Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Herb and Alice are married and file a joint return. Herb is 7 4 years old and Alice turns 7 2 in February 2 0

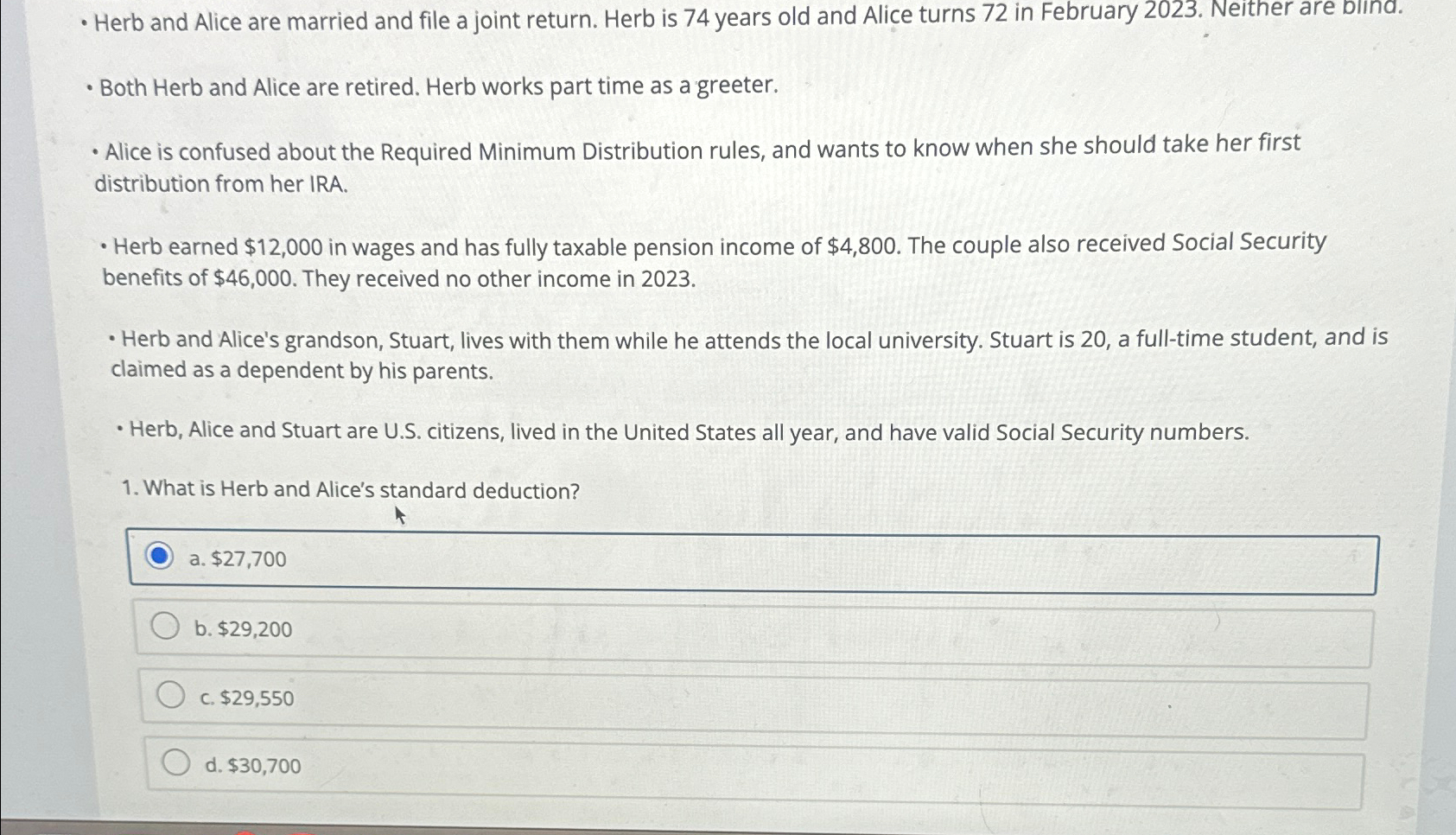

Herb and Alice are married and file a joint return. Herb is years old and Alice turns in February Neither are bilna.

Both Herb and Alice are retired. Herb works part time as a greeter.

Alice is confused about the Required Minimum Distribution rules, and wants to know when she should take her first distribution from her IRA.

Herb earned $ in wages and has fully taxable pension income of $ The couple also received Social Security benefits of $ They received no other income in

Herb and Alice's grandson, Stuart, lives with them while he attends the local university. Stuart is a fulltime student, and is claimed as a dependent by his parents.

Herb, Alice and Stuart are US citizens, lived in the United States all year, and have valid Social Security numbers.

What is Herb and Alice's standard deduction?

a $

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started