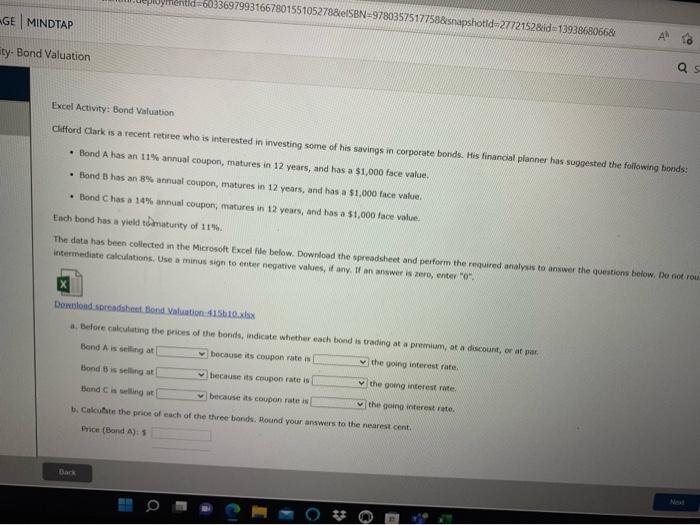

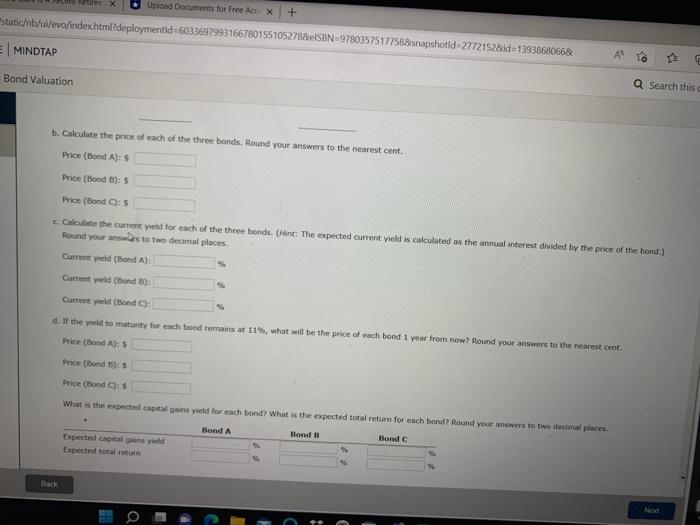

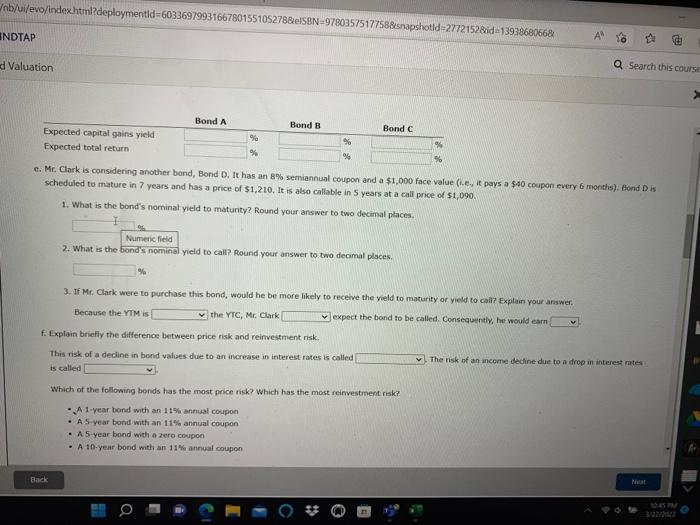

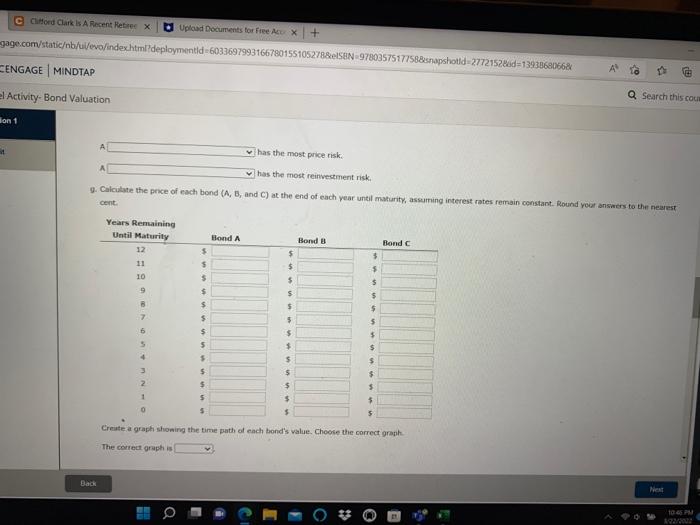

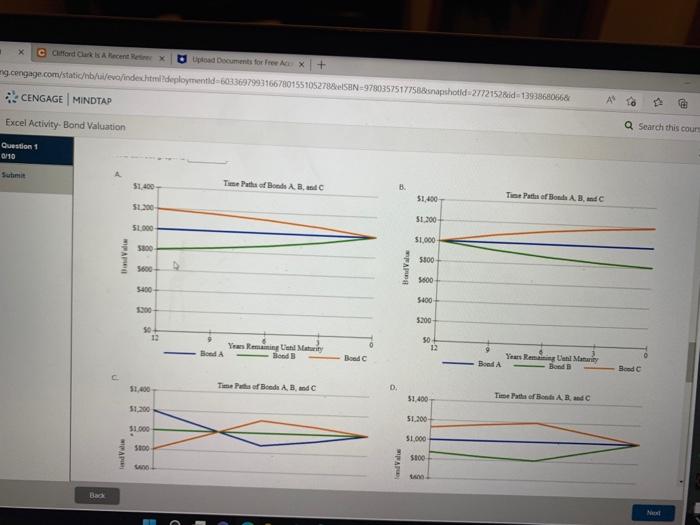

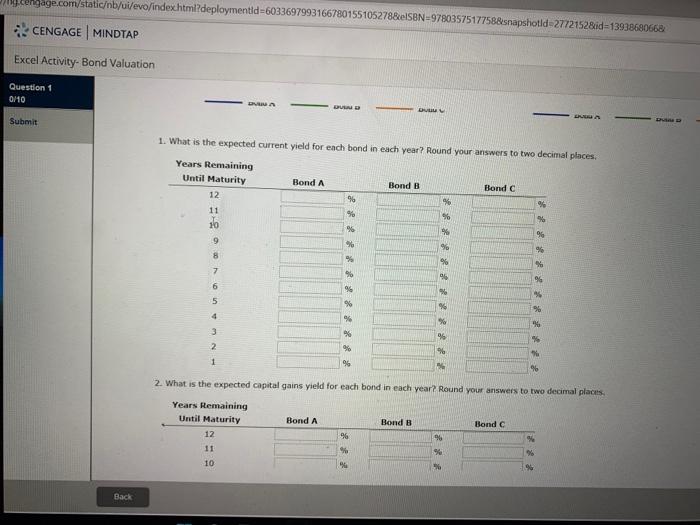

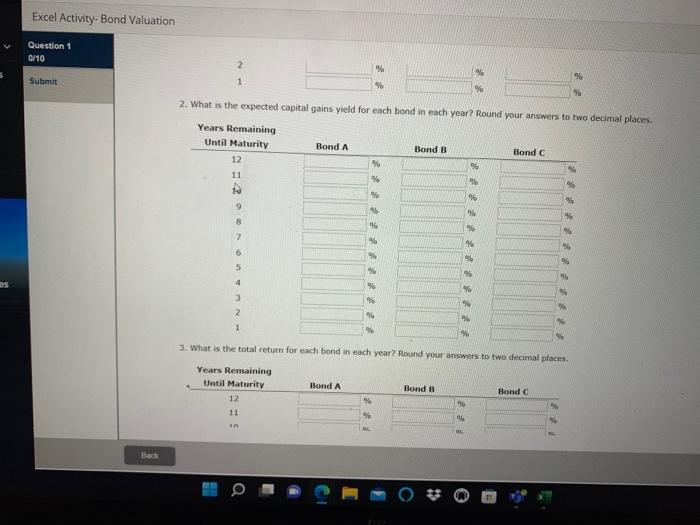

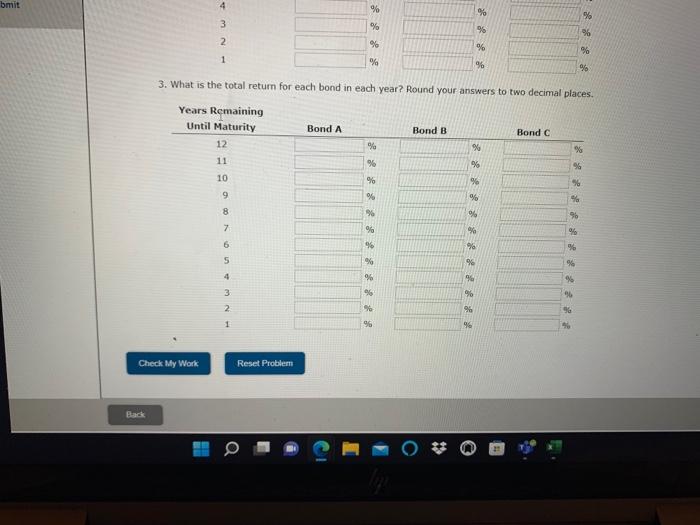

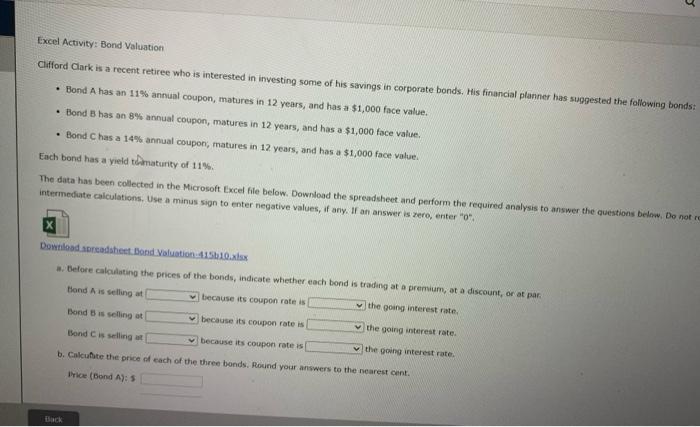

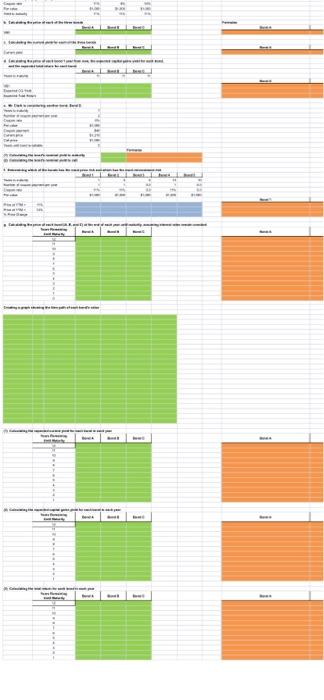

hentid=8033697993166780155105278&ISBN 9780357517758&snapshotid 27721528id=13938680668 GEMINDTAP A ty-Bond Valuation 0 o S Excel Activity: Bond Valuation Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: Bond A has an 11% annual coupon, matures in 12 years, and has a $1,000 face value. Bond B has an 8% annual coupon, matures in 12 years, and has a $1,000 face value Bond Chas a 14% annual coupon, matures in 12 years, and has a $1,000 face value Each bond has a yield thamatunity of 11%. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not rou. Intermediate calculations. Use a minus sign to enter negative values, if any. If an answer is zero, enter"0" Donload adobest Bond Valuation: 15h10.xlsx Before calculating the prices of the bonds, indicate whether each bond is trading at a premium, at a discount, or at par Bond Aisling at because its coupon rate is the going interest rate Bond is selling because it coupon rate is the going interest rate Bend Ciswing because its coupon rates the going interest rate Calculate the price of each of the three bonds. Round your answers to the nearest cent. Price (Bond A): 5 Bank ME Upload Documents for Free Aco X + staticb/ui/evo/indexhtml?deploymentid=60336979931667801551052788SBN 97803575177588snapshotid=2772152&cid=1393868066& MINDTAP Bond Valuation Q Search this b. Calculate the price of each of the three bonds. Round your answers to the nearest cent. Price (Bond A): 5 Price (Bond): 5 Price (Bond): 5 Calculate the current yield for each of the three bonds. (Hint: The expected current yield is calculated as the annual interest divided by the price of the hond.) Round your answars to two decimal places Current yield (Bond A): Current yeld (Bond B): Current yield (Bond C): % d. If the yield to maturity for each bond remains at 11%, what will be the price of each bond 1 year from now? Round your answers to the nearest cent. Price (Bond A): 5 Price (Bond 5): 5 Price (Bond : What is the expected capital gains yield for each bond? What is the expected total return for each bond? Round your answers to two decimal places. Bond A Bond Bonde Expected