Question

Henry, Hunter, and Harry formed a partnership (Widget Unlimited) on January 1, 2020. Henry and Hunter each contributed $200,000 and Harry transferred a building he

Henry, Hunter, and Harry formed a partnership (Widget Unlimited) on January 1, 2020. Henry and Hunter each contributed $200,000 and Harry transferred a building he had purchased two years earlier to the partnership. The building had a tax basis of $150,000 and was appraised at $300,000. The building was also encumbered with a $100,000 mortgage. The partners plan to use the building to manufacture, distribute, and sell green and purple widgets.

Harry will work full-time operating the business for which he will receive guaranteed payments (not included in expenses) of $5,000 per month. Henry and Hunter will devote less than twelve days a year to the business. At the end of 2020, Widgets Unlimited had made $6,000 in mortgage principal payments. The partnership agreement specifies that Henry, Hunter, and Harry will share in income/loss in the ratio of 3:3:4.

For the first year of operation, the partnership records disclose the following information:

| Sales revenue | $820,000 |

|---|---|

| Cost of goods sold | $735,000 |

| Operating expenses | $65,000 |

| Long-term capital gains | $3,300 |

| ~1231 gains | $1,500 |

| Charitable contributions | $700 |

| Political campaign donation | $500 |

| Municipal bond interest | $450 |

Instructions

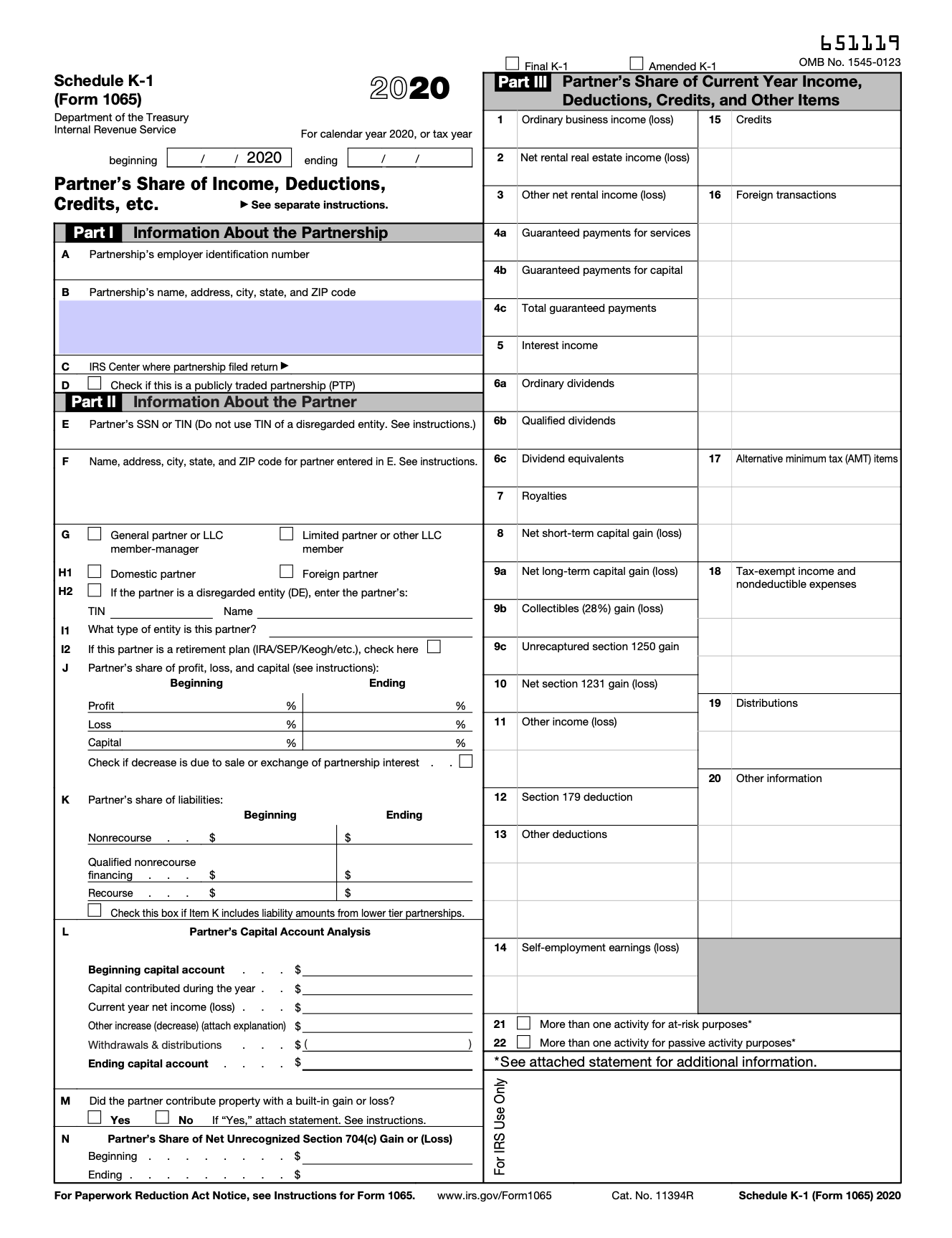

Using the information provided, complete the Schedule K-1 forms for Henry.

65]19

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started