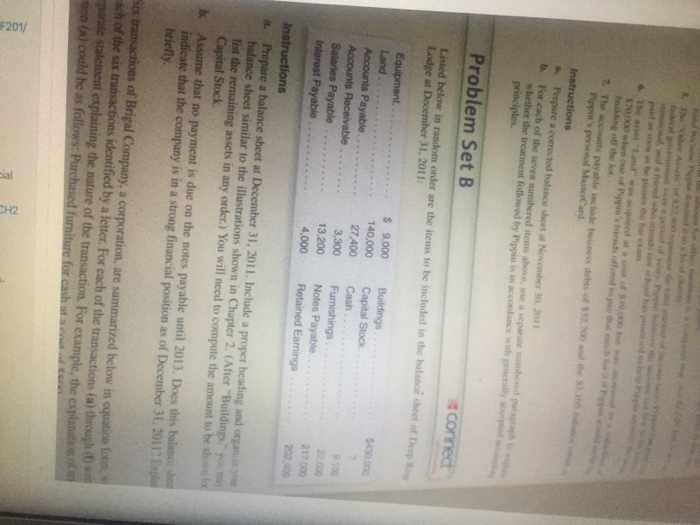

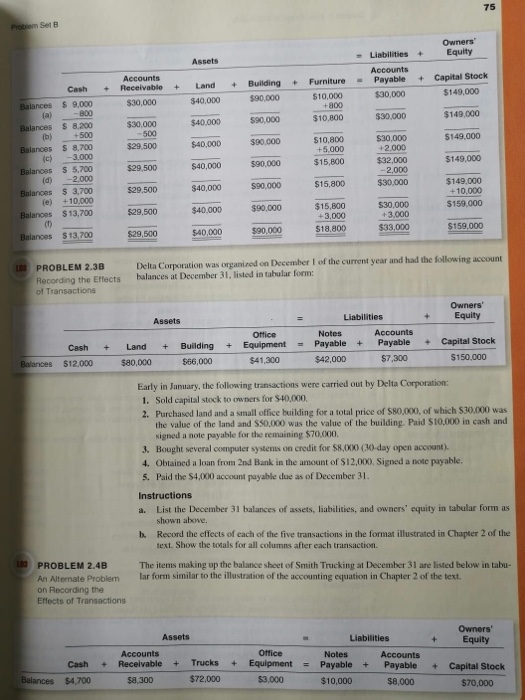

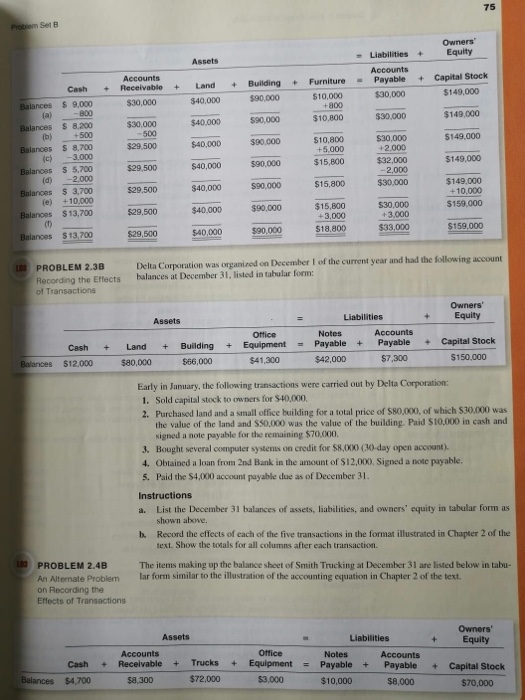

heps the bar 570.000 when one of Pippie's friends offered to y o a n 7. The accounts payable include business debes of 532.700 d rippin's personal MasterCard Instructions Prepare a corrected balance sheet at November 30, 2011 For each of the seven numbered items above, separate whether the treatment followed by Pippin is in accordance with principles p Problem Set B sconnect Listed below in random onder are the items to be included in the balance sheet of D Lodge at December 31, 2011: PR Buildings Capital Stock Equipment Land Accounts Payable. Accounts Receivable Salaries Payable Interest Payable $ 9.000 140,000 27.400 3,300 13.200 4,000 Cash Furnishings Notes Payable Retained Eamings 22.000 217.000 202.00 Instructions Prepare a balance sheet at December 31, 2011. Include a proper heading and organi balance sheet similar to the illustrations shown in Chapter 2. (After "Buildings list the remaining assets in any order.) You will need to compute the amount to be se Capital Stock Assume that no payment is due on the notes payable until 2013. Does this balance indicate that the company is in a strong financial position as of December 31, 2011 bapa briefly. Six transactions of Brigal Company, a corporation, are summarized below in aquation for each of the six transactions identified by a letter. For each of the transactions (a) through it aparate statement explaining the nature of the transaction. For example, the explanation in a could be as follows: Purchased furniture for cashots. com F201 Pam Se Owners Equity - Assets Accounts Receivable Liabilities Accounts Payable $30,000 + Cash + Land + Building $90,000 Capital Stock $149,000 $30,000 Furniture $10,000 +800 $10,800 $40,000 $149,000 $30,000 $30.000 590,000 $40,000 -500 $149,000 $29,500 $40,000 $90,000 Balances $ 9.000 a) -800 Balances S 8.200 (b) 500 Balances S 8,700 c) - 3.000 Balances $ 5.700 (d) -2.000 Balances $ 3.700 (e) +10.000 Balances $13,700 $10,800 +5.000 $15,800 $149,000 $30,000 +2.000 $32,000 -2,000 $30,000 $40,000 $29,500 $90,000 $40,000 $29,500 $15,800 S90,000 $149.000 +10.000 $159,000 $29,500 $40,000 $90,000 $15,000 +3,000 $18.800 $30,000 +3.000 $33,000 $159,000 $90.000 Balances $29,500 $13.700 $40,000 1 PROBLEM 2.3B Recording the Effects of Transactions Delta Corporation was organized on December 1 of the current year and had the following account balances at December 31, listed in tabular form: Owners Equity Liabilities Assets + + + + Cash $12,000 + Land $80,000 Office Equipment $41,300 Notes Payable $42,000 Building $66,000 Accounts Payable $7,300 Capital Stock $150.000 Balances Early in January, the following transactions were carried out by Delta Corporation: 1. Sold capital stock to owners for 540.000 2. Purchased land and a small office building for a total price of $80,000, of which $30,000 was the value of the land and S50,000 was the value of the building. Paid $10,000 in cash and signed a note payable for the remaining $70,000. 3. Bought several computer systems on credit for $8.OXXO (30-day open account). 4. Obtained a loan from 2nd Bank in the amount of $12,00). Signed a note payable. 5. Paid the $4,000 account payable due as of December 31. Instructions a List the December 31 balances of assets, liabilities, and owners' equity in tabular formas shown alone. b. Record the effects of each of the five transactions in the format illustrated in Chapter 2 of the Text Show the totals for all columns after each transaction The items making up the balance sheet of Smith Trucking at December 31 are listed below in tabu- lar form similar to the illustration of the accounting essation in Chapter 2 of the text. IN PROBLEM 2.4B An Alternate Problem on Recording the Effects of Transactions Assets Owners' Equity Cash + Accounts Receivable + Trucks + Office Equipment = $3,000 Liabilities Notes Accounts Payable + Payable $10,000 $8,000 + Balances $4,700 $a 300 $72,000 Capital Stock $70,000