capital gains yield Expected total return Back Net b/ui/evo/indexhtml?deploymentid=60336979931667801551052788eSBN=97803575177588snapshotid-2772152&id=13938680668 INDTAP 0 O 2 d Valuation Q Search this course Bond A Bond B Bond c Expected capital gains yield Expected total return % % % % e. Mr. Clark is considering another bond, Bond D. It has an 8% semiannual coupon and a $1,000 face value (.e, it pays a $40 coupon every 6 months). Bond is scheduled to mature in 7 years and has a price of $1.210. It is also calable in 5 years at a call price of $1,090 1. What is the bond's nominal yield to matunty Round your answer to two decimal places. Numeric field 2. What is the bond's nominal yield to call? Round your answer to two decimal places 3. If Me Clark were to purchase this bond, would he be more likely to receive the yield to maturity or yield to call? Explain your answer. Because the YTM is the YTC, Mr. Clark expect the bond to be called. Consequently, he would earn f. Explain briefly the difference between price risk and reinvestment risk. This risk of a decline in bond valsts due to an increase in interest rates is called v The risk of an income decine due to a drop in interest rates is called Which of the following bonds has the most price risk? Which has the most reinvestment isk? .A 1-year bond with an 11% annual coupon A5 year bond with an 11% annual coupon A5 year bond with a zero coupon A 10-year bond with an 11% annual coupon Back 19:45 PM 12/2012 cond Clark Is A Recent Retrex Upload Documents for Free Au X + gage.com/staticb/u/evo/index.html?deploymentid=6033697993166780155105278&SBN 97803575177588snapshotld-2772152d=13933620668 ENGAGE MINDTAP 9 el Activity-Bond Valuation Q Search this cou Ion 1 A has the most price risk has the most reinvestment risk g. Calculate the price of each bond (A, B, and C) at the end of each year until maturity, assuming interest rates remain constant. Round your answers to the nearest cent Years Remaining Until Maturity Bond A Bond B Bond 12 $ $ $ 11 $ $ 5 10 $ $ $ 9 $ s $ B $ 5 $ 7 $ $ $ 5 $ $ $ 5 $ $ $ $ $ $ 5 $ 2 $ $ $ 1 5 $ $ 0 5 $ 5 Create a graph showing the time path of each bond's value. Choose the correct graph The correct graphis Back Next 1045 PM 1920 X Cord Clark Recent Rex Upload Documents for Free X + ng cengage.com/static/b/u/ev/index.htm?deployment 66336979931667801551052788N-97803575177588snapshotid=2772157Bid 13938680668 CENGAGE MINDTAP Excel Activity-Bond Valuation 0 Search this cour Question 1 0/10 A $1,400 TiePaths of BoA BC B. $1,400 