule 2 (Form 1040 or 1040-SR), line 4, or Form 1040-NR, line 55 12 13 Deduction for one-half of self-employment tax. Multiply line 12 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040-SR). line 14, or Form 1040-NR, line 27 Part II Optional Methods To Figure Net Earnings (see instructions) Farm Optional Method. You may use this method only if (a) your gross farm income wasn't more than $8,160, or (b) your net farm profits? were less than $5,891. 14 Maximum income for optional methods 14 5,440 15 Enter the smaller of: two-thirds (1/3) of gross farm income (not less than zero) or $5,440. Also include this amount on line 4b above .................... 15 Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits were less than $5,891 and also less than 72.189% of your gross nonfarm income, and (b) you had net earnings from self-employment of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than five times. 16 Subtract line 15 from line 14 16 17 Enter the smaller of: two-thirds (/) of gross nonfarm income (not less than zero) or the amount on line 16. Also include this amount on line 4b above 17 7 8 8b d 9 1040 or 13 From Sch. F, line 9, and Sch. K-1 (Form 1065), box 14, code ? From Sch. F, line 34, and Sch. K-1 (Form 1065), box 14, code A-minus the amount you would have entered on line 1b had you not used the optional method. * From Sch. C, line 31; and Sch. K-1 (Form 1065), box 14, code A. From Sch. C, line 7; and Sch. K-1 (Form 1065), box 14, code C. Schedule SE (Form 1040 or 1040-SR) 2019 Fom 8829 Department of the Treasury Internal Revenue Service (99) Name(s) of proprietor(s) Expenses for Business Use of Your Home OMB No. 1545-0074 File only with Schedule C (Form 1040 or 1040-SR). Use a separate Form 8829 for each 2019 home you used for business during the year. Attachment Go to www.irs.gov/Form8829 for instructions and the latest information. Sequence No. 176 Your social security number Part 1 2 3 % 5 7 % 8 14 15 17 18 19 Part of Your Home Used for Business 1 Area used regularly and exclusively for business, regularly for daycare, or for storage of inventory or product samples (see instructions) 2 Total area of home 3 Divide line 1 by line 2. Enter the result as a percentage For daycare facilities not used exclusively for business, go to line 4. All others, go to line 7. 4. Multiply days used for daycare during year by hours used per day 4 hr. If you started or stopped using your home for daycare during the year, see instructions; otherwise, enter 8,760 ......... 5 5 hr. 6 Divide line 4 by line 5. Enter the result as a decimal amount 6 7 Business percentage. For daycare facilities not used exclusively for business, multiply line 6 by line 3 (enter the result as a percentage). All others, enter the amount from line 3 Part II Figure Your Allowable Deduction 8 Enter the amount from Schedule C, line 29, plus any gain derived from the business use of your home, minus any loss from the trade or business not derived from the business use of your home (see instructions) See instructions for columns (a) and (b) before completing lines 9-22. (a) Direct expenses (b) Indirect expenses 9 9 Casualty losses (see instructions) 9 10 Deductible mortgage interest (see instructions) 10 11 Real estate taxes (see instructions) 11 12 Add lines 9, 10, and 11 ... 12 13 Multiply line 12, column (b), by line 7 13 14 Add line 12, column (a), and line 13 15 10 Subtract line 14 from line 8. If zero or less, enter-O- 16 10 Excess mortgage interest (see instructions) 16 17 " Excess real estate taxes (see instructions) 18 Insurance 10 19 Rent nom 20 20 Repairs and maintenance 20 21 Utilities 2 21 22 Other expenses (see instructions) 22 23 Add lines 16 through 22 23 24 Multiply line 23, column (b), by line 7 25 25 Carryover of prior year operating expenses (see instructions) 25 26 26 Add line 23, column (a), line 24, and line 25 27 Allowable operating expenses. Enter the smaller of line 15 or line 26 28 99 Limit on excess casualty losses and depreciation. Subtract line 27 from line 15 29 Excess casualty losses (see instructions) ) 29 30 20 Depreciation of your home from line 42 below. 30 31 24 Carryover of prior year excess casualty losses and depreciation (see instructions) 31 20 32 Add lines 29 through 31 22 33 Allowable excess casualty losses and depreciation. Enter the smaller of line 28 or line 32 34 Add lines 14, 27, and 33 . 25 35 Casualty loss portion, if any, from lines 14 and 33. Carry amount to Form 4684 (see instructions) 36 Allowable expenses for business use of your home. Subtract line 35 from line 34. Enter here and on Schedule C, line 30. If your home was used for more than one business, see instructions Part III Depreciation of Your Home 37 Enter the smaller of your home's adjusted basis or its fair market value (see instructions) 38 Value of land included on line 37 :: 39 Basis of building. Subtract line 38 from line 37 40 Business basis of building. Multiply line 39 by line 7. 41 Depreciation percentage (see instructions) 42 Depreciation allowable (see instructions). Multiply line 40 by line 41. Enter here and on line 30 above Part IV Carryover of Unallowed Expenses to 2020 43 Operating expenses. Subtract line 27 from line 26. If less than zero, enter-O- 44 Excess casualty losses and depreciation. Subtract line 33 from line 32. If less than zero, enter -0-. For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 13232M 24 26 27 28 32 33 34 35 36 37 38 39 40 41 42 % 43 44 For 8829 (2019)