The Path of B A BC 5L200 $1.200 51.000 $1,000 5800 5300 5600 ndalu 5600 5400 5400 1300 5200 50 12 50 12 Years Reunigen Mature Boods Bond Bond Bood Years Regal Matar Bond Bende C The Path of Bonda. Bandc 51.400 D. 31 400 Tie Puth of SA 51.200 51.200 31.000 51.000 MIPA 5100 $100 Value B censage.com/staticb/ui/evo/indeschtml?deploymentid=6033697993166780155105278&eISBN=97803575177588snapshotid=2772152&id=13938680668 CENGAGE MINDTAP Excel Activity-Bond Valuation Question 1 0/10 IVA DU Submit 1. What is the expected current yield for each bond in each year? Round your answers to two decimal places, Years Remaining Until Maturity 12 Bond A Bond B Bond C 96 % % 11 90 % 90 10 % % 9 % 8 % 96 7 6 06 96 96 % 5 % % 19% 4 % % 90 3 98 % % 2 1 96 96 2. What is the expected capital gains yield for each bond in each year Round your answers to two decimal places Bond A Bond B Bond Years Remaining Until Maturity 12 11 10 96 96 % % Back Excel Activity-Bond Valuation Question 1 0/10 2 % 5 % Submit 1 % % 2. What is the expected capital gains yield for each bond in each year? Round your answers to two decimal places Years Remaining Until Maturity 12 Bond A Bond B Bond c % 96 11 % 9 90 9 % B 96 7 26 % 05 5 % 96 4 % 3 96 96 2 96 1 98 % % 9 3. What is the total return for each bond in each year? Round your answers to two decimal places Bond A Bond B Bond Years Remaining Until Maturity 12 11 an % % Back Q bmit 4 96 96 % 3 % 95 % 2 % % 96 1 % % % 3. What is the total return for each bond in each year? Round your answers to two decimal places. Years Remaining Until Maturity 12 Bond A Bond B Bond C % % 11 % % 96 96 10 % % 96 9 % 8 96 7 % % % 6 96 % 5 2X 9 4 96 9 9 3 03 96 2 96 96 1 96 96 Check My Work Reset Problem Back Excel Activity: Bond Valuation Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: Bond A has an 11% annual coupon, matures in 12 years, and has a $1,000 face value Bond B has an 8% annual coupon, matures in 12 years, and has a $1,000 face value. Bond Chas a 14% annual coupon, matures in 12 years, and has a $1,000 face value. Each bond has a yield amaturity of 11% The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do notre intermediate calculations. Use a minus sign to enter negative values, if any. If an answer is zero, enter" Download srcadsheet Bond Valuation 415010.xlsx . Before calculating the prices of the bonds, indicate whether each bond is trading at a premium, at a discount, or at par tond Ais selling because its coupon rate is the going interest rate Bond is selling at because its coupon rate is Bond Cisseling the going interest rate because its coupon rate is the going interest rate. b. Calculate the price of each of the three bonds. Round your answers to the nearest cent. Price (Bond A): 5 Back . hentid=8033697993166780155105278&ISBN 9780357517758&snapshotid 27721528id=13938680668 GEMINDTAP A ty-Bond Valuation 0 o S Excel Activity: Bond Valuation Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: Bond A has an 11% annual coupon, matures in 12 years, and has a $1,000 face value. Bond B has an 8% annual coupon, matures in 12 years, and has a $1,000 face value Bond Chas a 14% annual coupon, matures in 12 years, and has a $1,000 face value Each bond has a yield thamatunity of 11%. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not rou. Intermediate calculations. Use a minus sign to enter negative values, if any. If an answer is zero, enter"0" Donload adobest Bond Valuation: 15h10.xlsx Before calculating the prices of the bonds, indicate whether each bond is trading at a premium, at a discount, or at par Bond Aisling at because its coupon rate is the going interest rate Bond is selling because it coupon rate is the going interest rate Bend Ciswing because its coupon rates the going interest rate Calculate the price of each of the three bonds. Round your answers to the nearest cent. Price (Bond A): 5 Bank ME Upload Documents for Free Aco X + staticb/ui/evo/indexhtml?deploymentid=60336979931667801551052788SBN 97803575177588snapshotid=2772152&cid=1393868066& MINDTAP Bond Valuation Q Search this b. Calculate the price of each of the three bonds. Round your answers to the nearest cent. Price (Bond A): 5 Price (Bond): 5 Price (Bond): 5 Calculate the current yield for each of the three bonds. (Hint: The expected current yield is calculated as the annual interest divided by the price of the hond.) Round your answars to two decimal places Current yield (Bond A): Current yeld (Bond B): Current yield (Bond C): % d. If the yield to maturity for each bond remains at 11%, what will be the price of each bond 1 year from now? Round your answers to the nearest cent. Price (Bond A): 5 Price (Bond 5): 5 Price (Bond : What is the expected capital gains yield for each bond? What is the expected total return for each bond? Round your answers to two decimal places. Bond A Bond Bonde Expected capital gains yield Expected total return Back Net b/ui/evo/indexhtml?deploymentid=60336979931667801551052788eSBN=97803575177588snapshotid-2772152&id=13938680668 INDTAP 0 O 2 d Valuation Q Search this course Bond A Bond B Bond c Expected capital gains yield Expected total return % % % % e. Mr. Clark is considering another bond, Bond D. It has an 8% semiannual coupon and a $1,000 face value (.e, it pays a $40 coupon every 6 months). Bond is scheduled to mature in 7 years and has a price of $1.210. It is also calable in 5 years at a call price of $1,090 1. What is the bond's nominal yield to matunty Round your answer to two decimal places. Numeric field 2. What is the bond's nominal yield to call? Round your answer to two decimal places 3. If Me Clark were to purchase this bond, would he be more likely to receive the yield to maturity or yield to call? Explain your answer. Because the YTM is the YTC, Mr. Clark expect the bond to be called. Consequently, he would earn f. Explain briefly the difference between price risk and reinvestment risk. This risk of a decline in bond valsts due to an increase in interest rates is called v The risk of an income decine due to a drop in interest rates is called Which of the following bonds has the most price risk? Which has the most reinvestment isk? .A 1-year bond with an 11% annual coupon A5 year bond with an 11% annual coupon A5 year bond with a zero coupon A 10-year bond with an 11% annual coupon Back 19:45 PM 12/2012 cond Clark Is A Recent Retrex Upload Documents for Free Au X + gage.com/staticb/u/evo/index.html?deploymentid=6033697993166780155105278&SBN 97803575177588snapshotld-2772152d=13933620668 ENGAGE MINDTAP 9 el Activity-Bond Valuation Q Search this cou Ion 1 A has the most price risk has the most reinvestment risk g. Calculate the price of each bond (A, B, and C) at the end of each year until maturity, assuming interest rates remain constant. Round your answers to the nearest cent Years Remaining Until Maturity Bond A Bond B Bond 12 $ $ $ 11 $ $ 5 10 $ $ $ 9 $ s $ B $ 5 $ 7 $ $ $ 5 $ $ $ 5 $ $ $ $ $ $ 5 $ 2 $ $ $ 1 5 $ $ 0 5 $ 5 Create a graph showing the time path of each bond's value. Choose the correct graph The correct graphis Back Next 1045 PM 1920 X Cord Clark Recent Rex Upload Documents for Free X + ng cengage.com/static/b/u/ev/index.htm?deployment 66336979931667801551052788N-97803575177588snapshotid=2772157Bid 13938680668 CENGAGE MINDTAP Excel Activity-Bond Valuation 0 Search this cour Question 1 0/10 A $1,400 TiePaths of BoA BC B. $1,400 The Path of B A BC 5L200 $1.200 51.000 $1,000 5800 5300 5600 ndalu 5600 5400 5400 1300 5200 50 12 50 12 Years Reunigen Mature Boods Bond Bond Bood Years Regal Matar Bond Bende C The Path of Bonda. Bandc 51.400 D. 31 400 Tie Puth of SA 51.200 51.200 31.000 51.000 MIPA 5100 $100 Value B censage.com/staticb/ui/evo/indeschtml?deploymentid=6033697993166780155105278&eISBN=97803575177588snapshotid=2772152&id=13938680668 CENGAGE MINDTAP Excel Activity-Bond Valuation Question 1 0/10 IVA DU Submit 1. What is the expected current yield for each bond in each year? Round your answers to two decimal places, Years Remaining Until Maturity 12 Bond A Bond B Bond C 96 % % 11 90 % 90 10 % % 9 % 8 % 96 7 6 06 96 96 % 5 % % 19% 4 % % 90 3 98 % % 2 1 96 96 2. What is the expected capital gains yield for each bond in each year Round your answers to two decimal places Bond A Bond B Bond Years Remaining Until Maturity 12 11 10 96 96 % % Back Excel Activity-Bond Valuation Question 1 0/10 2 % 5 % Submit 1 % % 2. What is the expected capital gains yield for each bond in each year? Round your answers to two decimal places Years Remaining Until Maturity 12 Bond A Bond B Bond c % 96 11 % 9 90 9 % B 96 7 26 % 05 5 % 96 4 % 3 96 96 2 96 1 98 % % 9 3. What is the total return for each bond in each year? Round your answers to two decimal places Bond A Bond B Bond Years Remaining Until Maturity 12 11 an % % Back Q bmit 4 96 96 % 3 % 95 % 2 % % 96 1 % % % 3. What is the total return for each bond in each year? Round your answers to two decimal places. Years Remaining Until Maturity 12 Bond A Bond B Bond C % % 11 % % 96 96 10 % % 96 9 % 8 96 7 % % % 6 96 % 5 2X 9 4 96 9 9 3 03 96 2 96 96 1 96 96 Check My Work Reset Problem Back Excel Activity: Bond Valuation Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: Bond A has an 11% annual coupon, matures in 12 years, and has a $1,000 face value Bond B has an 8% annual coupon, matures in 12 years, and has a $1,000 face value. Bond Chas a 14% annual coupon, matures in 12 years, and has a $1,000 face value. Each bond has a yield amaturity of 11% The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do notre intermediate calculations. Use a minus sign to enter negative values, if any. If an answer is zero, enter" Download srcadsheet Bond Valuation 415010.xlsx . Before calculating the prices of the bonds, indicate whether each bond is trading at a premium, at a discount, or at par tond Ais selling because its coupon rate is the going interest rate Bond is selling at because its coupon rate is Bond Cisseling the going interest rate because its coupon rate is the going interest rate. b. Calculate the price of each of the three bonds. Round your answers to the nearest cent. Price (Bond A): 5 Back